Cybersecurity - A promising niche to invest in ETFs

Technology companies and ETFs with exposure to the industry of new technologies have long been experiencing good times, generating solid profits. Cyber security, which is gaining importance, is a special niche in the new technology industry. With the rapid transfer of much of the official and professional activity to the network as a result lockdown'u In March 2020, the demand for data and application security services increased by leaps and bounds.

Today we will look at ETFs offering exposure to this promising niche. We will consider:

- ETFMG Prime Cyber Security ETF (HACK),

- First Trust NASDAQ Cybersecurity ETF (CIBR),

- iShares Cybersecurity and Tech ETF (IHAK),

- Global X Cybersecurity ETF (BUG).

Be sure to read: ETFs - Physical or Synthetic Replication?

HACK - ETFMG Prime Cyber Security ETF

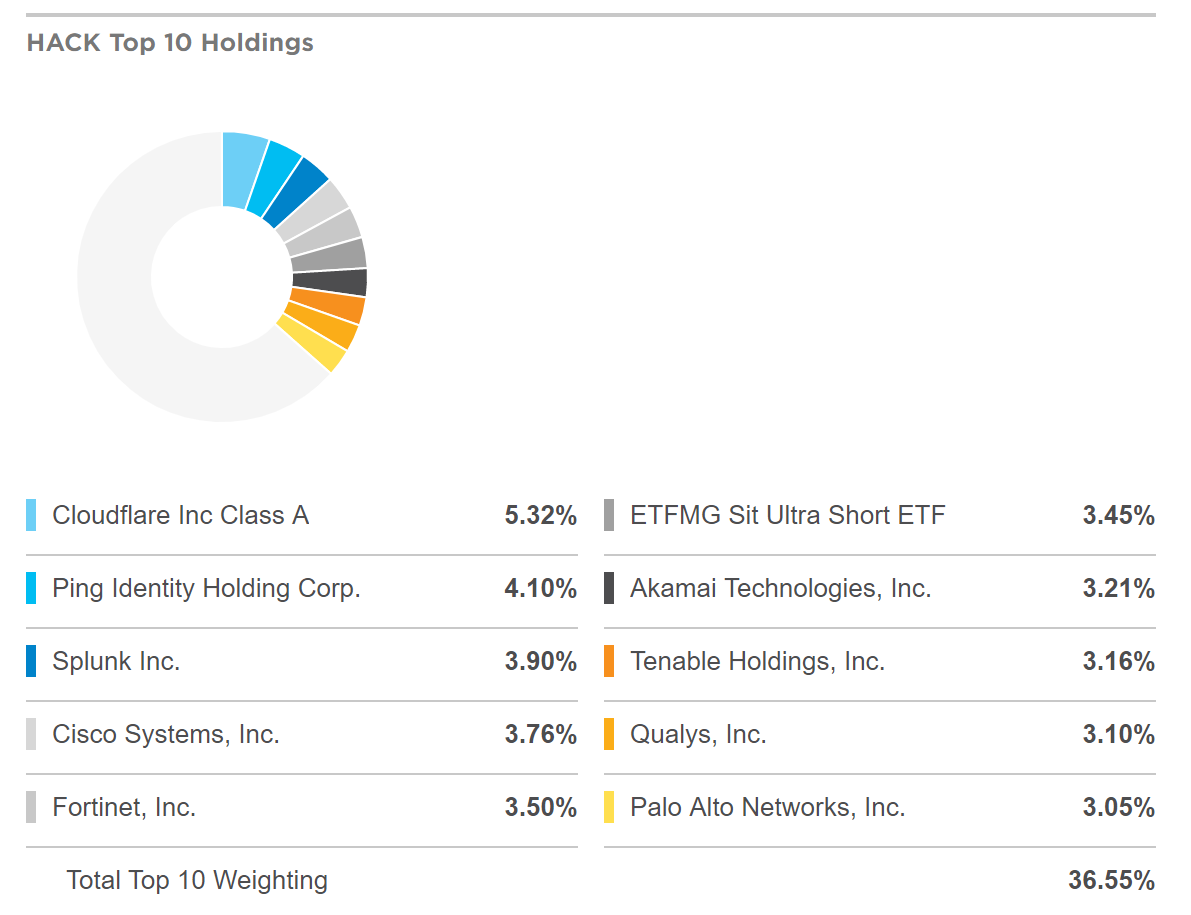

This is the oldest of these ETFs, it was created in 2014. It is also the second largest of the four listed because it has $ 1,4 billion in management. The annual fees are 0.6%. The fund has a fairly high liquidity, with a daily volume of USD 7 million.

The ETF consists of a basket of companies offering services and products related to data security. The percentage distribution of companies in the basket is fairly balanced, which means that the fund gives even exposure to the entire niche, without relying on the results of one or more players.

In addition to companies producing software, hardware and services ensuring online data security, the fund also has companies operating in the aviation and defense industries. This means that the fund is not a pure exposure to a cybersecurity niche. This may be due to the fact that it is still quite a narrow and shallow niche and it is difficult for the fund to find enough shares from the strict cybersecurity sector to cover investors' interest in this fund.

CIBR - First Trust NASDAQ Cybersecurity ETF

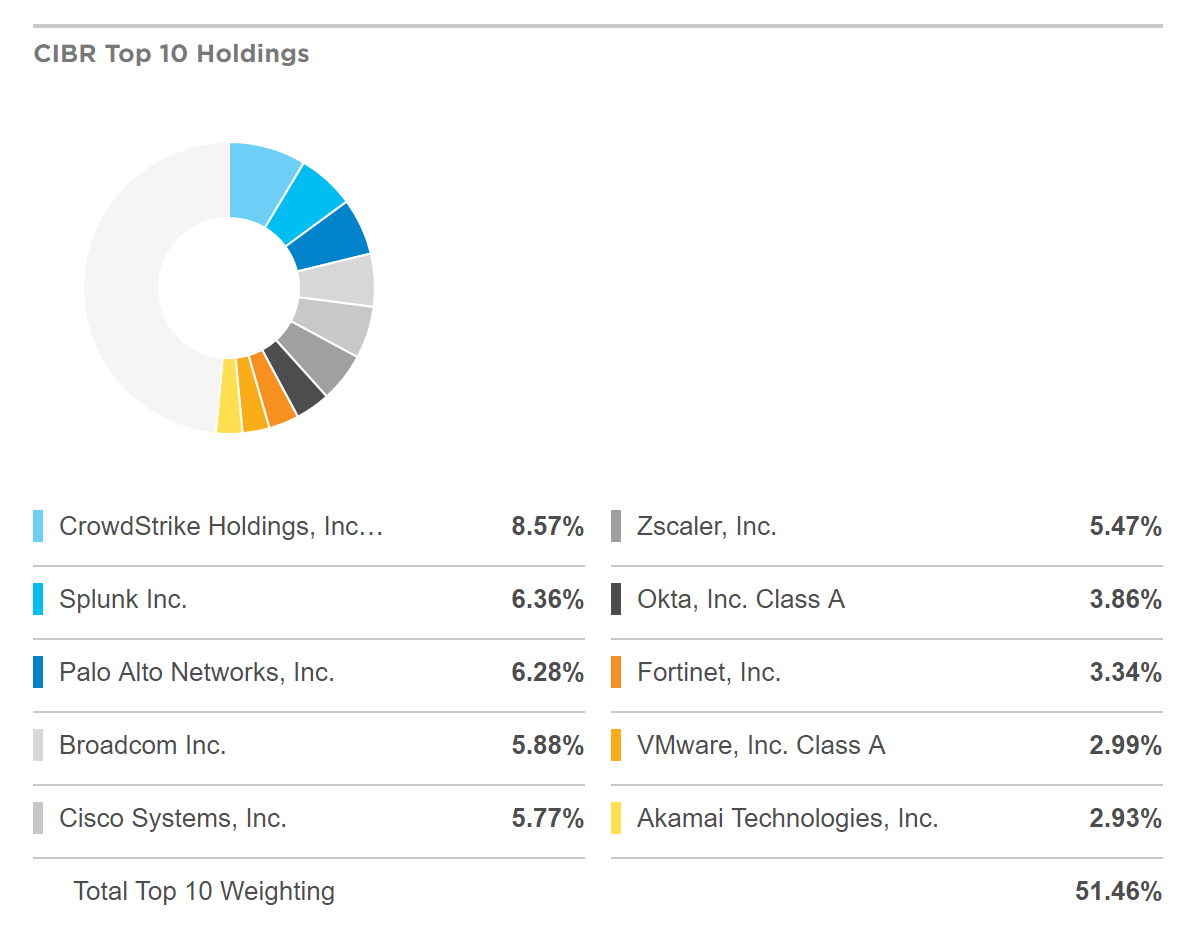

CIBR was established in 2015 and is currently the largest ETF in this industry managing $ 1,8 billion. The daily turnover is $ 14 million, so it is more liquid than its competitor HACK. Annual management fees are also 0.6%.

Like HACK, CIBR also does not only consist of companies that "offer" cybersecurity. In his basket you will also find communications, aviation and defense companies.

The basket structure of this fund is different from the HACK described above. The percentage share of companies in the basket is not evenly divided, only due to liquidity. At CIBR CrowdStrike Holding has over 8,5% share in the basket, Splunk and Palo Alto Networks over 6%. The exact percentage structure of the 10 largest companies is presented in the table below:

IHAK - iShares Cybersecurity and Tech ETF

The fund established in 2019 competes on the market with low management fees. We will pay 0,47% per year for entrusting money in this ETF. Due to the short time on the market, the fund currently manages $ 76 million.

Unlike the competitors described above, in this ETF you won't find airlines or the defense industry. 94% of companies in the basket deal with the production of hardware and software, mostly offering cyber security.

The percentage share of individual companies depends on their market capitalization. For this reason, in the TOP 10 of this ETF we will find companies such as: Docusign, Crowdstrike Holdings, Zscaler, Okta Inc, Citrix systems and Akamai Technologies.

The IHAK ETF stood out in 2020 with exceptionally good results, giving an annual rate of return above 20%.

BUG - Global X Cybersecurity ETF

Founded at the end of 2019 and offering 0.5% of management costs per year. BUG manages $ 21 million, and the daily turnover is $ 480.

This ETF consists of only 29 companies, with a percentage weighted by capitalization.

If we're interested in pure exposure to a cybersecurity niche, BUG will be a good choice. The fund selects companies to its basket using the income criterion. If a company generates 50% or more of its income from activities in the online security industry, it may go to the basket. Thanks to this, we will not find companies from the related industries such as aviation or the defense industry in this fund.

In the BUG portfolio we will find the same "stars" of the cybersecurity industry as Zscaler, which has grown since the beginning of the year Present in several = 144%, CrowdStrike noting Present in several = 100% tall or happy Octa Present in several = 71% growth since the beginning of 2020.

Brokers offering ETFs

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

397 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)