How to buy Netflix shares? Everything about investing in Netflix [Guide]

How to buy Netflix shares? Everything about investing in Netflix

Netflix is a company that offers access to series and movies as part of a fixed monthly subscription. In addition to offering a platform for streaming TV and film productions, Netflix also creates its own film productions and series. Currently, the company's services are available almost all over the world. In April 2020, Netflix had 182 million active subscriptions worldwide, and the company's market capitalization was $ 186,78 billion.

Chart - Netflix shares

Basic information about Netflix

| Logo |  |

| Name | Netflix |

| Headquarters | Los Gatos, California, USA |

| creation date | August 29 1997 |

| Stock symbol | NFLX |

| trade | entertainment, media |

| Capitalization (as of April 28) | 186,78 billion USD |

| Dividend | - |

| Web page | www.netflix.com |

Netflix CEO - Reed Hastings

The company's CEO is Reed Hastings. In addition to managing Netflix, Reed Hastings also sits on Facebook's supervisory board. In the years 2007 - 2012 he sat on the supervisory board of Microsoft.

The first company he founded Reed Hastings was called Pure Software. She produced software and her first product was a tool for finding errors in the code. The company was developing very dynamically, doubling its revenues for 4 years in a row. Reed Hastings left the company after its acquisition by Rational Software.

Then in 1997 Netflix was created. Co-founder was Marc Randolph.

Netflix company history and development

We associate Netflix with a fresh, innovative start-up, but it is a company that has been on the market for 22 years. Initially, it was a mail-order DVD rental, which at the time of establishing the company was also a quite innovative business model based on new technologies (DVDs instead of VHS cassettes).

Business expansion

In 2010, Netflix expanded its activity to include online movie and series streaming services. The company has been creating its own film productions since 2013. Netflix's first production was the House of Cards series with Kevin Spacey in the lead role. Since then, Netflix has been dynamically developing its branch of film production. In 2016, the company released 126 proprietary company productions, more than any other television network. In 2019, Netflix employed nearly 7000 employees. Such dynamic development of the company makes many people wonder if and how to buy Netflix shares.

Profits and debt

Strong orientation of the company on the production of good quality series and films results in a considerable debt of the company. In 2019, it amounted to $ 12 billion.

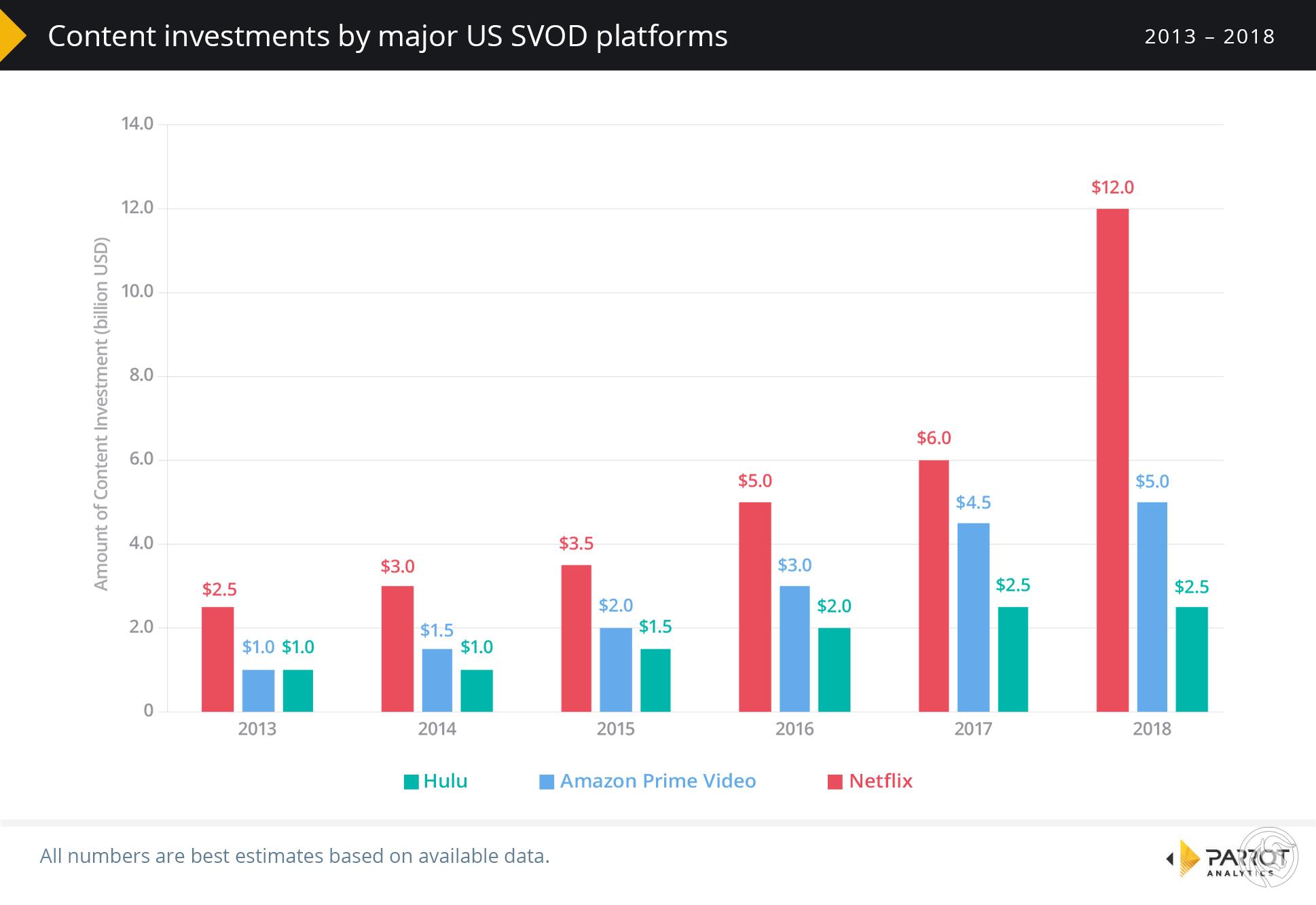

The chart below presents the expenditure on creating own production of three VOD giants (Netflix, Amazon and Hulu) over recent years.

The company's revenue for 2019 is $ 20 billion, of which Netflix is $ 1,8 billion.

Selected own productions

House of Cards

The first serial produced by Netflix. The series is based on the novel by Michael Dobbs. The premiere of the first season took place in February 2013. The plot of the series revolves around the character of the main character, Francis Underwood (played by Kevin Spacey). Francis Underwood is a spokesman for the party discipline of the Democratic Party in the US Congress. During the series, we observe his political skirmishes and games, as well as the road to more and more power.

- Budget: USD 60 million / season

- Seasons 6

Orange is the new black

The series was based on the book "Girls from Danbury. Orange Is the New Black. " Watching the series, we follow the story of Piper Chapman (Taylor Schilling) imprisoned for 15 months in a female prison. The reason for embedding Piper Chapman is a suitcase full of money from drug transactions of Piper's ex-girlfriend Alex Vause (Laura Prepon). The series presents the fate of female prisoners who represent the entire cross-section of society and their mutual relations.

- Budget: USD 50 million / season

- Seasons 7

The Witcher (The Witcher)

The series was based on the books of Andrzej Sapkowski about the witcher. The action takes place in the land of the Continent, inspired by the Middle Ages. The main character is Geralt of Rivia (Henry Cavill), a hired monster hunter in love with Princess Cirilli (Freya Allan) and the sorceress Yennefer (Anya Chalotra). So far in December 2019, the first season of the series has appeared. The premiere of the next season is planned for 2021.

- Budget: USD 70 million / season

- Seasons 1 (next in production)

Netflix competition

Companies such as are also fighting for VOD market share Amazon, Hulu, Disney and Apple Lossless Audio CODEC (ALAC),.

Amazon

Currently, Netflix's biggest competitor is Amazon. The Amazon Prime Video VOD service currently has 97 million paying subscribers. Amazon, like Netflix, also creates its own productions. The most popular is "The Marvelous Mrs. Maisel " and "Transparent".

Hulu

With 79 million active subscriptions, Hulu ranks third on the global VOD market cake. Hulu, like Netflix, began its existence by providing DVD rental services. Only with time did it switch to digital streaming of film productions.

Disney

The Disney VOD service is called Disney +. The offer includes all films and series produced by the giant of the film industry. In addition, Disney + offers Pixar, Marvel, Star Wars, Natonal Geographics and 21st Century Fox productions. At Disney + we will also watch all Simpsons seasons.

In addition, there are many smaller players on the market, each of whom has a long way to go to catch up with the giants described above.

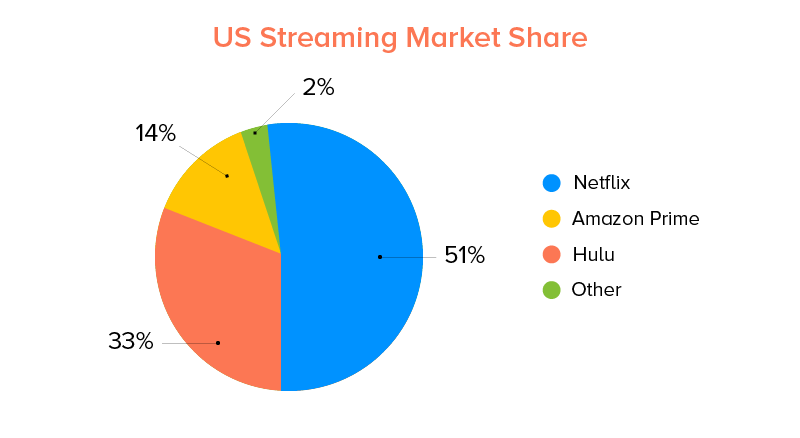

Market share

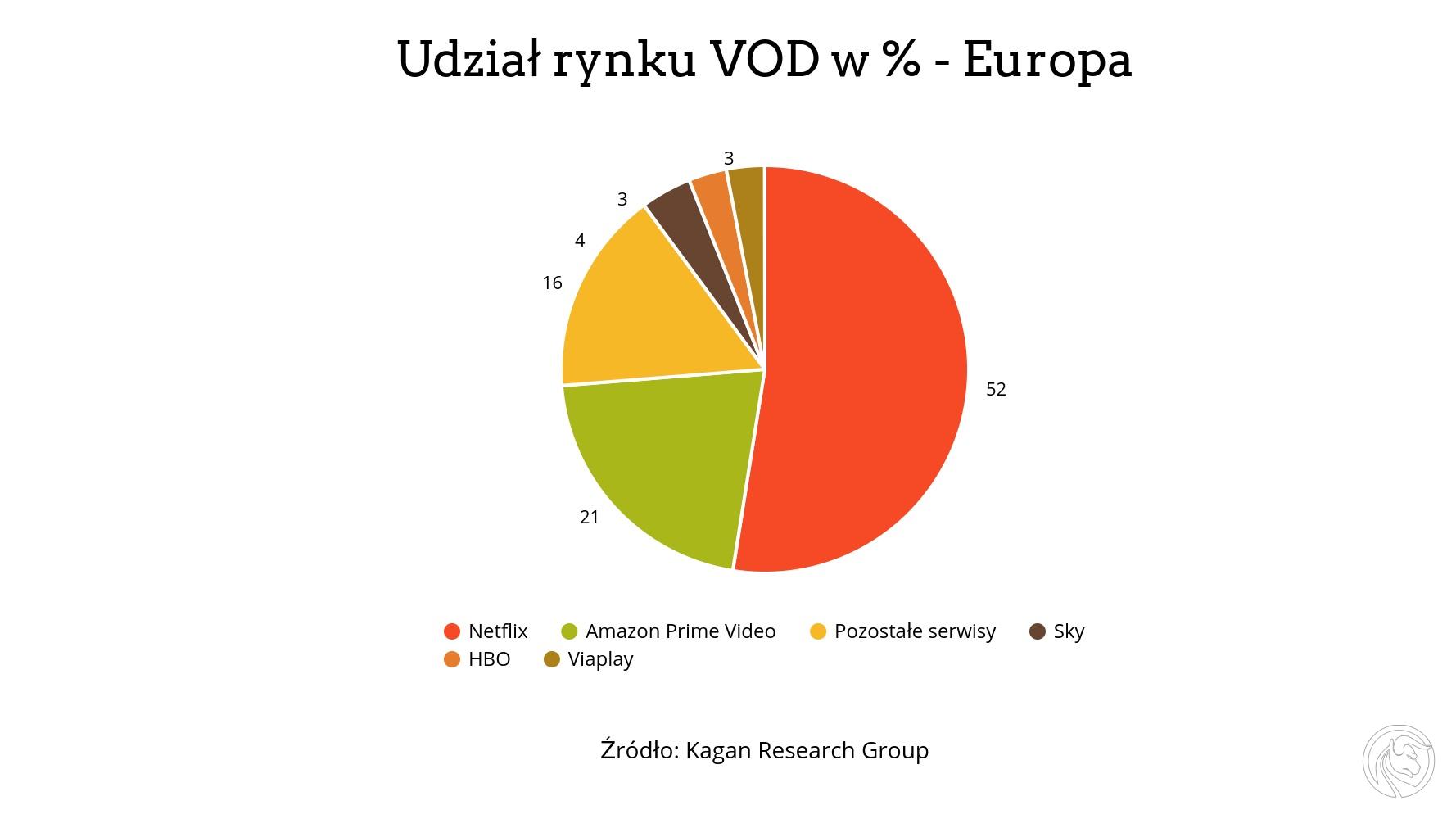

Both in the USA and in Europe, Netflix is the undisputed leader in the entire VOD market (Video on demand - video on demand).

In the US, according to data for 2019, we have 158,8 million users paying for Netflix subscriptions, which gives a 77% market share of 208 million users. The second largest competitor, Amazon video, enjoys market penetration of 46%. The third big player, Hulu, controls 36% of the US VOD market. It is worth noting that many users pay for a subscription to several VOD services at once.

In Europe, Netflix controls 52% of the market. The second largest player on the VOD market is Amazon (21% of the market). The remaining companies represent several percent of the market share.

Company philosophy

Netflix is distinguished by an unusual company management philosophy based on two overarching values - Freedom and Responsibility.

Hiring the best

Netflix achieves this goal in two ways. On the one hand, it pays all employees (including regular employees) above the industry average. By offering attractive salaries it attracts the interest of the best of the best candidates for a given position. On the other hand, it bluntly dismisses people who do not work, offering them very rich severance pay (often six-digit). In this way, by behaving fairly towards his former employees, he makes room for people more suited to a given position.

Freedom and responsibility

Having a team of the best people possible, a dream team, the management of Netflix assumes that by employing adult, talented individuals, it is logical to give them freedom in carrying out their duties. Thanks to this, the team can demonstrate their talents in the widest range and quickly react to opportunities and threats that arise.

A minimum of bureaucracy

By placing responsibility and freedom in the hands of its employees, Netflix can drastically reduce the number of corporate procedures. For example, Netflix employees can take holidays at any time and at any time. The only case where they are required to contact the HR department is when they want to take time off for more than 30 days in a row.

Operating according to such principles allowed Netflix to keep up with the dynamic growth rate of the VOD industry and to develop the position of the undisputed leader.

How to buy Netflix shares

We have several options to invest in Netflix. The first is to buy shares on the US stock exchange directly by a Polish brokerage house.

Another option is CFD investment, which gives us direct and exclusive exposure to Netflix shares and the option of investing with leverage.

We can also buy Netflix shares using ETFs. The following ETFs are of interest:

[FNGS] MicroSectors FANG + ETN

-

- Annual fees: 0.58%

- Issuer: BMO Financial Group

Technology ETF, including technology giants in its composition. FANG is short for Facebook, Amazon, Apple, Netflix and Google. In addition, the ETF includes Alibaba, Baidu, NVIDIA, Tesla and Twitter shares. The percentage shares of individual companies in this ETF are presented in the table below.

| TWTR | Twitter Inc | 12.88% |

| TSLA | Tesla inc | 12.17% |

| AAPL | Apple Inc | 9.99% |

| FB | Facebook Inc | 9.82% |

| GOOGL | Alphabet Inc | 9.74% |

| BABA | Alibaba Group Holding Ltd | 9.55% |

| NFLX | Netflix Inc | 9.18% |

| AMZN | Amazon.com Inc | 9.15% |

| BIDU | Baidu Inc | 8.97% |

| NVDA | Nvidia Corp | 8.55% |

[IEME] iShares Evolved US Media and Entertainment ETF

-

- Annual fees: 0.18%

- Issuer: iShares

ETF containing entertainment and media companies. Netflix shares have the largest percentage in this ETF. We also find companies such as Disney, Electronic Arts, Fox Corp and Discovery. A detailed list of companies included in the ETF is below.

| NFLX | Netflix Inc | 8.00% |

| ATVI | Activision Blizzard Inc. | 6.81% |

| CMCSA | Comcast Corp. | 6.20% |

| CHTR | Charter Communications Inc | 6.01% |

| DIS | Walt Disney Co | 5.19% |

| EA | Electronic Arts Inc. | 4.59% |

| LBRDK | Liberty Broadband Corp | 4.44% |

| FOX | Fox corp | 3.77% |

| IAC | IAC / InterActiveCorp | 2.87% |

| disck | Discovery Inc. | 2.77% |

[PBS] Invesco Dynamic Media ETF

-

- Annual fees: 0.63%

- Issuer: Invesco

The fund offers exposure to media companies from the US market. The largest percentage share in the composition of this ETF have Snapchat, Netflix, Spotify, Facebook, Google, Siri, Twitter. A detailed table of the 10 largest companies included in Invescro Dynamic Media ETF below.

| SNAP | SNAP INC | 6.45% |

| NFLX | Netflix Inc | 6.38% |

| SPOT | Spotify Technology AG | 6.02% |

| FB | Facebook Inc | 6.00% |

| GOOGL | Alphabet Inc | 5.61% |

| INFO | IHS Markit Ltd | 4.96% |

| SIRI | Sirius XM Holdings Inc. | 4.78% |

| TWTR | Twitter Inc | 4.57% |

| MTCH | Match Group Inc. | 4.01% |

| IAC | IAC / InterActiveCorp | 3.61% |

Where and how to buy Netflix shares

We can buy them through brokerage houses as well forex brokers. Below is a list of selected brokers offering shares, CFDs on shares or ETF with Netflix in their offer.

How to buy Netflix shares: Brokers offering shares and CFDs on shares and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Traditional shares and CFDs

How to buy Netflix shares, or which instrument is better - traditional stocks or CFDs? There is no clear answer to this question. In practice, everything will depend on our expectations, strategy, and the time perspective of the planned investment.

| Traditional actions | CFD per share | |

| Investment time horizon | long | short |

| Financial leverage | None | max. 1: 5 (depends on value) |

| Swap points | None | so |

| Possibility of playing for declines | nie | so |

If we believe that the share price will increase in the long term, then traditional stocks certainly seem to be a better choice - we do not use financial leverage here and therefore, if we are successful, we earn less, but at the same time risk less and bear no costs due to fees holding positions (swap points).

In the case of short-term speculation, CFD instruments maximize profit. Although, as a rule, fees are higher than in the case of traditional shares, the financial leverage mechanism allows to generate higher profit with less volatility of the instrument. In addition, we have the option of betting on price drops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy Netflix shares? Everything about investing in Netflix [Guide] how to buy netflix shares](https://forexclub.pl/wp-content/uploads/2020/05/jak-kupic%CC%81-akcje-netflixa.jpg?v=1588925830)

![How to buy Netflix shares? Everything about investing in Netflix [Guide]](https://forexclub.pl/wp-content/uploads/2020/05/Strategia-forex-na-koniec-dnia-6msc-102x65.jpg?v=1588575635)

![How to buy Netflix shares? Everything about investing in Netflix [Guide] wall street xtb april](https://forexclub.pl/wp-content/uploads/2020/05/wall-street-xtb-kwiecien%CC%81-102x65.jpg?v=1588584377)