Short squeeze - what is the trap for sellers

Deviating slightly from topics strictly related to foreign exchange market, in this article we will present an interesting phenomenon mainly related to the stock market, which it is short squeeze.

Every investor who moves and places his funds on the stock market certainly associates the situation in which the price of shares of a given company suddenly "stops". Seeing this type of price behavior, a large number of investors are opening up a short selling position with the intention of making money on price drops. But what happens next? The price goes up very quickly, activates orders stop loss sellers and, consequently, we are dealing with even more rapid growth. This phenomenon is called short squeeze and can be a serious threat to investors selling out given assets.

Short squeeze in theory

Simply put, short squeeze is when strong sold shares are growing and knock players out of position. It consists in closing investors' short positions, i.e. buying back shares of a given company at a higher price than expected. This is often a bit forced due to a sudden upward trend in the market. Consequently, price increases are even stronger than before the alleged potential decrease.

Why is this happening? Investors who have securities in their portfolio can see how many short sale transactions there are in relation to trading the shares of a given company. If investors refrain from selling their shares, this will reduce market liquidity. Demand, of course, will remain the same and thus the number of buyers far exceeds sellers, leading to a very rapid increase. It is also worth remembering that always an individual investor will be the proverbial fence among sharks. Central banks have access to information and can very easily (seeing the places of potential stop loss orders) play for growth, leading to such a rapid price response.

Short squeeze in practice

When choosing companies to play for a short time, it is always worth checking how large the number of short positions is, how it has evolved in the past, and how these figures compare with the liquidity of the asset.

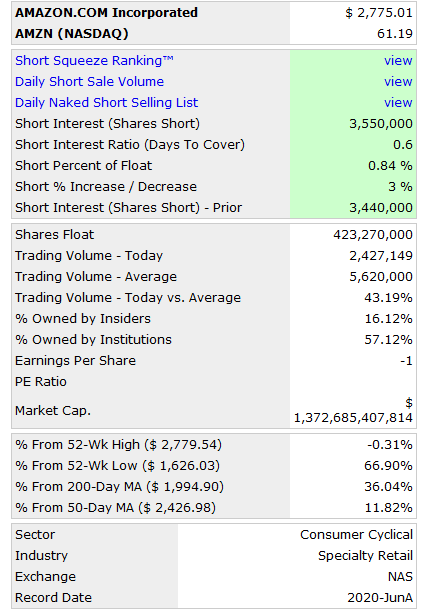

While trading typically under the trap of sellers, first select companies most often shortened, and then choose those where there was no increased volatility in the near future. An interesting tool that allows you to see a lot of relevant data is the page shortsqueeze.com. typing stock symbol, we can see interesting information about a given company from the machine. For the purposes of this article, we will select a popular technology giant - AMAZON (AMZN).

How to interpret the above data? The following is the explanation for the most important descriptions:

- Short interest - number of shares shortened by investors,

- Days to cover (Short interest ratio) - is an estimated number days needed to close all short positions. This is the result of dividing the number of shortened shares by the average daily volume (trading volume - average). The higher the value, the larger the short squeeze scale can be,

- shares float - number of free-float shares. The indicator is calculated based on a simple relationship. Shares issued - held by shareholders, employees and insiders - shares that cannot be sold at the moment (e.g. for legal reasons),

- Short percent of float - share of shortened shares in relation to all those in free float,

- Short% Increase / Decrease - current trend among sellers. On the example of Amazon we can see that it was only 3%,

- Short Interest - Prior - number of shares sold during the previous session.

Summation

Regardless of how good our investment idea is, we should always pay attention to how other market participants focus on selected assets. Events like short squeeze undoubtedly always cause a kind of storm. The correct recognition of this phenomenon offers at the same time a chance to generate a large income in the case of a long position, as well as a huge threat to currently having sales orders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)