Bad data good for the market. When will we feel their influence?

Market anomalies are currently not new. During the last sessions, we exceeded one million cases, which was more important information than a series of poor macroeconomic data from practically most regions. We could say that we got used to the poor economic readings a significant part of 2019, and not necessarily to such a massive number of cases. Stock indices, as a reflection of the broad market, closed slightly below the weekly prices on Friday. Looking at them, one can get the impression that there has been a larger correction lasting several days. However, there is no question that the currently ignored macroeconomic data will reflect its mark on the market.

The epidemic is spreading

Certainly the United States has become the main focus of the epidemic. They are now the epicenter of the spread of the pandemic. The number of cases is already reaching 350. Doland Trump's estimates have gone a long way with reality. Let us just remind you that the President of the United States assumed that his country should deal with the problem by Easter. Coronavirus is also surpassing the USA.

Macroeconomic data is similarly poor, as estimates and forecasts in the light of publications are usually extremely optimistic. The collapsing employment market is falling into a considerable crisis. The vast majority of analysts are currently in favor of a further decline in employment in the US, pointing to the growing number of applications for unemployment benefits. Restrictions that are currently being introduced in the United States (moreover, as everywhere) are not optimistic in the light of strongly slowing industry. There are no difficulties in such forecasts and it can easily be said that this is just the beginning of what awaits us. How will the dollar behave? On the one hand, we would expect further strengthening, pointing to its features of absorbed non-risk capital. On the other hand, the unpleasant situation on the labor market and poor publications encourage a vision of depreciation, at least against major currencies.

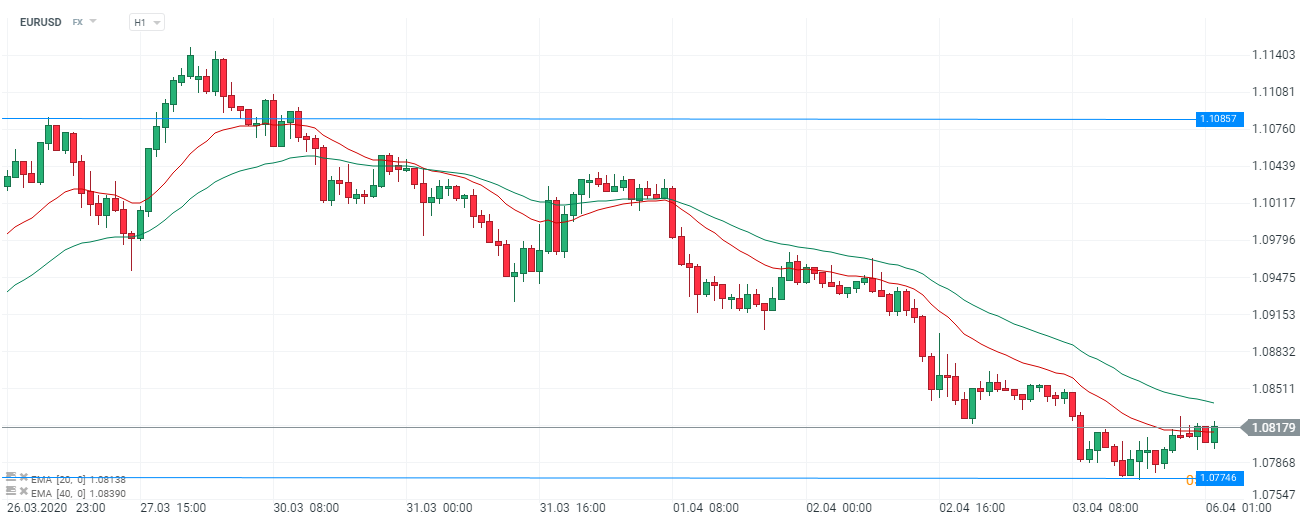

Chart EUR / USD, H1 interval. Source: xNUMX XTB xStation

Considering the coronavirus issues, we should not be surprised by the further appreciation of the USD as a global problem. The chart above shows EUR / USD from last week. We see the dollar want to return to favor and the momentary weakness was only a correction. What's more, the market did not react dynamically to the publication of data from applications for unemployment benefits, which were at historical, never before recorded peaks. This will, of course, sooner or later find its valuation in the American currency, but it is worth considering whether this will not escape the attention of investors. They can be overshadowed not only by global risk aversion, but also by buying programs and the global debt market.

Matter of time

Indexes in Europe are clearly trying to keep their level. We've seen slight increases throughout the past week. Everything, however, looks as if their decline would be only a matter of time and occur overnight. The German index of the thirty best companies DAX30 (DE30) lost its share of demand. Therefore, there is a good chance that rather Europe will glow red in the coming weeks. Despite this, the week starts very positively, and DAX gains about 4% on Monday morning.

Chart DAX (DE30), interval D1. Source: xNUMX XTB xStation

The automotive sector currently has the biggest problems in Germany, which stands practically in place, and adaptation to limited demand progresses from month to month, which is observed in the number of new cars. The light in the tunnel are recent reports that talked about the phone conversation of the management of the three largest German automotive companies with Angela Merkel. The conversation was intended to address the issue of helping governments for the car industry. Redundancies in this part of the industry can be extremely painful for the German employee market. Hence the great interest of the authorities.

Cash markets drive prices

Big price jumps on currencies are mainly the result of substantial turnover on the cash markets. Undoubtedly, the search for exchange options only by means of instant transactions quickly inflates currency prices. We should not be surprised by the increase of, for example, EUR against "local" currencies (such as PLN or Czech koruna) on the Old Continent. The demand for more "commercial" currencies will grow. What's more, its satisfaction as shown by volume reports is shifting to the spot market.

When will we see the real quote?

We could conclude that what is happening on most indices is virtually identical to the global global economic situation. Currencies give us a slightly different impression, which behave ignorantly towards the data, reacting completely inversely to the accepted norms. What it comes from? In my opinion, nowadays, whether the data are market-relevant or not is a matter of breaking through to investors' awareness. Currently, information on the spread of coronavirus is of greater psychological significance than macroeconomic data. The pandemic issue absorbs us more than global factors shaping the economic situation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response