OVERBALANCE strategy - methodology from Bryce Gilmore

Overbalance strategy - what is it and how does it work? As the basic rule says, the trend should be the main friend of every trader. It's no secret that by investing with the trend, we gain some kind of advantage. Simply put, we are on the right side of the market. The question is very often how to identify a trend? How many investors use so many methods, some use trend lines, others use indicators, and still others use moving averages. In this article, I would like to focus on a method that, in my opinion, is one of the best methods of identifying a trend, because it is based on the most important aspect ... price.

Basic assumptions overbalance

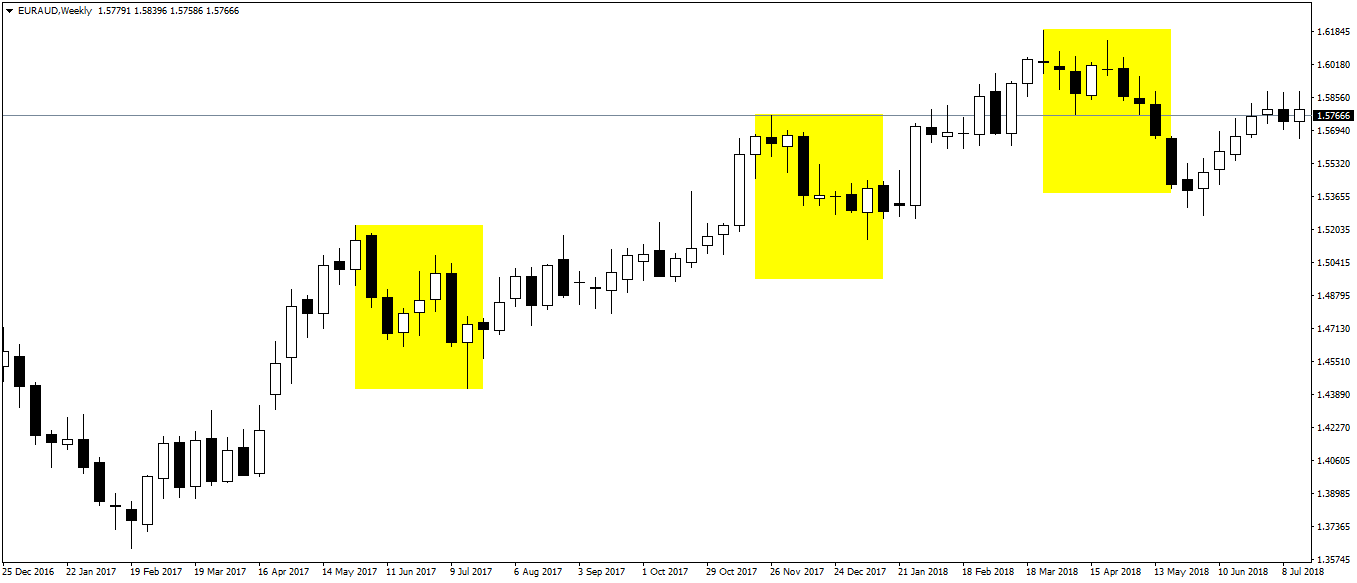

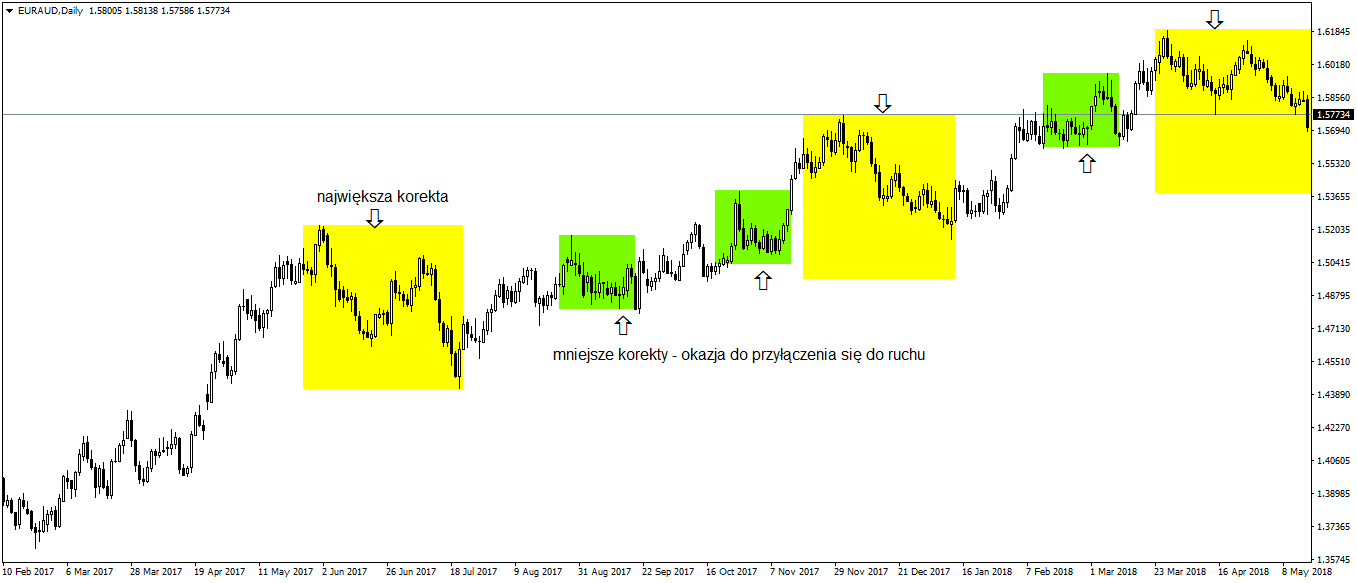

The author of the entire methodology is the Australian trader Bryce Gilmore. Regardless of whether the market is dealing with a downtrend or an uptrend, each trend consists of pulses, that is, movements in accordance with the current direction and adjustments that is movements opposite to the current direction. Methodology overbalance it focuses entirely on the second one, let's call it a "component" of the trend, or adjustments. The most important in the method is to identify the biggest correction in the currently prevailing trend. The basic assumption overbalance he says that a given trend lasts until the biggest correction is not the market is minted. If a breach or violation occurs, it may be the first signal to change the market trend.

Determining the trend by the method overbalance

The basic assumption is to focus only on the biggest correction. In my opinion, however, it is also worth taking into account typical adjustments for a given market, i.e. those that are repeated on the chart, e.g. in a given time range. It gives us a better picture, and allows us to see some key places where we can connect to buyers or sellers depending on the current trend. Of course, we should not forget that the biggest correction is crucial for the current trend.

Practical application - False breakouts

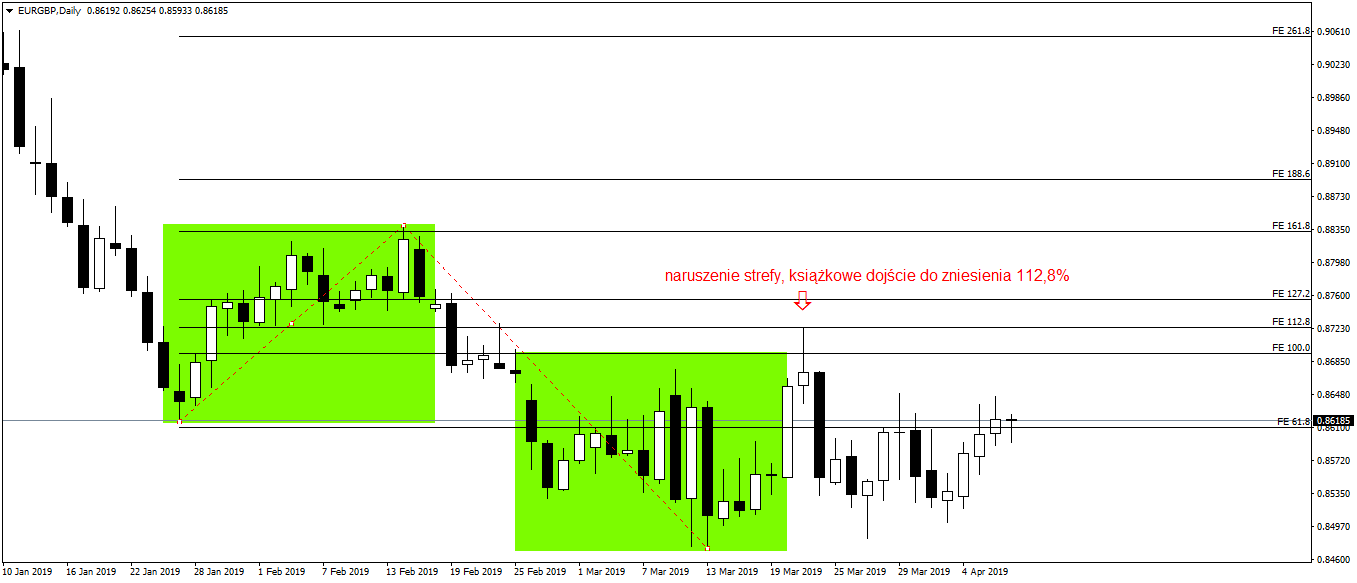

When using the method in everyday trading, it is worth remembering in advance to define the assumptions that we will use when using it. This is very important because the first problem we may encounter is the so-called false breaks. Very often on the market there is a situation that the price knocks out a given correction. But after a while, it comes back drawing only a shadow over or under the correction. Pre-set rules, e.g. we only consider closing the candle above or below the zone, will allow us to avoid many false signals, which also means overtradingu. I can say from experience that an interesting idea is also a connection overbalance with some Fibonacci abolitionsI specifically mean the 112.8% retracement of the previous move. Very often the price violates a given correction by breaking it and even closing the candle below the specified range. When for the majority it is a clear signal to change the current trend, the price is close to the 112,8% range. And then we have a book continuation in line with the current trend.

Summation

In conclusion, in my opinion, the method overbalance is a relatively simple and effective trend-setting technique. Its strength is based on an extremely important aspect of the market, namely price. It works very well as a complement to a specific investment strategy. Regardless of how we invest, we should take into account the current market trend.

Using the methodology in practice, let us remember about:

- determination of assumptions: for precise opening of a position, we can use additional confirmations, e.g. from price action,

- false bets: pay attention to closing the candle within a given correction,

- 112.8 range of the previous traffic.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Stop Loss hunting - who is hunting our SLs? [Video] stop loss hunting](https://forexclub.pl/wp-content/uploads/2021/10/stop-loss-hunting-300x200.jpg?v=1632996842)