Can the market situation after the collapse of SVB calm down quickly?

The collapse of the SVB bank (Silicon Valley Bank) caused great turmoil in the financial markets. On Thursday, March 9, it turned out that the SVB bank had to save itself through an unannounced share issue, which caused the share price of the bank's owner (SVB Financial Corporation) to fall by 60% during the official session, and the price fell further in OTC trading. On Friday, the US regulator shut down the bank during the day. Of course, the financial markets did not like this situation. Around USD 150 billion of deposits at SVB were uninsurable (return guarantee). Investors had to wait until late Sunday afternoon when they received a joint statement from Treasury Secretary Janet L. Yellen, Federal Reserve Board Chairman Jerome H. Powell and Chairman FDIC (Federal Deposit Insurance Corporation) by Martin J. Gruenberg, in which i.a. could read:

“…Secretary Yellen has approved actions allowing the FDIC to complete the resolution of Silicon Valley Bank in Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all their money effective Monday March 13 (…) We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which closed today (…). All depositors of this institution they will have access to all their money".

It seemed to be enough. The guarantee of all deposits gave a clear signal that none of the depositors would suffer losses. Futures indices on S & P500 index rebounded about 2,5%. However, after the first positive reaction, they started to fall and by the opening of the spot market on Monday they were down by about 3%. However, later the broad US stock market somewhat calmed down and closed Monday's session unchanged (S&P500 -0,15% vs. Friday's close).

The financial sector suffered the greatest losses

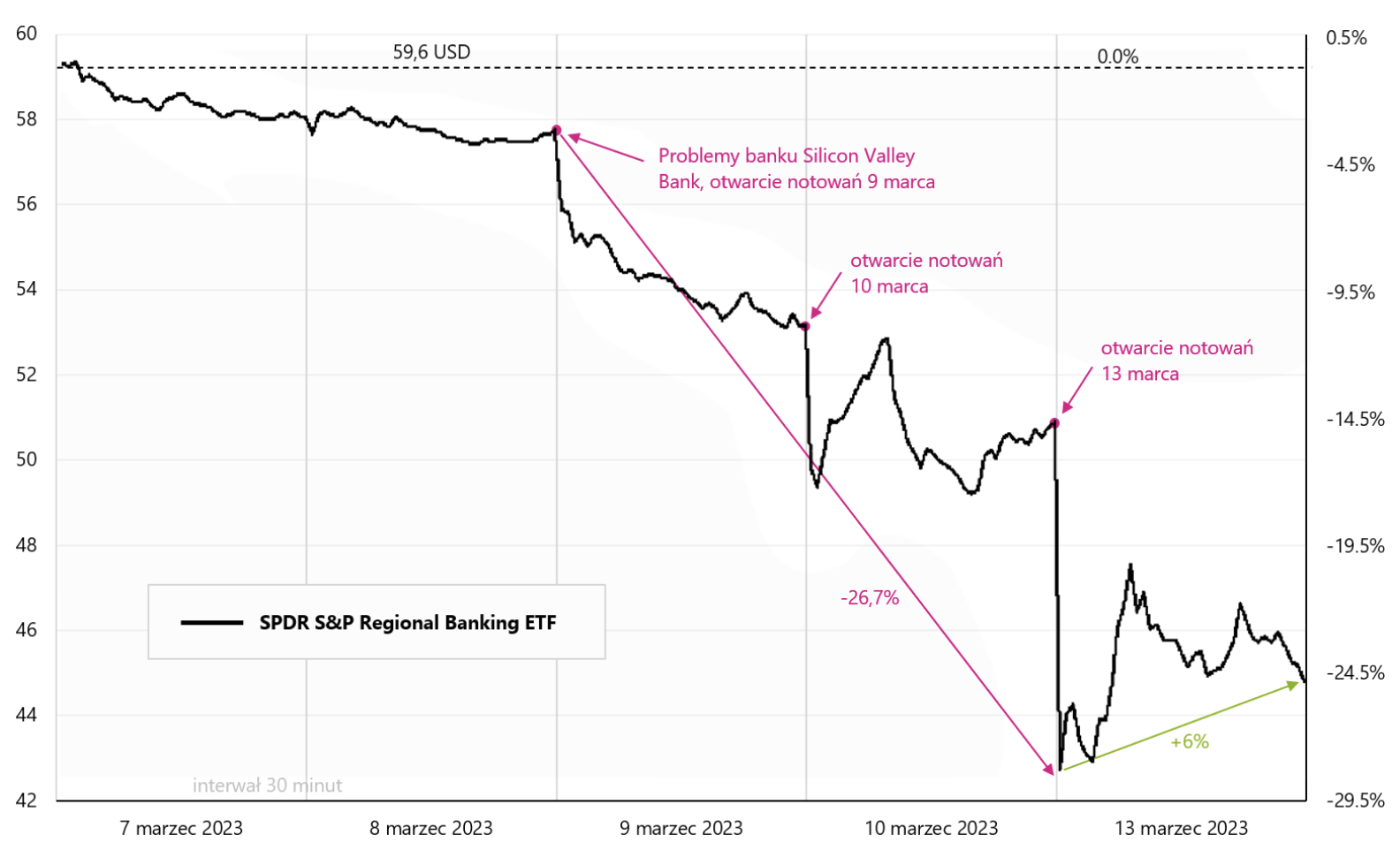

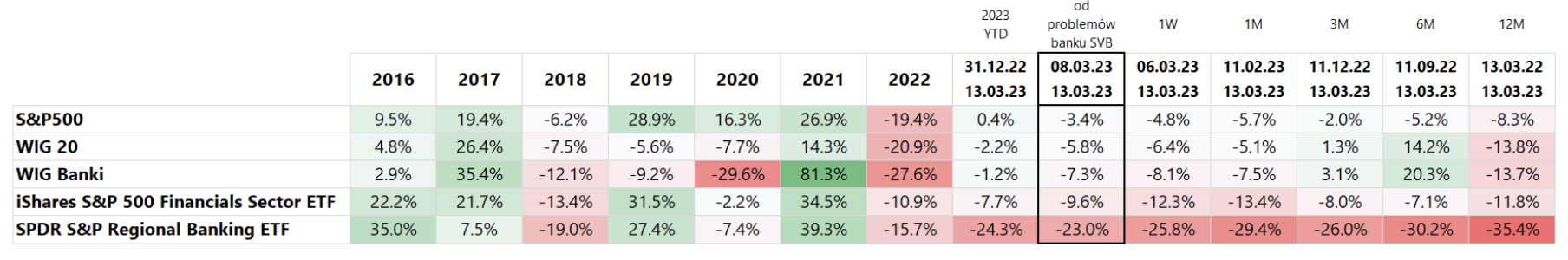

The problem affected especially US regional banks. The SPDR S&P Regional Banking ETF, which invests in U.S. regional banks, has fallen since March 8. by 27% (to the bottom of quotations on Monday), and closed the Monday session itself with a drop of 12,3%. However from open to close on Monday, the SPDR S&P Regional Banking ETF was up about 6% (see chart below).

The declines in bank shares did not stop at US regional banks and also affected major American banks and the financial sector in general around the world, including Poland. From Wednesday, March 8. iShares S&P500 Financial Sector ETF fell 9,6% and the Polish WIG Banki index fell 7,3%. At the same time, the broad American market fell by 3,4% (S&P500), by the Polish WIG20 index of 5,8%. However, since the beginning of the year, the Polish WIG Banki index has fallen only 1,2%, while the iShares S&P500 Financial Sector ETF has fallen 7,7% and the SPDR S&P Regional banking ETF has fallen by as much as 24,3%. Details are presented in the table below.

We had a very strong reaction to the crisis on the bond side, where the decline in profitability was so strong that it was practically comparable only to the situation after the collapse of Lehman Brothers in 2008, or even to the decline in profitability during the famous "Black Monday" in 1987. Yields on 2-year US Treasuries fell by 110 basis points from 5,08% (Wednesday) to 4,98% (Monday)! Such a decline in yields automatically translates into the market valuation of the path of interest rate hikes by the FED. While last week the market priced in 4 more rate hikes (25 bps each), now we are talking about only one hike! Some investment banks have changed their forecasts and claim that the Fed will not raise rates on March 22 due to the crisis in the banking sector, and one of the banks (Nomura) even forecasts a cut by 25 basis points.

Does the situation have the right to calm down?

In my opinion, yes. The American authorities took the first (and actually quite a big step) to stave off a further crisis in the banking sector. Now they are waiting for the financial markets to "calm down" and for the Americans to continue withdrawing deposits from banks (why take the next big step right away). If there is no such reassurance, then the American authorities will take the next (also a big) step without hesitation.

Will the Fed refrain from raising interest rates? It can be like that (but only for a while) and provided that the situation does not calm down by March 22 this year. (The FOMC will make a decision only then). 8 days left. Let's not forget that the FED has a second problem, which is inflation!

While falling stock prices tighten financial conditions (less interest rate hikes are needed), the crisis in the banking sector itself (unless it gets out of control) should not have a major impact on inflation. After the situation calms down, the FED should return to the "fight" with inflation, looking at the incoming data from the economy.

New important data and events, such as today's inflation in the US for February this year, and a 50 bps interest rate hike on Thursday by the European ECB may to some extent "divert" the markets' attention from the banking crisis. Markets expect another increase in Europe by another 50 bps in May this year. and another 25 bps in June this year. On Wednesday in the US we will also get data on retail sales and PPI inflation for February this year. (These details will also influence your decision FOMC regarding the increase on March 22 this year).

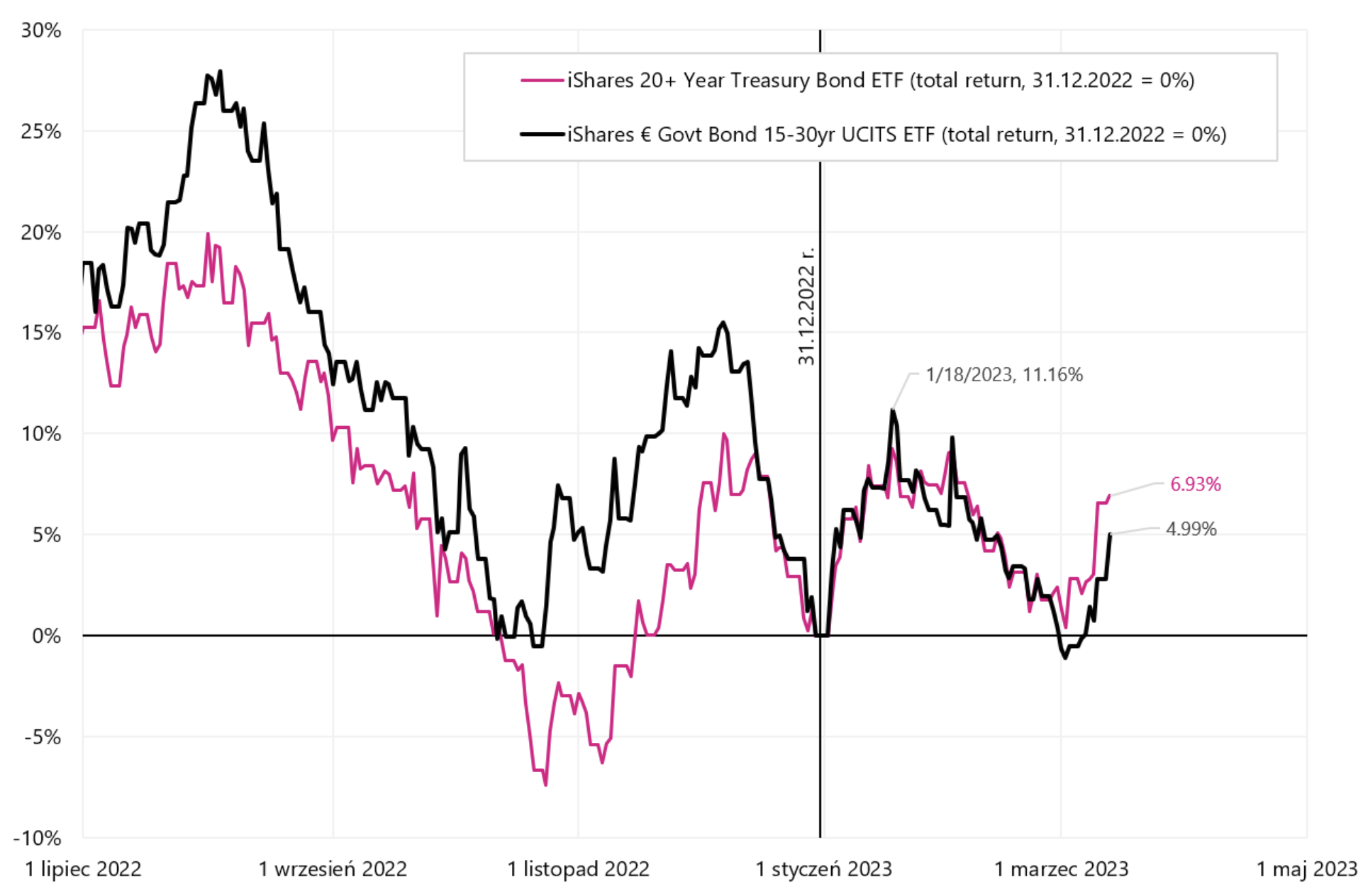

In the meantime, long-term government bonds benefited most from the current situation in the banking sector and falling yields. iShares 20+ Year Treasury Bond ETF has increased since March 2. to yesterday by 6,5%, a iShares Euro Govt Bond 15-30yr ETF up 6,2%. The chart below shows the rates of return of these ETFs from the beginning of this year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)