A good face for a bad game, or the FED's policy in all its glory

Every investor has a perfect persona Janet Yellen. Former boss Federal Reserve and the current head of the Treasury Department threw a bit of uncertainty and fear into the markets.

For the uninitiated: it is about the comment of the ex-head of the Fed, which echoed loudly in the markets. Yellen found that a "modest" increase is needed for the marketso that the economy does not overheat.

Her words caused a significant sell-off in the market and were quickly reflected by herself and turned into phrases that Powell uses in her comments. How did this "scratch" affect the markets? How does current Federal Reserve policy relate to this? What conclusions can be drawn from it? I invite you to a short comment in which I will try to explain these issues.

Modestly, i.e. by how much?

Janet Yellen

Admittedly, Yellen did not mention the nominal value of the modest increases. In her opinion, they are supposed to "cushion" the overheated economy after all government increases. Of course, it can be said that Yellen's statement was largely a response to Biden's fiscal plans, which are associated with another cash package debiting the economy. She expressed her opinion on the FED's fiscal policy for the first time during an event organized by the magazine The Atlantic. During it, she emphasized that all government spending, which is now being pumped up to the stop, will lead to overheating of the market.

Admittedly, she later canceled her words and explained extensively that she did not suggest any hikes, and inflation would only be overshooted in the short term. In an interview for The Wall Street Journal has made every effort to spapper the words of the current head of the Federal Reserve, Powell, that the US is not struggling with the problem of inflation. Nevertheless, the word was spoken. It said so much that on Tuesday we saw a large sell-off of indices, an increase in bond yields, a sell-off on the gold and a strengthening of the USD.

Dollars from the air

Is there an actual inflation problem in Usa? Does inflation really only occur as an "impulsive", insignificant and short-term factor causing inflationary pressure? The Federal Reserve is especially fond of explaining the rising inflation as a "supply bottleneck" in particular lately de facto shedding the problem on economic recovery. The boom in their rhetoric is reopening, making the demand “more aggressively” return to normal. The main place where it accumulates is Petroleum. Oil feels very good in an environment with high inflation potential (rising inflation). Closing the economies and defrosting them again is a good argument to explain the high oil prices and higher inflation that arose from the increased demand for black gold.

So where is the problem, and why is pressure on interest rates so unfavorable for the Federal Reserve? After all, the US government cannot afford to raise interest rates or allow the Fed to limit its bond purchases. On the contrary, I argue that the FED will need to expand its quantitative easing activities in the near future in order to be able to take out additional loans, which the specter of borrowing hangs heavily on the US government. You need cash to be able to buy government bonds. Thus, the answer suggests itself that in its absence reprinting will become the primary tool of the Reserve. Biden is well aware that the tax increase will not fully cover all planned economic packages. The mechanism of covering the costs of this type of investment will be financed by the same mechanism in which the stimulus packages introduced in 2020 were financed.

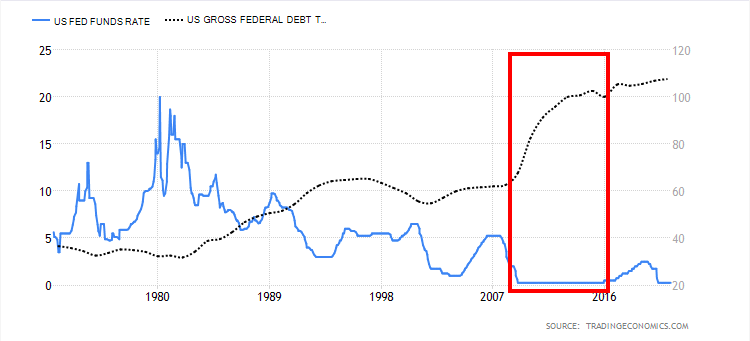

Debt vs interest rates in the US. Source: Trading Economics

The most significant increase in debt in the United States has been achieved in an environment of low interest rates. In the chart above, we see this steep upward movement as rates hovered around zero. In general, the Fed will be forced to buy bonds, preventing implosion in this market.

The Treasury Department can handle it

Interestingly, the Treasury Department increased the amount it plans to borrow in the second quarter of 2021. In February, the Treasury Ministry forecasted loans for the second quarter to be a relatively modest $ 95 billion. The new loan estimate for the second quarter is $ 463 billion. Thereafter, this amount is expected to double in the third quarter, with an estimated loan of $ 821 billion. Could Janet Yellen realistically assess the chances of hikes and the necessity to do so? Judge for yourself. In my opinion, the Federal Reserve is a bit pressed against the corner, and both Powell and Yellen know it. They themselves emphasized that low interest rates are the main reason why the government can "invest" in the economy. Therefore, it is to be expected that loans will grow in the near future.

In February, the Treasury projected second-quarter loans to be a relatively modest $ 95 billion. The new loan estimate for the second quarter is $ 463 billion. Thereafter, this amount is planned to double in the third quarter, with an estimated loan of $ 821 billion. This is partly an answer to why it is not profitable (even if necessary) to raise interest rates now.

Nothing is for free

There is nothing for free in economics as well as in life. While high inflation is seen as negative (the consumer pays more for the goods and services they purchase), it is largely a hidden aid to governments paying off large debt packages. Both it and the relatively low level of interest rates allow countries to exit from high levels of credit.

Higher inflation is often seen as an "aid" in emerging from the low interest rate environment. Their negative levels carry a number of economic threats which, combined with the high level of debt and the lack of prospects (including fiscal tools) for their control by central level institutions, have a negative impact on the economy. It is enough to look at the commercial banking sector, which so far has been absorbing the negative effects of low interest rates, but it will only be a matter of time before these costs will be passed on (if the negative / zero environment is in the long-term plans) to consumers. It is worth saying that in such an environment fiscal policy becomes somewhat ineffective. Why? To stimulate further economic growth, the next packages pumped into the economy simply have to be more abundant.

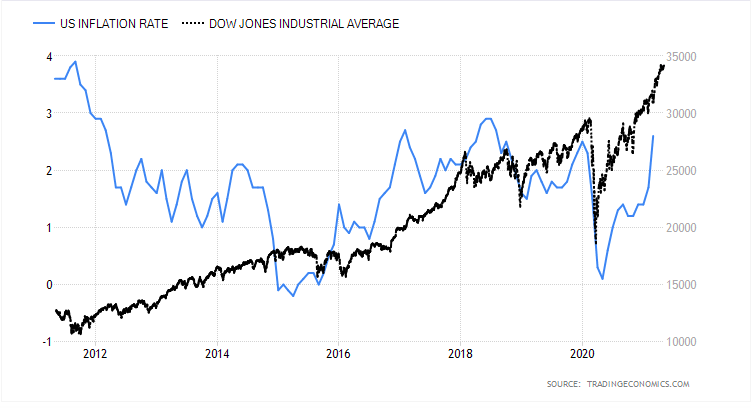

Inflation in the US and the Dow Jones Industrial Average. Source: Trading Economics

Encyclopedias can be written about the impact of higher inflation on the stock market and currencies. An important element that will be related to them are interest rates and the fundamental question that must be asked - will the rise in the level of prices in the economy cause them to rise. To a large extent, after the performance of indices in relation to inflation (which can be seen in the chart above), we can see market expectations and pressure on rate hikes.

Bond yields are relegated to the background

The Federal Reserve has not talked much recently about government bond yields. Although this is an extremely important indicator, in the short term it does not have too much impact on debt servicing costs. Of course, a much more important element in the whole puzzle is the interest rates, which play a major role in the event of a debt rollover. Rollover is nothing more than a kind of debt refinancing.

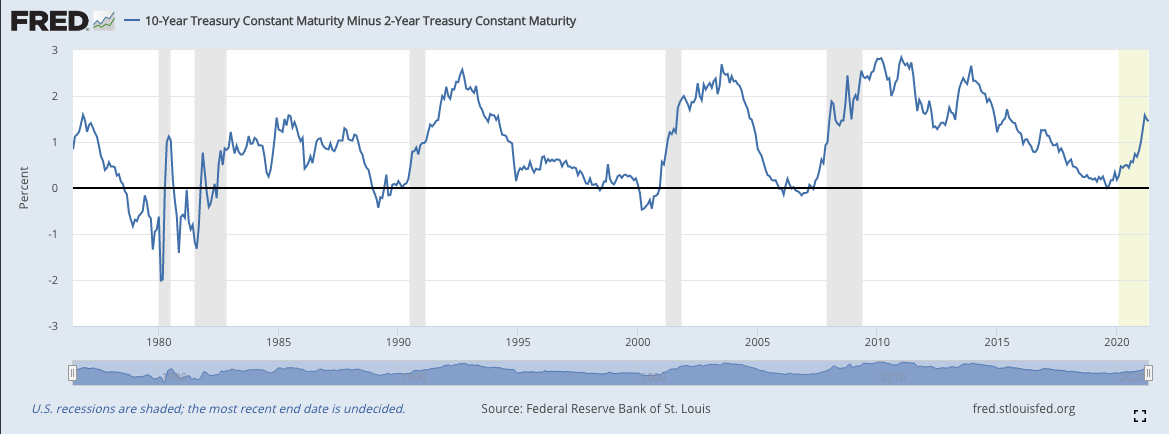

The current valuation of profitability has been in an upward trend for a year. Their high level means that investors get rid of debt securities, hoping that the new coupon (new issue) will take place on more favorable terms (they will receive a greater payment for the borrowed money). A good indicator that wags the proverbial finger is also the yield curve (difference between 10y and 2y bonds). Usually, touching the zero border informs us about the impending crisis.

Currently, its levels are not alarming yet, but it is interesting that it was brought closer to the crisis levels in 2019. The curve itself is a very good barometer that filters the expectations of the debt market. As the curve approaches critical levels, investors are forced to pay much more for short-term loans than for long-term loans.

Summation

Taking into account all the factors that we briefly took into account in this analysis, it is worth highlighting a few important things.

- Enabling inflation to be pumped up to higher levels improves the effectiveness of fiscal policy in the long term. Central Banks are able to exit the environment of low interest rates more efficiently. Taking into account historical data, the effectiveness of banks' policy depends on high and sustained levels of inflation, very high interest rates or low debt. After all, no condition has been met at the moment.

- The Federal Reserve will uphold its decisions in the near future due to the necessity to adjust the monetary policy of some kind to the growing debt needs.

- The Fed still has QE and the ability to buy bonds at its disposal. It has a real impact on the reversal of their trend (on profitability). The reserve may repeat its actions and in some way prevent banks from introducing money from QE programs (exchange of bonds for reserves) into the household sector (e.g. through credit). Thus, this program becomes more of a form of recapitalization of the banking sector than of creating additional inflation. However, it is worth bearing in mind that the QE program that was introduced in 2020 was different and allowed for easy transfer of funds to the private sector.

- Higher inflation, combined with the environment of low interest rates, allows for a cheaper payment of liabilities.

These arguments largely explain why the Federal Reserve will not decide to raise rates in the short term. It's hard to say how much deficit will still be needed to get straight. Raising them at the moment only due to higher inflation readings in recent months is like a shot in the knee.

More about the impact of Janet Yellen's words on the market:

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)