Canadian dollar - CAD [Fundamentals of the currency market]

Canadian economy

This article will present the basic issues related to the functioning of the Canadian economy. Find out from whom, what and in what quantities Canada imports, and to whom and what exports. You will learn the most important commodities for the Canadian economy on which its condition depends and thus indirectly affect the exchange rate of the local currency, namely CAD.

Be sure to read: Australian Dollar - AUD [Currency Foundations]

Export

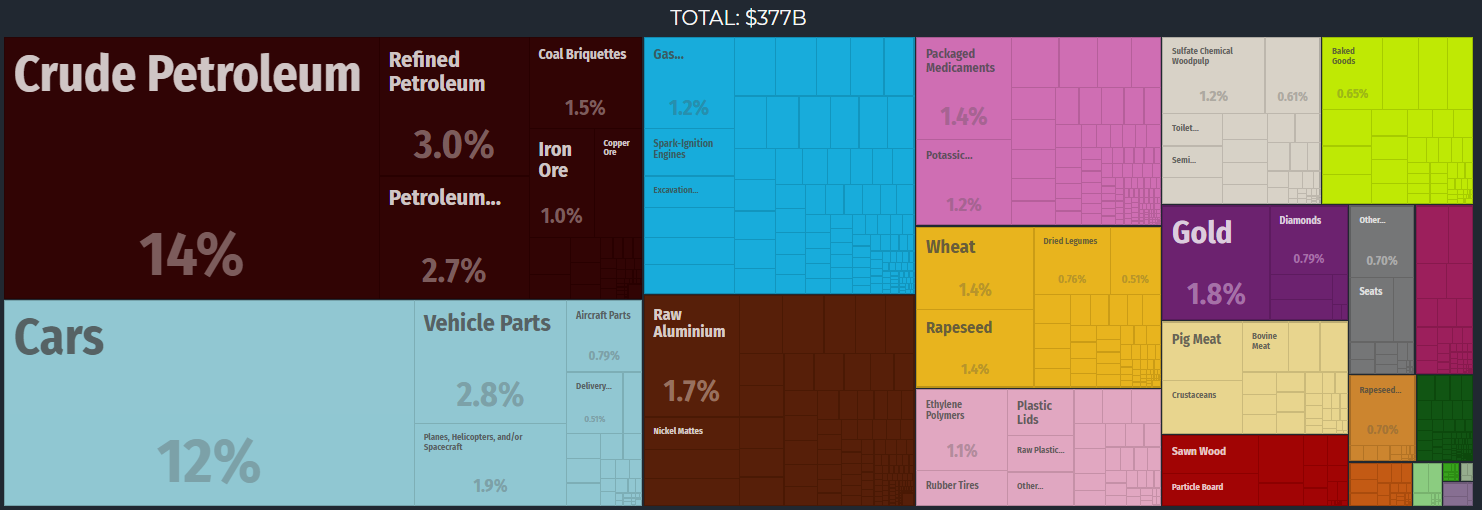

According to data from the International Monetary Fund for 2017, Canada is 10 the world economy with GDP over 1,6 trill USD. In turn, in the context of exports, it is 12 economy of the world. In 2017, Canada exported goods worth 377 billion USD. At that time, goods worth 326 billion USD were imported.

The most important export commodity of Canada is oil and cars. In 2017, the value of crude oil sold abroad was 54,1 billion USD, constituting 14 per cent. the entire export of the northern neighbor of the United States:

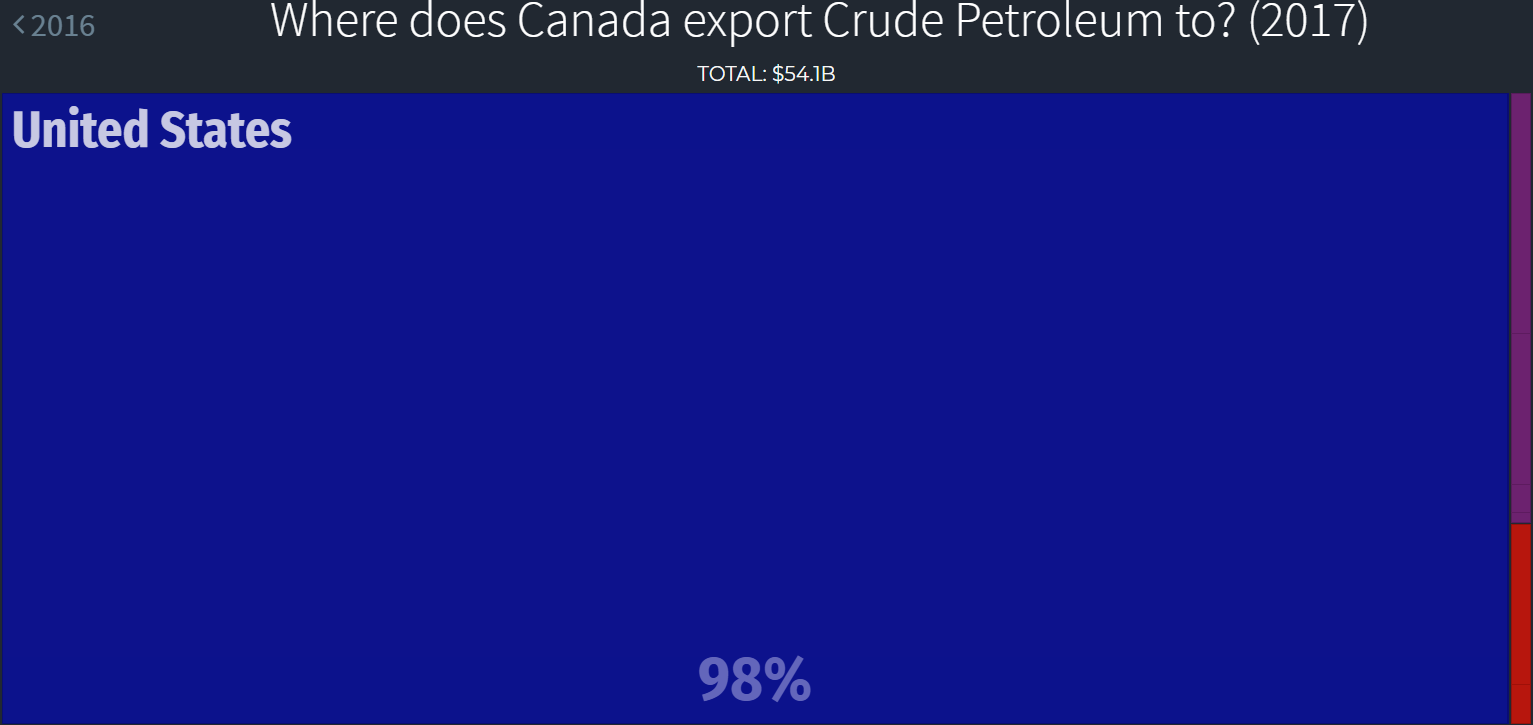

Of course, due to the geographical location, the main recipients of the oil exported by Canada are the United States (Check the USD / CAD chart). This is where 98 proc goes. raw materials.

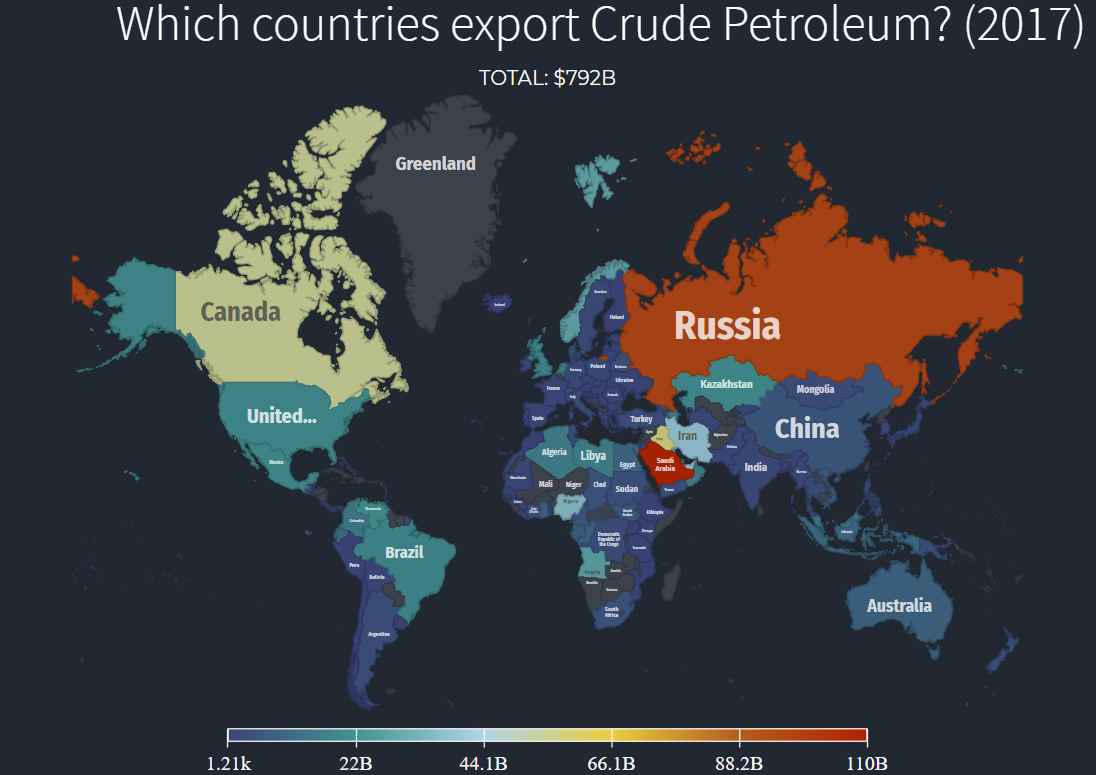

It is worth mentioning that Canada is the fourth largest exporter of oil in the world after Saudi Arabia, Russia and Iraq. In 2017, the share of world oil exports from Canada amounted to 6,4 per cent.

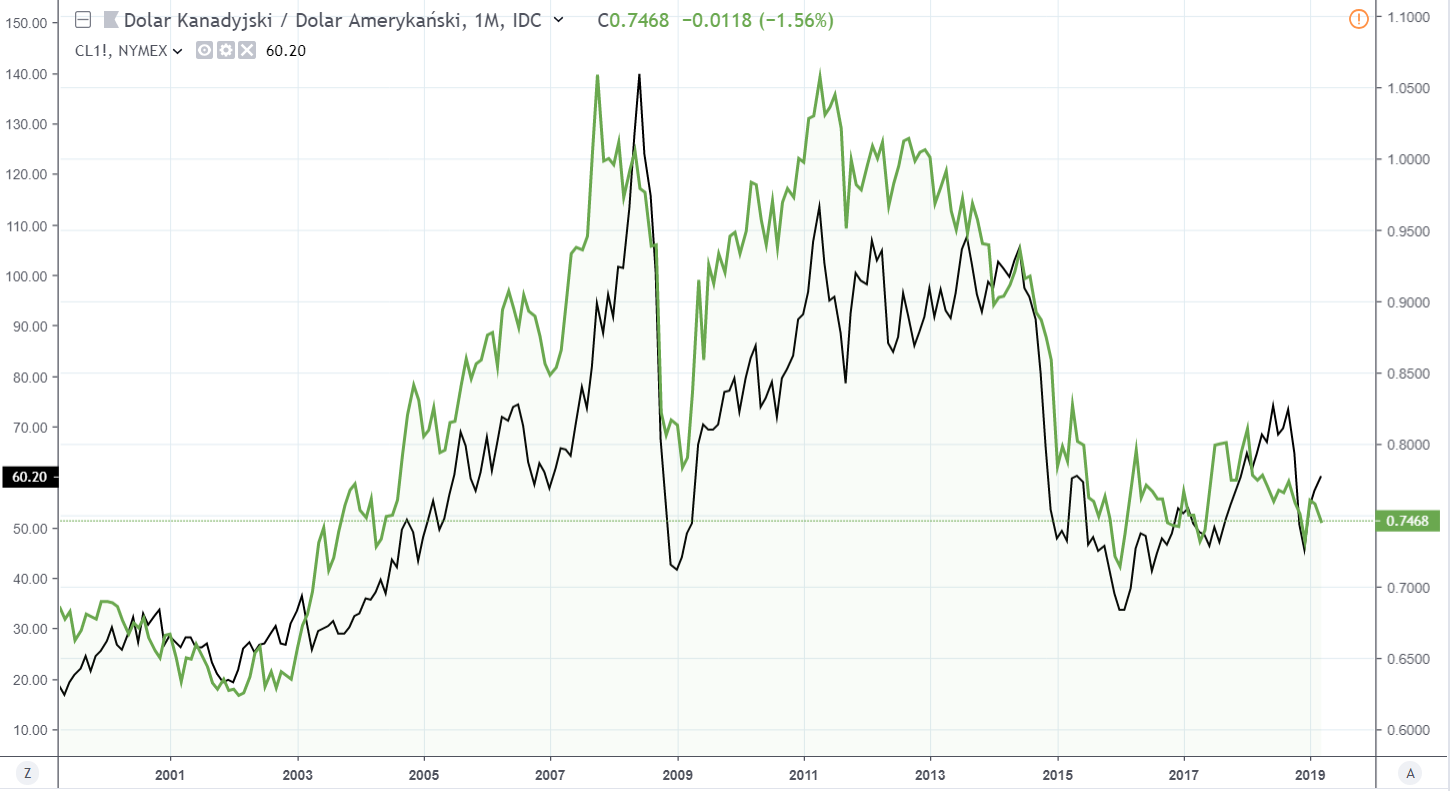

And here we come to the heart of the matter, which is a significant correlation between the key raw material for the Canadian economy, its price and exports, and Canadian dollar quotations.

Looking at the chart above, it is quite easy to see the long-term relationship - the chart dates back to 2000 - between CAD and oil prices. In other words, more expensive crude oil may translate into a strengthening of the Canadian dollar (a decrease in the USDCAD pair), and cheaper crude oil may cause a weakening of the CAD, i.e. an increase in the USDCAD rate.

The situation on the oil market is crucial for the Canadian economy, as the fall in oil prices may have a negative impact on GDP and / or inflation, and this may lead to monetary easing by Canada, which may lead to a weakening of CAD. Otherwise, i.e. a rise in oil prices, it may lead to an increase in economic activity, stimulation of inflation, which may translate into a more hawkish tone of the Bank of Canada.

Now you know the basics of Canada's economy and the structure of its imports and exports, and you know what to pay attention to.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Canadian dollar - CAD [Fundamentals of the currency market]](https://forexclub.pl/wp-content/uploads/2019/03/dolar-kanadyjski.jpg)

![Canadian dollar - CAD [Fundamentals of the currency market] coinmarketcap](https://forexclub.pl/wp-content/uploads/2019/03/coinmarketcap-102x65.jpg)

![Canadian dollar - CAD [Fundamentals of the currency market] dragonex](https://forexclub.pl/wp-content/uploads/2019/03/dragonex-102x65.jpg)