The WorldCom bankruptcy - the big scam of the dotcom era

The dotcom bubble period was full of famous financial scandals and bankruptcies. They are standard examples Enron affairs and WorldCom. Both companies were market stars and in a very short time became symbols of financial fraud. WoldCom was a telecommunications company that was in second place in the long-distance segment at its peak.

WorldCom logo. Source: Freebiesupply.com

The largest company at the time was still AT&T. WorldCom in the late XNUMXth century from a "second-league" company quickly joined the market leaders. Unfortunately, the company failed to do this sustainably, but through a large number of acquisitions that WorldCom was unable to make the most of. This, combined with the falsification of financial results, was a ready recipe for a spectacular bankruptcy.

In today's article, we will introduce the history of this company and describe the course of the last months of WorldCom. WorldCom's bankruptcy is a great example of how not to run a large corporation. We invite you to read!

1983–1998: Formation of a giant

In 1983, Long Distance Services was founded in a coffee shop in Hattiesburg, Mississippi. He was the main originator of the company Bernard Ebberswho served as CEO. The company's headquarters was established in Jackson, Mississippi. Just 6 years after its founding, the company merged with Advantage Companies. The merger was intended to accelerate the growth of the organization. In the following years, a number of mergers and acquisitions took place, which allowed to increase the scale of the company's operations.

Bernard Ebbers. Source: Wikipedia

One of the major acquisitions that occurred at the beginning of WorldCom's operation was the transaction with Advanced Telecommunications Corporations. The transaction closed in the amount of USD 720 million. A small, little-known company beat competitors such as Sprint Corporation and AT&T in the race for the company. The Mississippi company challenged the "great" US telecommunications market.

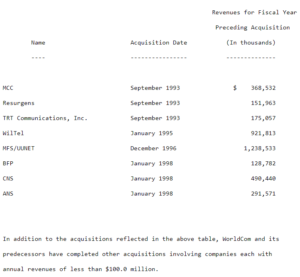

In the following years, the company acquired such companies as: Metromedia Communication Corp (1993), Resurgens Communications Group (1993), IDB Communications Group, Inc (1994), Williams Technology Group Inc. (1995), MFS Communications Company (1996). The company has become a consolidator of the fragmented telecommunications market.

Thanks to these transactions, WorldCom quickly joined the group of leading players in its market. A very important acquisition was MFS/UUNET. Interestingly, MFS acquired UUNET just before WorldCom bought the combined company. The acquisition took place in 1998 and allowed WorldCom to increase revenue by over $1 billion. As you can see, at the end of the XNUMXth century, the telecommunications market was in "merger fever".

Merger with MCI

This was not the end of the company's expansion plans. On November 4, 1997, the company announced a plan to merge with MCI. The value of the contract was to be USD 37 billion. The deal closed on September 15, 1998, and was the largest merger in US history at the time. The merger created one of the largest telecommunications companies in the world. After the merger, the company adopted the name MCI Worldcom. The merger was not without problems. To appease the regulators, in 1997 MCI started the process of disinvestment in the Internet sector. Only then was the merger approved by the US Department of Justice.

At the time of the merger, MCI generated approximately USD 18,5 billion in revenues, making it one of the largest companies in its industry in the world. It also had one of the most advanced Internet networks in the world.

As a result of the merger, an enterprise was created that operated on local and long-distance telecommunications services. The company also had a segment of internet services and international telecommunications services. After the merger, a company with a turnover of more than 30 billion dollars was created. The owner of MCI, British Telecommunications plc, agreed to the takeover transactions.

Under the terms of the merger, each MCI shareholder received $51 in WorldCom shares. The exception was British Communications, which received cash for its shares. After the transaction, the current shareholders of MCI held 45% of shares in the newly established company. The transaction was carried out in such a way that it did not force MCI shareholders to pay any tax.

Of course, the transaction was treated as a source of numerous synergies. WorldCom's management expected the cost optimization to be $2,5 billion by 1999. By 2002, savings were to be estimated at $5,6 billion. In addition, thanks to the merger, a review of capital expenditures was to be carried out. As a result, CAPEX savings were expected to amount to $2 billion. In addition, after the merger, cross-selling of WorldCom services (for MCI customers) and MCI (for WorldCom customers) began. The merger was supposed to create one

After the merger, there was:

- One of the largest Internet service providers in the world

- The second largest telecommunications company operating on the long distance market

- One of the leaders on the American CLEC market (competitive local exchange carrier)

WorldCom CEO (Bernard Ebbers) mentioned in an interview that:

"the benefits of the merger apply to both MCI and WorldCom shareholders. [They result from] synergies and holding shares in the best-performing telecommunications companies of the last decade (...) thanks to the [merger], customers will get a better offer of services".

In turn, the head of MCI mentioned:

"Shareholders, clients and employees were rewarded by the value that MCI has generated for them over the last 30 years. Currently, we are well prepared for further development (…) and taking advantage of the opportunities that lie ahead of us around the world".

As a result of the merger, there was also a reshuffling of senior management. The Chairman of the Board of Directors at MCI was to perform the same role at MCI WorldCom. In turn, Gerald Taylor, who was the CEO of MCI, became the vice-chairman of the board and was to supervise the international activities. Timothy Price, who was COO at MCI, was to take the position of CEO of a subsidiary operating on the American telecommunications market.

As for WorldCom's COE, Mr. Ebbers has managed to retain that position at the combined giant. It is worth mentioning that Scott D. Sullivan continued to control the accounting and financial activities through his role as CFO. As it turned out later, the lack of changes in the position of CEO and CFO was not a good idea.

A proposal to connect with Sprint

Sprint logo. Source: Wikipedia

The great connection with MCI only aroused the management's appetites. On October 5, 1999, MCI WorldCom and Sprint announced plans to merge the two companies. The value of the combined companies was estimated at $129 billion. If the merger were to take place, a company with a scale much larger than AT&T would be created. However, government institutions in the United States and the European Union began to fear that there would be too much concentration in the telecommunications market.

The Department of Justice and the European Commission were against the transaction. Due to legal problems, the transaction was not completed. On June 13, 2000, the managers of both companies suspended the merger plans. As it turned out later, it never came to fruition.

WorldCom was a typical turn-of-the-century telecommunications company. The Management Board believed that only a large number of acquisitions would make the company count on the market. At the same time, acquisitions made it easier to meet Wall Street's earnings expectations. At the same time, it allowed to hide operational inefficiencies by bragging about the increase in revenues and profits.

The lack of a merger with Sprint put WorldCom's business model under question. A change of strategy was needed. The management had to somehow find a way to improve the financial results. Otherwise, a reshuffle at the highest levels of the corporation would be possible.

Pre-bankruptcy company financial data

WorldCom was a rapidly growing telecommunications company with the goal of becoming the largest company in its industry. The plans were ambitious because the position of the former monopoly - AT&T - seemed impregnable. Acquisitions were necessary because the market for telecommunications services was already saturated and the Internet was not as widespread as it is now. A long-term price war with AT&T was out of the question. The merger with MCI offered a chance to throw down the gauntlet to the biggest ones, and the merger plans with Sprint only confirmed the company's ambition.

company in a few years significantly increased the scale of its operations. This is best seen in the table below:

| World Com | 1997 | 1998 | 1999 | 2000 | 2001 |

| revenues | $ 7,64 billion | $ 17,62 billion | $ 35,91 billion | $ 39,09 billion | $ 35,18 billion |

| Net profit | $ 0,14 billion | $ 2,77 billion | $ 3,94 billion | $ 4,09 billion | $ 1,38 billion |

| long-term debt | $ 7,81 billion | $ 16,45 billion | $ 13,13 billion | $ 17,70 billion | $ 30,04 billion |

Source: own study

As can be seen, in the years 1997-2000 there was a very dynamic increase in the scale of operations. On paper, the company was very profitable, which allowed it to increase the scale of debt and find people willing to issue new shares.

If we looked at the data on operating cash flows and capital expenditures, WorldCom's activities did not seem so colorful anymore. Although the company generated large cash flows from operating activities, capital expenditures were much higher. This meant that the company was unable to generate sufficient cash to finance its investment plans. Below is a basic statement of cash flows for the years 1999 - 2001.

| World Com | 1999 | 2000 | 2001 |

| OCF | $ 7,35 billion | $ 5,33 billion | $ 6,61 billion |

| CAPEX | $ 7,93 billion | $ 10,98 billion | $ 7,62 billion |

| FCF | $ 0,58 billion | $ 5,65 billion | $ 1,01 billion |

| Acquisitions | $ 0,79 billion | $ 0,01 billion | $ 0,21 billion |

Source: own study

As you can see, over three years, capital expenditures were $7 billion more than cash generated from operations. Bulls believed that capital expenditures are now a necessity to build the right scale and then monetize the acquired customers for many years. Therefore, negative free cash flow did not raise too much fear among investors. As it turned out later, many of the capital expenditures were ordinary operating costs that were hidden in cash flows.

corporate culture

Very often, budding fundamental analysts do not put much effort into screening the corporate culture. This is a mistake because effective use of human resources is crucial in any organization.

It is best when employees are free to express their views, and employee efficiency and honesty are rewarded, not their attachment to "clans" forming within the organization. Creating a work environment based on honesty, fairness and openness is key to counteracting fraud within the organization. Of course, corporate culture is not about writing on the walls, but about employees' internal beliefs about how to solve problems in the company.

In the case of WorldCom, the situation was different. Constant takeovers meant that the organization was constantly hiring new employees. As a result, "groups" were formed that tried to stick together within the organization. At the same time, WorldCom itself focused from the very beginning on achieving profits and revenues in line with Wall Street expectations. As a result, the development of employees within the company was pushed to the background.

The pressure to score did not create an environment of fairness because no one wanted to be held responsible for failure. The bonus system rewarded loyalty to superiors. So being involved and asking uncomfortable questions was viewed negatively at WorldCom. Docile employees who focused on getting a bonus were preferred. The defiant were fired or passed over for promotions. Such organizational culture combined with low oversight within the organization was a recipe for trouble.

Accounting scandal

At the turn of 1999 and 2000, there was a problem with further duplication of the growth pattern. There was simply a lack of potential, interesting enterprises that could be taken over to increase revenues and profits. The failed merger with Sprint only confirmed investors' fears. The share price started to fall. Without acquisition, the quality of services and operational efficiency of the organization should be improved. The CEO and CFO had no idea how to do it in an honest way. At the same time, rewarding managers in shares meant that they wanted the share price at the time of "expiration" of the option to be as high as possible.

The authors of the accounting scandal, which took place between mid-1999 and May 2002, were: Ebbers (CEO), Scott Sullivan (CFO), financial controller David Myers and chief accountant Bford "Buddy" Yates. The "team" in question started using accounting tricks to improve the net result. This was to keep the company's share price high, which was to benefit WorldCom's senior management. The sale of shares received in bonuses gave managers millions of profits.

How did accounting tricks look? The most popular ways were:

- Accounting for line costs as capital expenditure. Line costs are the costs of connections with other telecommunications companies (so-called interconnection). As a result, they did not land in the profit and loss account, but in the cash flow statement. This practice meant that the net profit was artificially inflated. However, it could not be hidden in cash flows from investing activities. Wall Street analysts were told that large CAPEXs served to improve the competitive position, which was accepted by institutional investors.

- Increasing the level of sales. It was a practice of "stretching" economic events so that revenues could be recognized. Very often, special accounts were used that grouped "unallocated corporate income".

The beginning of problems

In December 2000, WorldCom's financial analyst Kim Emigh was asked to implement a new directive related to the accounting of labor costs related to the development of networked systems. Kim feared that the implementation of the new directive would cause him to be involved in a tax crime. For this reason, he submitted his comments to the COO of WorldCom.

The directive was not implemented, but Kim Emigh had a "disciplining conversation" with his immediate superiors. He was then released in March 2001. Kim himself found a job elsewhere, but he didn't want to give up. He was waiting for the right moment to settle accounts with his former superiors.

Initiation of internal controls

Cooper first on the left. Source: Time

In May 2002, Kim Emigh mentioned in Fort Worth Weekly that he had expressed doubts about MCI's spending management for years. He also mentioned that the improvement resulting from the acquisition of the company by WorldCom was small. Kim believed that there was a lot of room for cost optimization in the company. The article in question aroused the interest of the internal audit manager at WorldCom. Glyn Smith contacted his boss Cynthia Cooper and together they decided to look at capital expenditures at WorldCom.

During a meeting with the auditors, CFO Saneev Sethi explained that the differences between the capital expenditure accounts are due to the so-called "prepaid capacity".

The term has never been heard by Cooper and her team. Pressed by the auditors, Sethi could not explain what exactly the term is and when it is used. In the end, the auditors were referred to David Myers, who was a controller at WorldCom.

No one wanted to explain exactly what is meant by the term prepaid capacity. To clear up the mystery, Cooper met with WorldCom's director of asset management. Mark Abide mentioned that he had already booked these types of expenses in various corporate asset accounts. These were e.g. accounts showing the value of furniture, communication or transmission equipment. Sam Abide had no idea what exactly prepaid capacities were.

It's getting hotter

The audit activity encountered resistance within the organization. One of the main opponents of the audit who expressed this publicly was David Myers. He believed that auditing capital expenditures was a waste of time. David tried to convince Cooper that her actions were pointless and only burdening other employees with extra work, which did not add value to the company.

Cooper and her team didn't feel strong about "technology and databases." Therefore, Eugene Morse joined their team. He was trying to comb through the data on accounting transactions. Very often this led to the "hanging" of the accounting systems.

Cooper wanted to avoid open conflicts with Sillivan and Myers, so she decided to have part of the team work nights. On June 10, a report was ready, which showed that significant amounts were "taken" from the profit and loss account and booked in the balance sheet. As a result, the costs were capitalized, which allowed to improve the results "here and now".

Scott Sullivan, Cooper's immediate supervisor, asked her and her team to "guide him" into the audit conclusions. When it came to "prepaid capacity", Sullivan said that these are expenses related to the use of lines that are not used at all or to a small extent. According to the CFO, this type of cost is fixed so it can be capitalized on the balance sheet. Naturally, Scott insisted that "the matter should be clarified" and insisted on adjourning the audit to the end of the third quarter of 2002.

The scams came to light

The supervisor's assurances did not reassure the audit team. After an overnight conversation with the chairman of WorldCom's audit committee, it was decided to work with Farrell Malone of KPMG. It was discovered that due to accounting manipulations, the company's net profit in the first quarter of 2002 was fictitious. Instead of a net profit of USD 130 million, the company should report a loss of USD 395 million.

Cynthia Cooper tried to find out from former employees of Arthur Andersen (the WorldCom audit team was taken over by KPMG) about prepaid capacity. Kenny Avery, who worked at Arthur Andersen, said he had never heard of the term. What's more, he said he didn't find any GAAP rules that would allow you to capitalize line costs. In addition, Kenny mentioned that Anderse never thoroughly checked WorldCom's capital expenditures.

After confronting the auditors with Myers, Myers admitted that they should not have made the above-mentioned accountings because, although the reasoning is defensible from a business point of view, there is no accounting law allowing for the aforementioned practices. Sullivan argued that the above-mentioned capitalization of costs could have taken place on the basis of the principle of matching costs and revenues, but the auditors were of a different opinion.

Over the weekend, a total of 49 postings improving financial results were detected, which were mainly commissioned by Myers and Sullivan. In addition, the aforementioned operations were commissioned to be performed by novice accountants who were not fully aware of the mistakes they made.

Sullivan was asked to explain, but his "white paper" did not convince the supervisory board. KPMG discovered that the postings were not a "malpractice" but a deliberate act to ensure WorldCom met Wall Street's net profit expectations. Arthur Andersen's former team, when asked why they allowed such accounting practices, stated that they did not know about such practices. Otherwise, they would have questioned these actions. After the clarification, WorldCom decided that adjustments to the financial results were necessary and the immediate dismissal of the current CFO and controller.

On June 25, the board of directors accepted Myers' resignation and fired Sullivan, who refused to sign the resignation. On the same day, senior WorldCom managers informed the SEC that they must adjust the financial result for the last 5 quarters. Then a report was released announcing that the company had to cut its total net profit for the last 15 months by $3,8 billion.

This was the nail in the coffin for the company, which had already struggled with rumors of liquidity problems. Moreover, it was in the middle of a bear market after the dotcom bubble burst. Even before the scandal, the bonds had junk status (i.e. not investment). The scale of the debt was staggering, because the interest debt amounted to about $30 billion. In order to restructure, WorldCom mentioned that it planned to lay off 17 employees. On June 000, an SEC investigation was launched to find and punish those responsible for these accounting frauds.

WorldCom bankruptcy

WorldCom has filed for creditor protection. It was the largest bankruptcy in US corporate history. As a result, Enron fell to the second place in this infamous list, having only been "enjoyed" in the first place for only a year. The company had $41 billion in interest debt at the time the application was filed. The company's assets were now valued at over $100 billion. WorldCom was the largest bankruptcy in US history until the collapse of Lehman Brothers and Washington Mutual.

SEC logo. Source: Wikipedia

The restructuring of the company was very painful. The sale of assets, layoffs of employees and the signing of court settlements began. For example, MCI (formed on the ashes of the old WorldCom) agreed to pay $750 million to the SEC (in cash and stock) to be transferred to aggrieved investors.

Protection against creditors caused the company's creditors to find themselves in trouble. According to the Guardian, among the largest were the so-called Identure Trustees, who represented the interests of bondholders who purchased WorldCom's debt securities. The largest IT companies were: JP Morgn Trust Co ($17,2 billion), Mellon Bank ($6,6 billion), Citibank ($3,3 billion). It is worth mentioning that not only the bond holders had a problem, but also the banks that borrowed their money. Among the victims were JP Morgan Chase ($3,0 billion), Bear Stearns ($2,7 billion) and Bak of New York ($2,6 billion).

2003-2006

On December 16, 2002, new CEO Michael Capellas announced the relocation of the company from Clinton, Mississippi, to Ashburn, Virginia. The change of headquarters was to symbolize the beginning of a new chapter in the history of WorldCom.

In 2003, MCI signed a controversial agreement with the US Department of Defense. According to the contract worth $45 million, MCI was to create mobile services in Iraq. It was one of the elements of "rebuilding" Iraq. Many journalists and analysts were controversial about the fact that MCI had no experience in building wireless networks yet.

The "heirs" of the former MCI WorldCom had to sign a settlement with the SEC. As a result, the company agreed to pay a fine of $ 2,25 billion for accounting fraud and violation of market regulations. As a result of the settlement, the "new" MCI was de facto supervised by the SEC, which began reforming the company's corporate governance. Jed Rakoff and Richard C. Breeden played a large role in reforming the company.

In 2004, the company completed the restructuring process. As a result, the company had $5,7 billion in debt and about $6 billion in cash. About half of this cash was used to pay off settlements and fines imposed on the company. Previous bondholders received only 35,7% of the nominal value of liabilities. The repayment was paid in the form of new bonds and shares of the established MCI. The shareholders of the previous company were left without shares in the new company. The company honored its commitments to former employees, but many of them had to wait as long as two years for the severance pay they were entitled to in the event of dismissal.

It wasn't just WorldCom that had to contend with its past. An example is former CEO Bernard Ebbers, who was accused of accounting fraud, falsification of documents and suspicions of insider trading. He was sentenced on June 13, 2005 to 25 years in prison. He was released at the end of 2019 after several years in prison. The reason was health problems. He lived only a few months in the wild. Bernard Ebbers passed away in February 2020.

Ebbers had problems not only with the law but also financially. Between September 2000 and April 2002, WorldCom's board of directors authorized several loans and loan guarantees for Bernard Ebbers, who was the company's CEO. Thanks to these transactions, Ebbers did not have to sell WorldCom shares to meet the margin call requirements that occurred on Bernard's account as a result of the bursting of the dot com market bubble. Unfortunately, Ebbers' position was significantly weakened by the failed merger with Sprint. There was no vision other than a desire for further consolidation.

The situation changed because after the bursting of the bubble on the dotcom market, there was a shortage of people willing to continue cheap financing. The council, seeing that it was time for change, forced Ebbers to resign, which took effect on April 30, 2002. As a result, all loans were consolidated into a single debt of $408 million. The loan was secured by a promissory note. In 2003, Ebbers defaulted and WorldCom seized many of the former CEO's assets.

In addition to the CEO, Scott Sullivan, who worked at WorldCom as CFO, was also convicted. Sullivan was convicted of forgery of documents, securities fraud and accounting fraud. The sentence was passed on March 2, 2004. In addition to them, David Myers, Buford Yates and former manager of the accounting department Betty Vinson were also on the dock.

The company began to rebuild its market position. As a result, it began to be a tasty morsel for much larger competitors. In January 2006, Verizon Communications acquired MCI and integrated it with its product - Verizon Business.

Consequences

In addition to imprisoning those responsible and slowly restructuring the company (the remnants of which were taken over by Verizon in 2006), WorldCom's bankruptcy allowed more congressional supporters to pass the Sarbanes-Oxley Act. It was pushed through on July 30, 2002 and for many it was a milestone in improving the corporate standards of American companies.

The SOX Act significantly tightened the internal control requirements for entities that are registered with the SEC (United States Securities and Exchange Commission). Pursuant to the new act, a body called PCAOB (Public Company Accounting Oversight Board) was introduced, which deals with the introduction of accounting and auditing standards.

The purpose of the act was also to improve the quality of audit firms, which were to prevent accounting irregularities from being "sweeped under the carpet". Moreover, the senior management of a public company was to certify the compliance of financial reports. It was one of the "whips" on dishonest CEOs that caused the collapse of companies such as Enron and WorldCom.

Increasing the responsibility of management boards and auditors was to contribute to rebuilding trust among individual and institutional investors after a series of financial scandals that affected the United States at the turn of the XNUMXth and XNUMXst centuries.

The accounting scandal took a toll on the already tarnished image of Arthur Andersen, who had previously been implicated in the Enron scandal. An attempt to save itself in the eyes of Wall Street was the withdrawal of the opinion on the performance of the audit of WorldCom's annual report for 2001. Eventually, the company was "thrown off the market". The audit market has become even more consolidated. Instead of the "big five" of the auditing market, since 2002 people began to talk about the "big four". Currently, it consists of: Deloitte, Ernst & Young, KPMG, PricewaterhouseCoopers (PwC).

Cooper's actions earned her the title of "Man of the Year" by Time magazine. The WordCom scandal was only beaten in 2008 with the collapse of Bernard Madoff's pyramid scheme. Upon learning of the results of an internal investigation by WorldCom, the US capital market regulator (SEC) launched its own investigation. It lasted from June 26, 2002 to the end of 2003. As a result, it was discovered that the company's assets were overvalued by approximately $11 billion.

WorldCom's bankruptcy is a great example of how a popular company that is being scrutinized by many professional analysts can be a scam. Therefore, it is worth carefully analyzing the corporate culture of the company beforehand and carefully approaching the numerous mergers carried out by the analyzed company.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-300x200.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-300x200.jpg?v=1711728724)