Is this the end of the rebound on the German DAX?

On Thursday, the German stock market went up most of the day, rebounding yesterday's strong sell-off. However, in the last trading hours, stock market bulls were afraid of very poor macroeconomic data from the United States (the number of new unemployed increased by over 5,2 million, and the Philadelphia Fed index plunged into long-term lows), and the DAX index began to show initial increases.

Be sure to read: Brokers offering DAX trading - Summary

A clear brake on the DAX

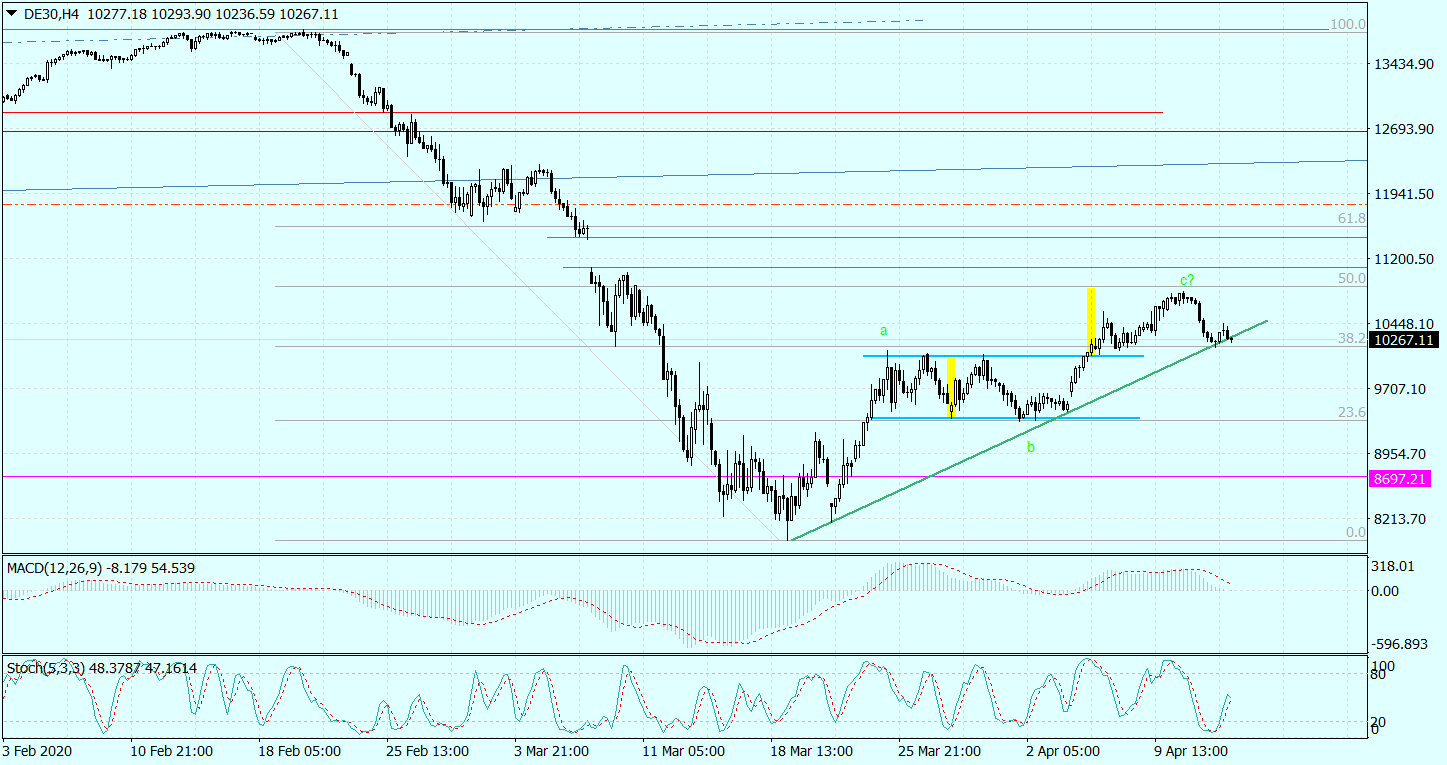

The situation on the German market is very interesting. Basically just before the settlement. This is clearly seen on the DE30 chart quoted on the Tickmill platform. Currently, the H4 chart of this instrument is struggling to stay above the 4-week uptrend line (currently it is at 10285 points). This is a real battle because earlier the same chart realized the upward move resulting from breaking up after breaking out from consolidation in the range 9361,90-10077,70.

DE30 chart (CFD per index DAX 30), interval H4. Source: MT4 Tickmill.

If the above picture is supplemented with yesterday's retreat DE30 just below the resistance level formed by 50 percent. Fibo lifting of the declines from February 20 - March 19, this will break the aforementioned upward trend line, and will also confirm the end of the upward correction, which took the form of a zigzag abc. In this situation, the generated supply signal will be so strong that not only will the thesis about the end of the upward rebound of the panic sell-off from a month ago be likely, but also the one that the market will open up a path towards the March lows (7961,35 points). ).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

I would not bet that DAX will break out in the following days. Germany will catch shortness of breath now.

I also. today you can see the first signs of market weakness, but who knows ... recently they like to surprise