Australia wants to increase the protection of retail investors

The Australian Securities and Investments Commission (ASIC), an institution dealing with the supervision of the Australian financial market, has published a document in which it presents the main ills of the Forex / CFD market there. This is primarily a problem with transparency, trade security and unreliable marketing for individual investors. Do Australians want to follow the footsteps of the European Union?

The main problems of the market

ASIC draws attention to several key problems faced by the FX / CFD industry. They are mainly:

- misleading marketing materials,

- unclear methodology of price formation on platforms,

- inadequate risk management,

- insufficient monitoring of their partners and how they work.

The Australian equivalent of the KNF has reservations about virtually every sphere of the market - Forex, CFDs and binary options. However, the most attention is drawn to the latter, which are characterized by an extremely low level of transparency and, at the same time, the worst results achieved by investors.

The document itself draws attention and describes problems more broadly, but at the same time it does not include planned ad hoc solutions. It can therefore be assumed that ASIC only prepares them. It is comforting that the Australian regulator does not indicate financial leverage as a source of any problem. Comparing the documentary tone with recent changes in Europe, it can be expected that similar steps could take place mainly in terms of risk communication, marketing regulations and restrictions in offering binary options.

Worst results on "binaries"

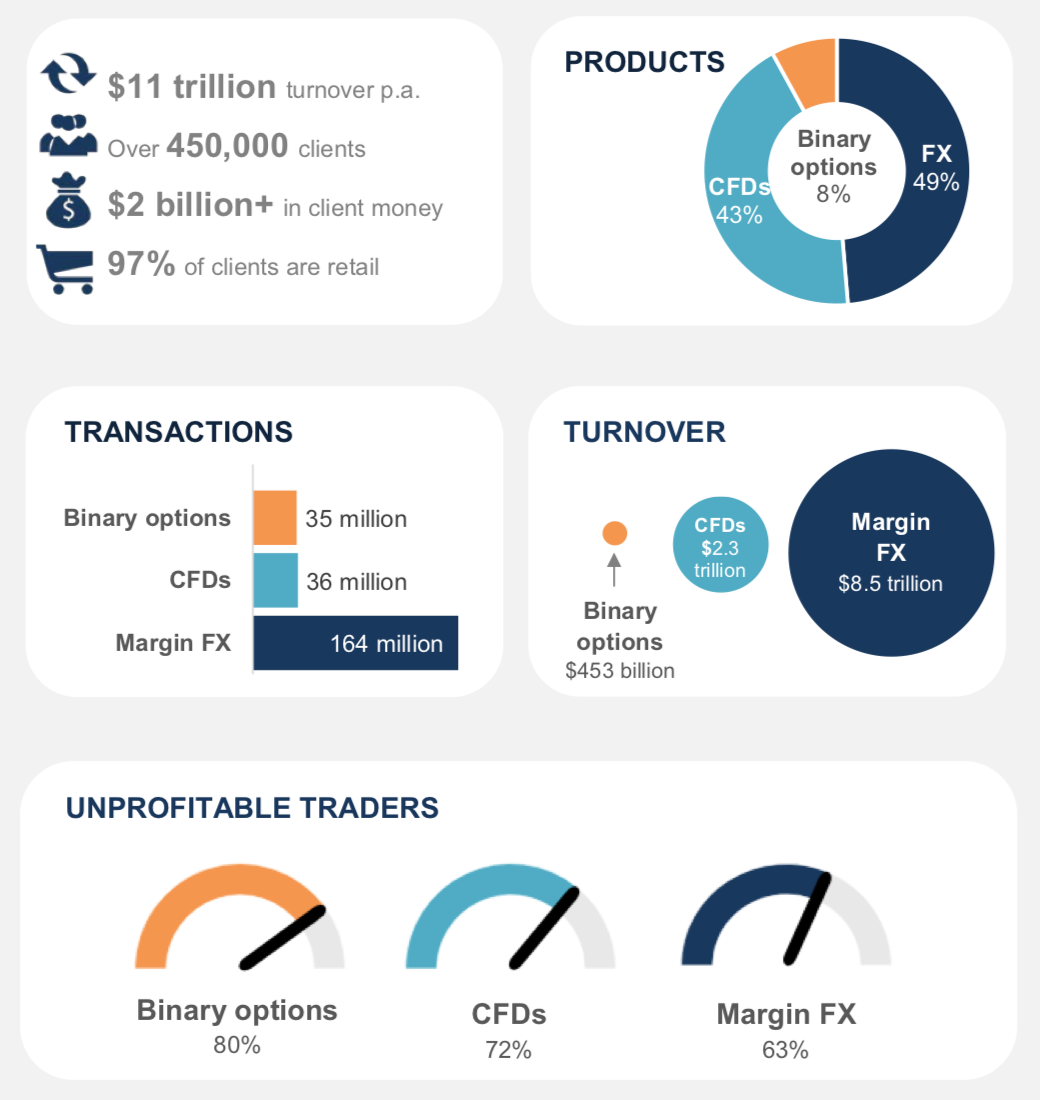

In his report, ASIC included a handful of interesting information about the market divided into sections: Forex, CFD and binary options. The entire OTC sector in Australia has approx. 450 clients - however, no information has been given as to whether they are only citizens of this country or clients from around the world with accounts with Australian brokers. Interestingly, as many as 000% of traders have the status of a retail client.

Forex is the most popular (as much as 49%), followed by CFD instruments (43%), and options account for only 8% of the market. It also turns out that the more interest, the better the results. 37% of traders record profits on FX instruments, 28% on CFDs, and only 20% on binary options. Compared to the European market, the statistics look better - according to the latest data, which we presented in THIS article, on average, 23,9% of traders from the EU record a profit.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-300x200.jpg?v=1708677291)