The National Tax Administration requests registers from cryptoclosure exchanges

The National Tax Administration demands access to transaction registers carried out in recent years by customers of cryptocurrencies and stock exchanges. Will be forwarded, among others user data, bank account numbers, as well as a list of all transactions.

There are only three weeks left to settle accounts with the Polish tax office on the revenues obtained in 2017. Meanwhile, KAS does not wait and is already drawing heavy artillery. At the beginning of March this year. The Seym almost unanimously supported the entry into force of the amendment to the act on counteracting money laundering and financing of terrorism. The changes were forced to adapt to the requirements of EU law. It also includes cryptocurrencies known as "digital currencies". The EU directive imposes an obligation on cryptocurrency exchanges and exchange offices to apply the same security measures to their clients, as is the case in banking institutions.

Confusion around cryptocurrency

In Polish law, the regulations on virtual coins are relatively fresh, despite the fact that they have been talked about for several years and the regulatory process itself will certainly evolve. At the moment, the act defines cryptocurrencies as "digital mapping of value convertible in business transactions into legal tender ".

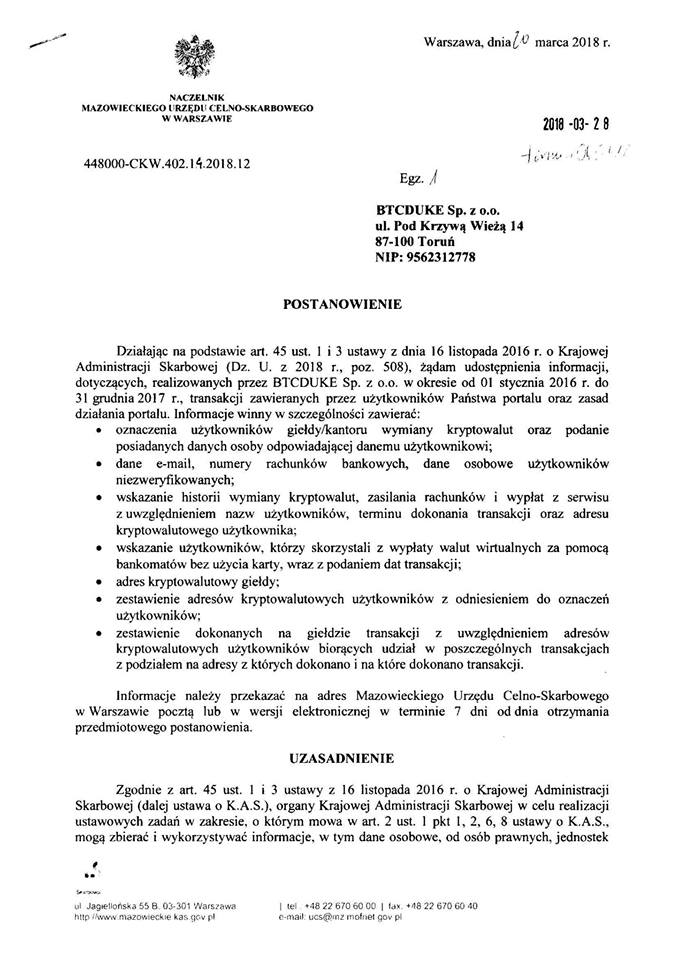

BTCDuke, one of the Polish cryptocurrency exchanges, received the following letter from the Mazowieckie Tax and Customs Office in Warsaw.

According to the content of the document, the above-mentioned exchange must provide KAS with the following information:

- user data, their e-mail addresses, bank account numbers as well as unverified user data,

- register of transactions, payments and withdrawals from users' accounts,

- statement of transactions with the addresses of exchange users and data of both parties to the transaction,

- list of users who have withdrawn funds from ATMs.

At the moment, it is not known whether all institutions dealing in the intermediary of cryptocurrencies in Poland received letters of identical-sounding demands. However, you can assume that it's only a matter of time.

Regulations and taxes are a certainty

The anonymity that was supposed to be behind the trading of cryptocurrencies is evidently not the taste of the tax office. In the opinion of the Ministry of Finance, the nature of the exchange is conducive to avoiding paying taxes. It was decided to create a special department, which is to focus primarily on monitoring the course of cryptocurrencies exchange transactions and payment of tax receipts by citizens.

Fragment of the statement of the Ministry of Finance:

"The Ministry of Finance is planning to establish a new Department of Economic Analysis, which will gather all the existing competences of other departments in the field of analyzes, and which will be dedicated to in-depth analysis, inter alia, in the scope of fulfilling the tax obligation of entities making transactions in cryptocurrencies and making profits on this account. The main detection activities will be carried out centrally with the use of the best specialists in this industry and with the use of the existing tools that apply in-depth analytics. In order to develop an optimal model of the analytical process, KAS authorities closely cooperate and use information from other bodies dealing with cryptocurrency issues, as well as information from the administrations of other EU countries. "

Such an action is also a signal that the government's crusade associated with cryptocurrencies may be coming to an end. The desire to regulate and collect taxes from their turnover may suggest that the Ministry ceases to fight the technology that is to revolutionize the FinTech sector. Let's hope, however, that all new legal provisions will be introduced with caution and maintaining the space favorable to the development of the industry.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)