CMC Markets is earning less and less. The "ESMA effect" continues.

CMC Markets, a broker listed on the London Stock Exchange, has just published annual financial results. ESMA has insulted a company that posted a net profit lower by 90 percent. compared to the previous year. The rate reacted by a fall of 4,36 percent. The board sees, however, the pros of this situation and looks to the future with optimism.

Be sure to read: The Tickmill Group significantly improved results in 2018.

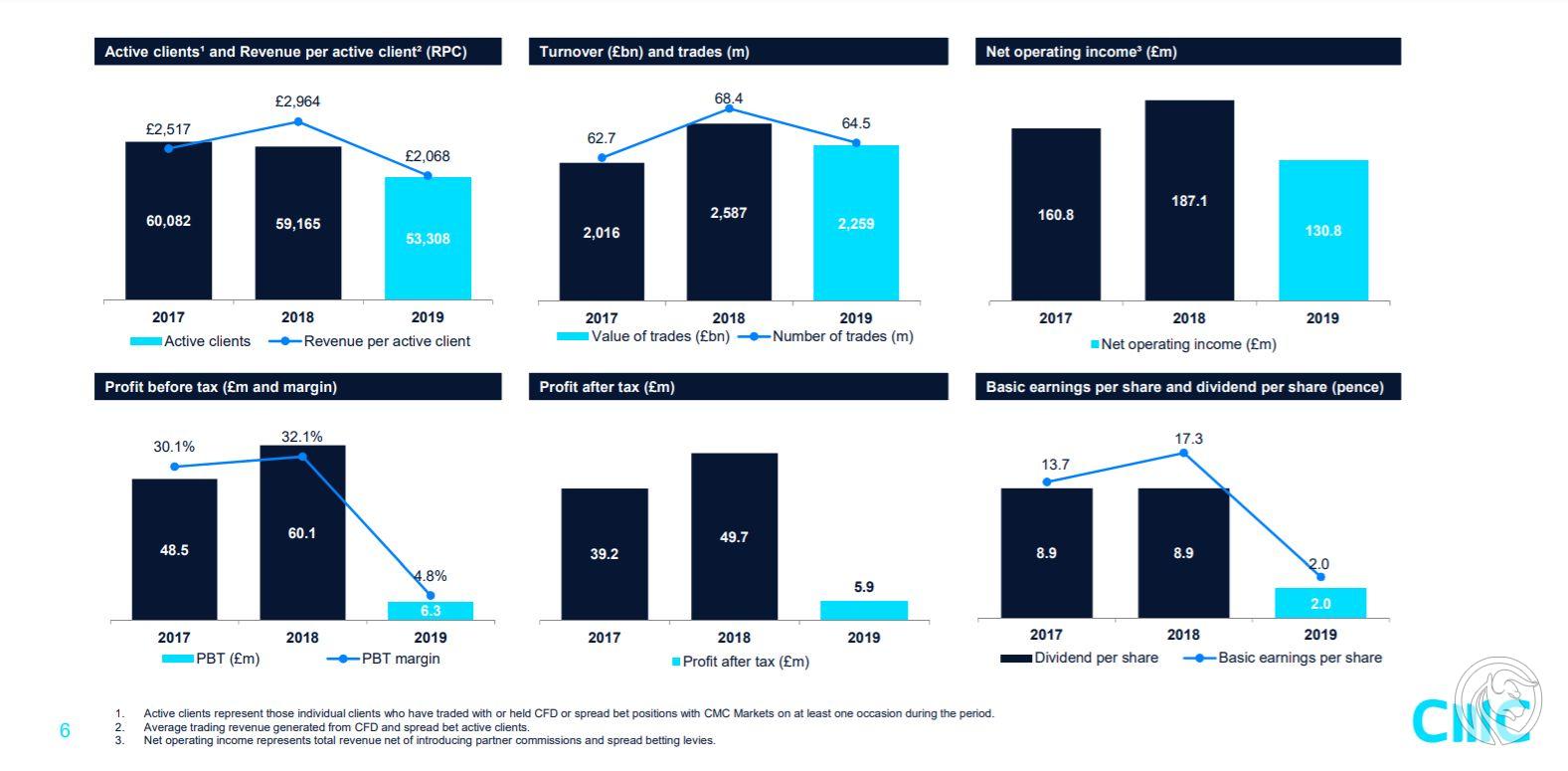

The annual financial results of CMC Markets, a popular broker in Poland, concern the period ending 31 on March 2019. Due to the regulations introduced by ESMA, everyone expected weaker results, but the scale of the decline in income surprised analysts and, above all, investors. The company reported that its net operating income fell by 30 percent to 56,3 million pounds, and net profit dropped by 90 percent to 6,3 million pounds. The full CMC Markets financial report is available here.

This translated into a change in the company's valuation at the London Stock Exchange. CMC Markets shares dived at 4,36 percent.

ESMA with CMC Markets

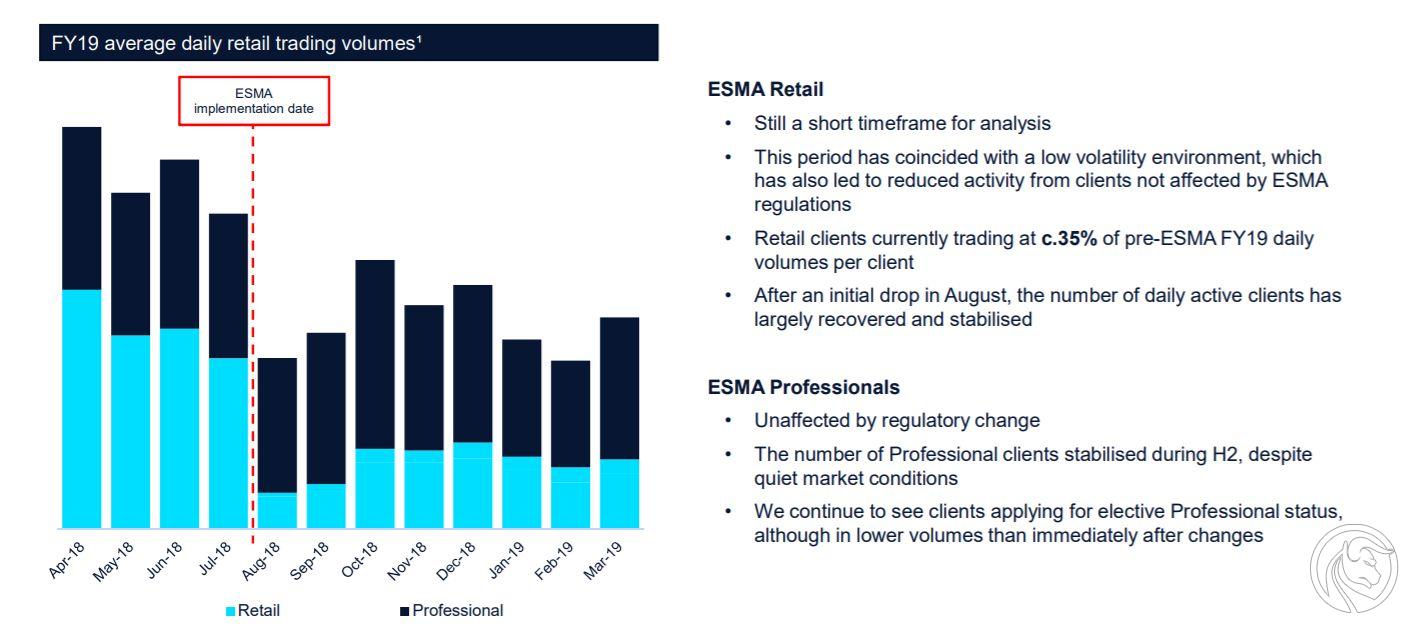

Not only ESMA contributed to worse financial results. The company reports that it was also affected by lower volatility in the first quarter of the year 2019. However, ESMA definitely left the biggest imprint on the results, which can be seen after a deeper analysis of the available financial results. Revenues in the second half of the financial year amounted to 60,2 million pounds, compared to 70,6 million pounds in the first half of the financial year. Thus, the drop in CFD revenues is significant.

Less money, because fewer customers

The company's profits fell, because a large part of the clients emigrated to countries where the financial leverage during the transaction may be greater. As a result, the total number of active clients fell last year by 10 percent. and amounted to 53 thous. 308 people, which was obviously affected by lower trade and leverage opportunities compared to the previous year. CMC Markets, however, claims that it has mostly more wealthy customers, because the amount of their money, which they trade at the broker, increased by 9 percent. and it reached 332,4 million GBP on 31 on March 2019 year.

"Client money represents our clients' ability to trade and is a primary indication that our client base is still healthy." - we read in the description of the financial results attached to the report. The managers are also convinced that the future of the company looks positive, because after the decline in customer activity in August 2018, which was expected due to ESMA's activities, no other business risks have emerged. The management board also does not see further reefs in the next 12 months.

Turnover and revenues are falling, costs are not very high

Customer revenue decreased by 30 percent. compared to 2018 a year and now amount to 2 thous. 068 pounds. The company's costs, which were reduced by only 2 percent, did not drop significantly. up to 123,1 million pounds.

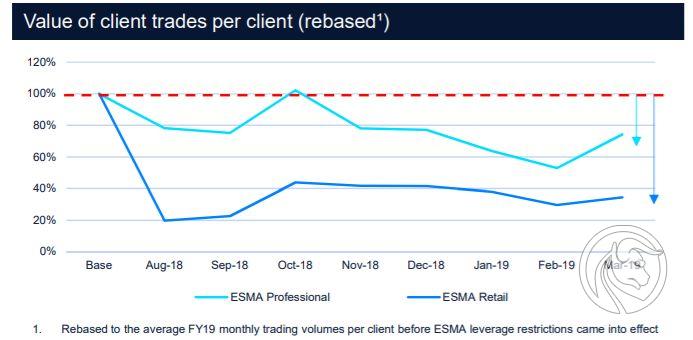

While revenues dropped by almost a third, throughout the year, turnover fell only by 13 percent to 2,26 billion pounds. The main problem was again the impact of ESMA regulations and the prolonged period of low volatility in the markets.

The discrepancy between trading volumes and revenues signals that the company's clients did not lose so much as a result of ESMA's activities, which was confirmed by subsequent reports. For many customers, the reduction of financial leverage has been positive, but on the other hand it has undoubtedly reduced the performance of traders who manage to earn on the markets.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)