CUDA, i.e. Compute Unified Device Architecture. How to invest in CUDA?

We currently live in times where technological development is stunning. This is most visible in solutions such as GPT-chat, which allows you to obtain information in a very simple way, using a chat with an AI-based platform. For many years, computing power and hardware capabilities limited many concepts that remained "on paper" for years. Currently CUDA (Compute Unified Device Architecture) can do real wonders in terms of computational performance, a NVIDIA shares they are financial proof. In this article, we will explain what CUDA is and how you can gain exposure to this market. We invite you to read!

What is CUDA?

CUDA is short for Compute Unified Device Architecture. It is a computing platform that enables the use of graphic processors (GPU) to perform efficient calculations, e.g. financial calculations or simulations of physical phenomena. CUDA allows you to use your graphics card to solve complex problems and quickly search data sets. The idea itself is not new because NVIDIA developed this project in the first decade of the 21st century. As you can see, sometimes a technology takes over a decade to become more widely adopted. Compute Unified Device Architecture is useful for supporting applications that require a significant amount of parallel processing. In short, CUDA is software that manages chips and allows for better communication between them. Thanks to this solution, GPU graphics chips turn into "calculating machines". Thanks to this, NVIDIA has changed from a company specializing in the gaming market to a key company in the development of AI. You could say that NVIDIA is the shovel supplier at this time of fever in the market artificial intelligence.

The key aspects related to CUDA include:

- Software language – in the case of a programming language, CUDA extends languages such as C, C++ or Fortran with structures enabling parallel GPU calculations.

- Programming model – allows programmers or algorithms to define kernels, i.e. functions that are executed in parallel by many threads on the GPU.

- Instruments – one of NVIDIA's great successes is that CUDA can be used with NVIDIA GPUs. The architecture is designed to significantly speed up computations. Thanks to this, the use of CUDA "outclasses" standard CPU processors.

- Tool ecosystem – CUDA itself is also an ecosystem of tools that makes this solution even more practical. The platform offers many development tools (including compilers, libraries, debuggers and profilers). Thanks to them, you can optimize applications that use CUDA.

Compute Unified Device Architecture – one of NVIDIA's advantages

NVIDIA gained a competitive advantage due to the fact that the American company was a pioneer in creating a mature programming platform for GPUs. Initially, it was a niche market, which is why many competitors with deep pockets ignored the development of this project, because at the beginning of the 21st century there was not much demand for this type of solutions. Another advantage was that the technology developed by NVIDIA was a proprietary solution. This meant that the company did not have to share the results of its work with potential competitors. At the same time, CUDA was developed not for the general market, but for its own products (GPU). Thanks to specialization, the platform ensured high efficiency on NVIDIA hardware. Working on improving its software and hardware has resulted in GPU performance getting better and better. The next factor that ensured the dynamic growth of NVIDIA's revenues is the development of AI. Progress in the field of artificial intelligence or deep learning has increased the demand for more efficient computing equipment. Thanks to this, the demand for NVIDIA solutions has skyrocketed.

It is worth remembering that MIRACLES have been achieved “early maturity” before the DL (Deep Learning) boom and building AI tools. Thanks to this, even when the demand for solutions grew exponentially, libraries and tools were already ready. An extensive ecosystem was created, which made using NVIDIA solutions even more desirable. It is therefore not surprising that most major deep learning frameworks have quickly implemented native support for GPU acceleration via CUDA. NVIDIA's solution has become the standard in the AI world. Because NVIDIA's solution was unrivaled, the use of the computing platform became a standard in the IT world. Thanks to this, the competition is a few steps behind NVIDIA. So far, AMD's or Intel's attempts have not changed the market situation.

Application of CUDA

The NVIDIA solution is a key technology that is used in the application of deep learning and in the analysis of very large data sets. For this reason, there are many applications of CUDA. These include:

- AI and DL: CUDA is a key solution that accelerates the process of training and conclusions from deep learning, artificial intelligence and other advanced solutions related to operating on large data sets.

- Image and video processing – thanks to the solution, a large number of images and videos can be analyzed very quickly. They also enable faster video compression or filtering.

- Science and engineering simulations – high efficiency allows for more accurate and faster simulation. These include fluid dynamics, simulation of the movement of particles and materials. In addition, we can mention climate modeling (a very complicated issue).

- Analysis of numerical and text data – high computing power allows for quick data processing. This allows you to perform advanced analytical projects more cheaply. This can be used in financial analysis or, for example, inventory optimization.

- Cryptography – CUDA also accelerates cryptographic algorithms (encryption, decryption, hashing). You can expect the digital security industry to embrace NVIDIA products over the next few years.

Of course, these are not all the uses of CUDA. After all, it can also be used to solve complex chemical or physical problems. Basically, you could say that we are only limited by our imagination.

How to invest in CUDA?

In fact, the best exposure to CUDA is the purchase of shares of NVIDIA, which is the leader in this market. Of course, there is competition to the American company, but for now it is far behind.

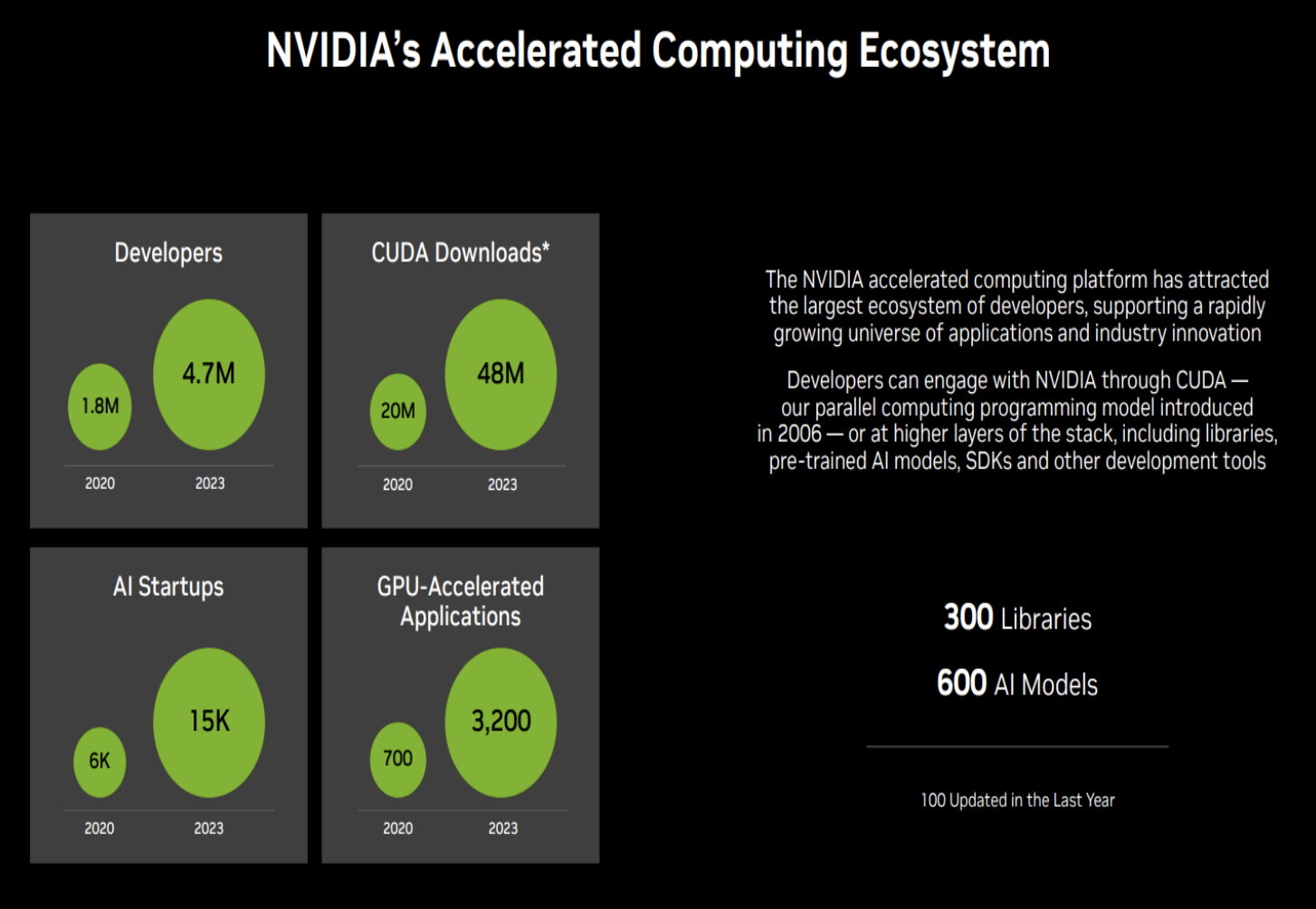

Source: NVIDIA

We can therefore see that the advanced CUDA technology, which revolutionized parallel computing, is gaining more and more users. This is good news for the company, because the increased popularity of this solution contributes to higher revenues and profits.

It is worth remembering that the data is not stored on the GPU, but must be transferred from the main memory. Data transfer incurs a computational time cost. For now, current technology cannot offset the cost of lost time. Therefore, it is important that the savings made using CUDA more than cover this cost.

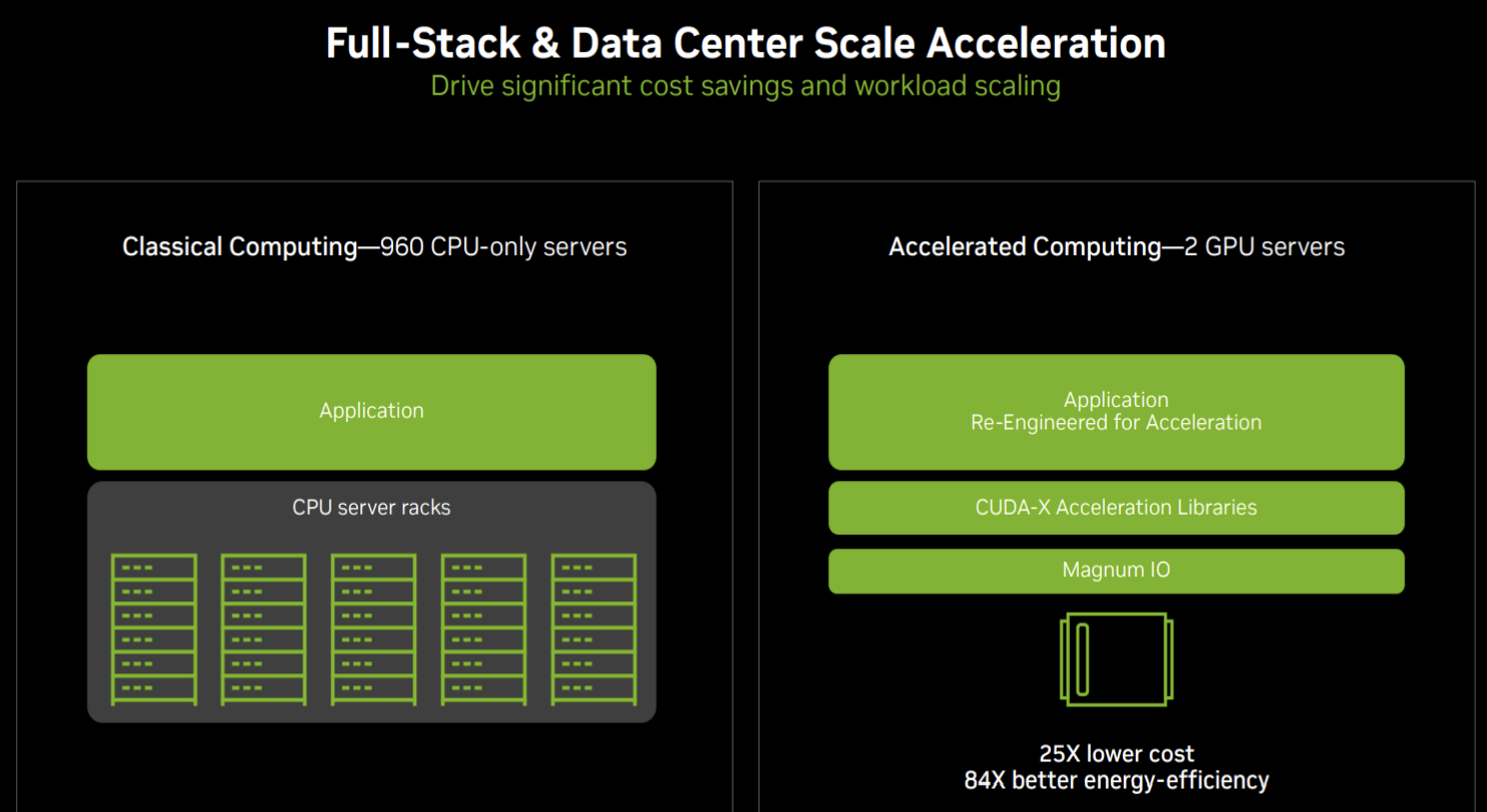

The chart below shows that the architecture based on Accelerated Copmuting is 25 times cheaper and several dozen times more energy efficient. Therefore, not only is this solution cheaper, but it is also more energy-efficient, which fits into the ever-fashionable "green trends".

Source: NVIDIA

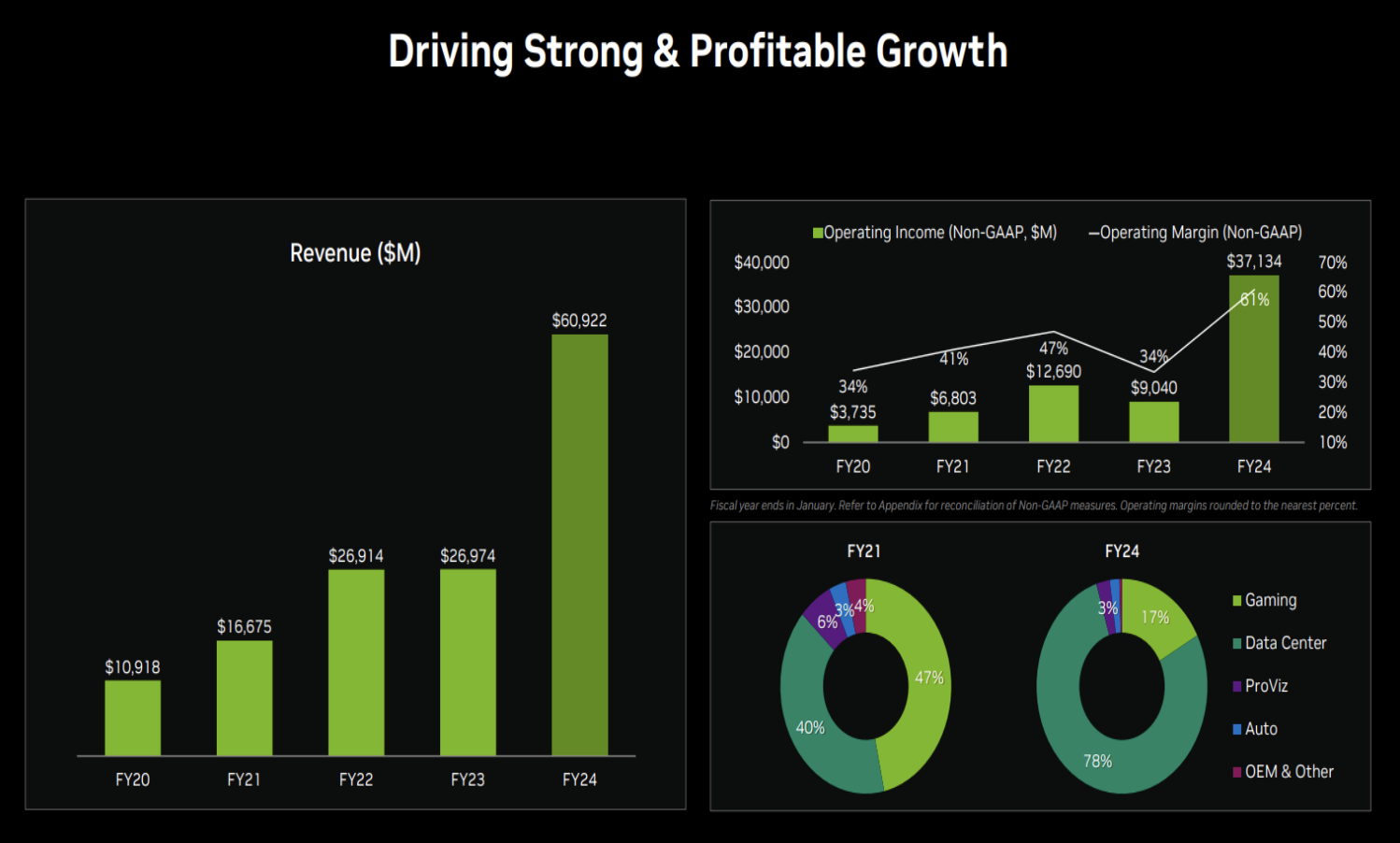

The chart below shows why the company's capitalization has increased dramatically over the last few quarters. Revenues related to the “data center” segment have literally exploded. In fiscal year 2024, they outshined the main market, i.e. gaming, several times. The rapid increase in revenues was followed by profits. The operating margin in the last quarter of FY24 was 61%, which is a stunning result. Operating profitability can be expected to decline slightly in the future. However, it will still be at a high level.

Source: NVIDIA

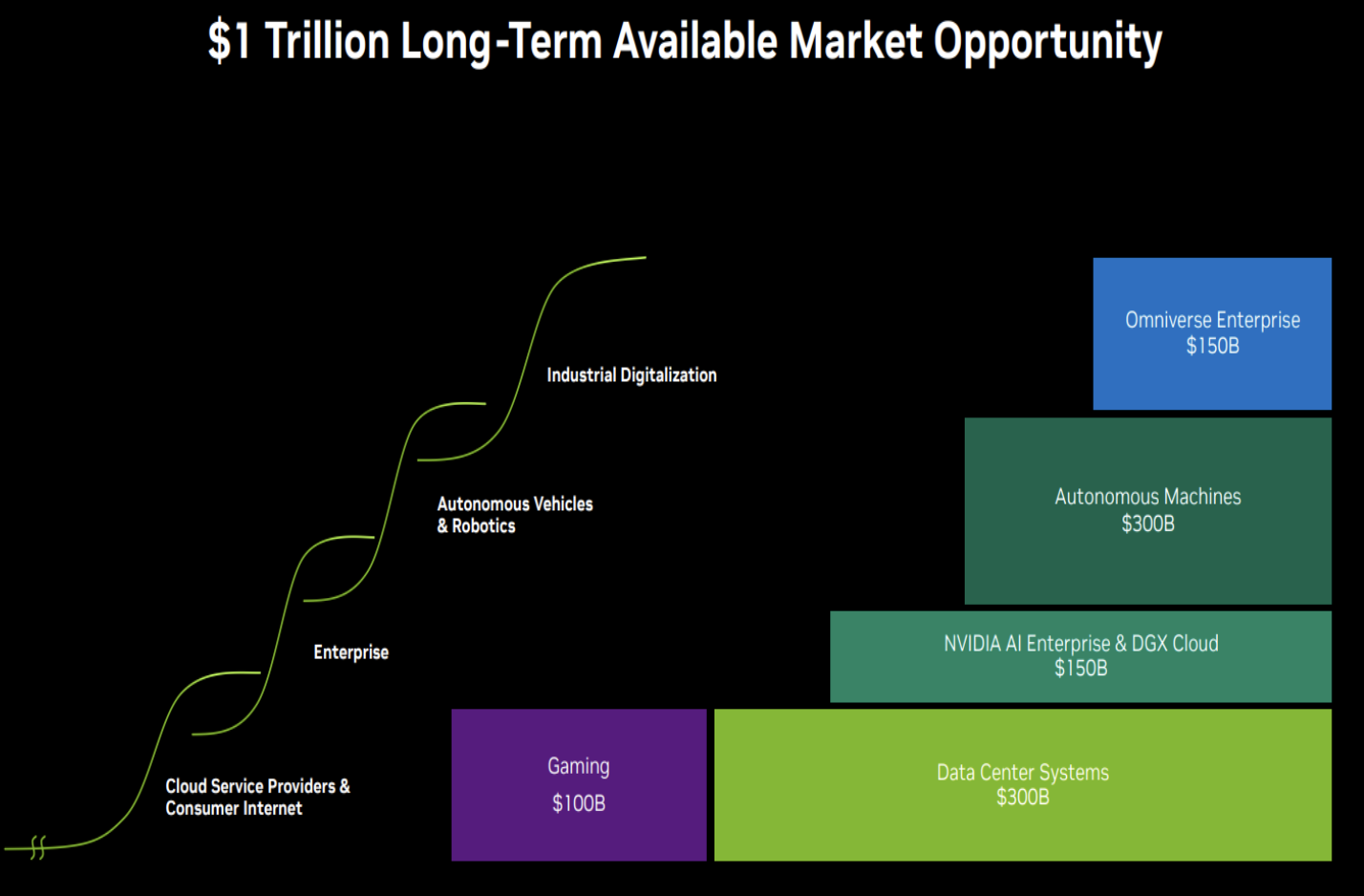

Of course, NVIDIA also has a plan for further development. In the long term, the company's management plans to achieve $1 billion in revenues. Currently the main markets (Data Center Services and Gaming) are expected to generate less than half the value. The company sees great potential in machine automation and the so-called Omniverse Enterprise. Will the company manage to implement its ambitious plans? The future will tell.

Source: NVIDIA

Brokers offering ETFs and stocks

How to invest in CUDA? NVIDIA shares in the portfolio seem to be the only way, but it must be admitted that it is a poorly diversified portfolio. The reduced share of this company in the total investment portfolio is a voice of reason that is worth implementing. An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 21 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

3 - shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

323 - ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | 0% commission* |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 | 100 USD |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

EToro platform |

*Zero commission means no brokerage/transaction fee was charged during the activity. However, they may still incur general fees, such as currency conversion fees for deposits and effects in non-USD currencies, fees for fees, and (if applicable) inactivity fees. Market spread also applies, although this is not a "fee" charged by eToro.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

Summary: miracles, miracles announce!

Thanks to its long-term approach to product development, NVIDIA spent many years developing a product that did not yet have a large market. However, these were not blind investments. Designers and managers realized that CUDA could be useful in the development of the artificial intelligence market. It is worth mentioning that AI in the first decade of the 2012st century was the melody of the future. Only after XNUMX did the development of this sector begin to accelerate. Taking into account that strong competition (e.g. Intel) slept through this market. For now, there is one leader and the peloton chasing him. Thanks to this, NVIDIA has become almost a monopoly in the GPU optimization market. For now, AMD or Intel do not have a product that can compare to CUDA. Also the OpenCL product is not that advanced yet. For now, no one is breaking the NVIDIA monopoly, but there are voices that for faster AI development it would be better if there were several platforms similar to CUDA.

Thanks to the enormous development of AI, NVIDIA has become one of the largest companies in the world (in terms of capitalization). The American company is a great example of the existence of the so-called “optionality”. CUDA was once downplayed as "toy", not a product ready for monetization. Years later, it turned out that this whim had created one of the leaders in the red-hot segment. Will NVIDIA continue to develop dynamically? We will find out in the next two years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)