Anatomy of the Crisis or Anatomy of FEAR?

"Anatomy of the Crisis. What if the bull market ends? " - this is the title of one of the mailings I received recently. It attracts attention, right? Does it cause you concern? Is it time to reverse your positions? If not today, then maybe tomorrow? Doubts are starting to multiply and we are losing faith in our previous analyzes. I guess it's time to get ready for the crash. The Anatomy of Crisis or maybe the Anatomy of Fear?

They like to scare us ...

Below I present the content of the title e-mail sent by Polish FX broker. It was he who inspired me to bring up this topic.

There has been a boom on the world markets for 9 years and like all the previous ones, it will also find its end one day. This time will be no different. Usually the trend changes rapidly and will surprise most investors. Don't let the crisis surprise you - take care of your education and get ready for it, even if you don't see any clear signs of it today.

Is there anything wrong here? Actually no, but… I'm not going to judge the substantive quality of the training, only the form of its promotion.

The broker clearly suggests that the bull market has been going on for a long time and it will probably end soon. So it's time to prepare for it. Right now? We should be ready for such a scenario when entering the market. Because the crash can always occur (and of course, always violently and surprisingly). But the last fragment suggests that the harbingers of the upcoming financial disaster have already begun to appear, only you probably do not see them.

Crash - then when?

Some analysts blindly believe in economic cycles based on statistics. Since according to historical data, on average, the crisis followed 4 years of growth, after the 2-times longer boom must come with redoubled strength. But then why did we miss one crash? A fundamental analyst would find different macroeconomic reasons here with 20, and a technical analyst would show textbook formations that worked on the graph. And I am quite convinced that there would be a whole body of people saying that it will end soon :-).

Some analysts blindly believe in economic cycles based on statistics. Since according to historical data, on average, the crisis followed 4 years of growth, after the 2-times longer boom must come with redoubled strength. But then why did we miss one crash? A fundamental analyst would find different macroeconomic reasons here with 20, and a technical analyst would show textbook formations that worked on the graph. And I am quite convinced that there would be a whole body of people saying that it will end soon :-).

The fact is, market crashes happen every now and then. Just as you can assume that it will rain someday, and in some time we will only drive electric cars. If anyone knew precisely the future, they certainly wouldn't be an analyst. Statistics is a kind of hint based on what was. But after each head and shoulders formation, we do not have any drops in the market, right?

Speculative bubble

It happens that someone manages to catch some symptoms that suggest an impending event, such as, for example, on the basis of black clouds, it can be estimated that it will probably rain, but there is no guarantee to look for a guarantee. Even a handful of people who "predicted" the occurrence of the last great crisis had quite a hard time with it (I recommend the film "The Big Short", dir. Adam McKay). The capital that was going to end, waiting for the market collapse, also almost buried them as well.

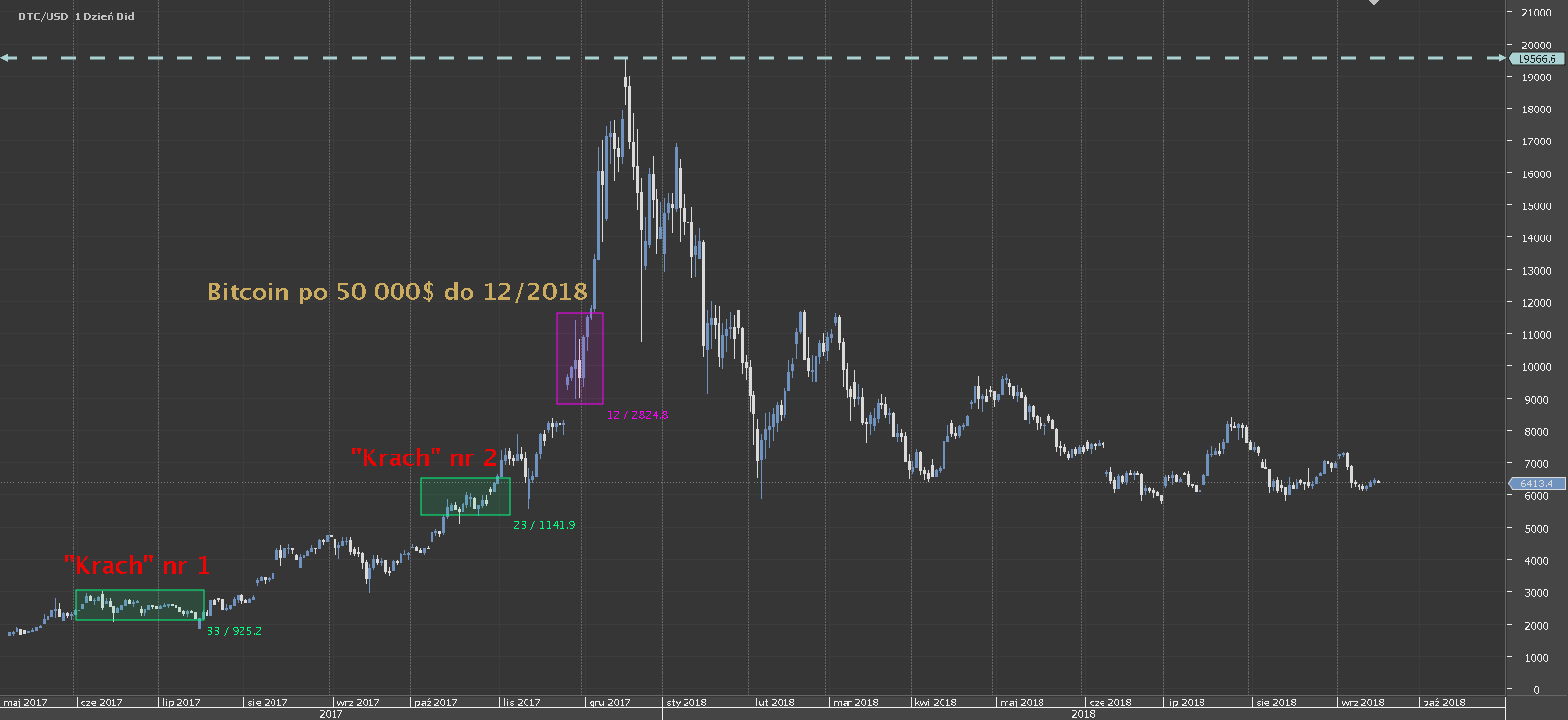

Similarly with speculative bubbles. They were, they are and they will be. And a great example here is popular in recent years Bitcoin. The fact that the valuation of bitcoin is a result of the bubble was buzzing the entire internet already in mid-2017. Then the rate hovered around $ 3000. A few months later, at the $ 6000 valuation, there was no shortage of opinion that the market would collapse at any moment. Volatility was rampant, but ultimately the rate continued to climb practically uninterruptedly. With the absurd valuation of $ 15, you could still hear that "how's it going with a bang" and we'll probably go back to the real valuation of $ 000.

WATCH IT MUST: Bitcoin - a speculative bubble or an investment opportunity [VIDEO]

But at the same time, after another sharp wave of increases, there were voices from "specialists" who predicted that by the end of 2018 the price of bitcoin would reach $ 25, or even $ 000 - on the principle of "who will give more?" Absurd? Looking at it now, you can certainly think so. Back then, these were just one of the many attention-grabbing prophecies.

What are we dealing with today? With a strongly reduced amplitude of fluctuations and valuation around 6000 $. It is still more than in October 2017 year, when there was a second, and maybe even a third wave of loud exhortations that KRACH is coming. So his first followers are still losing about 3000 $ on one bitcoin.

There is really only one absurdity here. It is the belief that anyone of the proponents of the above theories actually knows the future. Neither you nor Amazon's CEO, nor Your broker they don't know where the price will be in X time. If you do not have sufficient capital to be able to control the price, the only thing you can do is estimate the probability of a given scenario and react to current events.

Fear> Greed

According to research, fear is three times stronger than greed. Knowing this, you will understand why it is easier to attract your attention with the coming crash than with the opportunities to make money from the ongoing trend.

According to research, fear is three times stronger than greed. Knowing this, you will understand why it is easier to attract your attention with the coming crash than with the opportunities to make money from the ongoing trend.

It is inherent in human genes to join the crowd. It is there that we feel safer and more confident. We also feel that we can do more as a group. However, when it comes to investing, participation in the crowd causes a lot of problems. In the herd, we start to imitate others, we are more gullible, more impulsive, we react more emotionally and we want to find a leader - Guru - who will guide us. In other words, we lose our independence and our ability to think for ourselves.

It is not difficult to find potential gurus. You don't actually need to look for them - they will try to find you. Only on the Polish Forex market there are at least a few of them. One of them, since 2016, has notoriously tried to attract the public by announcing the impending collapse in the global stock market indices. Interestingly, after continued gains in the markets for the next 2 years, without any major correction, the bias finally changed. Sounds familiar? This is a bitcoin prophecy scenario.

Does the guru want you to fail? Not necessarily. The goal is usually more selfish. The motivation may be, for example, increasing the reach of his audience for advertising or sales purposes, or simply the need to promote oneself (i.e. ultimately also for sales or advertising purposes 🙂). The worst that can happen is that his "prediction" will come true. Then, as a gullible novice investor who is in a group like yourself, you run the risk of building a belief that he is infallible and starting to follow him completely blindly. To end.

Think alone

Building in us certain beliefs of others, instilling a feeling of fear and danger is something that we should avoid at all costs. And you, thinking that someone is trying to help you is actually ruining your trading, even if they think they are helping you. If the guru gets it wrong, at most he will lose some of his audience. But if you make a mistake with him, you will lose your money.

Do not be frightened. Have your own opinion. Stay independent.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Jason Zweig "Your brain, your money" [REVIEW] jason zweig your brain your money](https://forexclub.pl/wp-content/uploads/2022/02/jason-zweig-twoj-mozg-twoje-pieniadze-300x200.jpg?v=1644579798)

![Choose and win a book by Andre Kostolany - "Psychology of the Stock Exchange" [Competition] Stock market psychology contest](https://forexclub.pl/wp-content/uploads/2021/12/psychologia-gieldy-konkurs-300x200.jpg?v=1639400692)