Bitcoin: Liquidity problems in Forex brokers

Spectacular variability of cryptocurrencies, in particular Bitcoin, attracted the attention of currency traders at an express pace. So you did not have to wait long for the Forex brokers to join the action. Very competitive terms were offered, but the stairs started. No one suspected that the upward trend on virtual coins would increase.

Meanwhile, today Bitcoin broke another historic peak at 17200 $.

With a hoe for the sun?

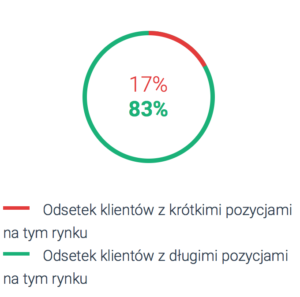

Initially, the conditions offered by the brokers were very attractive. Now some of them have started to withdraw from it. Reason? First of all, liquidity and a problem with the proper securing of transactions. Extreme gains, even faster growing interest and 80% of long investors - these are the reasons for the "deteriorating" trading conditions.

Extending spreads, withdrawing from trading on weekends, reducing leverage or maximum volume per trade, or even freezing the ability to open new positions - these are just a few of the consequences of increasing popularity.

You have to see: Brokers offering Bitcoin - 2017 statement

Here are some of the messages sent in the last week by brokers:

"... Due to the limited liquidity on the BITCOIN instrument, as of December 7, 2017, starting at 17:00 p.m. / broker name / will limit the exposure limit on the BITCOIN instrument from 10 net lots in total to 5 net lots in total. "

“Due to the difficulties with obtaining current market prices for the BITCOIN instrument, trading may be limited and the instrument may be offered only in the" close only "mode.

"Due to the change of the liquidity provider, which is currently not operating on weekends, the trading hours for BTCUSD and ETHUSD will be changed."

"All BTCUSD and ETHUSD positions will close at the last quoted price at 22:59 CET (23:59 EET) on Friday, December 8, 2017 during the weekend system maintenance following the aforementioned date. date. Pending orders for BTCUSD and ETHUSD will also be canceled. "

And what about the spreads situation? It's not better. Initially, one of the brokers declared min. spread at the 5 $ level. He has now set this value rigidly to 100 $. For some, you can even find values of 150-200 $. Why so much?

Here there are "problematic" contracts with liquidity providers who impose their fees (included in spreads) not in the amount but a percentage of the value of Bitcoin. This means that the higher the rate, the higher the spread.

Read: Bitcoin Trading - is it actually profitable?

An immature market

A few months ago, hardly anyone predicted such strong increases in Bitcoin. But it's nothing. Even fewer people can explain them logically now. Or maybe there is no such explanation and we are actually dealing with a ticking bomb? Technology, technology - investors no longer think about the use of blockchain or possible applications of cryptocurrencies. Coin mining? It's unprofitable. It is better to speculate on exchange rate changes.

A few months ago, hardly anyone predicted such strong increases in Bitcoin. But it's nothing. Even fewer people can explain them logically now. Or maybe there is no such explanation and we are actually dealing with a ticking bomb? Technology, technology - investors no longer think about the use of blockchain or possible applications of cryptocurrencies. Coin mining? It's unprofitable. It is better to speculate on exchange rate changes.

However, the above problems show how immature the cryptocurrency market is and we will have to wait a little longer for its "civilization" ...

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)