Bank of England - the most interesting bank in developed markets

In those words, the chief credit strategist Deutsche Bank - Jim Reid described in his comment Bank of England. Not without reason, as it is one of the few central banks that is not afraid to talk about inflation problems. Taking into account the short end of the yield curve (2-year bonds) and their yields, the scenario for GBP pairs looks really good. Taking them into account, the prospect of a strong monetary tightening in the UK is really real.

As many as four increases in 2022?

Let's start with the elementary thing, i.e. the valuation of the increases themselves. When talking about their potential number, we look at two things - minutes from central bank meetings or bond yields.

Two-year yields rose the most since 2010, while the 3M libor GPB rose the most since the Lehman collapse. We have an extremely interesting situation on the debt market in the UK. It's worth saying that such a sharp move on bonds came after BOE Bailey's recent weekly comments (the Bank of England seems to be using recent weekends to prepare the markets for impending interest rate hikes, as noted by DB's Jim Reid). There is no secret that the UK is a favorite in terms of potential rate hikes. It is estimated (through the prism of profitability based on inflation readings) that the market in 2022 is pricing in an increase by as much as 80 bp, which gives us roughly four potential rate hikes, while by the end of this year it is estimated that it will tighten by 35 pb. Thus, the forecasts for the UK are strongly hawkish.

Unclear future

From the perspective of investors and analysts, of course, a big nod to the Bank of England, which is not afraid to talk about inflationary problems, which has recently been extremely frustrating in the rhetoric of the FED. However, there is a certain ambiguity in the hawkish attitude of the UK, which is afraid of other central banks, which are dovishly approaching a series of hikes. The ambiguity is based primarily on that inflation is indeed rising, but the outlook for economic growth is limited and unclear. The problem is that banks often build positive projections of economic growth, while many previously unknown factors affect the markets. The latest forecasts of the International Monetary Fund showed a downward decline in GDP for China and the US, among others. The latest GDP readings for the third quarter in China showed a significant slowdown in the economy. The local government counted on the fact that the high demand for Chinese goods and the lack of reaction of the central bank to the current situation would maintain good economic growth. However, this did not happen and the readings were far from our wildest expectations. However, taking into account the markets at the opening today, hardly anyone cares about a potential slowdown.

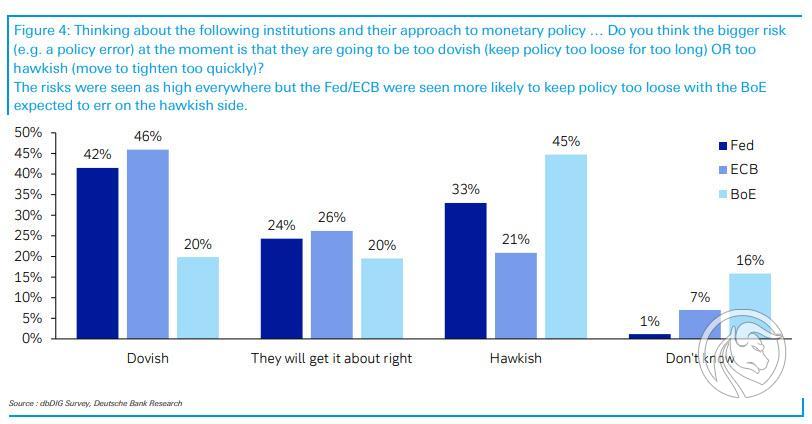

The "economic uncertainties" I wrote about above are illustrated by a survey conducted by Deutsche Bank, in which respondents assess the activities of central banks. The survey is monthly in nature and is quite surprising at this point. Respondents were asked about the greater risk of doing politics (literally, do you think the greater risk now is that central banks will dove ... etc). Looking through the prism of the answers, as many as 45% of respondents believe that BOE's hawkish policy carries the greatest risk at the moment.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)