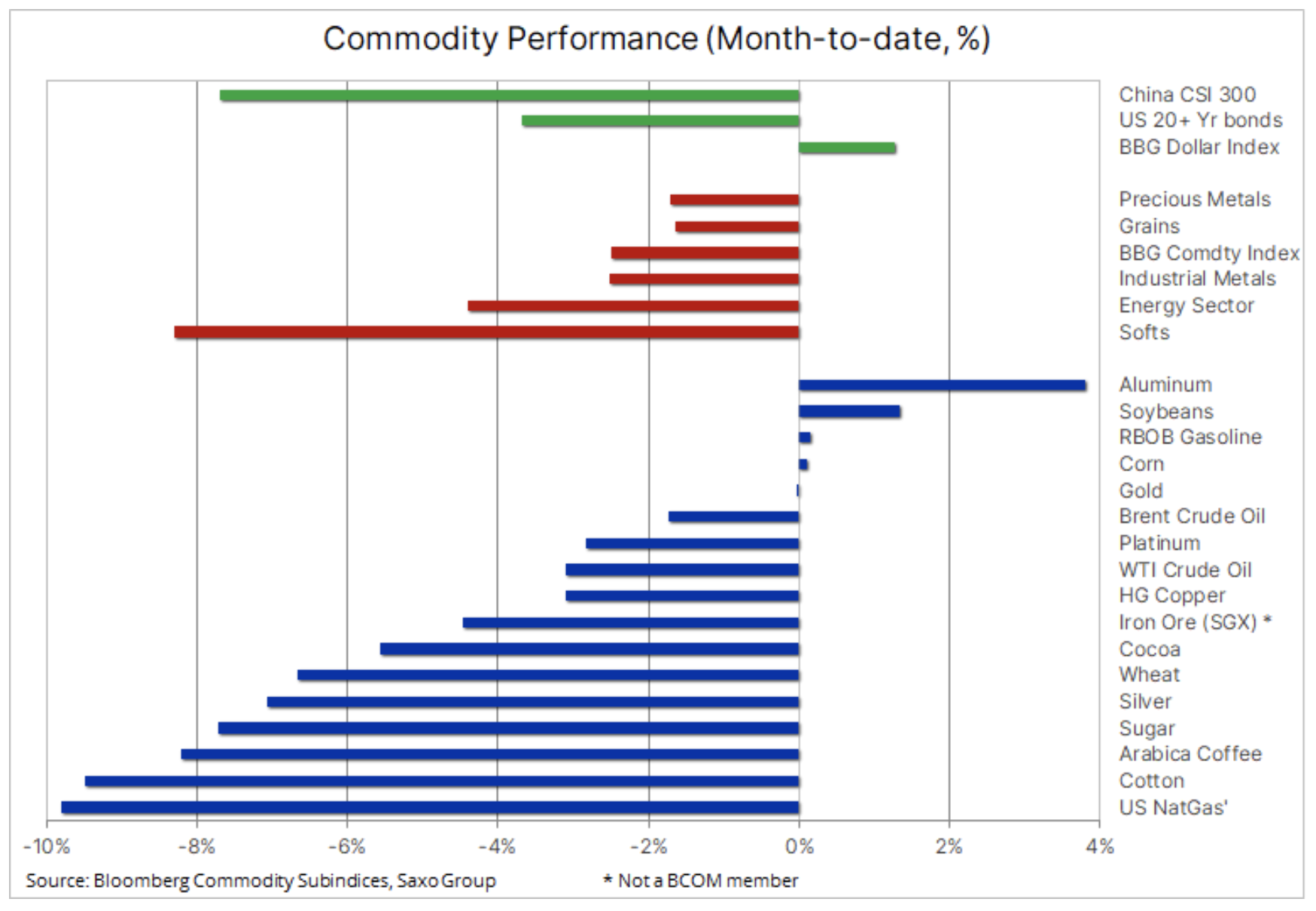

China, the dollar and the virus are negatively affecting the sentiment in the commodity markets

The Bloomberg commodity index, which has fallen 2,3% m / m so far, could record its worst month since last September. Deteriorating sentiment in Asian markets contributed to the strengthening of the dollar, thus causing the consolidation of prices of an increasing number of raw materials - most recently industrial metals.

The surge in US Treasury yields, the prolongation of lockdowns and vaccine problems in Europe, as well as signals that China has begun to phase out a wide-ranging fiscal stimulus program that has supported both the Chinese and global economy in the early stages of an ongoing since the year of the pandemic.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

We are still waiting for the US currency to weaken in QXNUMX, but tactically there is considerable room for maneuver to extend the rally as long as US growth prospects are seen as temporary spikes above most of the rest of the world and as long as Federal Reserve will ignore the long-term impossible mathematics of this year's planned government bond issue (and with it the multi-trillion-dollar Biden final infrastructure plan) in the context of the current scale of the Fed's asset purchases under quantitative easing.

Copper

Copper

Copper is below local support at $ 4 / lb, but has so far found potential buyers ahead of $ 3,93 / lb, a 50% retracement from the line of growth since late January. While the long-term outlook for copper remains decidedly positive due to signs of a structural supply constraint, the market lost momentum in response to an 80% rebound in inventories monitored by the London, Shanghai and New York stock exchanges.

While copper has managed to hold its sideline since the end of the Lunar New Year, sentiment has worsened on signs of weakening in China, where easing the fiscal stimulus was seen as one of the reasons behind the 300% decline in the CSI 18 over the past five weeks. At the same time, speculative investors have been net sellers of HG copper for four weeks, bringing the long net position to just 45k. flights, i.e. up to the eight-month minimum.

Accordingly, there is a risk that further liquidation of weak long positions could result in an even greater retracement to around $ 3,88, the 3,80-day moving average, at which level tactical long positions below $ XNUMX are most likely to emerge.

Silver

The weakening of industrial metals has created another handicap for silverthat struggled last week and the recent drop below $ 25 has pounded the metal's value against gold to its lowest level in two months: the XAU / XAG ratio again surpassed 70 ounces of silver to one ounce of gold. The silver completely eliminated the madness and not based on facts squeezewhich brought its price briefly above $ 1 on Feb.30.

Overall, silver remains in a very broad range of $ 22,50-30, but due to the high beta and the risk of further dollar appreciation, it faces another liquidation of speculative positions before finally finding support again, as we are convinced.

In addition, US farmers may this summer sow the largest acreage since 2014. Last year, the Bloomberg crop index rose by more than a third, and soybeans (+ 58%) and maize (+ 45%) recorded their highest levels in more than seven years. While mining companies can take 5-10 years to increase production in response to higher prices, farmers are able to respond year by year. The U.S. Department of Agriculture will release its crop forecast on March 31, and if the weather is good, a record harvest is projected - research indicates increased acreage of soybeans, particularly maize. Speculative investors have an almost record long position, so expect volatility to increase before and after the release.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response