Bitcoin has returned to levels from the beginning of the year. But is it for a long time ...?

The cryptocurrency market has been recovering for two weeks: bitcoin price has now returned to the level at the beginning of the year, and a Ethereum is approaching this level. This increase is most likely due to the increased risk appetite and favorable regulatory changes. However, global tensions, in particular the invasion of Ukraine, could quickly turn the tide. In the context of Ukraine - the country intends to launch a series of non-exchangeable tokens (NFT).

About the author

About the author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

Rebound to the level at the beginning of the year

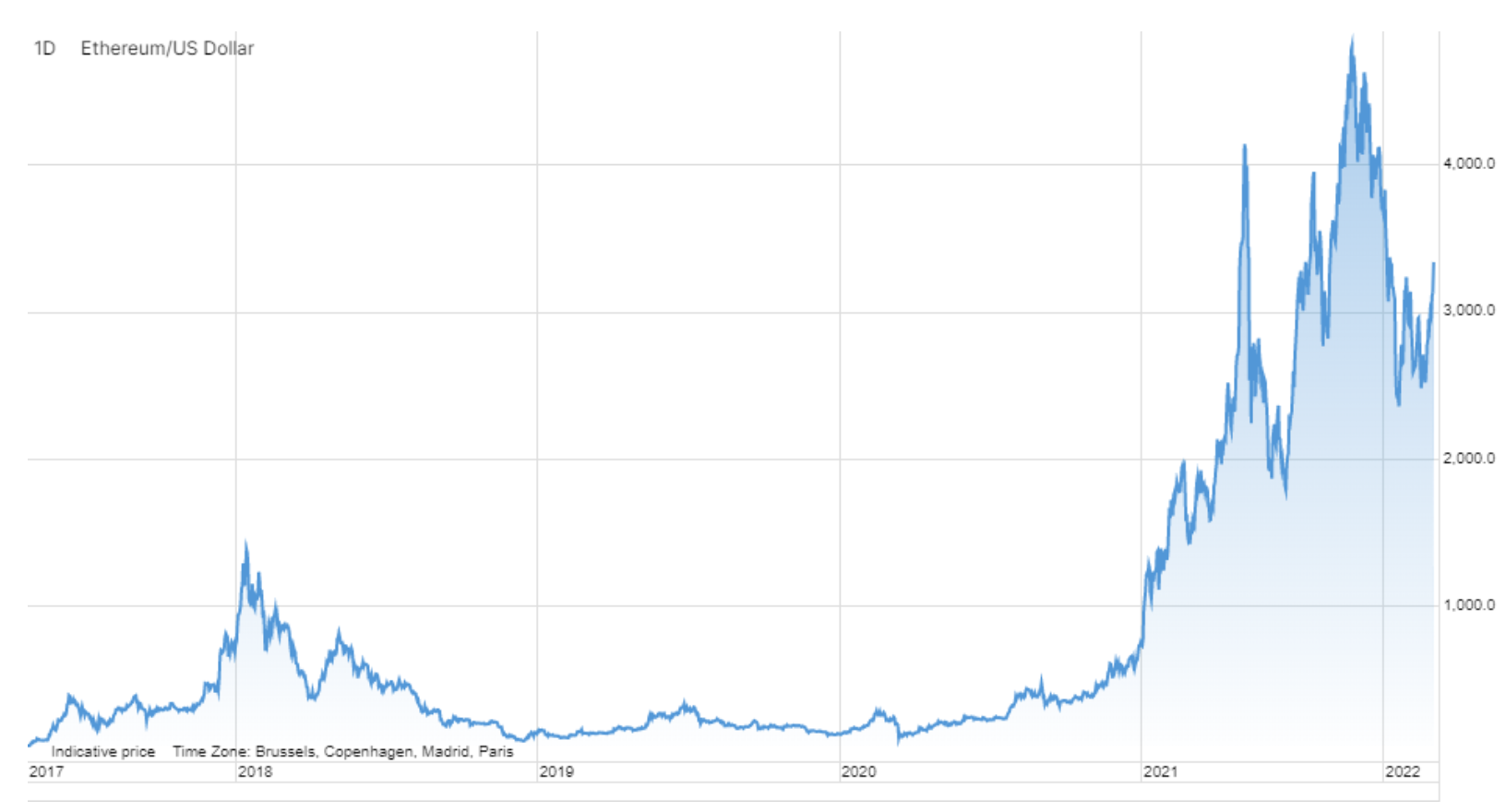

Since December last year, the situation in the cryptocurrency market has been largely shaped by the same events as the situation on stock market, in particular for tech stocks and growth stocks. In our opinion, the sentiment has changed, in particular with regard to riskier assets such as tech stocks and cryptocurrencies, as a result of which investors replaced some of their high-risk assets with less risky assets, which led to a decline in the cryptocurrency market from a record high in November total market capitalization. In addition, amid rising global tensions - especially fueled by the invasion of Ukraine - cryptocurrencies do not seem to be the safe haven that cryptocurrency community members hoped for, who considered bitcoin the digital equivalent of gold. Contrary to this assumption, the cryptocurrency market performed poorly in times of increased global tension.

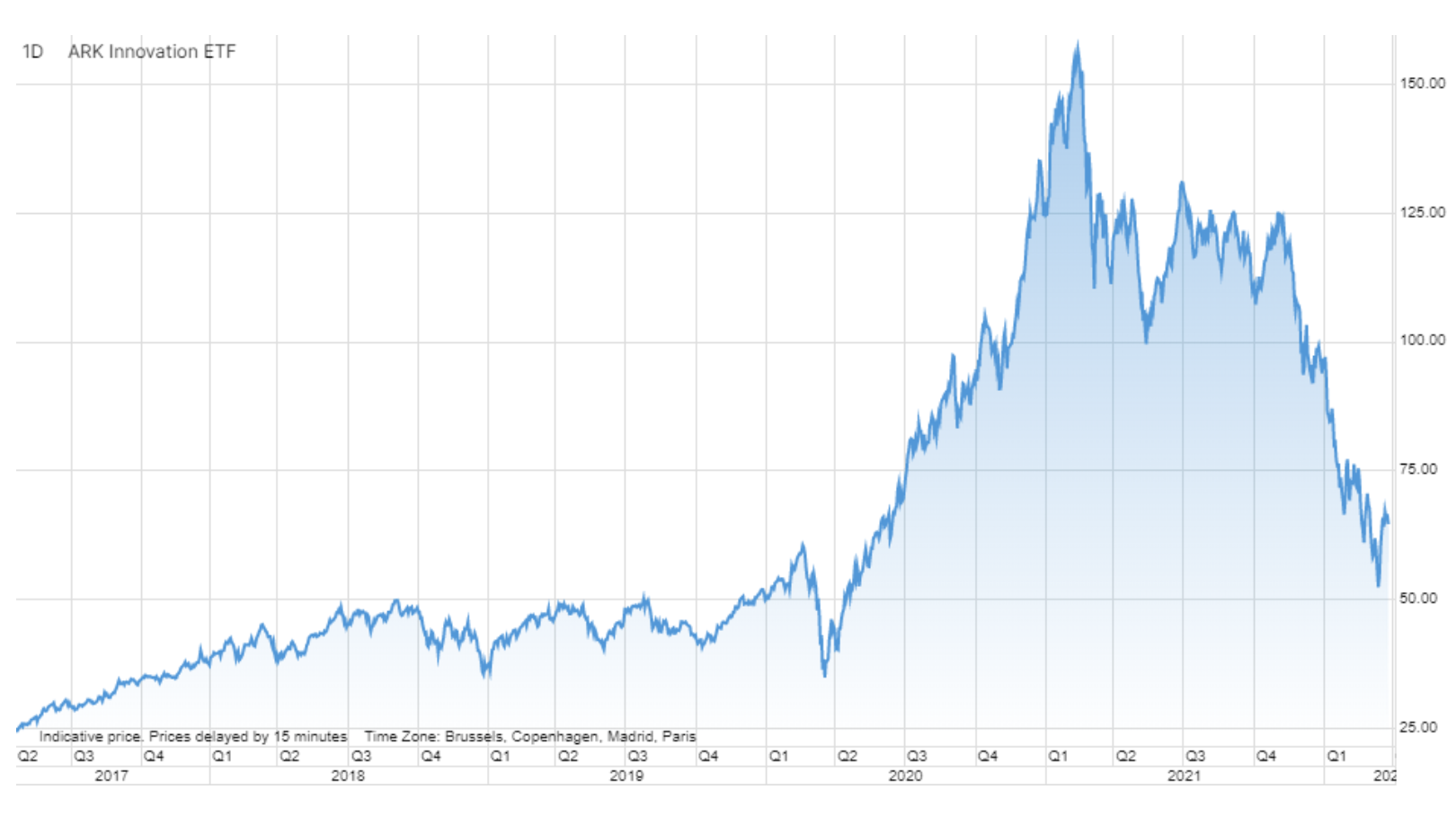

As the general approach to risk in the market and global uncertainty have clearly influenced the cryptocurrency market recently, investors analyzing short-term movements in the cryptocurrency market should prioritize these issues. Since mid-March, many upward stocks have partially recovered. For example, the Ark Innovation fund from the mid-March low of $ 52,5 strengthened to the current price of $ 64,50. This is a signal that the previous risk appetite is returning to some extent.

For now, the cryptocurrency market seems to be benefiting from this - bitcoin has returned to its early-year price, while ethereum continues to get closer to it. However, whether this increase in risk appetite proves to be sustainable in the long term depends to a large extent on global tensions, i.e. the invasion of Ukraine, and its long-term consequences.

Regarding the uncertainty, this time relating only to the cryptocurrency market, in particular over the past month, the market has been influenced by positive developments in the area of regulation. As the regulatory environment is one of the main sources of uncertainty in the cryptocurrency market, regulatory clarity is essential to the further development of this area. In early March, President Biden signed an executive order to analyze the regulatory environment for cryptocurrencies. However, this regulation was relatively beneficial as it focused largely on fostering innovation. A few days later, the parliament of the European Union voted on a draft banning essentially cryptocurrencies using the consensus protocol proof-of-work used for bitcoin as well as so far for Ethereum, due to environmental issues. The European Parliament voted against this provision (30-23).

American secretary of the treasury i Former Federal Reserve Chairman Janet Yellen last week gave the following comment on cryptocurrencies:

“I'm a bit skeptical as I believe there are legitimate concerns about this. They concern, among others financial stability, consumer / investor protection, use of cryptocurrencies for illegal transactions and other matters. On the other hand, cryptocurrencies also bring some benefits and we are aware that innovation in the payment system can be healthy. " The last point is really interesting because Yellen has always been very skeptical about cryptocurrencies. This could mean that Yellen's approach to cryptocurrencies will be more favorable in the future.

The government of Ukraine will introduce non-exchangeable tokens (NFT)

Shortly after the invasion of Ukraine in late February, the Ukrainian government went public pleaded for support in bitcoins, ether and other tokens Ethereum-based networks, such as the USDT stablecoin, to finance defense capacity enhancement. Last week it was reported that on March 30, the Ukrainian government will launch a series of non-exchangeable tokens (NFT). The series is to include 54 NFTs, each of which will depict the key moments of the first days of the invasion (February 24-26). With regard to this series of NFT, the Ukrainian government he declared:

"We will not allow even one day of this period to disappear from the book of world history ".

https://twitter.com/mintsyfra/status/1507330672565919751?s=20&t=KYkTgWvz5HgP6fkt5FwutQ

All proceeds from the sale of NFT will go to the official cryptocurrency account of the Ukrainian Ministry of Digital Transformation to financially support this country.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)