Bubble is not bad. What can we learn from them?

Speculative bubble - a word that excites investors, raises the hair of economists and draws the eyes of Kowalski to clickbait headlines of financial portals. We associate them mostly negatively, drawing in our minds a picture of the crisis, bankruptcies of many petty savers and well-known units of the financial world. Bubble is "something" that has benefited from a hot economy, cash printing and plentiful wallets over the years, pushing the quotes to astronomical levels that were not (at least apparently) reflected in fundamental premises. Economists see in them irrationality of behavior, various types of "asymmetry" of information, which favors making investment mistakes and incorrect assessment of the situation, as well as the usual madness of crowds succumbing to fashion.

History floods us with a multitude of examples of spectacular speculative bubbles, showing that their course is always similar. Most of the population is enchanted by stock market gains, soon after receiving a bucket of cold water in the form of a huge discount. Some lose, others gain. This pattern can be written into any bubble that has arisen on the market. However, are speculative bubbles only inflated stock "creations"? Is there real value behind them? Do bubbles on the stock exchange set future investment directions, or are they only a tool for destroying the market?

Bubble ≠ loss

Before I move on to the very potential that is hidden in speculative bubbles, I would like to give a little introduction to their behavioral context. Without focusing on academic claims, it is noteworthy that people see the problem of speculative bubbles when they lose something - property, savings or work - related to it. The blame can then be placed on banks, speculators, investment funds, the invisible hand of the market, bankers, etc. It is therefore difficult to talk positively about bubbles. However, few people remember that before they reach the size that allows them to break, they must undergo a certain process. A bubble is born, it develops (and therefore a certain group of investors see its potential), it experiences its golden period, and then ...? Dying? Not necessarily.

The first and historically most famous symptom of speculation is tulipanomania. I think that I will not be very close to the genesis of this event, because many could say what tulips are with such advanced financial instruments that we currently have (and on which contemporary speculative bubbles have occurred). Semper Augustus - that was the name of the flower that caused the madness of the Dutch, shaped two important things from the point of view of modern economics. The first is regular marketwhere purchase and sale operations were made on a "standardized commodity". The second, much more interesting result of this bubble is the seed of futures contracts. Then the so-called wind trade contracts, where we can literally translate them as wind trade. So, bulb contracts were traded before they were physically delivered. Tulipanomania itself strongly influenced the development of speculation on the market. There was speculation in what was possible - bonds, tulip bulbs, stocks of Indian companies. It has already been speculated to such an extent that basic necessities have been excluded from this type of trade.

READ: To be in the majority, i.e. a few words about the crowd phenomenon

Internet bubble and the IT sector

In this article, I will omit the historical chronology related to the crises a bit to outline my point of view on the positive aspects of asset bubbles. We will therefore go towards the modern world by looking at experiences dot-com boom crisis. Alternatively, it can be called dot-com bubble, IT bubble, or dot-com. The most important thing is to understand the crisis itself in the context of what happened after it. Despite the bursting of this bubble in 2000, the dominant companies in the American and global economy are those from the IT sector. We can use a whole lot of examples related to it here. Of course, voices will wake up that people lose their funds on the bubbles (when they burst), which is of course true. By logic, however, speculative bubbles are a really good barometer of future, long-term market trends. In terms of behavior, it can be said that investors follow a certain fashion and trends of novelty. Hence, they appreciate the potential in the unknown in some way. It does not have to be a rational valuation. In this case, what counts is purely speculative movement, usually created on a vision of the future, in which our activity, due to its high potential, will bring enormous profits.

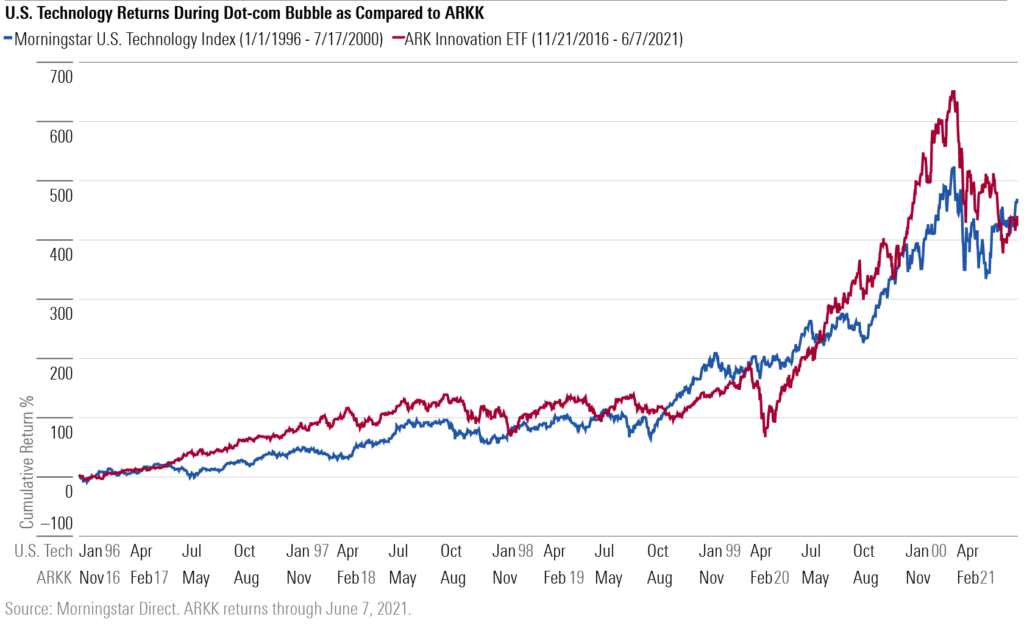

Source: morningstar.com

The dot-com boom in the 90s was mainly fueled by the pressures of the advent of the internet and its capabilities. Many of the stocks of companies related in any way to the word Internet were nothing more than a great idea with little plan to grow - much less the ability to demonstrate profitability. Despite the bursting of this bubble, which inevitably was the result of general fashion, the IT industry itself (large-scale technology sector) is now one of the most successful industries in developed economies. Often, when I speak positively about the bubble, I hear an opposition argument in the form of: local companies had nothing to do with operating on the Internet, some of them are bushes, etc. the cryptocurrency industry in terms of a long-term, profitable trend, are we talking about projects that were scams?

As a rule, it will usually be the case that in "fashionable" markets / sectors / industries there will always be "side effects" in the form of scam companies taking advantage of the popularity of the sector. There are also those that have nothing to do with a potential bubble (in terms of activity) except the name. Summarizing the submission of this example - there are or no companies, but the trend that emerges from an asset bubble is long-term. So, bubbles themselves are not bad in themselves (with a lot of emphasis on modern ones), as they are largely a good barometer for which industries the market can go into.

Once the Internet, today new technologies

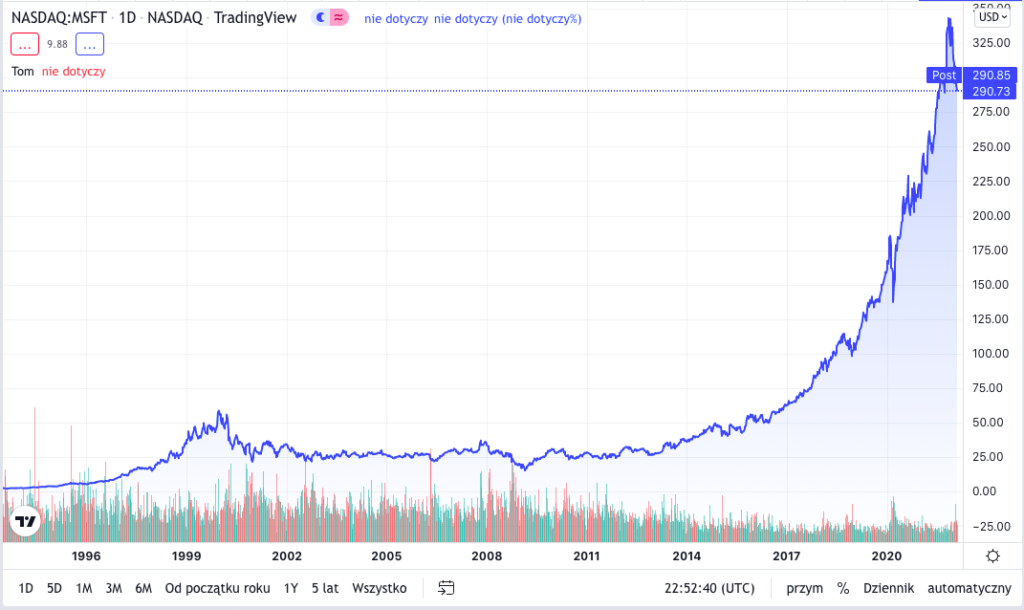

As a rule, academic textbooks and scientific articles usually say one thing about the dot-com bubble - behavioral bomb with no value. These theses are often based on arguments that modern companies related to new technologies (US-TECH also listed above) have little to do with the bubble of Internet companies. Of course, this is not entirely true. You don't have to go far to find an example, for example Microsoft. Would this company develop as quickly if the monetary policy + market rationalization of the time wanted to combat the growing internet bubble? Going further, would there have been such a major reshuffle in the industries of the future had it not been for the dot.com bubble? It's a bit like comparing covid and the accelerated (somewhat forced by conditions) digitization of society. Would we have started introducing virtual solutions to everyday life so intensively, if not for the epidemiological crisis?

I often come across the argument that the high-tech companies of the time had little to do with the dotcom boom. After all, as I mentioned above, among the fashion for internet companies, there were also those in this basket that had little to do with the Internet, apart from the name. But who are the giants of the new technology industry today? Is Microsoft, Apple Lossless Audio CODEC (ALAC), or even Amazon did not survive the dotcom crisis? In this context, the bubble itself can therefore be seen as a catalyst. Assets that follow the trends of the bubble created will eventually sell off in a commercially rational manner. I mean that investors necessarily discount the real value of a given company in a correct way (after a wave of discounts). Just look at the Microsoft price chart attached above. The 2000st century and the year XNUMX actually brought a significant sell-off on the stocks of the tech giant of the time, BUT in the long run the speculative bubble was only a catalyst that purged the internet industry (the broadly understood scope at the time), leaving behind two things: potential i companies with value. Since Microsoft was founded, despite its several years of making up for losses caused by the bursting of the Internet bubble, the current returns on shares (taking into account the entire term, you can count in thousands.

Subprime, real estate and commodities

In the context of the crises they fuel, I would divide speculative bubbles into two categories. One of them would be bubbles in traditional markets, driven by the rhythm related to the money supply (inflation, people in circulation, monetary policy, including interest rates). That is, factors that naturally support the creation of the environment for the irrationality of investors. State policy and the activities of public institutions create price bubbles. Banks also benefit from the demand for given assets, additionally supported by the state, by granting easier loans. The loop and the vicious circle of irrational decisions and investments therefore begin to tighten and circulate faster. Clients and investors are susceptible to the handicap offered - state support, but also instincts and behavioral factors that they are shaped by decisions that are far from rational. This is the first type of bubble that relies somewhat on the mechanism described in The War for Money in terms of "sheep shearing". For the uninitiated, it is a practice that is artificially created by monetary policy so that a group of people who actually see benefits in such an overestimation could earn on it. Shearing the sheep is aimed at earning money on the sheep's rush of the crowd.

READ: The Chinese Real Estate Market - Everything You Need To Know About It

The second type of bubbles that are already in my area of interest are investment fashion bubbles. Of course, not every fashion has its reference in value. The common point connecting the dotcom bubble and the bubble on Bitcoinie is that both assets previously made a technological breakthrough. Real estate and its lending have been with us for some time. The bursting of the bubble in this market was the result of, among other things, an overstatement with the number of people credited, the inability to repay the contracted liabilities, loose (and therefore supporting) policy of central banks and fancy actions of financial institutions in the context of creating structured products based on the market swinging by money. Taking into account the issues related to the saturation of the market and the formation of a bubble on internet and crypto companies, it is easier to incline to the theory of their inflated growth simply in the context of the fashion for "unknown with potential"

New bubbles, new sectors of the economy

The first thought that comes to me in the context of the recent bubble is Bitcoin and the broadly understood crypto market. It was on the BTC quotes that you could see the first symptoms of speculative fever (at least in 2017). In the context of the aforementioned examples and conclusions that speak about the creation of enormous long-term potentials on the market, it can be concluded that the next breakthrough will be the cryptographic industry. We experienced the first boom in fascination with this market when every corporate bank and large enterprises wanted to have their own cryptocurrency. Apart from the form of its utility (mainly in terms of payments), the desire to create a "company currency" went towards prestige rather than real added value for products / services. Following the blow is what it is tokenization may in the coming years become what the Internet does for the new technology industry.

Nowadays, speculative bubbles are a good starting point when we are looking for modern and innovative industries that have a very large potential to take over a large part of the market. The attitude towards the bubbles that we should embrace should rather be based on a long-term basis, which takes into account the assumption of rational development. At the moment, contemporary speculative fever has brought really good investment directions. Therefore, it is worth treating them as market catalysts that leave behind only those assets that are worth our attention.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)