AQR Capital – quants and scientists who revolutionized the world of finance

AQR Capital Management is one of the most interesting investment companies in the world. It was founded in 1998 by Cliff Asness, David Kabiler, John Liew and Robert Krail. The name AQR is an acronym for the phrase Applied Quantitative Research. The fund had a task Beat the broad market with quantitative data-driven strategies. AQR is known for operating slightly differently than traditional investment funds.

The fund operates on a huge scale and has branches all over the world. Out of 7 of them, 3 are in the United States. Interestingly, none of the American facilities are located in New York. AQR chose Boston, Chicago and Los Angeles. In addition, it also has headquarters in Greenwich, Connecticut. Abroad, AQR has points in Bangalore, Hong Kong, London, Tokyo and Sydney.

This is a very interesting fund that tries to be flexible in its investments. What's more, AQR blog is a source of valuable knowledge for anyone who wants to engage in investing in a professional way. In this article, we will explain what exactly AQR does and what its views on the market are.

AQR Capital Management will be established

AQR was created somewhat by accident. Cliff Asness, Robert Krail and John Liew met at the University of Chicago during their doctoral studies. It was then, during the talks, that the first assumptions were made about how the fund could operate. The three wanted to create a fund where there would be a scientific mechanism of “reviewing” investment ideas and strategies. At the same time, the mentioned people wanted to create a quant fund that places great emphasis on data analysis and meticulous checking of investment strategies.. Great attention was to be paid to data of appropriate quality to help create the strategy.

During his dissertation, Cliff Asness began working in Goldman Sachs, where he managed a team of "quants", i.e. analysts who drew conclusions based on the analysis of large data sets. Krail and Liew soon joined the team. These three led the work of this department. They decided to use what they learned during their time at university in their work. A fund was created within Goldman Sachs, which quickly multiplied the money. From $10 million, the fund grew to $100 million in a few years.

In 1998, Cliff Asness with his closest associates (including Krail and Liew) left Goldman Sachs and opened AQR. The firm was the first hedge fund to register with SEC (Securities and Exchange Commission). In the beginning, AQR only offered the opportunity to invest in one product, which it was hedge funds. However, after only two years he also started "traditional" management of client portfolios.

Good results and a breath of new things meant that assets under management grew like a weed. Already in 2001, AQR had $750 million in assets under management (AuM). However, after another three years, AuM grew to $12 billion. Following the wave of success, the investment company began to open branches abroad. In 2005, AQR opened a branch in Australia. After 6 years, the company opened another office. This time in the United Kingdom. In 2019, they had $185 billion in assets under management. A year later, AuM dropped to $140 billion.

AQR realized that it was necessary to properly educate the fund's staff. For this purpose, he established in 2015 QUANTA Academy. It developed training and development programs for the company's employees. They were based on three pillars:

- technical skills and knowledge,

- leadership and management,

- personality enrichment.

Such action is to increase the productivity of employees, which is to allow the company to create even better investment products. It is worth mentioning that more than half of AQR's employees had PhDs in various fields (e.g. econometrics, economics, mathematics).

AQR investment philosophy

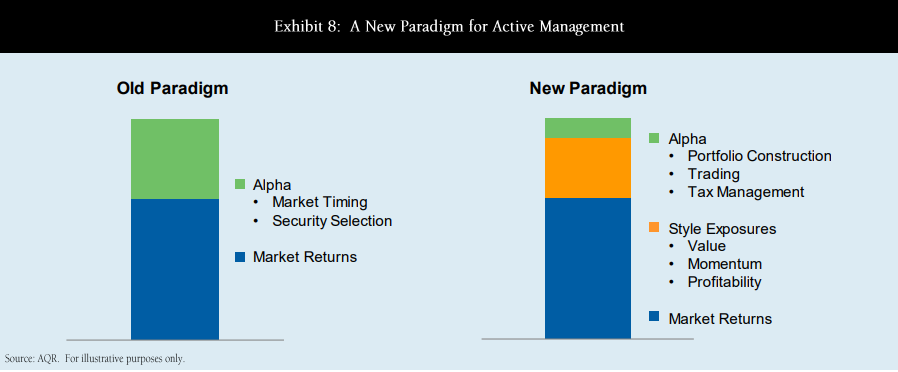

AQR employs many people with a background in mathematics or physics. The fund devotes a lot of time to research on optimal portfolio construction. Therefore, it is not a fund that is intended to be invested in a conservative manner. He does not believe that you should invest only using one strategy (e.g. value or momentum). He tries to find a golden mean between different approaches to the market. In AQR studies you can find information about the so-called A New Paradigm for actively investing. In the traditional model, the investor tries to select assets that will have a so-called "alpha". Alpha is intended to provide a higher rate of return than the market. This may be, for example, the purchase of a discounted company with good fundamentals, or a rapidly growing company. According to AQR, such action is difficult and hard to scale over time. They themselves believe that it is necessary to move smoothly between investment strategies and to construct an investment portfolio properly.

Source: AQR Capital

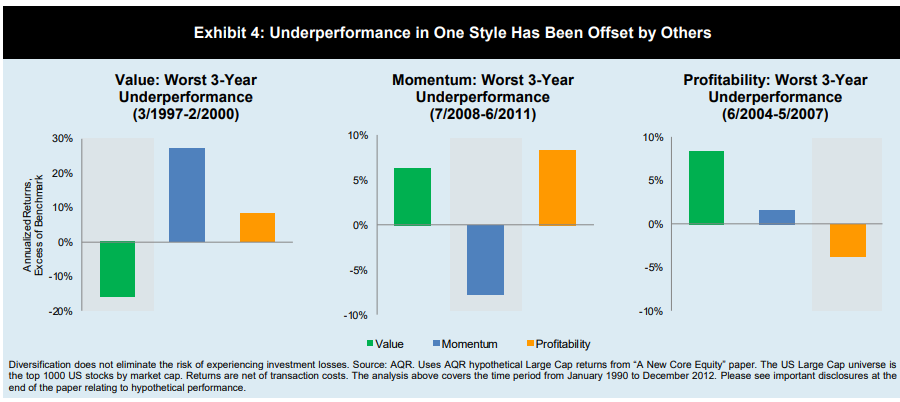

AQR believes in deep diversification of the investment portfolio. In his analyses, he carefully pays attention to the correlation between individual investment strategies. The investment fund has been conducting research for years on the construction of market-beating portfolios. Some of the work can be seen in the chart below. As you can see in the chart below, every investing style has its bad days. However, other ways of investing provide positive returns. For this reason, according to AQR employees, it is possible to construct a portfolio that will generate a higher rate of return with less risk than the "classic" approach to investing.

Source: AQR Capital

What is AQR Capital's advantage over the competition? One of them is openness of discussion within the company and with other people “external”. It may not seem obvious, but AQR believes that good ideas come from conversations between analysts, scientists and traders. It is the opposite of many financial institutions that prohibit employees from talking about their work or publishing the results of their research. Such action creates information silos where talented employees of financial institutions cannot confront their ideas with the entire community of talented people. It is for this reason that John Liew (one of the co-founders of AQR) decided that he wanted to leave his job in the so-called Quant Firm. According to AQR, having 100 intelligent people who cannot exchange views is much less effective than talking together on investment topics. You could say that AQR introduced it “scientific approach” to solve investment problems.

Risk parity – one of the investment ideas

AQR is known in the market as a company offering an alternative approach to the market. They try to provide their clients with an investment product that will be... low correlation to regular portfolios “long only”. It is worth adding that AQR was one of the first asset management companies to offer such strategies to its clients “risk parties” (PR).

To put it very simply, portfolio construction risk parity is similar in its asset selection methodology to creating a minimum variance portfolio. One of the branches of RP is the wallet all weather, which is expected to perform well in both bull and bear markets.

The first fund to introduce an asset management offer using the Risk Parity method was PanAgora Asset Management. This took place in 2005. A few years later, AQR Capital presented its offer. This investment strategy has had its golden years for some time financial crisis 2007-2008.

Risk parity is an interesting idea for building an investment portfolio. Normal allocation involves constructing a portfolio in specific assets (e.g. stocks, bonds). In the case of RP, managers focus on allocating capital, taking into account risk, which is most often defined as volatility. So this is a look at investing from a "defensive" point of view. According to the theory, risk parity aims to achieve a higher Sharpe ratio. At the same time, they are to be more resistant to possible market declines than ordinary investment portfolios. The RP strategy may be sensitive to strong changes in the correlation between assets. Then the carefully constructed wallet is not as "marble" as it seemed when it was built. When building risk parity, it is worth carefully analyzing historical correlations between given assets in various market conditions. COVID-19 has temporarily upended the rules of the risk management game. Due to market panic, many correlations stopped working. Similarly, during the post-Covid boom, some assets moved contrary to historical relations.

Other investment products

AQR, in addition to risk parity, also offers asset management using trend following strategy (trend following) using managed futures. Managed futures are more commonly known as MFA (Managed Futures Account) or IFF (Managed Futures Fund). This is a type of alternative investment that is regulated by CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association). The fund contains various positions in the commodity market, indices, currencies in order to generate profit. Very often, managed futures is a strategy that is uncorrelated with, for example, strategies based on fundamental analysis.

The list of available funds is really large. Their investment strategy and the rates of return achieved can be tracked on the AQR website. Below are two sample funds (*this is not investment advice).

AQR Large Cap Defensive Style Fund

This is a fund that was developed for clients who want to invest in shares but are afraid of too much market volatility. The fund focuses on defensive companies that have stable business models and low market volatility. The fund is looking for such companies in: Russell 1000 index, which brings together large and medium-sized companies. According to data prepared by AQR, Since its establishment in 2012, the fund has achieved an average annual rate of return of 12,54%. At the same time, the Russell 1000 Total Return Index generated 13,72%. The annual portfolio management costs are 0,38% per year. As you can see, the index performs worse than the benchmark in terms of long-term return. It is worth noting that the minimum deposit for an individual investor in this product is $5 million. At the end of August 2023, assets under management of this fund amounted to $3,3 billion.

AQR Sustainable Long-Short Equity Carbon Aware Fund

This is a fund established in 2021 and is small in size. Assets under management amount to $32 million. As the name suggests, the fund uses a long-short strategy. This means that AQR takes a long position for some companies and a short position for others. In theory, the strategy should perform well in all market conditions. The benchmark for the fund is a portfolio constructed as follows:

50% MSCI World Index + 50% 3-Month Treasury Bill Index.

There is also a Polish accent in the fund. The head of ESG at AQR is a Pole - Lukasz Pomorski – who has been working at AQR for 8 years. Since the beginning of the fund's operation (16.12.2021/XNUMX/XNUMX) the average annual rate of return for the fund is 17,9%. At the same time, the benchmark earned 1,54% on average annually. Individual investors cannot invest in the fund.

Summation

AQR Capital is an example that sometimes it's worth believing in yourself. Cliff Asness and his three friends created an investment company that particularly believes in data analysis. The company was also innovative. AQR was the first investment company to offer AMT, i.e. Alternative Mutual Funds. In short, it is an open fund that dealt with alternative investing.

Thanks to the work of financiers, mathematicians, physicists and econometricians, new investment strategies are developed. Very often, AQR shares his thoughts with readers. On the AQR website you can find dozens of articles about investing. For those interested, I encourage you to check out the AQR investment blog, where you can find really interesting analyzes of various investment strategies.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response