A long hot summer for the capital markets

Today ends the second quarter and the first half of 2022. They were disastrous for investors, who had nowhere to hide, and the markets plunged into a slump. They were fueled by the double impact of high and sustained inflation and aggressive central bankers, followed by growing fears of a recession. US and global equities fell by more than 15 percent in the second quarter, and bitcoin by more than half. Both bonds and commodities fell. Among the largest markets, only China recorded growth, among the asset classes the US dollar.

About the author

Ben Laidler - global markets strategist in eToro. Capital investment manager with 25 years of experience in the financial industry, incl. at JP Morgan, UBS and Rothschild, including over 10 years as the # 1 investment strategist in the Institutional Investor Survey. Ben was the CEO of the independent research firm Tower Hudson in London and previously Global Equity Strategist, Global Head of Sector Research and Head of Americas Research at HSBC in New York. He is a graduate of LSE and Cambridge University, and a member of the Institute of Investment Management & Research (AIIMR).

QXNUMX slightly better than QXNUMX?

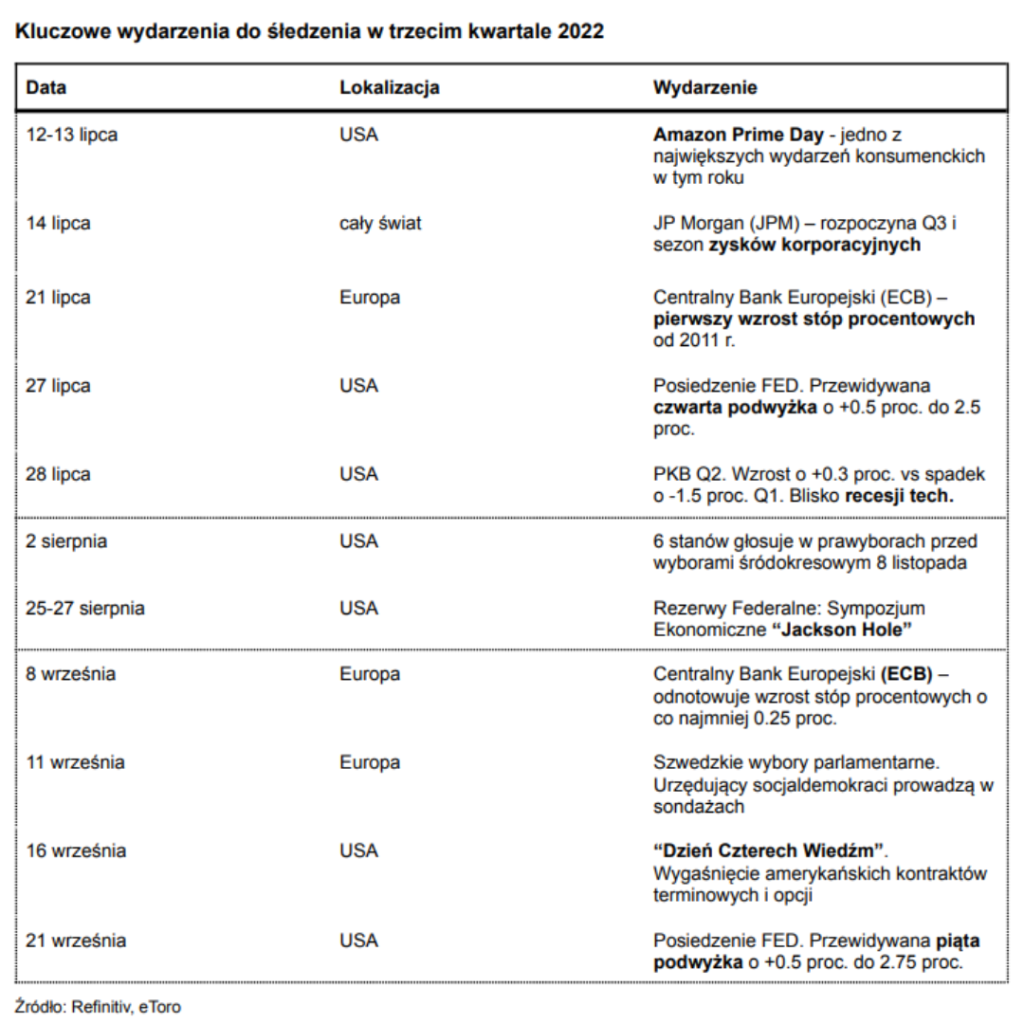

The race between peak inflation and recession is crucial for the markets and will ensure a long hot summer. Inflation in the US should peak and allow The Fed to slow down the pace of rate hikes before recession becomes inevitable. EBC faces the even more difficult task of raising interest rates in view of high and long-term oil prices and the ongoing conflict in Ukraine. Hopes for economic growth are shifting to Asia, and the re-opening of China increasingly anchors the global economy and avoids another blockade. As if that were not enough, the third quarter is usually the weakest for the markets, but this is not the standard year.

Future perspectives

In QXNUMX, we see the volatile market reaching the bottom. Much has already been valued and valuations have fallen further. We are close to the peak of inflation, financial conditions are significantly tightened and economies are slowing. Recession it is neither inevitable, nor global, nor possibly large. However, the risks remain high as inflation has yet to reach a clear peak and profits have not declined at all. We expect inevitable growth, but we defend ourselves against the risks. Bull markets are built on the shoulders of bear markets and are typically four times longer. We see a U-shaped recovery in the second half of the year. Our focus is on defensive companies, from healthcare to high dividends, and markets from the UK to China.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)