Charles Ponzi - the creator of the famous financial pyramid

There have been many charlatans in the history of finance who offered their clients the prospect of above-average profits. Few, however, were "lucky" enough to be remembered in history. One of them is Charles Ponziwhich is famous for the term Ponzi Pyramids Ponzi scheme. In today's article, we will present the profile of this financial fraudster and explain what the financial pyramid model is all about. We invite you to read!

What is a financial fraud?

A financial fraud is a situation in which one person or a group of people is fully aware that the offered product or service is dishonest and raises legal doubts. Nevertheless, the organizers of the scam misrepresent facts and manipulate data in order to gain material benefits. Financial fraudsters want to quickly raise funds from their victims (i.e. unaware customers) and then transfer them to hide and embezzle them.

There are many types of financial scams, the most popular of which are:

- Creating a financial pyramid

- Data manipulation to present "amazing financial prospects"

- Manipulating financial results to sell shares at a higher price (window dressing)

- Lowering the company's profits in order to drop the price and "pull" the company off the stock exchange

- Not investing funds for their intended purpose

- Money laundering

- Extortion of money

- Check and credit card fraud

- Illegal asset management

Financial fraudsters, as a rule, do not act in a sophisticated manner. Most often they are looking for a specific type of client and adjust their marketing to it. The target is people who would like to earn big money without risk, have no financial knowledge, dislike "traditional" financial institutions and are gullible. This combination creates an ideal client for any financial fraudster.

Often, financial frauds are easy to identify. The appearance of the following "red flags", which should warn against entrusting funds. These include:

- Ensuring high "guaranteed" profits - as a rule, there are no free lunches on the financial market. High returns always carry a higher risk. If the market risk-free rate (i.e. NBP reference rate) is 6,75%, the 20% offer without risk should raise suspicions.

- The short duration of the "promotion" - fraudsters try to persuade people to transfer funds quickly. For this reason, they use marketing tricks to ensure only a "temporary" offer. This is to lull the victim's vigilance, as emotions can obscure common sense. A client who wants to achieve above-average, safe profits may be tempted and quickly invest in a promotional investment offer.

- Reluctance to share detailed financial information - fraudsters like to spread the vision of great financial prospects, but do not like to inform in detail about their ventures. Sometimes it happens that a company, despite such an obligation, does not submit its annual financial statements to the National Court Register

- Possession on the list of KNF alerts - Polish Financial Supervision Authority deals with monitoring the financial market in terms of compliance with regulations. If a financial entity does not comply with all regulations or its activity raises serious concerns, it lands on "List of public warnings of the Polish Financial Supervision Authority".

- The company's small capitals - often financial frauds are organized through specially established companies. Because ultimately such a company has a "short life", the capital of such a company is at a minimum level.

- No company registration in the National Court Register or CEIDG - the company presenting itself as "with Polish capital" offering investment products is not even registered.

In the case of financial fraud, it is always worth asking yourself:

Why is someone offering me very high risk-free returns?

After all, if the offer is really so safe and profitable, it is much wiser to use a bank loan to finance the entire project.

One of the most widespread financial scams is the financial pyramid scheme. Although the operation of the pyramids has a long history, one of the most famous creators is Charles Ponzi. Later in the article we will focus on what the Ponzi pyramid was and who exactly was Charles Ponzi?

Why can't the Ponzi pyramid work?

The Ponzi scheme is one of the most famous types of financial fraud. Its idea is unsustainable the higher the interest it proposes to its clients. This is due to the effect of compound interest, which initially works favorably for fraudsters (ensures a quick inflow of capital) but over time is the greatest enemy of the creators of the pyramid. Simple math is enough to show that offering a 100% return in 90 days is financial suicide.

For example, a scammer at the beginning offers a 100% rate of return within 3 months and thus obtains PLN 1 million. How much will he have to donate if initial donations hold funds until the end of the year? The answer is: PLN 16 million. The schedule is below:

| Operation of the Ponzi pyramid | Amount at the beginning of the investment period | Interest |

| The first 3 months | PLN 1 million | PLN 1 million |

| From 4 to 6 months of investment | PLN 2 million | PLN 2 million |

| From 7 to 9 months of investment | PLN 4 million | PLN 4 million |

| From 10 to 12 months of investment | PLN 8 million | PLN 8 million |

Source: own study

As you can see, after 9 months, the fraudsters have to return 1 million capital and 7 million interest (including interest on capitalized interest) to the original investors. After 12 months, the creators of the pyramid would need an injection of an additional PLN 15 million to pay off the first investors. The inflow of 15 million additional capital means that after the next 3 months the fraudsters would need PLN 30 million to pay off the second round of fraudsters.

The larger the financial pyramid, the more difficult it is to manage. Moreover, such a structure is very sensitive to even a small panic of investors. For this reason, its future is already known at the moment of its creation - the project will end in the fraudulent use of investors' funds. Only the first wave of investors will benefit, but after the collapse of such a pyramid, they will have to return interest to cover the capital paid in by other clients.

Who was Charles Ponzi?

Charles Ponzi around 1920, source: Wikipedia

His full name is Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi. Charles Ponzi was born on March 3, 1882 in Lugo in the Emillia-Romagna region. Ponzi's ancestors were very rich, but as a result of poor property management, they fell into financial problems. Even so, his mother still lived in the past and used the title "donna." Charles hired a postal worker to raise money. The accumulated money allowed him to start his education at La Sapienza. However, during his studies, Ponzi preferred to play instead of studying. He made friends with wealthy students and spent several years spending in Roman bars, cafes, and opera houses. As a result, he neglected his studies and ended up not getting an education. At the same time, he lost all the funds he had for education.

Encouraged by his family, he came to the United States at the end of 1903. During the long journey, he spent most of the money he had been given to help take off to a new continent.

As he himself mentioned: "I have landed in this country [i.e. USA] with $ 2,5 in my pocket and $ 1 million in hope, and that hope never left me".

Charles learned English very quickly and worked part time for several years. After some time, he got a job as a dishwasher in a restaurant where he slept on the floor to save money. Thanks to his diligence, he was promoted to waiter. However, the promotion did not last long and he was fired very quickly for cheating restaurant customers.

Travel to Canada

In 1907, Ponzi realized that there was no major career waiting for him in the United States. For this reason, he moved to nearby Canada. The choice fell on Montreal, where Charles became an assistant cashier at the newly opened Banco Zarossi, which mainly dealt with servicing Italian immigrants. Ponzi was hired because he knew Italian, English and French very well and was focused on success. As a result, the superiors gave young Charles a chance.

It was thanks to his work at this bank that Ponzi got to know the operation of the financial pyramid scheme, which at that time was called "To rob Peter to pay Paul". The pattern of operation was as follows: Banco Zarossi offered a very high interest rate on deposits, which was then 6% per annum. It was a rate twice as high as the market average. Thanks to attractive interest rate deposits, the bank was growing rapidly. As the bank grew, Charels Ponzi was promoted to manager. However, the bank's situation was not colorful. The high interest rates on deposits meant that the bank had a high cost of capital. As a result, there was a problem with the bank's interest profit.

Loans granted by the bank in the mortgage market did not pay off as scheduled. Banco Zarossi decided to solve the problem by paying interest on deposits from newly acquired funds. Nothing could last forever. Eventually, the bank found itself in such a difficult situation that its president, Luigi "Louis" Zarossi, fled to Mexico with some money belonging to Banco Zarossi's clients. Charles Ponzi stayed in Montreal and lived with the Zarossi family for a while. He planned to return to the United States, but did not have much money. He decided to forge a check for $ 423,58. To make the check seem genuine, he forged Damien Fournier's signature. Despite the liquidation of the check, Ponzie was arrested by the police because the crime had come to light. For this reason, he spent 3 years in the federal prison in St. Vincent-de-Paul.

After he was released from prison in 1911, he very quickly found himself behind bars. The reason was participation in the illegal smuggling of immigrants of Italian origin across the Canadian-American border. Ponzi was sentenced to 2 years in prison in Atlanta. There Charles became friends with the gangster Ignazio "Wolf" Lupo. However, the real role model for the young Ponzi was Charles W. Morse. He was a wealthy businessman and stock market speculator. After being released from prison, our hero tried to work legally but did not achieve much success. Attempts to set up your own business also failed.

Business idea - postage stamp trade

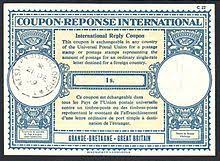

In 1919 he came up with the idea of using the IRC (International Reply Coupon). The IRC allowed its holder to pay for the mail service in

IRC, source: Wikipedia

other country. The International Reply Coupon was purchased at the cost of the postal service in the country of purchase, but covered the cost of the stamps in another country (regardless of price). As a result, there was a chance for arbitration - purchasing IRC in a country with a lower cost of postal services, replacing it with postage stamps in a country with more expensive postal services, and then selling the stamps at a slight discount.

The macroeconomic environment favored such a solution. World War I caused very high inflation in Europe. This made the price of IRC in Italy very low compared to the price of postal services in the United States. There was a chance for arbitration. Charles Ponzi only needed the capital to start the business. At first he wanted to use bank financing, but the Hanover Trust Company was not interested in financing such a venture.

According to Ponzi, the profit on speculation could exceed 400%. So he started encouraging his friends to invest in his venture. It offered to double the investment in 90 days. It was a staggering rate of return considering that banks were offering around 5% interest annually in those days.

Humble beginnings

In January 1920, Ponzi started his own company, which he called the Securities Exchange Company. Interestingly, the abbreviation of the company's name is SEC, just like the current overseer of the American capital market. During the first month, he acquired 18 investors who deposited a total of $ 1800, which is the equivalent of about $ 25 today. So they were not wealthy investors, but small savers hoping that they could quickly double the invested funds. The profits from the investment were paid out within a month, mainly from new investors' contributions. Reliability and high profits meant that new clients started using the services thanks to the recommendations of previous investors. As a result, more and more capital landed in the Securities Exchange Company.

Business blushes

With the influx of new capital, the company could afford to expand significantly. He changed the office to a larger one, located in the Niles Building on School Street. To ensure a faster capital inflow, Ponzi hired commissioned agents. Between February and March 1920, the assets under management increased from $ 5 to $ 000. Charles saw the potential of the idea and therefore built up sales teams in New England and New Jersey. Until June of the same year, clients had invested as much as USD 25 million in the SEC. Then the contributions sped up. At the end of July, investors were already depositing $ 000 million a day. Investing in the Ponzi scheme has been increasingly popular. The more greedy people mortgaged their homes and invested their life savings to get rich quickly.

As the scale grew, Charles Ponzi needed a financial institution that would like to hold his funds. The choice fell on the tiny Hanover Trust Bank of Boston (the same that refused to finance the Ponzi project). As more capital poured in, Ponzi increased its exposure to the bank, eventually acquiring a majority stake.

Business grew rapidly, but it was also a cause for concern for SEC managers. The more capital poured in, the more capital was needed to pay interest. Due to the fact that the Securities Exchange Company did not conduct actual investment activities - it meant one thing - the need to acquire new clients. It got to a point where as much as 75% of the Boston police force had savings invested in the SEC. To Ponzi, it made no difference who invested in his scheme. From petty savers who entrusted just a few dollars to very rich people who entrusted $ 10.

At first, no one asked any questions. However, it took a little imagination to realize that running such an activity would be very logistically difficult. For example, a first investment of $ 1800 required 53 IRCs to be acquired, shipped across the Atlantic, and sold in the United States. As the scale grows, it would be necessary to rent ships the size of the Titanic to cash in on the arbitration. Of course, a lot of people would be needed to keep an eye on the loading, store IRCs, convert them into stamps and sell them at a discount.

Due to the difficulties in organizing such a business, Charles decided to buy a pasta company and a stake in a winery to partially pay off the IRC investors from the profits. However, compound interest did not give such plans any chance of implementation. To keep the investor illusion alive, Ponzi lived a lavish life buying real estate, cars, and expensive jewelry. But black clouds were gathering over the Securities Exchange Company and its owner.

SEC problems

Along with the increase in scale, the activities of the Securities Exchange Company aroused more and more interest. As a result, critical voices began to emerge regarding the viability of the SEC's business model. However, Ponzi, at the instigation of lawyers, sued a journalist in the financial court, who in one of the articles stated that there is no physical possibility of obtaining IRC profits on such a scale. The journalist was unable to prove his theses in court, which resulted in a fine of $ 500 on him (and the publisher). This allowed for a moment to silence skeptical voices.

Another problem was the lawsuit filed by Joseph Daniels, the owner of a furniture factory. Joseph demanded payment for furniture that he had delivered to Ponzi a few months earlier, for which Charles had not paid. Although the lawsuit was unsuccessful, it caused a brief panic and a "run" on the SEC. The scale of panic was so small that the pyramid did not collapse. The news that the profits were paid out reassured other investors and prevented the collapse of the "stamp business".

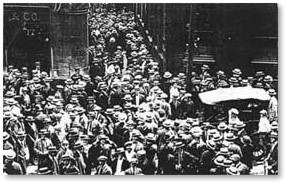

In an effort to save its reputation, Ponzi began spending on advertising. On July 24, 1920, a positive SEC article appeared in The Boston Post. There was also a mention that the company offers 50% interest in 45 days. At the same time, an advertisement for a bank offering 5% per annum appeared on the page with the article. The next day, thousands of Boston residents appeared in front of the company's headquarters to invest in Charles's business.

School Street crowd in front of the SEC office source: https://aknextphase.com/

However, the article in The Boston Post also caught the attention of people in the financial world. One of them was the famous Clarence Barron, who is called the father of modern financial journalism. Barron said there should be approximately 160 million IRCs in circulation for the SEC to operate. However, according to his research, there were only 27 in circulation. At the same time, his research revealed that The United States Post Office did not report increased demand for IRC at home or abroad. At the same time, the journalist noted that the single price was so small, and the product could not be sold in bulk, that operating activities should consume a significant part of the gross profit. The final thesis of the article was that even if such activity is actually carried out, it is morally questionable because it "robs" the government of the United States or another country.

Barron's text caused a panic among investors who disbursed $ 3 million within 2 days. To calm the panic, Charles invited investors for coffee and donuts. There, he calmly explained the operating activity of the SEC, which made it possible to stop the outflow of money.

Once again, Ponzi tried to save his reputation with the power of the media. To this end, he hired the publicist William McMasters. The latter, however, quickly realized that the company in practice did not conduct major operating activities and that the SEC itself looked to be financially illiterate. During an internal investigation, McMasters discovered that Ponzi was paying off new incoming payments. After discovering this fact, William went to his former employer - Grozier. He then sold him the story for $ 5000. An article appeared in a Boston newspaper on August 2. This caused a panic that could no longer be calmed down.

However, that was just the beginning of the bad news. On August 9, it became known that the SEC was unable to meet its clients' payouts. As a result, he had debts of $ 7 million. Two days later, an article appeared that recounted stories from Montreal 13 years ago and Ponzi's activities at Zarossi's bank. On the same day, the Hanover Trust funds were frozen, which prevented Ponzi from withdrawing funds and fleeing the country.

Prison and the following years

The losses of the pyramid participants amounted to several million dollars. Schema Investors they got back 30 cents on their dollar investedall interest reinvested was also lost. Charles was charged with 86 postal fraud, for which he could even get a life sentence. However, he pleaded guilty, which meant that he received a lighter sentence. The court sentenced Ponzi to 5 years' imprisonment, which was reduced to 3,5 years due to the payment of bail.

After leaving prison, Ponzi returned to his criminal practice assuming the Charpon he was offering profit of 200% in 60 days in connection with real estate investments in Florida. In 1926, he was sentenced to one year in prison for breaking trust and securities laws. However, Ponzi appealed the sentence and was released after paying bail of $ 1500. After paying bail, Charles tried to flee to Italy. To this end, he shaved his head and grew a mustache. However, while traveling by ship, he revealed his identity to one of the crew members. He notified the police and the scammer was arrested in New Orleans. As a result, he was sentenced to 7 years in prison.

Upon his release in 1934, Ponzi was immediately sent for deportation. The request for a pardon was denied, which meant Charles would leave the United States forever. On October 7, 1934, he was officially deported. After returning to Italy, the fraudster returned to the path of breaking the law. He has tried numerous financial scams but few have been successful. Over time, he moved to Brazil where he worked as an agent of Al Lottoria, which was the Italian state-owned airline. However, their activities were closed due to Brazil's allied joining the war.

In recent years Ponzi lived in poverty, earning his living from learning English. He had one friend left in Brazil - Francisco Nonato Nunes - who was a hairdresser. Nunes's knowledge of Italian and English helped in friendship. Charles Ponzi died at the charity hospital in Rio de Janeriro on January 18, 1949.

Summation

The story of Charles Ponzi shows that you don't have to be a financial genius to create a great financial fraud and he has quickly made his way from a shoe-shine to a millionaire. The financial pyramid he created was not the first structure of this type in the history of finance, but it was very media-driven. Ponzi defrauded the police, journalists and the judiciary for many months. This pyramid shows that investors are not very interested in what the company is going to profit on (in the case of the SEC, it was arbitration on international postage costs).

MyChargeBack.com is an American company specializing in the recovery of funds extorted by unreliable companies and "scams" pretending to be honest Forex brokers, binary options brokers and cryptocurrency projects. If you've been scammed, there's a good chance that MyChargeBack.com will be able to help you!

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)