What is convergence? Chasing leaders

The concept of convergence has a wide scope of application. The Polish language dictionary defines this expression as convergence. It may concern, among others: the convergent movement of the eyeballs, the presence of similar features in unrelated species or the presence of similar cultural products independently of each other in different peoples. Convergence is also an economic phenomenon. It is a convergence of the level of development of a less developed economy to a more developed one. Convergence is also referred to as "Catch-up effect".

Thus, it is an economic theory which states that developing countries in the perspective of many years, or even decades, "catch up" in the development of developed countries. Of course, for such an effect to occur, a number of economic, social, cultural and institutional factors must occur. A low level of development alone will not cause the convergence effect to occur immediately. Some countries, despite a very low level of GDP per capita (in purchasing power parity), are still unable to reduce the distance to developed economies.

Which is conducive to convergence

Convergence is possible for several reasons. These are:

- The law of diminishing returns - in developed countries it is more and more difficult to find an investment to achieve a satisfactory rate of return. The aforementioned law says that as one factor (e.g. capital) grows without increasing the other factors, less and less added value is achieved. As a result, the investor or entrepreneur is looking for a place for a more effective allocation of capital, also in foreign countries. As a result, foreign entities begin to invest in selected developing economies in order to achieve a satisfactory rate of return on invested capital. An example can be foreign investments in the countries of Central and Eastern Europe after 1990. Investments introduce new methods of production, resource management and technology transfer.

- Faster absorption of modern solutions - convergence may also result from faster adaptation of modern solutions. It is, in a way, a paradox that the technological delay allows the transformation of the economy to be accelerated. The economy may take advantage of modern solutions and not "repeat" the path of development of more developed countries. An example is the Polish banking sector, which has adopted card payments (e.g. with chips) faster than in the United States. At the same time, payment by checks did not develop significantly, which allowed to “jump over” this method of payment. Another example is the Chinese payment market, which "skipped" card times and introduced QR code payments to the widespread use of payments much faster. Another acceleration in China is the faster transition in the segment of mobile applications and mini programs. This was due to the fact that universal access to the Internet came much later than it was in "Western countries".

- Lower work armament - in less developed countries, people tend to be less productive. This is due to worse work organization, the use of more backward technologies and capital shortages. Sometimes employers become aware of the ineffectiveness of their business model but do not have enough capital to transform the enterprise. As a result, obtaining foreign capital contributes to increasing the productivity and earnings of employees.

- Geographic location - sometimes economic convergence can support convergence. One example is Singapore, whose key position in shipping was a factor that helped foster economic development. However, keep in mind that this is one of the factors. The geographical location itself is not a key factor, but it facilitates or hinders economic development.

- Economic policy of the country - this is one of the key ingredients for a successful convergence recipe. Even the best geographic location and predisposition for rapid development will do nothing if the country does not have efficient government institutions and a stable and transparent law. If there is a lot of corruption in the country, unstable law and a short-term view of the rulers on economic development, then it is difficult to achieve stable economic development. An example can be Ukraine, which, despite the enormous potential that the country had in 1990, did not take advantage of its chance and was distanced by, for example, neighboring Poland. On the other hand, a long-term view of economic development and reasonable protection of one's own market contributed to the dynamic development of the "Asian Tigers".

Due to the above-mentioned factors, poorer countries can use their lagging behind to grow faster thanks to imitating production methods and new technologies. At the same time, developing countries have access to technological know-how, which is experience (both positive and negative) related to the use of technology. Thanks to this, adaptation can be faster, which stimulates economic growth.

Convergence Convergence

However, keep in mind that simple solutions only work for a limited time. Initially, a simple imitation brings effects that can be seen in the dynamic growth of such measures as CBA or GDP per person at purchasing power parity. Sometimes, the lack of sufficient consistency in the rulers who are satisfied with simple solutions or seeking popular activities among the society (e.g. lowering the retirement age, very generous social transfers) may contribute to the growing imbalances in the economy, which may have a negative impact on convergence in the future. Very often, initial success is followed by a slowdown in growth as "simple reserves" are depleted. It is necessary to support sustainable growth and not to rely only on lower labor costs, exploitation of natural resources or favorable geographic location.

According to the economist Moses Abramowitz developing countries, along with the growth of GDP, must develop the so-called "Social capabilities". These abilities include the ability to absorb new technologies, raise the level of education (both primary and higher) and create conditions to prevent "brain drain". The phenomenon of the brain drain means that the most ambitious, educated and productive individuals leave the country to develop in places with better conditions for development (the so-called "better prospects"). The emergence of world champions who, due to their international success, can create new technologies and not only copy solutions from more developed countries, helps to keep such people. Examples of the success of such a solution include South Korea (e.g. Samsung, KIA), Japan (e.g. Toyota, Toshiba) or Taiwan (e.g. Acer, TSMC).

Another limitation facing the country is the ability of the political elite to create a stable environment for the development of entrepreneurship. For this reason, it is worth developing transparent economic law, emphasizing the rule of law and efficiency of the judiciary, and creating a clear strategy to support industries that will help transform the economy to higher places in the production chain. Very often, choking on initial successes may cause a country, despite its great potential, to become only a supplier of components or a supplier of unprocessed products (raw materials, semi-finished products).

An example of convergence

Japan

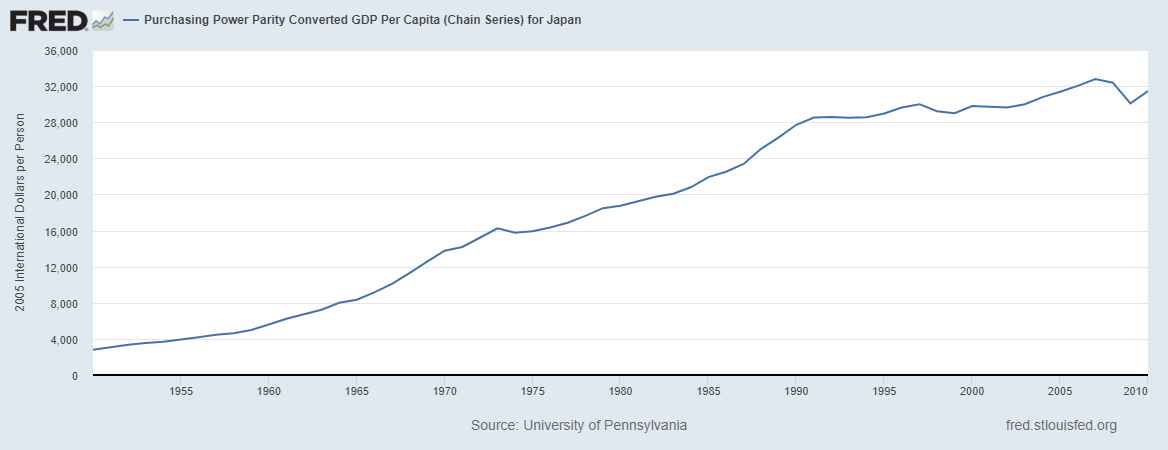

One of the most famous examples of successful convergence is Japan. In 1911- 1940 it was the fastest growing economies in the world. After the tragedy of World War II, the economy rebuilt. In 1950, Japan's GDP per capita after purchasing power parity was $ 2800. After 15 years, the index increased to $ 8300. In the beginning, the country began importing equipment and technology from the United States. However, after some time, the Keiretsu were able to compete in the world market with foreign competition. Although initially Japanese products were not characterized by high technological advancement, after some time they became a symbol of high quality products. Examples include companies such as Sony, Panasonic or Toshiba. Japan has also been successful in the automotive market, an example of which is the huge success of the Toyota brand. By the end of the XNUMXs, the country was quickly catching up with the United States.

The dynamic growth continued until the beginning of the 90's. In 1990, GDP per capita (PPP) was $ 27,7. Then, due to the bursting of the real estate bubble, demographic problems and problems with Keiretsu reform, economic growth slowed significantly. Despite ultra-low interest rates, loose monetary policy of the central bank and growing deficits, there was no return to the rapid economic growth of the 2020s. In 44,6, GDP per capita (in PPP) amounted to XNUMX thousand. dollars (according to IMF), while the US had a value of $ 68,3 thousand.

Poland and Ukraine - two roads since the 90's

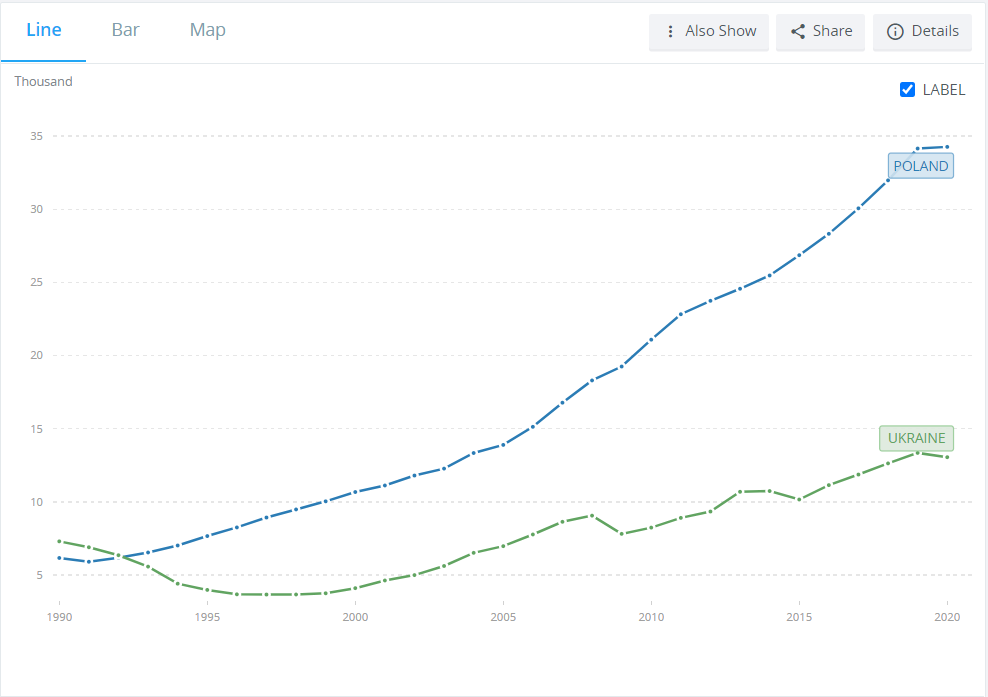

The fact that economic growth does not go hand in hand with low economic development is evidenced by the results of two economies of Poland and Ukraine. Both countries remained for decades in the embrace of a centrally planned economy. Both had a similar population and a similar level of development. However, at the beginning of the transformation, Ukraine had "better cards". In 1990, Ukraine had higher GDP per capita (in purchasing power parity) than Poland ($ 7300 vs $ 6100).

At the same time, Ukraine "inherited" from the Soviet Union a well-developed engineering, aviation and space industry. However, over the last 30 years, Poland has become the beneficiary of greater investor interest in the Central and Eastern European market. Ukraine has failed to use its potential and find an interesting place in the supply chain. It is also worth mentioning that at the beginning of the transformation a group of oligarchs developed which, thanks to favorable privatization, built huge fortunes. This social class was not interested in introducing market reforms. At the same time, the country "missed" the moment of EU enlargement to the East, which Poland took advantage of. In turn, Poland introduced unpopular economic reforms in the early 90s ("shock therapy"). Although it arouses mixed feelings among many commentators, it was one of the initial "engines" supporting economic growth. At the same time, accession to the EU made it easier to join European supply chains. Additionally, the accession made the country "credible" in the eyes of many investors, which contributed to an increase in foreign investments in the country. These factors contributed to strong economic growth, which was reflected in the increase in GDP per capita (PPP). As you can see, convergence is not easy and obvious.

Summation

Convergence in the economic dictionary means a situation when a poorer country develops faster than a developed country. As a result, the difference in the level of development is constantly decreasing (it is more and more converging). Over the past 100 years, we have witnessed many convergences in countries such as Japan, Taiwan, South Korea, China, the Czech Republic and Poland. Most often, the initial phase of convergence is very dynamic, which is related to the use of simple advantages (demographic rent, labor cost arbitrage, underinvestment). As a result, rapid economic development may "put to sleep" the rulers, who may not take advantage of the good time to implement reforms. However, along with climbing the development ladder, it is also necessary to develop education and create conditions for the qualified workforce to remain inside the country (preventing brain drain).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)