ARK Innovation ETF - innovations in the portfolio

From the beginning of the industrial revolution, innovation has become one of the engines of economic development. Telegram, telephone, television, computer, GPS and the Internet changed the world and caused a sharp increase in productivity. For many years, innovators have been able to benefit from a rapidly growing industry. If the company was very well managed, the shareholders were also the beneficiaries of the innovation. Take the rates of return of companies such as Apple and Microsoft as an example. These companies started out in the garage and now have capitalization in excess of $ 2 trillion.

Currently, we are on the threshold of the next innovations that can change the world. We are talking about the development of artificial intelligence, the automation of mental and production work. We cannot forget about the fintech market, which is undermining the profitability of the banking sector. It is possible that many companies operating in these industries can generate an above-average rate of return.

Innovation is not just about creating new breakthrough products. Sometimes an innovation may be a different way of managing the production or sale of products. An example is Amazon, which was a regular seller in the first years of operation. The difference was the way of selling. Instead of buying himself to build a stationary sales network, he offered a wide range of products through his website. This made it possible to offer more favorable prices, which convinced customers to take advantage of the company's offer.

Disadvantages of investing in innovative companies: Timing

Even the best business idea can fail if it is introduced at the wrong time. This is a paradox, but sometimes launching a product too early can cause a project to fail. The flagship example is Webvan, which developed the e-grocery segment in the 90s. The company's plans were ambitious, the delivery of food products was to take 30 minutes from the moment the order was placed. To achieve this, it developed a network of warehouses and its own logistics services (as is currently the case with Amazon). Webvan's target group was a mass client. Low margins combined with high sensitivity of customers to price fluctuations resulted in large losses on operating activities, as the company applied an aggressive promotional policy.

The company developed dynamically, but generated huge losses. In 2000, she had a loss of $ 525 million on revenues of $ 175 million. Despite having over 750 customers, the company did not manage to build an appropriate scale of operations. In 000, the company filed for bankruptcy. Webvan's idea was not bad, there was not enough capital and time. Customers had to be mature enough to buy food products online. It is worth mentioning that in 2013, Amazon launched its e-grocery service (Amazon Fresh). Jeff Bezos also hired former Webvan managers to "learn from mistakes" made several years earlier.

The decision of when to be patient

For those investing in growth companies, it is worth having patience. In the case of many listed companies, it happened that after a disappointing two quarters, the company's valuation fell by several dozen percent. Such stories apply not only to small companies, but to corporations with a valuation of several dozen or even several hundred billion dollars. An example is Amazon, the capitalization of which has repeatedly decreased by several dozen percent - even despite the continuous increase in the scale of operations. For this reason, long-term investors should not react to nervous market reactions. However, patience is only advisable if you know what you are buying. If the investor overpays for the company, the correction may not be a nervous market reaction, but a valuation adjustment.

Time and information asymmetry

When investing on their own account, the investor has to decide for himself what strategy he wants to use and on which market to allocate his capital. The investor himself chooses whether he wants to use technical or fundamental analysis to select companies.

However, the disadvantage of such a solution is the amount of time that the investor has to spend on selecting companies for the portfolio. When a trader uses technical analysis, it is imperative to monitor the market to open a position with a favorable reward / risk ratio. It takes your time.

It is similar in applying fundamental analysis. The investor must read the financial statements (annual and quarterly reports) and examine the micro and macro environment of the company (e.g. relations with suppliers and recipients or barriers to entering the market). Nobody is the alpha and the omega. For this reason, very often a person who individually invests in technology companies has a knowledge gap. For this reason, the investor has three options to choose from:

- Use analytical reports,

- Educate yourself,

- Abandon individual selection of technology companies.

When using analytical reports, the investor must rely on the knowledge of sell side analysts or people dealing with the industry. However, in such a case, the investor should still educate himself to be able to "separate the grain from the chaff". However, the use of external studies by professionals allows you to shorten the time to learn about the strengths and weaknesses of the market and the company.

Self-training requires a lot of time. This is an expensive option in terms of opportunity cost. Spending 300 hours learning about the industry can be "investing" in extra work or increasing your competitiveness in the job market. Sometimes, even after training, it is impossible to draw conclusions that will translate into a higher rate of return. For this reason, it is worth considering all the pros and cons in order to take the time to learn about the company's industry operating in an innovative market.

Another solution is to accept your ignorance and use products that allow you to invest in innovative companies without having to spend your own time understanding the industry and selecting winners.

They are such a solution ETFsthat give exposure to innovative companies. Some of them focus on specific industries (e.g. biotechnology, robotics, etc.). As a result, the investor can buy a "basket" of innovative companies at an affordable price (management fee).

Investing in ETFs investing in innovative companies

To avoid the above-mentioned challenges, you can use the offer of ETFs that invest in innovative companies. Thanks to this, the investor does not have to waste time choosing companies for the portfolio. He buys a diversified "basket" of shares. Depending on the ETF's investment policy, an investor may gain exposure either to a specialized segment of the market or to various 'innovative' companies. In the further part of the article we will present one of the ETFs investing in innovative companies - ARK Innovation ETF.

ARK Innovation ETF

The aforementioned ETF is one of the best-known passive solutions that give exposure to the market of innovative companies. The real success of the fund came in 2020, when the value of the unit increased by over 150%. Interestingly, the ETF's job is not to follow an index, but to actively manage it. ETF focuses mainly on investing in enterprises known as "disruptive innovations". Dysruptor is a company that intends to change the way the industry works.

The most famous person associated with the fund is Cathie Wood, who is the founder, CEO (Chief Executive Officer) and CIO (Chief Investment Officer) of the investment company Ark Invest. Cathie Wood has many years of experience in asset management. In the years 2001 - 2013 she worked at AllianceBernstein as CIO, where she was responsible for global strategies. In 2014, she started working on her own account, establishing Ark Invest. Interestingly, Bill Hwang from Archegos Capital invested in the project.

Ark Innovation ETF was founded on October 31, 2014. The management fee is 0,75%, which is quite a high fee for an ETF. On the other hand, this is an actively managed ETF, so understandably the costs have to be a little higher. At the end of September 2021, assets under management (AUM) totaled $ 19,4 billion.

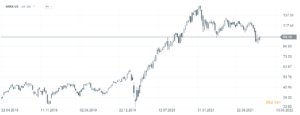

Ark Innovation chart, interval W1. Source: xNUMX XTB.

Below are the top 10 ETF components as of December 22, 2021:

| Company name | Participation in the index |

| Tesla | Present in several = 7,21% |

| Roku | Present in several = 6,10% |

| teladoc | Present in several = 5,99% |

| Zoom | Present in several = 5,92% |

| Coinbase | Present in several = 4,77% |

| UnitySoftware | Present in several = 4,69% |

| Spotify Technologies | Present in several = 4,23% |

| twillio | Present in several = 4,13% |

| Exact Sciences | Present in several = 3,92% |

| Intellia Therapeutics | Present in several = 3,73% |

Tesla

It is currently one of the most famous automotive companies in the world. The founder and CEO (Chief Executive Officer) is Elon Musk. Elon is considered by many to be a visionary, others accuse him of being too eccentric. Tesla is best known for its electric cars, which offer a very high level of autonomy. In recent years, the company has produced many models (Model S, Model X, Model 3, Model Y). Recently, the cumulative sales of the Model 3 exceeded 1 million units. In turn, the cumulative sales of the latest Y model exceeded 200. pieces. In addition to the production of cars, Tesla also has a network of its own charging points. The company's capitalization exceeds $ 1 billion.

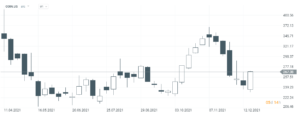

Tesla chart, interval W1. Source: xNUMX XTB.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 11 759 | 21 461 | 24 578 | 31 536 |

| operational profit | -1 | -253 | 80 | 1 994 |

| operating margin | -13,88% | -1,18% | Present in several = 0,00% | Present in several = 6,32% |

| net profit | -1 961 | -976 | -862 | 690 |

Roku

The company was founded in 2002. It is an American hardware manufacturer that is to enable customers to use the online video streaming offer. Thanks to the Roku offer, customers do not have to buy new TVs to conveniently use the streaming offer. All you need to do is connect the Roku plug to the USB input, create an account and a wide range of platforms is at your fingertips. The company cooperates with with companies such as Netflix, Disney + or Amazon Prime. At the end of August 2021, it had over 55 million active customers. In addition, Roku launched an advertising offer in 2017 that allows companies to broadcast advertisements to Roku users. The company's capitalization exceeds $ 31 billion.

Year chart, interval W1. Source: xNUMX XTB.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 512,8 | 742,5 | 1 128,9 | 1 778,4 |

| operational profit | -19,6 | -13,3 | -65,1 | -20,3 |

| operating margin | -3,82% | -1,79% | -5,76% | -1,14% |

| net profit | -63,5 | -8,9 | -59,9 | -17,5 |

teladoc

In 2020, it was one of the beneficiaries of the pandemic. Lockdown and the transition of many activities "online". The main product of the company is the provision of online medical services. Thanks to this, customers do not have to waste time traveling to undergo a medical consultation. The offer mainly applies to non-life-threatening matters (such as colds, flu, conjunctivitis). In 2020, over 10,5 million visits took place using the company's offer. It is worth mentioning that in 2020 Teladoc took over a competitor - Livongo for $ 18,5 billion. In mid-2021, the company announced that the number of its paid subscribers in the United States alone exceeded 51 million, an increase of 92% y / y. The company's capitalization is approximately $ 15 billion.

Teladoc chart, interval W1. Source: xNUMX XTB.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 233,3 | 417,9 | 553,3 | 1 093,9 |

| operational profit | -62,2 | -65,9 | -73,8 | -418,2 |

| operating margin | -26,61% | -15,77% | -13,34% | -38,23% |

| net profit | -106,8 | -97,1 | -98,9 | -485,1 |

Global Coinbase

The company was founded in 2012, incl. by the current CEO - Brian Armstrong. It is the largest, regulated and centralized giełda kryptowalut in United States. The company offers transaction services for both individual and institutional clients. In addition to transactional revenues, the company also offers portfolio services for storing the private key. It is also worth mentioning the staking offer (depositing cryptocurrencies in PoS in order to earn interest income). For over three years, the company has been investing in various projects in the crypto world through Coinbase Ventures. In 2021, the company made its debut in 2021. The company's current capitalization has exceeded $ 70 billion.

Coinbase chart, interval W1. Source: xNUMX XTB.

| PLN million | 2019 | 2020 |

| revenues | 533,7 | 1 277,5 |

| operational profit | -35,6 | 408,9 |

| operating margin | -6,67% | Present in several = 32,01% |

| net profit | -30,4 | 322,3 |

Zoom

This is another company that has benefited from the pandemic. The transition of many companies to remote work has increased the demand for telecommunications tools. Zoom was established in 2011. The company was founded in 2011 by a former Cisco employee, Eric Yuan. Initially, the company had very big problems with raising capital as PE and VC felt the market for video calling applications was very saturated. Ultimately, after acquiring the first investors and acquiring well-known clients (Stanford University), the company caught the wind in its sails. Along with the increase in the scale of operation, the company increased the functionality of its application. Currently, the company's offer includes audio calls, chats and file sharing. Companies are the main customers of Zoom. At the end of Q2021 2, the company had over 500 customers who paid over $ 100 per year for using the services. The current capitalization of the company is approximately $ 000 billion.

Zoom chart, interval W1. Source: xNUMX XTB.

| PLN million | 2018FY | 2019FY | 2020FY | 2021FY |

| revenues | 151,5 | 330,5 | 622,7 | 2 651,4 |

| operational profit | -4,8 | 6,2 | 12,7 | 659,8 |

| operating margin | -3,17% | Present in several = 1,88% | Present in several = 2,04% | Present in several = 24,88% |

| net profit | -8,2 | 7,6 | 21,8 | 671,5 |

Spotify

It is one of the few European technology companies to hit the global subscription services market. Spotify Technologies is a Swedish company that offers audio streaming through its platform. Spotify customers can listen to music or podcasts. Extensive functions are possible after purchasing a subscription (freemium model). Spotify offers over 70 million songs. In 2021, the company had 172 million subscribers who come from over 180 countries. The company's capitalization exceeded $ 45 billion.

Spotify chart, W1 interval. Source: xNUMX XTB.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 4 090 | 5 259 | 6 764 | 7 880 |

| operational profit | -378 | -43 | -73 | -293 |

| operating margin | -9,24% | -0,82% | -1,08% | -3,72% |

| net profit | -711 | -78 | -186 | -581 |

Forex brokers offering ETFs

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain / Cyprus |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

397 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response