Coffee - How to invest in coffee? [Guide]

Coffee, one of the most popular drinks in the world. Many of us cannot imagine starting the day without a little black cup. But apart from its flavor and awakening properties, coffee can also be a source of profit and an increase in capital. So let's answer the question - how to invest in coffee?

The use of coffee

The effect of coffee on health

Scientific research shows many health-promoting properties of coffee, despite the negative properties of caffeine consumption. It is assumed that consuming up to 300 mg of caffeine per day does not pose a health risk. This is equivalent to about 2-3 cups of coffee. Research has shown that drinking coffee can reduce the risk of Parkinson's disease, type 2 diabetes and colon cancer. For people who struggle with low blood pressure, coffee is a way to get rid of dizziness and bring blood pressure back to normal.

Coffee requirements and cultivation

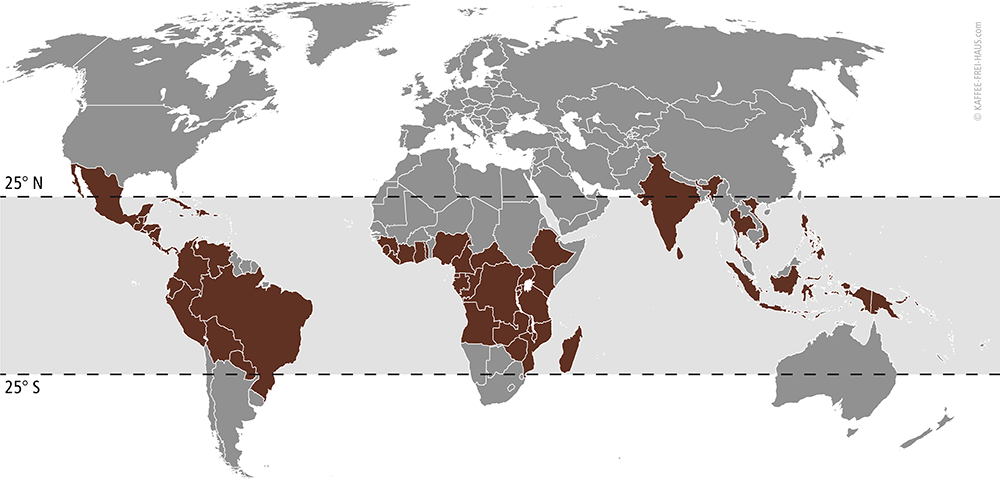

Coffee requires appropriate climatic conditions. It is grown in subtropical and equatorial climates in over 70 countries around the world. In subtropical climates, coffee grows in one season and its fruit ripen only in the second. On the other hand, in the equatorial climate, thanks to abundant rainfall and high temperatures, coffee trees continue to bear fruit. The graphic below shows the area where it is possible to grow coffee due to the appropriate climatic conditions.

Types of coffee

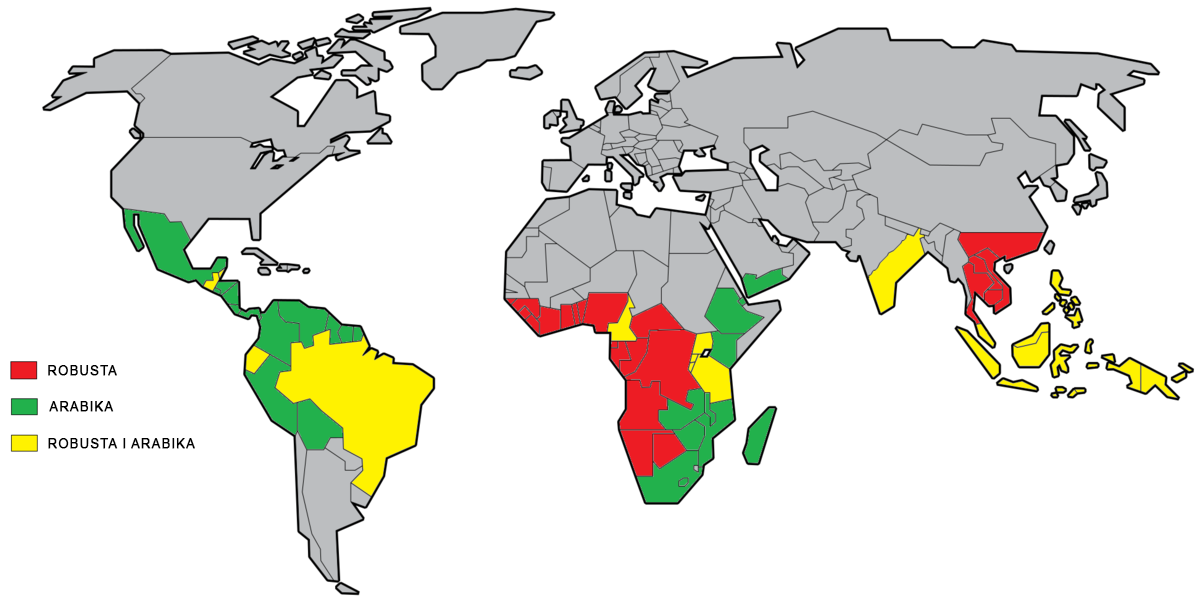

Coffee comes in two of the most popular types - robusta and arabica. Arabica is considered a better quality coffee because of its less bitter taste and deeper aroma. Arabica coffee also has about half as much caffeine as robusta coffee. Arabica coffee production accounts for 60% of world coffee production. Arabica and Robusta also have different growing requirements. Arabica coffee is grown at an altitude of 1200 to 2000 meters above sea level, while Robusta coffee is grown from 400 to 600 meters above sea level and on the plains. Arabica fruits ripen faster, while Robusta is a bit slower, but are more resistant to diseases and high temperatures. The map below shows which countries produce which types of coffee.

Coffee producing countries

The amount of coffee produced is given in jute bags. Coffee prices are quoted and billed in US dollars.

One jute bag is 60 kg of coffee beans.

The largest coffee producers

The amount of coffee produced worldwide in 2019 is estimated at almost 169 million bags. Brazil is the largest coffee producer in the world, accounting for 26% of the world's coffee production. Vietnam comes in second, producing 16% of the coffee sold in the world market. Colombia and Indonesia account for 7% and 6% of the world's coffee supply. Below is a table of the world's largest coffee producers with data for 2019.

| End | Bags (60 kg each) | Tony |

| Brazylia | 44,200,000 | 2,652,000 |

| Vietnam | 27,500,000 | 1,650,000 |

| Colombia | 13,500,000 | 810,000 |

| Indonesia | 11,000,000 | 660,000 |

| Ethiopia | 6,400,000 | 384,000 |

| Indie | 5,800,000 | 348,000 |

| Honduras | 5,800,000 | 348,000 |

| Uganda | 4,800,000 | 288,000 |

| Meksyk | 3,900,000 | 234,000 |

| Gwatemala | 3,400,000 | 204,000 |

| Peru | 3,200,000 | 192,000 |

| Nicaragua | 2,200,000 | 132,000 |

| China | 1,947,000 | 116,820 |

| Ivory Coast | 1,800,000 | 108,000 |

| Costa Rica | 1,492,000 | 89,520 |

Coffee importing countries

The largest market for coffee is the United States, which accounts for almost 20% of world coffee imports. Then we have Germany and France, importing almost 11% and 9% of coffee, respectively. Italy is fourth, importing 5,4% of coffee. Interestingly, Poland is also a fairly significant importer of coffee. In 2019, we imported coffee worth 578 million US dollars, which corresponded to 1,9% of the share in global imports. The Polish coffee consumption market is one of the fastest growing in the world. Since 2015, we have recorded an increase in the import of this stimulating drink by over 26%.

Below is a list of the top 15 coffee importers (by US dollar value) in 2019. The 15 largest importers collectively account for just over 77% of the total coffee imports in 2019.

| End | Import value in USD | Share in world imports |

| United States | 5,8 billion | 19,4% |

| Germany | 3,2 billion | 10,7% |

| France | 2,7 billion | 9,1% |

| Włochy | 1,6 billion | 5,4% |

| Japan | 1,2 billion | 4,1% |

| Canada | 1,2 billion | 4% |

| The Netherlands | 1,2 billion | 4% |

| Belgium | 1,1 billion | 3,6% |

| Great Britain | 1,1 billion | 3,5% |

| Spain | 969,6 mln | 3,2% |

| Switzerland | 750,5 mln | 2,5% |

| South Korea | 661,7 mln | 2,2% |

| Russia | 621,4 mln | 2,1% |

| Poland | 578 mln | 1,9% |

| Australia | 447,4 mln | 1,5% |

Factors influencing coffee prices

Climate

Progressive climate change may affect the production capacity of the current leading players on the coffee market. The constant warming of the climate may cause the production of coffee to move to other regions, and before this happens, prices may rise until the supply meets the demand for this raw material.

In addition to long-term climate change, coffee prices are also affected by periodic droughts or floods in major coffee producing countries.

Politics

The three largest coffee producers - Brazil, Vietnam and Colombia - account for half of the world's coffee production. Therefore, political turmoil (e.g. corruption scandals) in these countries can significantly affect coffee prices.

Transportation cost

Coffee is only produced in subtropical and equatorial climates. Supplying it to major coffee importers (mainly the US and the EU) is associated with fuel costs and transportation. Oil prices affect the price of coffee and all raw materials, the so-called soft commodity.

Health issues

Medical reports on the health and performance of coffee drinking can have a significant impact on price developments in the long run.

The level of wealth of the society

Coffee is not a necessity but a "luxury" commodity. We can afford it only after our basic needs for food or housing fees are met. Therefore, the growing wealth of societies is conducive to the growing market for coffee beans and drinks made from them. On the other hand, economic turmoil among the leading coffee importers may reduce consumption and cause price turbulences.

Investing in coffee

Investing in coffee may turn out to be a great idea if we expect a progressive increase in the wealth of the society (and thus a greater demand for coffee and other luxury goods). Another reason to invest in coffee may be the expected turbulences in the production and supply of this raw material to global markets. As 50% of the world's coffee production is in the hands of only three countries, it is a raw material very susceptible to political and economic turmoil in these countries.

It's worth noting that the world's main coffee producer, Brazil, is currently one of the countries hardest hit by the coronavirus pandemic and at the same time struggling with drought.

Futures contracts

Coffee futures can be found on the NYMEX exchange (which is part of the CME Group) and on the ICE - Intercontinental Exchange.

1 contract is for £ 37,500 of coffee. Coffee contracts expire in March (H), May (K), July (N), September (U) and December (Z). Coffee contracts have the abbreviation "KC". Coffee contracts expiring in December 2021 can be found under the acronym "KCZ21".

CFDs

A simple method to speculate on coffee prices is to create an account forex brokerage and speculating on CFDs, or contracts for difference in price. This solution has several advantages. The margin requirement is low and the broker offers leverage (1:10).

How to buy coffee - CFD Brokers

Below is a list of offers from selected brokers offering the best conditions for trading on coffee (CFD).

| Broker |  |

|

|

| End | Poland | Australia, Mauritius, Cyprus | Denmark |

| Coffee symbol | COFFEE | Coffee | COFFEE |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

200 USD | 0 PLN / 0 EUR / 0 USD |

| Min. Lot value | price * 2000 USD | - | b / d |

| Commission | - | - | - |

| Platform | xStation | MT4/5, cTrader | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETF

The commodity market is not rich in ETFs. When it comes to the coffee market, we only have one choice.

[JO] iPath Series B Bloomberg Coffee Subindex Total Return ETN

-

- Issuer: Barclays Capital Inc.

- Annual fees: 0.45%

The fund only buys one type of contract over a period of time. The fund's strategy is based on buying contracts 2-3 months in advance and selling them out in the month they expire. The fund has the advantage of high liquidity and low management fees.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Coffee - How to invest in coffee? [Guide] coffee - how to invest in coffee](https://forexclub.pl/wp-content/uploads/2020/08/jak-inwestowac-w-kawe.jpg?v=1596463996)

![Coffee - How to invest in coffee? [Guide] crypto retirement profit](https://forexclub.pl/wp-content/uploads/2020/08/kryptoemerytura-zysk-102x65.jpg?v=1596463093)

![Coffee - How to invest in coffee? [Guide] xtb shares number of clients](https://forexclub.pl/wp-content/uploads/2020/02/xtb-ilos%CC%81c%CC%81-kliento%CC%81w-102x65.jpg?v=1580833276)