Analysis of the FOMC meeting [Macro review]

After the latest meeting of the FOMC, the preliminary conclusion is: the Fed will allow both the economy and inflation.

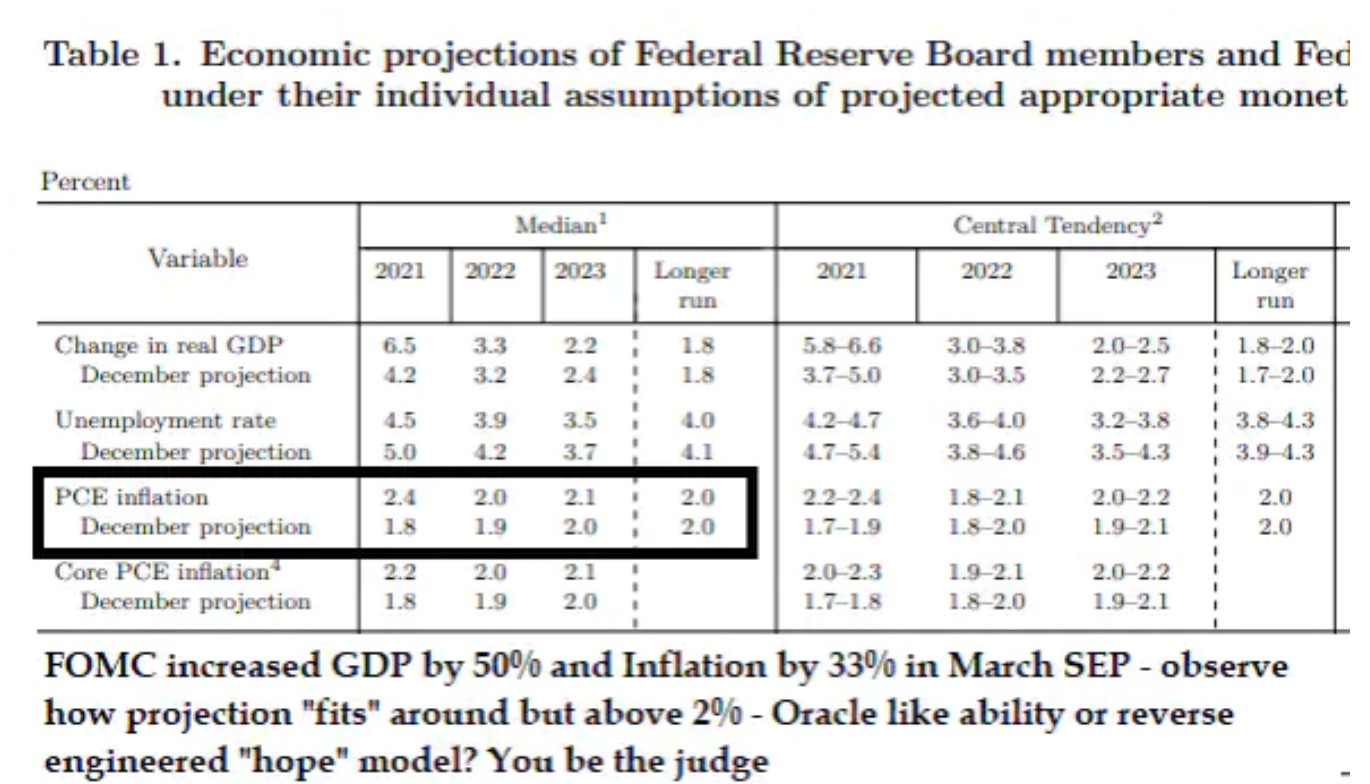

The desired level of inflation was clearly stated by CEO Powell: above 2% in the longer term, where "longer" actually means "longer". In other words, Federal Reserve announces that it intends to ignore rising inflation readings in the coming months amid the spring-summer effects of the end-year price slump in the wake of the Covid-19 pandemic. Fed projections suggest that inflation will pick up significantly this year, but will ease over the next two years - thus the US central bank seems to assume that inflationary pressures will be temporary. Personally, however, I cannot understand how, mathematically, the Fed distinguishes between transitional inflation and permanent (long-term) inflation. Where does one end and the other begin?

Although the Federal Reserve has made it clear that it does not intend to change the Fed's rate of funds or engage in monetary easing until it is clear about the effects of inflation, we have not received any suggestion about the role of the Fed in managing the assets and liabilities of the Federal Reserve's balance sheet or amounting to USD 28 trillion in public debt. The Congressional Budget Bureau estimates that the United States will run a deficit in excess of 2050% of GDP each year until 5. The Fed's asset purchase rate under quantitative easing is currently just under $ 1 trillion annually, or less than 5% of GDP in the year in which a deficit of 14% of GDP is projected and 7% in the following year (although due to new fiscal stimulus / new infrastructure, this level may turn out to be much higher). Consequently, there should be some "upper bound" to real yields that the US will be able to pay out to keep the economy afloat given the upcoming government bond issue. The Fed is already late in answering to what extent the scale of quantitative easing is insufficient in the context US treasury bonds both this and next year.

About the Author

Steen Jakobsen, Chief Economist and CIO Saxo Bank. Djoined Saxo in 2000. As a CIO, he focuses on developing asset allocation strategies and analyzing the overall macroeconomic and political situation. As head of the SaxoStrats team, Saxo Bank's internal team of experts, he is responsible for all research, including quarterly forecasts, and was the founder of Saxo Bank's outrageous forecasts. Before joining Saxo Bank he cooperated with Swiss Bank Corp, Citibank, Chase Manhattan, UBS and was the global head of trade, currency and options in Christiania (currently Nordea). Jakobsen's approach to trading and investing is thought-provoking and is not afraid to oppose consensus. This often causes debate among the global market community. Every day, Jakobsen and his team conduct research in various asset classes, covering major macroeconomic changes, market movements, political events and central bank policies. With over 30 years of experience, Jakobsen regularly appears as a guest at CNBC and Bloomberg News.

This question is still omitted, at least in Fed press releases, and remains a major unknown. At what level of profitability at each point on the yield curve will the United States be able to attract capital - not only domestic given the very high saving rate during the pandemic, but also foreign capital?

It is impossible to clearly assess the impact of the FOMC meeting on the risk appetite. It is easiest to assume that the meeting will be positive for market sentiment, as the Fed will not hold back the realization of the maximum potential for short-term economic growth, and normalization after vaccination will result in a dynamic increase in demand with the support of the government and central banks.

There is, however, an important "but" here: at what cost? US fiscal domination will scare private investment away, will significantly increase regulation, and due to the priority nature of green transformation, too much capital will be allocated to physical investment, which is associated with a limited supply of necessary resources and infrastructure.

Naturally, a green transformation is needed, but governments themselves make this process difficult, and their decisions can be compared to building a railroad backwards. Normally it starts with the traction position before moving on to ordering and producing the rolling stock. In the 20s of the XNUMXst century, however, the situation is different: we produce trains (electric cars), and we deal with traction further (production of green electricity and construction of the necessary infrastructure). Such a solution will be costly and inefficient and will continue to drive up the price of everything from maize to metals and wood, as investing in 'black energy', which is still used almost everywhere, will mean higher energy prices. Inflationary pressures will translate into lower margins, lower profits and higher financing costs. I think this cause and effect chain is now clear.

The real lesson I am drawing from the FOMC meeting is that the Federal Reserve has failed to answer too many questions despite President Powell's reckless efforts. From my perspective, the Fed follows a dogmatic model that focuses on maximum employment at all costs, regardless of inflation and higher rates. All of this at a time when the data, due to the pandemic and political responses, are too volatile to be useful. The sharp decline in GDP last year and the current dynamic recovery are disrupting the Fed's linear models and confusing most market participants.

My goal is that a key risk factor - the process of highlighting as long-term interest rates rise - means that seemingly small movements generate big impulses and are starting to turn back. This is the exact opposite of the linear models used for most economic forecasting. In the next month or two, be aware of these risks. Allowing the economy to warm up to redness and increase inflation is a signal from the Fed that we will face an increase in volatility and an even more negative convexity. This, in my opinion, is the real conclusion.

In practical terms, I remain neutral on the markets until there is a clear signal from break-even yields, gold and the US dollar. For now, I fear that the situation is still pending and there is no plan to address the post-pandemic productivity deficit and debt problem. The importance of debt increases as rates rise, and on Wednesday the Federal Reserve confirmed and "allowed" an increase in nominal rates in the market. This is a huge risk.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Analysis of the FOMC meeting [Macro review] fomc usd](https://forexclub.pl/wp-content/uploads/2019/02/fomc-usd.jpg)

![Analysis of the FOMC meeting [Macro review] covered call option strategy](https://forexclub.pl/wp-content/uploads/2021/03/strategia-opcyjna-covered-call-102x65.jpg?v=1616143060)

![Analysis of the FOMC meeting [Macro review] MSCI etf](https://forexclub.pl/wp-content/uploads/2021/03/MSCI-etf-102x65.jpg?v=1616398604)