CCI and CCI Divergence - Indicators of one family [MT4]

CCI and CCI Divergence - Indicators of one family [MT4]

We know that the indicators can work together well but also cause a lot of confusion. The reason is often too large a number on the chart or total mismatch and thus the conflicting signals generated by them.

Today we will know another interesting combination of two indicators from one family. Like the double RSI (we wrote about RSI in TYM article) they will be superimposed. Thanks to this solution, we gain a very effective reading and save a lot of space on the chart.

Installation and operation of CCI Divergence

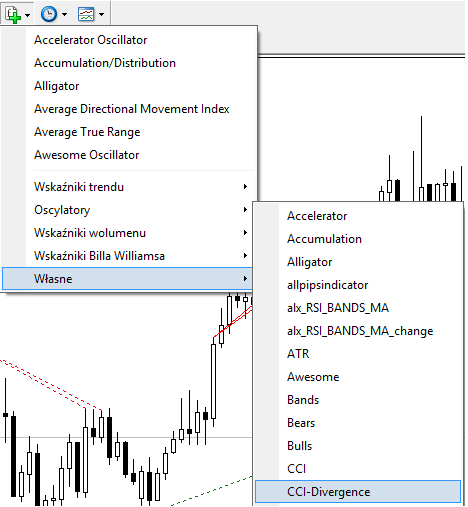

CCI indicator, i.e. Commodity Channel Index, it should be well known to most of you - we describe it more widely in TYM article. It is publicly available on the MT4 platform. While CCI Divergence to be downloaded separately (available on our forum HERE). As in any other case, the downloaded file must be moved to the directory Indicators. After restarting the platform, the indicator can be found in the tab Own .

Be sure to read: How to add custom tools to MetaTrader 4

To place one pointer on another, open the navigator window in MT4, find our missing pointer on the list and drag it to the previously loaded one. Configuration of colors or thickness of lines and posts remains at the discretion. It is important that we get a comfortable reading for ourselves.

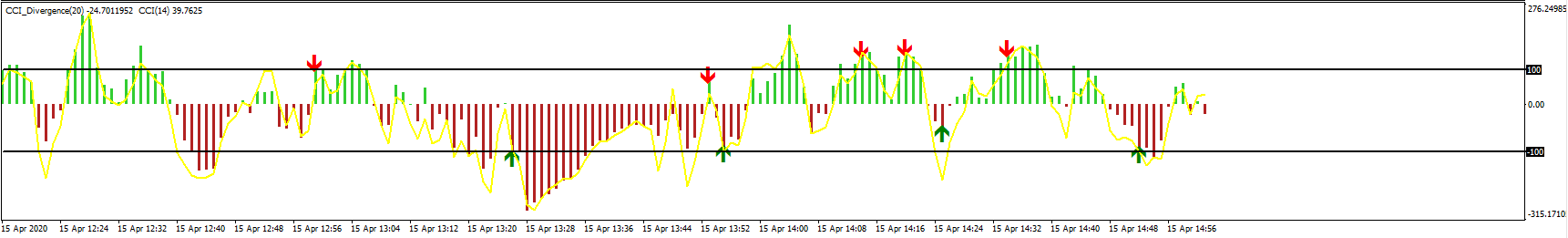

The CCI, or in this case the yellow line, is an oscillator that measures the force behind price movements. It shows who currently has an advantage on the market - bulls or bears. It is similar in structure and interpretation to such indicators as Momentum or RSI. In the event that the indicator reaches a value higher than 100, we deal with an overvaluation of the given instrument, and thus a possibility of a price drop. Likewise, if the value drops below -100, the current price is perceived as undervalued and interesting to buy.

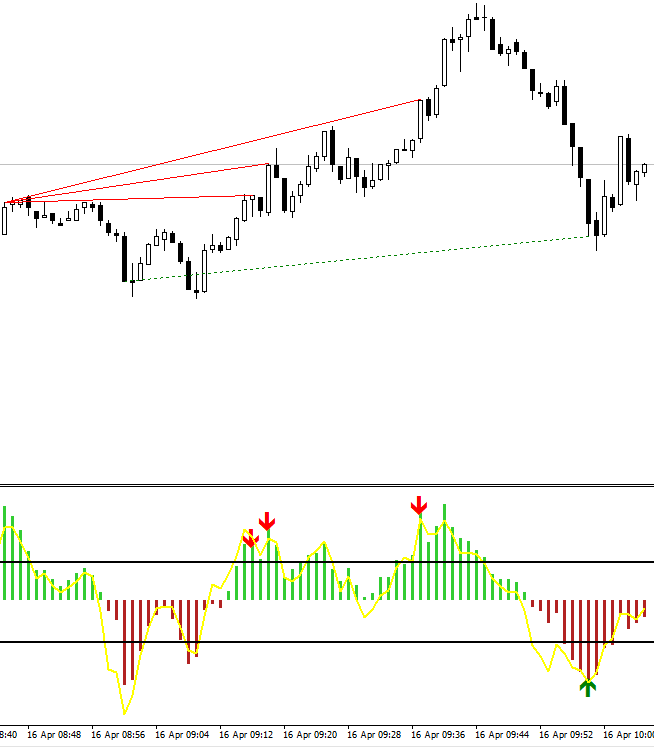

CCI Divergence, i.e. the green upward and downward red bars visible in the chart, indicate the current trend. In addition, an additional advantage is that the indicator will show the so-called divergence, i.e. the discrepancy between the price range and CCI indications. This signal is shown to us by arrows and lines connecting two points on the chart. In the event that the price reaches a new higher peak and the indicator a new lower peak, then we have a strong signal of a possible decrease in price. Similarly, for a buy signal, divergence will mean the creation of a lower hole by price and a higher hole by CCI.

Conclusions and final assessment

Having tested the performance of both indicators together, it can be concluded that the best moments to conclude transactions are those in which the green or red bars and the yellow line are below the levels of –100 and over 100. A strong signal will also be the appearance of divergence in this place. At low intervals (M1, M5) it often pops up, which may be already late information, especially in a strong impulse. The higher the interval, e.g. H1, H4, this signal is very strong. Of course, divergence in the M15 and M30 middle time frames generates a very decent signal. As usual when using indicators, it is always worth having additional tools and a thorough analysis. We cannot blindly believe that one indicator will show everything and on this basis we cannot make hasty decisions.

Advantages:

- Works on every time interval,

- For use on any instrument,

- Combines many signals with each other,

- Easy to interpret.

Disadvantages:

- Compare his indications with other tools,

- At high dynamics at low intervals, divergence is too slow.

RATING: 8/10

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CCI and CCI Divergence - Indicators of one family [MT4] CCI Divergence](https://forexclub.pl/wp-content/uploads/2020/04/CCI-Divergence.jpg?v=1587028073)

![CCI and CCI Divergence - Indicators of one family [MT4] Petroleum](https://forexclub.pl/wp-content/uploads/2020/04/ropa-naftowa-102x65.jpg)

![CCI and CCI Divergence - Indicators of one family [MT4]](https://forexclub.pl/wp-content/uploads/2020/04/dax-analiza-102x65.jpg?v=1587050212)