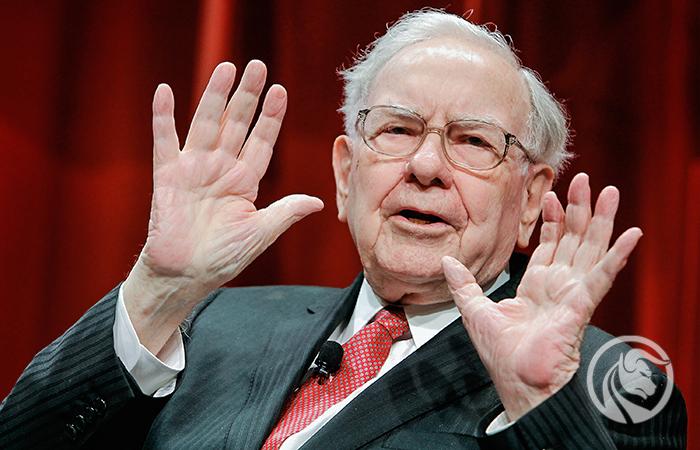

Will Warren Buffett be greedy again when others are scared?

Berkshire Hathaway, a company whose president is a legendary investor Warren Buffett, has $ 100 billion in purchases and acquisitions. Buffett seems to be going to go along with his own saying once again: "Be greedy when others are afraid." The market appreciates this, because the company's shares have increased by 10% since the beginning of the year. We will know the details on Saturday, during the annual meeting of the company's shareholders.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Legendary meeting of shareholders

On Saturday, the annual shareholder meeting of Berkshire Hathaway, America's largest non-tech company will take place in Omaha. This is the first such live meeting since 2019. Lots of investors will arrive, and even more will be watching the online meeting. This is Warren Buffett's 62nd year as president of the company. The meeting will also be there Charlie Munger, his long-term business partner and Greg Abel, who is expected to succeed Buffet as president in the future.

Recently, Berkshire has been doing better and better, improving results and catching the wind as the market sell-off of tech companies accelerate. Once again, the market particularly appreciates Buffet's perverse investing style, focused on seeking the real value of companies. The present time seems to be good for the realization of one of his famous sayings:

"Be greedy when others are afraid."

This is favored by a declining market and lower valuations, as well as, and perhaps most importantly, by the fact that Berkshire has more than $ 100 billion in cash reserves. It will target low-cost cyclical companies as well as defensive companies that generate profits and dividends, regardless of the overall market situation. It seems to be the best investment strategy at the present time.

Stocks down, Buffett stocks up

Berkshire (Series B) shares have jumped 10% since the start of the year, while at the same time S & P500 fell by 12,8 percent. The company's diversified portfolio includes shares of insurance companies (Geico, Gen Re), railroads (BNSF), energy companies (BH Energy), as well as 6% of shares. Apple shares,

20 percent American Express, 13 percent Bank of America and 9 percent. Coke. The company recently acquired the insurer Alleghany (for $ 12 billion) and acquired new shares in Occidental Petroleum and HP. Despite this, as mentioned, it still has over $ 100 billion in cash.

Berkshire has been an attractive investment since its inception. Over the last decade, the company grew at a pace similar to the S & P500 index, which is a great result given its strong gains. However, this may be slightly disappointing to those who expected the company to double the annual gains of the S & P500 (and grow by an average of 20% per year), as was the practice for the previous decades since 1965. Berkshire also sees its own value, as demonstrated by its $ 27 billion buyout of its own stock last year. Therefore, it does not pay dividends, unlike 80%. companies in the market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)