Is the bottom in the stock market definitely behind us?

This is one of the most important questions investors are asking themselves today. But is there a simple yes or no answer? On the one hand, nothing on the market is 100% obvious, on the other hand, it seems that the peak of inflation in most countries (including the US) is behind us. But the mere fact that the peak of inflation is behind us is still not enough for investors to celebrate. Whether the bottom of the market is behind us will be clear next year, and it will depend mainly on three things:

- inflation paths in 2023,

- the Fed's monetary policy in 2023, and

- how much the economy will slow down in 2023 due to interest rate hikes in 2022.

If inflation goes down fast...

Then the situation will be relatively simple and this is the most optimistic scenario. The Fed will then be able to think about interest rate cuts sooner. Quick interest rate cuts will also protect the economy against a major slowdown, and even if the slowdown is stronger, the capital markets, seeing interest rate cuts approaching on the horizon, will become highly resistant to major drops.

We had a foretaste of this scenario today after the release of US inflation data for November this year. Inflation in virtually every item surprised positively, ie it was lower than expected. Consequently S & P500 jumped up almost 100 points (2,5%) immediately after the release of the data. Of course, it's only one month and we can't be sure that inflation will continue to fall so fast and this rhetoric will probably also be used in the upcoming statements of the Fed's representatives.

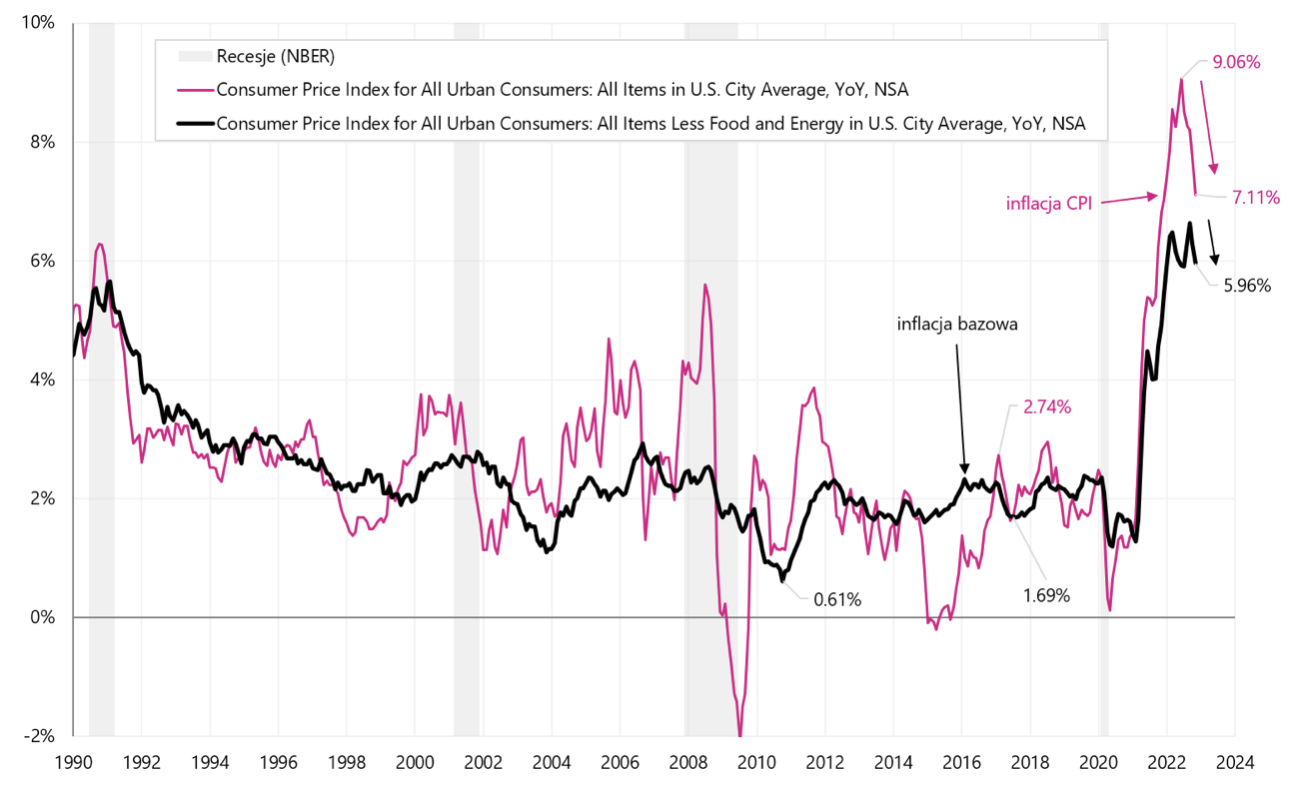

Inflation and core inflation in the US, year-on-year change (after today's publication of data for November this year). Source: own study, FRED

The fact that the inflation peak in the US is very likely behind us is not that important. More important in 2023 will be the pace of inflation decline, in other words, whether inflation is heading permanently towards the central bank's inflation target (2% in the case of the FED). If, after falling to around 4-6%, inflation stops clearly falling further, then FED will be forced to keep interest rates at higher levels for longer, and in such a scenario it is possible that the first reduction would take place only in 2024. And that would be a distant prospect for stock markets. Likewise, it would also mean more economic slowdown in 2023.

The low in the stock market depends on inflation

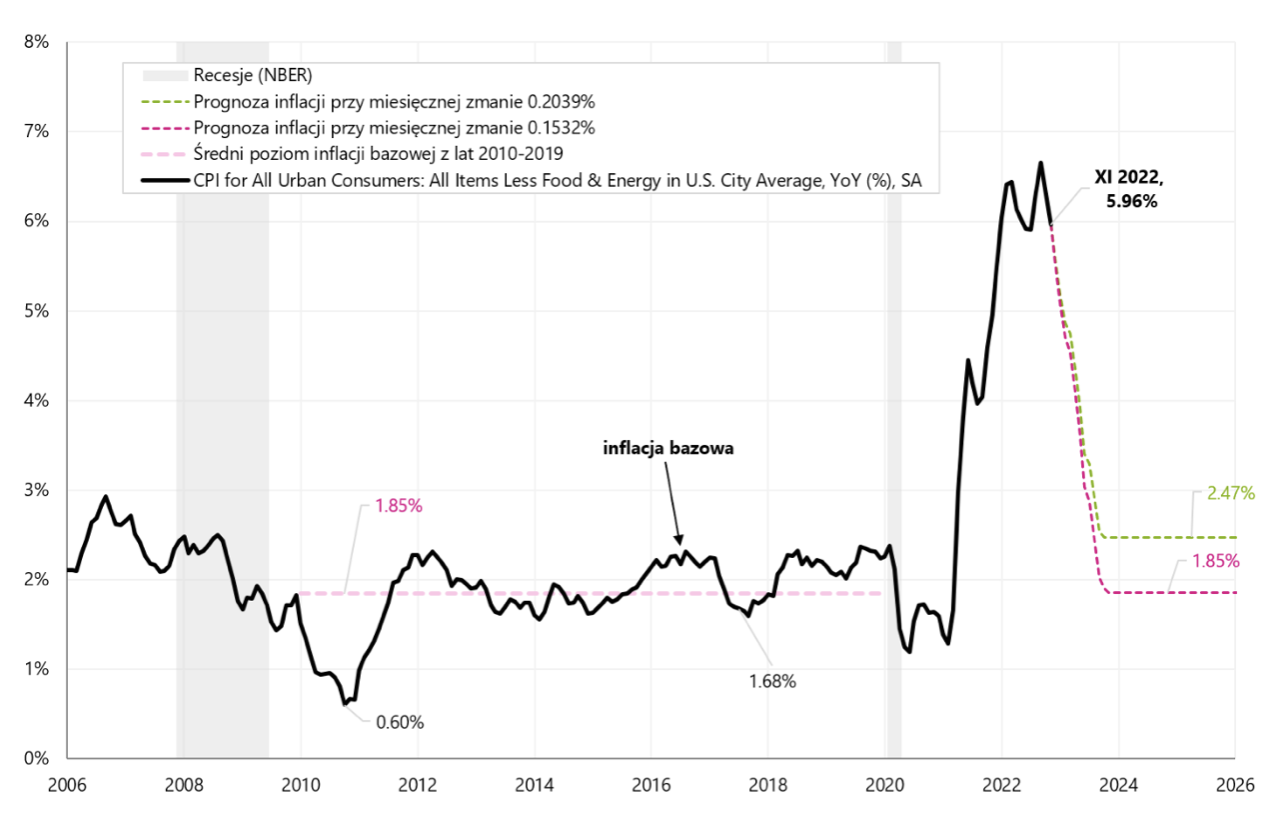

Inflation generally consists of three parts: energy prices, food prices and prices of other components of the basket. Central banks tend to only look at the latter category, which is called core inflation. In order for core inflation in the US to return to pre-pandemic levels (and this is in line with the FED's inflation target), its monthly changes should not be higher than 0.1532% in the next 12 months (optimistic scenario).

On the other hand, core inflation in November this year amounted to only 0.1987%. Of course, this is the smallest change in 15 months, but in the optimistic scenario, if we could count on a change of this magnitude in the next 12 months, the annual core inflation would eventually fall to 2.41%. In the chart below, we present both paths of core inflation in 2023: in the 0.1532% and 0.1987% scenarios.

Simulation of the decrease in core inflation in the US depending on the size of the monthly change in the next 12 months. Source: own study, FRED

As seen in the chart in both scenarios, core inflation quickly falls towards the Fed's inflation target - which is the most optimistic scenario. On the other hand, let's remember that in the last five months we had a high volatility of CPI inflation: we had two months when inflation rose by 0,39% and 0,44% (September and October), deflation in July -0,02% and low readings in August 0,12% and November 0,08%. Such high volatility is a risk that inflation readings in the coming months may not be so positive. In addition to the risk that November was exceptionally good, the FED Cleveland Inflation Nowcasting forecasted a monthly inflation change of 0,37%, while the actual change was only 0,08%.

Such a large difference shows that today's positive surprise is not consistent with other data from the economy used to forecast inflation (according to this model). At the same time, monthly changes in core inflation in the last 5 months ranged from 0.199% (November) to 0.576% (September).

Summarizing, in the current cycle, a lot depends on the path of inflation decline in 2023. This will also be the main determinant for the Fed regarding the beginning of the cycle of rate cuts. In addition, the magnitude of the slowdown will also depend on how long interest rates remain high. Therefore, it will be particularly important for investors to observe how inflation behaves (mainly in the US), and the pace of its decline may also largely depend on the durability of the current rebound in the markets.

About the Author

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)