Christopher Dembik: The clock is ticking - monthly macro forecast

The narrative about the "transitional" nature of inflation is no longer relevant. In November, CPI inflation in the United States increased by 6,8% y / y. This is the highest level since 1982. Inflationary pressures are wide-ranging: e.g. energy (+ 3,5 %), gasoline (+ 6,1 %) and used cars (+ 2,5 %). Base prices are also rising at the fastest pace in 30 years. Research suggests that inflationary pressures in the United States have already peaked. In our opinion, it is too early to make such definite statements. Expect American Federal Reserve (Fed) will accelerate the pace of reducing asset purchases (the so-called Tapering). As a result, quantitative easing will end in March 2022 instead of June 2022.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

In our opinion, there are at least two possible interest rate hikes in 2022. In China, the government has started to open the credit tap again. Our leading index, China's credit impulse, remains low. However, it is likely to be positive again in 2022, reflecting a more accommodative approach. The Middle Kingdom has also issued new guidelines on the matter carbon dioxide emissions after the annual Central Economic Labor Conference on December 13.

United States: This is not temporary

The debate is over. The proponents of "transitional" inflation have failed. Both Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen admitted that at this point the term “transitional” should be abandoned in the context of discussions on current inflation trends in the United States.

"We usually use the term" transitional "in the sense that it will not leave a lasting mark in the form of higher inflation (...). I think this is probably a good time to move away from that phrase and try to explain more precisely what we mean " Powell said in a Congressional hearing on November 30.

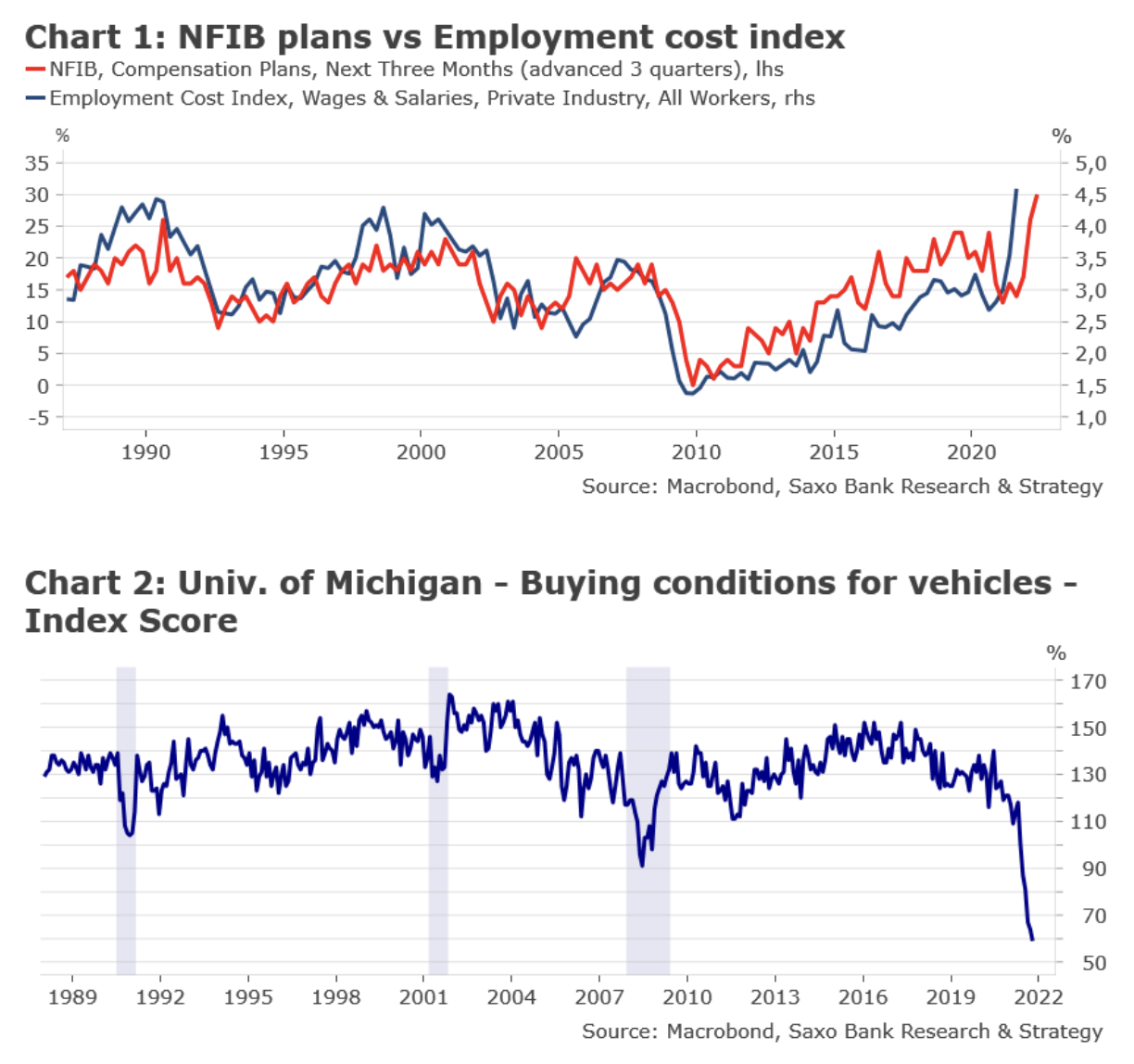

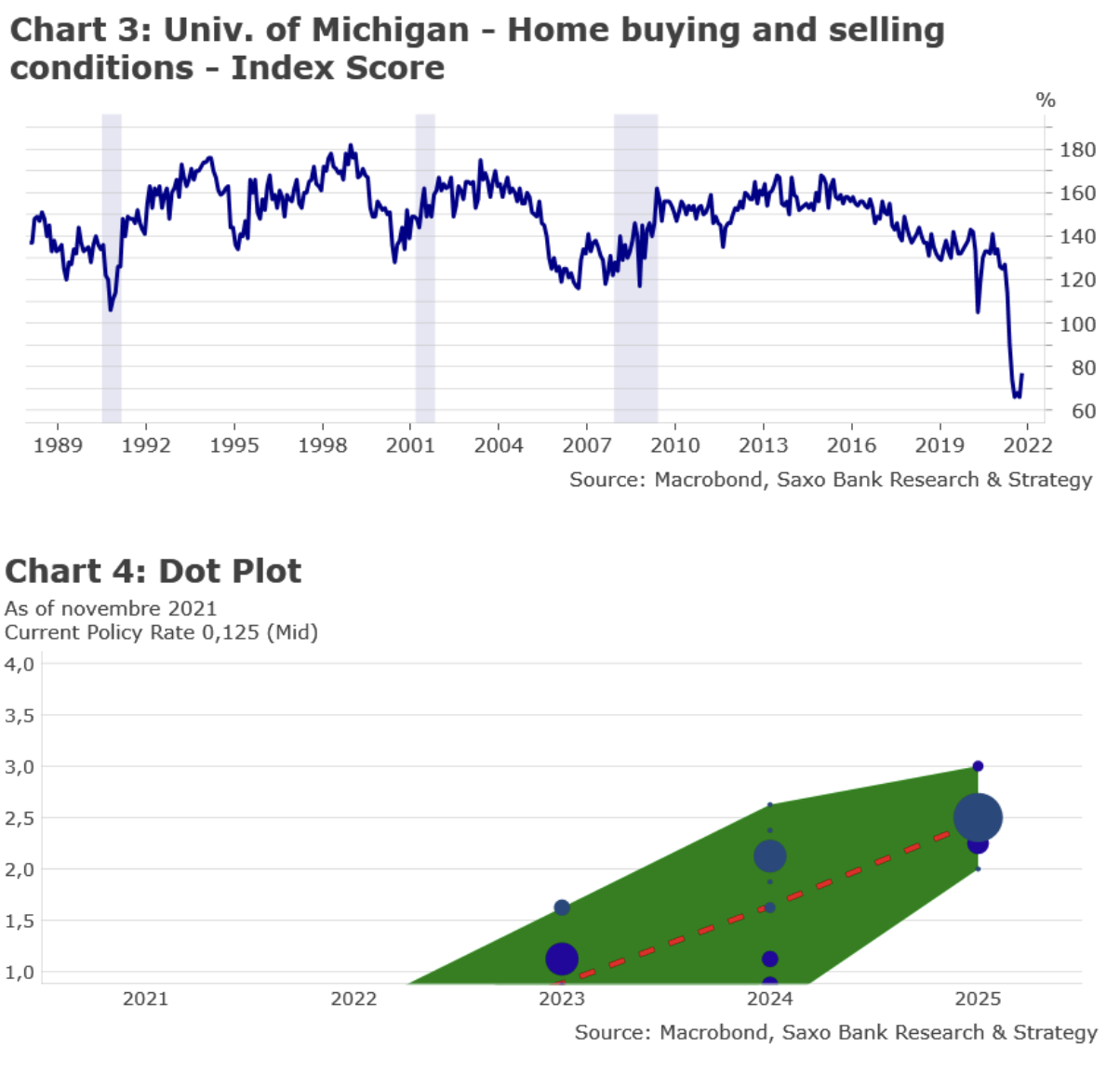

The United States is facing a wage-price spiral (Figure 1). NFIB's wage plans are three months ahead of the HCO index (which measures the increase in total employee wages). It is planned to increase net salaries by as much as 30% in the next three months. This is the highest level ever. In the third quarter, the employment cost ratio increased by 4,5% year on year. It is expected to continue to rise, most likely well above 5% in 2022. However, rising costs of living are offsetting some of the benefits of higher wages for workers. They have to pay more for a wide range of products. This issue was highlighted in the November CPI report. For example, vehicle purchase conditions are at their worst level ever (Chart 2), while home buying and selling conditions are still very negative (Chart 3). However, the lowest point may have already been reached.

The Federal Reserve could no longer turn a blind eye to the accelerating pace of inflation. Much evidence has emerged in recent weeks that the central bank is far behind the inflation curve. Expect that FOMC accelerate the pace of reducing asset purchases. As a result, quantitative easing would end in March 2022 instead of June 2022. We expect the median in the 2022-2024 scatter chart to move upwards, pointing to two interest rate hikes in 2022 and four increases each in 2023 and 2024 (Figure 4). The economic projections should also reflect lower unemployment and higher inflation in 2022. The evolution of the omicron option should not have a major impact on the economic projections. The new variant turns out to be mostly mild for the time being. The word "transitional" should be removed from the summary of the meeting. At the press conference, Powell's main task will be to better explain the current and expected state of inflation. This will put pressure on the Governing Council of the European Central Bank (ECB), which will meet later this week. Certainly, there are more and more doubts about the pace of decline in inflation in the euro area next year and beyond. However, let's not expect from EBC no monetary policy decision or narrative change this week. The ECB will need to clarify its response function sooner rather than later.

In 2022, the evolution of monetary policy in the United States will depend primarily on the trajectory of inflation. The market consensus assumes that inflation will gradually decline next year due to slower demand growth and elimination of supply bottlenecks. This is the most optimistic scenario. Our baseline scenario is a bit worse. Supply disruptions due to Chinese policy "Zero Covid" and higher energy prices due to years of underinvestment in fossil fuel energy infrastructure will prove to be more sustainable than anticipated. Inflation may remain volatile and unpredictable. This will be a major challenge for the US Federal Reserve as well as for all the world's other central banks. Instead of two interest rate hikes, there may be three.

China: Monetary and fiscal policy was too harsh for most of 2021. This is the past.

Our leading index, China's credit impulse, remains low (-2,5% of GDP). This is the lowest level since the beginning of 2019. It is expected to turn positive in early 2022, thus providing the desired support to the global economy. The People's Bank of China announced last week that it would lower the reserve requirement ratio (Reserve Requirement Ratio, YYY) by 0,5 percentage point, effective from 15 December. After this move, the average RRR for all banks will be 8,4%. The released cash will be lower than expected as it will be partially reduced to cover the liquidity injections. Economists consensus expects the net injection to be around CNY 1,2 trillion (ie EUR 120 billion). It is not much by Chinese standards. However, in our opinion, further support measures will be introduced in the coming weeks and months. After a year of good results, we expect China to welcome the weakening of the CNY also in 2022. This will be another way to support the export side of the economy. The authorities have no choice but to stimulate growth in 2022. It will be a strategic year for China due to two important events: the Winter Olympics in February 2022 and the 20th Party Congress in October 2022.

Finally, the Middle Kingdom also issued new guidelines on carbon dioxide emissions after the annual Central Economic Labor Conference on December 13. Rather than setting targets for energy consumption, China will reduce carbon emissions as part of its overall energy consumption to meet its environmental goals. Not all details are known yet. However, the newly added renewable capacities and "Raw material energy" (feed stock energy) will now be exempt from all energy consumption quotas to help guarantee energy supply. This likely means that restrictions on heavy industries such as coal-chemical and petrochemicals will be eased in the short term. The new approach aims to avoid disruptions to the energy supply, which have been frequently observed in the last few months, and to promote 'sustained' growth in 2022.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)