Turkish monetary policy – what went wrong. The lyre dance of the dervishes is in full swing

The Mevlevilik Muslim order, which is often called, comes from Turkey whirling dervishes. The name comes from the dance figures that are created as a result of moving meditation. One of the most spectacular figures is fast spinning. It is connected with mysticism and spiritual closeness to God. It is mystical, inscrutable and at the same time effective (but not necessarily effective). monetary policy of Turkey. It works against the advice of economists and currency experts. In this article, we will tell you about the history of Turkey's struggles with a weakening currency and the effects of introducing new ideas to heal the economic situation. But let's start with a picture that says more than 1000 words - a chart of the US dollar against the Turkish lira over the last two decades.

USD/TRY exchange rate (Turkish lira to dollar) in 2003 - 2023, MN interval. Source: xStation, XTB.

A quick change from the sick man of Europe into an economic tiger

For many years, Türkiye or its predecessors were on the economic periphery. Despite its potential, the country was unable to use it. However, the 80st century is a period of rapid transformation. Currently, Türkiye is one of the largest economies in the world. This is not surprising, as this country is inhabited by over XNUMX million people whose standard of living is relatively high. Cities such as Istanbul and Ankara are important centers of economic development. However, dynamic development is only one side of the coin. Türkiye has been struggling with this for many years weak exchange rate of the Turkish lira and high inflation. There are many reasons why this happened. But from the beginning.

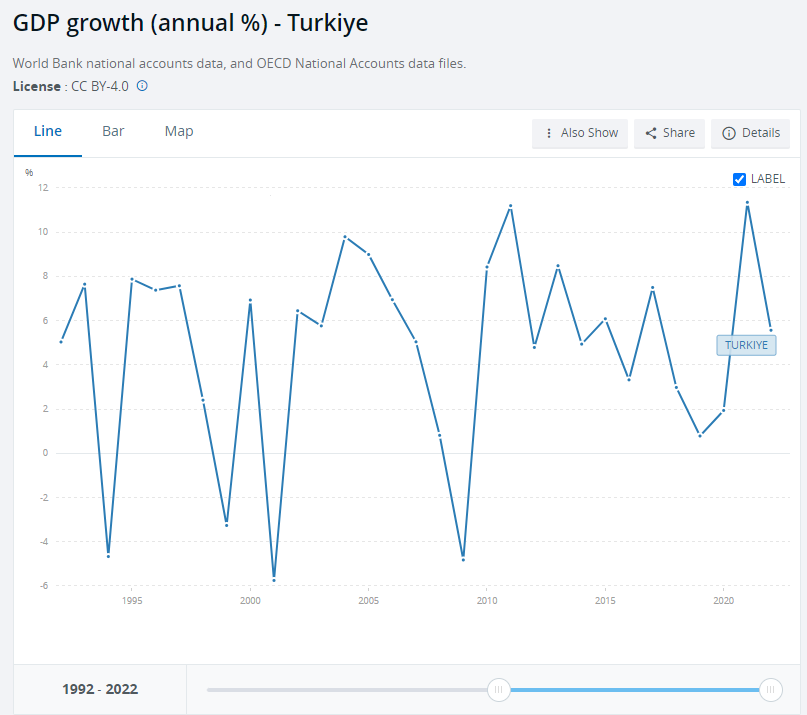

Economic growth in Turkey. Source: world Bank

Throughout the 90s and the beginning of the XNUMXst century, Turkey focused on integration with the European Union. The reason was the desire to join the common market, which would help Turkey become a production base for the Eurozone countries. However, despite apparent willingness on both sides, the country ultimately did not join the EU. At the beginning of the XNUMXst century, our title hero became famous thanks to the so-called Anatolian tigers, i.e. small and medium-sized companies, which were the main engine of the stunning growth of the Turkish economy, which was able to grow at a rate of 7-9% per year. The increase was based on labor cost arbitrage. This meant that the country had simple reserves but could not grow in this way in the very long term.

Recep Erdogan. Source: wikipedia.org

The turning point was definitely coming to power Recep Erdogan. This politician was appreciated for his good term as president of Istanbul (1994 - 1998), as he developed the city while reducing municipal debts. Erdogan was able to captivate crowds - at rallies he promised that Turkey could once again become a very well-developed economic country. After one of his speeches, he was accused of spreading hate speech. He ended up resigning from the position of president of Istanbul and spending several months in prison. After being released from behind bars, he founded the AKP party (Justice and Development Party), which slightly softened its pro-Islamic statements. Before the 2003 elections, the AKP announced that it was in favor of Turkey joining the European Union, which also encouraged people to vote for them. The AKP won a parliamentary majority. From that moment on, the so-called Erdogan era. Rapid economic development caused his party to win subsequent elections - and three times in a row. In addition, Erdogan became president of Turkey in 2014 and pushed through the change of the system from a parliamentary to a presidential system. Some of the opposition accuse Erdogan of authoritarian tendencies because he is trying to subjugate the media and the courts to himself and his party.

Joyful life on other people's money

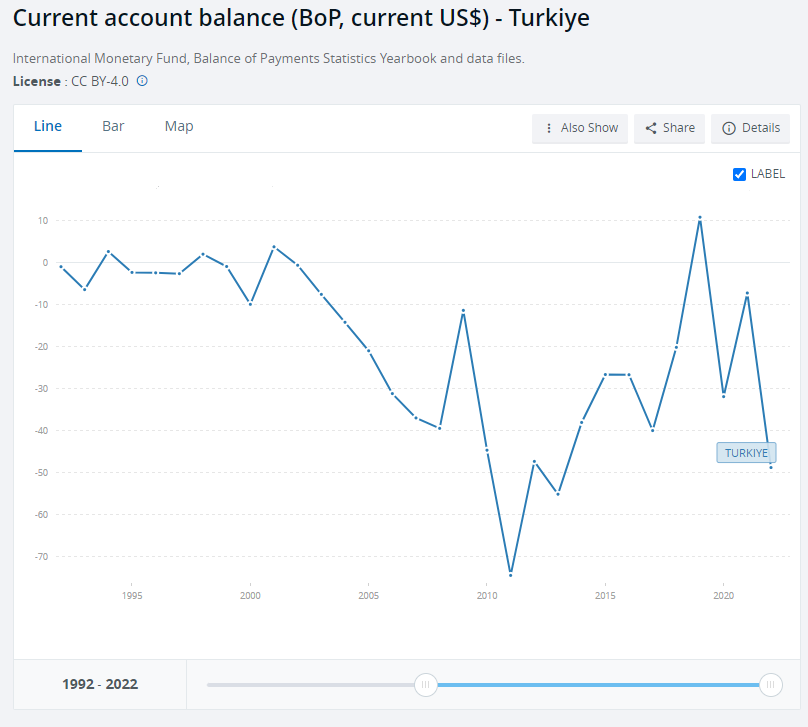

Türkiye was developing very quickly. The reasons were low labor costs, a large internal market and a good geographical location (at the junction of Europe and Asia). However, economic growth was not sustainable. The current account deficit in 2010–2017 ranged between -3% and -9%.

The mentioned deficit was financed by surpluses on the financial account. What does this tell us? In short: the outflow of foreign exchange caused by the surplus of imports over exports was financed by the inflow of funds from abroad. Mainly in the form of debt instruments. The debt was purchased by Turkish banks and enterprises. Using other people's capital allowed for acceleration of economic growth and increased consumption. The disadvantage of this development model was the greater sensitivity of the economy to external shocks.

Current account. Source: World Bank

Copernicus was right - Türkiye confirms this

The weakening of the Turkish lira makes dollar-denominated liabilities increasingly difficult to service. Moreover, symptoms began to appear dollarization of the economy. This is because high inflation has caused people to try to limit their savings in the national currency. Citizens prefer to keep their savings in dollars or surpluses they buy gold. Lira as “worse money” are issued as quickly as possible (in accordance with Copernicus' law).

At the end of 2021, individuals had more foreign exchange accounts (approximately $147 billion) than Turkish liras ($131 billion). Outside the bank, of course, dollars, euros and gold dominate. Some people save in this way outside the banking system, keeping their financial resources "under the mattress". This action results from the reluctance to keep foreign currencies in banks. Such people are apparently afraid of the "Argentine" scenario, where dollar deposits were once exchanged at a non-market rate for Argentine pesos. By keeping dollars or euros in banknotes, such people feel safer. Of course, they pay for it in the form of an inflation tax, but this is a topic for a separate discussion. During the period of rising inflation, the phenomenon of foreign exchange leakage outside the banking system intensifies.

The Central Bank of Turkey should be the guardian fighting inflation and too weak exchange rates. However, his role in recent years has been to submit to Erdogan's will. This guy is not a master of economics, which is why he allowed himself to be talked into believing this for years too high interest rates accelerate inflation even further. Moreover, in more than one statement the Turkish president said that high interest rates "they make the rich richer and the poor poorer". The use of low interest rates in an environment of very high inflation has resulted in the Turkish lira becoming worth even less. However, Erdogan stuck to his unorthodox monetary policy. Interestingly, it did not occur to him that high inflation primarily affects the poorest and the middle class.

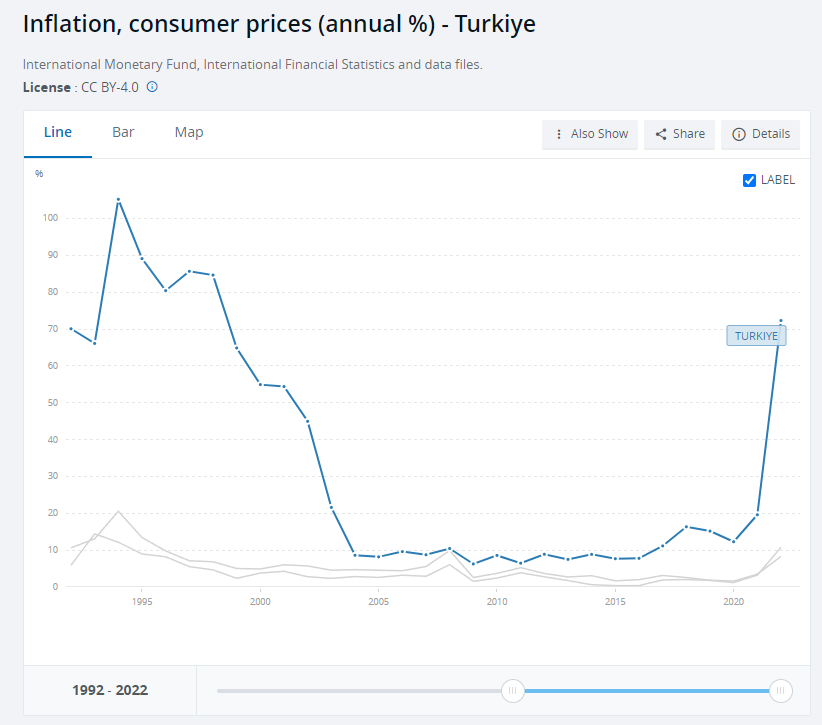

Inflation in Turkey (blue) compared to inflation in the region (gray). Source: World Bank

The president also liked to surround himself with trusted people with not necessarily high competences. For example. in 2018, the Turkish leader's son-in-law became the treasury minister. We have serious doubts whether there wasn't a better candidate on the Bosphorus. Well, it is easier to convince a family member to use unconventional methods of fiscal policy. The increase in interest rates in the US and the sanctions imposed on Turkey meant that in order to save the weakening lira, the interest rate increased in a short time from 17,5% to 24%. However, this was still not enough as the country struggled with high inflation and a weak current and financial balance. There was an increase in exports and a decrease in imports, which allowed the financial turnover deficit to be partially covered (i.e. the opposite situation occurred than during dynamic growth). The lira exchange rate also stabilized thanks to the sale of part of the foreign exchange reserves by the Turkish central bank. The stabilization of lira prices continued throughout 2019. Therefore, it can be said that the situation has normalized over several quarters. Inflation was still high, but the central bank seemed able to respond quickly and effectively.

Erdoganomics and the Turkish Economic Model

This so-called has been going on for several years Turkish Economic Model (TMG). According to President Erdogan's plans, Turkey is to become one of the 10 largest economies in the world. TMG assumes, among other things, that Turkish exports will be less dependent on imports (the import intensity of exports will decrease). According to the model, Türkiye will need fewer foreign components for its production. In addition, the model is intended to increase export competitiveness and raise the level of private investment. The plan is intended to lead to economic growth without increasing the foreign trade deficit.

The development model itself is original in its own way. The mechanism is supposed to look like this:

- Lower interest rates were intended to provide cheap credit that would stimulate the development of economic activity (including exports).

- The weak lira was expected to increase the competitiveness of Turkish goods on foreign markets, which is expected to improve the trade balance.

- Economic development using domestic financial resources and an increase in the trade surplus were expected to reduce the current account deficit. This was to make Turkey's development independent of the inflow of foreign capital.

- Ultimately, this development model was supposed to reduce inflation and stabilize the exchange rate.

He was the creator of the Turkish Economic Model Camil Ertem, who was an advisor to the president. Ertem himself believes that high interest rates cause lower exports, less credit and higher unemployment, as well as an increase in foreign debt. In the extreme variant, this will lead to dollarization of the economy, because companies and people will prefer to take out loans in foreign currencies, which will have lower interest rates. Opponents of this idea point out that the plan requires large national savings. This means either the government would have to limit spending to create a budget surplus, or it would have to limit consumption and investment by households or enterprises. In practice increasing savings by the private sector is impossible in the case of high, negative real interest rates. However, a restrictive fiscal policy would be difficult from a political point of view. Therefore, the Turkish development model assumed monetary loosening and a loose fiscal policy. This couldn't work in the long term.

Türkiye was looking for additional capital to finance its projects. One of the ideas was financial amnesty. It consisted in the fact that a person could bring capital to Turkey that had previously been taken out of the country. This did not require an explanation of the source of its origin, a tribute of 2% of assets (in some situations 3%) was sufficient. Turkey expected a capital inflow of around $130 billion, but it achieved much less.

Türkiye also runs the program liraization of the economy, i.e. aiming to reduce the turnover of dollars and other currencies in economic transactions. The plan was ambitious, but impossible to implement in conditions of such high inflation. You can't convince people to do things that are obviously unprofitable. Why would people save in lira if it depreciates by several dozen percent every year? Financial surpluses are also invested in the real estate sector because it is treated as a safe haven in times of rapid price increases. Of course, the government is doing everything it can to obtain foreign exchange. One of them is requiring exporters to exchange part of the acquired dollars or euros for lira. Another idea is to force non-residents to exchange their foreign currencies for liras, if they want to use, for example, bank deposits.

The central bank plays an important role in erdoganomics. Its aim is to reduce dollarization and stimulate economic growth. For this reason the bank is to help in granting low-interest loans and investment credits to the small and medium-sized enterprise sector. Another task of the central bank is to reduce the supply of consumer loans to reduce investment pressure. At the same time, CBRT is intended to keep interest rates as low as possible. Therefore, the bank must use other instruments and methods to achieve its goals. The ideas include:

- banks' reserve requirements;

- the requirement to maintain treasury debt instruments of a certain size if the bank granted loans other than export, agricultural or investment loans;

- currency swaps (including with Qatar, China and South Korea).

Erdogan changes CEOs like gloves

The President of Turkey has transformed from the sensible politician he was at the beginning of his political career into a leader with authoritarian tendencies who is always right. As a result, if the president was not satisfied with the central bank's policy, he fired its president. Over the course of 3 years (2019 - 2021), the president of this institution was replaced three times. Therefore, Erdogan's personnel policy resembled a typical Polish president of a football club, who believed that if the team lost, it was solely the coach's fault.

The president also did not like the Turkish Statistical Institute. As a result, between 2019 and 2021, the president was changed 4 times. This reflects poorly on Erdogan himself, who is unable to approach the choices of the right people rationally. After all, if he got rid of four presidents, it means that he is undermining the independence and the remnants of the reputation of institutions that are supposed to be independent.

This unstable institutional environment also had a negative impact on the perception of the central bank. If the president of one of the country's most important institutions can be replaced because of the satrap's bad temper, two things happen. First, investors expect a much higher risk premium. Secondly, there are careerists who are only yes-men and do not enter into dialogue with the leader of the state. This means that even if there are specialists in the central bank (and there are many of them), the intellectual potential of the organization is blocked by “up”. This leads to serious errors in the management of monetary policy, which translates into economic instability.

Erdogan continued to insist that the relationship between interest rates and inflation was specific. In his opinion "The interest rate is the cause and inflation is the effect". By this logic, the lower interest rates, the lower inflation will be.

Pandemic and another wave of weakening of the lira

After the COVID-19 pandemic, another cycle of rate increases began not only in developed but also developing countries. Türkiye should also start a cycle of increases to attract capital from abroad. However, the Turkish central bank chose a different path. At the end of 2021 began a cycle of rate cuts from 19% to 14%. This was intended to stimulate economic growth and reduce interest costs. This was consistent with the leader's new theory:

"Higher rates mean higher inflation".

However, such action undermined the independence of the central bank in the eyes of investors. There was an outflow of the kaipal, which resulted in it only in November 2021 USD/TRY rate increased by 40%. The Turkish government saved itself as best it could. As a result, a new financial product appeared: deposit in Turkish lira z “currency option”. What does it mean? The government was to pay the difference if the profits from investments in dollars were higher than those in lira. So it was a deposit in liras with a built-in deposit currency option, which offset the effects of the weakening lira. This was to stop people from converting liras into dollars. Since foreign capital was flowing out, it was necessary to generate a positive balance on the current account. As a result, the exchange rate had to "adapt" to the new conditions.

Inflation in Turkey reached levels unheard of in the European Union. In 2022, inflation will be measured by government agencies indicated the level of 85%. The following year the rate was 44%. These are official figures, but many people complain that real inflation is much higher. The prices of basic necessities are rising particularly strongly, which is very difficult, especially for the poorest. But The Turkish president seems to be satisfied with his economic policy. Otherwise he would have given up on his ideas. However, he stubbornly believes that only he can heal Turkey. As a result, the central bank continued to maintain deeply negative interest rates. For now, he is successful in fighting inflation "at least average".

The Turkish government is focusing on stimulating demand, announcing significant increases in the minimum wage and allocating huge amounts of money to social assistance. In 2023, just before the elections, Erdogan announced 45% raise for civil service employees. However, when the money supply increases, additional government spending also fuels the fires of inflation.

2022 – 2023: further blows to Turkey "economic miracle" and a moment of sobering up

The macroeconomic environment did not help the Turks again. The first blow was Russia's aggression against Ukraine. This led to an increase in the prices of hydrocarbons, which constitute an important component of domestic imports. Food prices have also increased, which has also affected the poorest part of Turkish society. The spike in inflation also posed a challenge to defending the Turkish lira. In addition, in the first quarter of 2023, a huge earthquake occurred in Malatya Province. This resulted in the need for huge expenditure on rebuilding infrastructure and helping survivors. Of course, many countries and world organizations declared help. However, it should be remembered that the previous great earthquake in 1999 caused two years of economic perturbations. Ultimately, the difficult economic situation then paved the way for Erdogan. What will it be like this time? It is unknown.

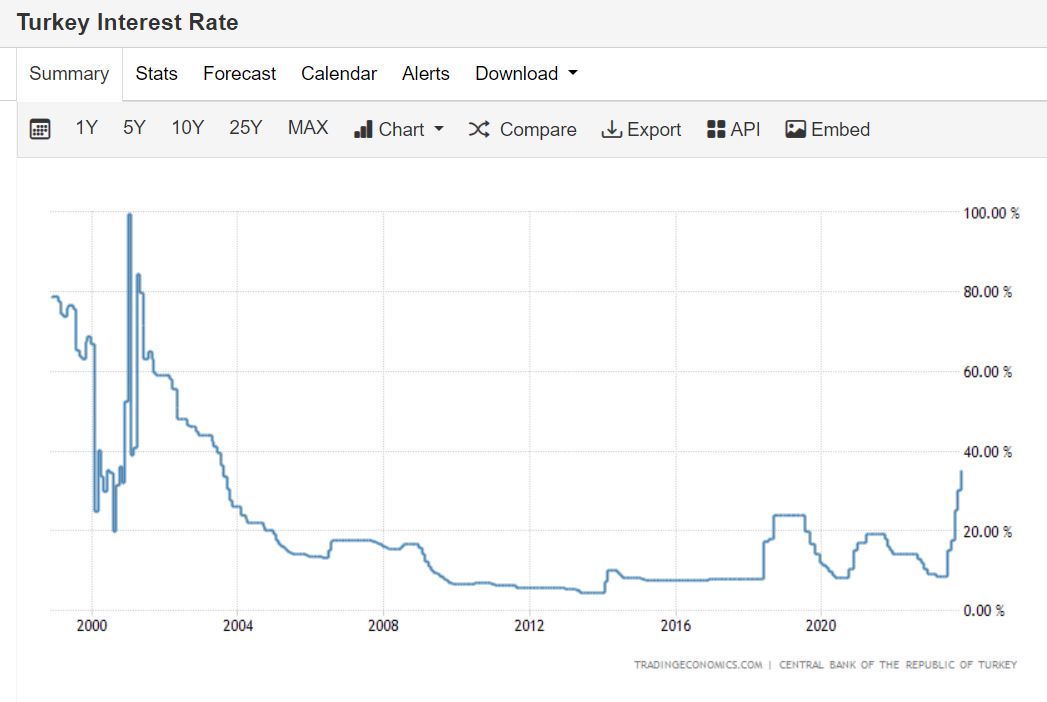

Interest rates in Turkey. Source: Tradingeconomics.com

Turkey's monetary policy and results

The year 2023 will see further weakening of the Turkish lira and persistence high inflation that has returned above 60%. People are increasingly disappointed with Erdogan's policy, which was visible after the elections, where he won only in the second round. Will there be a sobering up and a return to orthodox monetary policy? They say people become rational when all other methods fail. Maybe this is what awaits Erdogan. We'll find out soon. At this point, the central bank raises the interest rate very significantly. In October 2023, it increased to 35% from 30%. This was intended to stop the weakening of the lira and reduce inflation. For now, the dervish dance on the lyre is in full swing.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)