Can the Lindy effect be useful in investing?

The material world surrounding man is very often finite. Man alone cannot live 200 years now. It is physically impossible. Thus, the older a person is, the less time he has left "experiences". If a person is 70 years old, statistically there is a very small chance that he will live longer than a healthy person at the age of 20. However, the intangible world is governed by its own laws. Ideas and technologies are often the beneficiaries of the so-called the Lindy effect. In this article, we will briefly explain what it is Lindy Effect, we will characterize this phenomenon and try to find out how it can be used in investing.

What is the Lindy Effect?

He was the first to propagate this law Albert Goldman. In 1964, his article on the subject appeared in The New Republic. According to Goldman, comedians generally have a steady stock of comedic material. Thus, a comedian's "longevity" on television is inversely proportional to the frequency of his appearances.

The article attracted mathematician Benoit Mandelbrot to study the Lindy effect in the book Fractal Geometry of Nature. The book was published in 1982. According to him, the chance of a comedian "surviving" is proportional to his frequency of appearances. The more often a comedian appeared on television, the more likely he was to appear again.

Currently, the Lindy effect says that the longer something exists in the intangible world, the more likely it is to continue to exist. This applies in particular to ideas, technologies and brands. So it is the opposite of the "survivability" of living organisms.

The longer a given idea or technology "lives" in a given society, the longer its expected life. For this reason Classics of literature have a greater chance of remaining in the "social circulation" than a newly published book. It's the same with technologies, some of which are older than many countries (like writing). Of course, the technology itself evolves (e.g. typing, on a computer) but the idea "writing thoughts with signs" remained.

sama Linda's name is derived from the restaurant of that namewhich was on Broadway. It was founded in 1921 by Leo "Lindy" Linderman. In 2017, it announced that it intended to close its operations. Finally, it ended its operations at the beginning of 2018.

Lindy Effect and the enterprise

Many companies have trouble staying on the market. For this reason, businesses that are over 100 or 200 years old are rare. Simultaneously, the longer a company has been in business, the better chance it has of raising capital, patents and business relationships to continue operating on the market. The capital will allow, if necessary, to introduce a new product or take over the competition. In turn, patents help to build greater entry barriers for competition. Long-term business relationships with customers can cause the appearance of so-called "Switching cost" , i.e. the reluctance of customers to change the contractor. Therefore capital, patents, and business relationships can be the moats that will keep businesses going longer.

It is worth analyzing what factors can ensure the company's long-term survival. The key element is the brand, which can be the beneficiary of the Lindy effect. It is important that the company has a vision that it wants to convey to customers. Thanks to this, despite the change in trends, a given brand could still be present in the awareness of the society. That's why brands like Louis Vuitton and Adidas can still find customers despite changing fashion tastes. A coherent brand vision increases the company's chance of survival.

The second important point is that even a company operating in a "declining" industry can change its business model or enter new markets thanks to its recognition and resources. Examples include Coca-Cola and Pepsi. The decline in sugar consumption in society and the increase in the popularity of being "fit" was a threat to enterprises. As a result, companies introduced "diet" versions of their products and started investing in brands of juices, water, etc.

The company's longevity allows it to develop standards in the organization that help them survive difficult times. Of course, the corporate culture itself can change, about what people who have read the article about Arthur Andersen know.

Examples of long-lived companies

Some companies have surprisingly long lifespans. As a result, they gained a strong market position and became a good investment opportunity for long-term investors. Each of these companies had periodic problems (like Coca-Cola after changing the taste in the second half of the XNUMXth century), which they overcame. Among the known examples of companies that can be considered beneficiaries of the Lindy effect are:

Coke

Founded in 1892, the company is one of the world's largest producers of sweetened beverages. In addition to the Coca-Cola brand, the company also owns brands such as Fanta, Sprite, Schweppes and Ciel. In addition, the company is the owner of the Costa coffee chain.

Pepsi

The company was founded in 1898. For over 120 years, it has competed with Coca-Cola for the title of the most popular manufacturer of sweetened beverages. In addition, PepsiCo also owns FritoLay, which owns brands such as Lay's, Cheetos and Doritos. In the beverage segment, the company owns brands such as: Pepsi, Mirinda, 7up and Gatorade. In addition, the company has a minority stake (39%) in the juice producer Tropicana.

READ: Pepsi Co. – much more than sweet drinks [Guide]

S&P Global

The beginnings of activity S&P Global it can even be dated back to 1860, when Henry Vanrum Poor published his first book. In 1868, Henry V. Poor and his son founded the H. W. Poor Co., which published financial studies on railroad companies. It is now one of the largest rating companies in the world. He is also the owner S&P index. Another branch of business are analytical services.

Moody's

The company was founded by John Mood in 1909. She began her activity by preparing financial studies on the American stock and bond market. Currently, the company belongs to the "big three" rating agencies. Moody's also has a segment responsible for providing software to help in assessing credit risk, market risk and financial modelling.

Survivor bias and the Lindy effect

It is important not to fall into the so-called when analyzing competitive advantages "survivor bias". This is an error that results from incorrect data selection. Incorrect selection of the statistical sample may result in incorrect conclusions, even though the subsequent analysis process was carried out correctly. Although the previous sentence may give you a headache, we will try to give examples of the survivability bug.

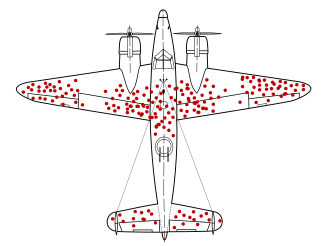

A classic example is the analysis of bombers returning to base during World War II. Initially, analysts suggested strengthening places that have bullet marks. However, according to the statistician Abraham Wald, it is possible that the undamaged seats on the returning planes need to be reinforced, because other planes did not return because of this.

Hit areas of planes returning to base are marked in red. Source: wikipedia.org

Another example was the 1987 study of cats that fell from a floor higher than 6. The initial conclusion was that cats that fell high altitudes had less damage than those falling from lower floors. According to the researchers, this may have been due to the cats reaching terminal speed, which caused the cats to be more relaxed. In 1996, The Straight Dope reported another solution to this puzzle. It's just that after falling from the 6th floor or higher, most cats did not survive, which meant that they were not reported by veterinarians.

The same is true of the Lindy effect and its application to the selection of companies based on their "founding year". Many companies that once had a dominant position in the market did not provide a high rate of return to their shareholders. Many of them died without arousing much interest.

However, there are stories that show that nothing lasts forever. An example is Kodak, which had the capital, patents and business relations to count on the camera market for a long time. However, focusing on the short term (a profitable motion picture division) caused Kodak to sleep through the digital camera revolution. Of course, the company was trying to enter the market and gain market share. Although the history of the company dates back to the end of the 2012th century, in XNUMX the company declared bankruptcy (specifically, protection against creditors).

Summation

The Lindy effect is an interesting concept about the intangible world. Analyzing the "longevity" of literary classics, one can agree with the concept that the longer something "lives" in the social consciousness, the longer it will live in the future. However, such reasoning is not a good idea when selecting companies. Just because a company has been in business for 100 years doesn't make it "indestructible". There are cases when large companies (e.g. Kodak, General Electric), as a result of mistakes made and changing trends, have lost their dominant position in their industries.

When analyzing and valuing a company, you need to look at how the future of the company is shaping up, not how great its past was. Nothing lasts forever. The founders eventually leave the company, its organizational culture also evolves. It is important to realize that every company is at risk of collapse. There isn't "unsinkable businesses". Let's take one of the largest audit firms in the world as an example - Arthur Anderson – which, as a result of mistakes made, lost its dominant position on the market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)