The MiFID II Directive came into force. What changes has the EU prepared for us?

MiFID II is a directive that came into force on January XUMUM 3. It is to revolutionize and above all civilize, the finance and insurance market in the EU member states. However, what in practice has changed the new rules covering over 2018 sites?

MiFID II is a major change

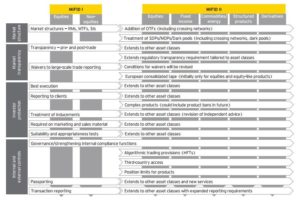

The immediate goal of the introduction of MiFID II is to increase investor protection and increase the level of market transparency in the entire financial sector. Regulations cover the scope of activity of all entities that are members of the financial market in the EU.

The main goals of MiFID II are:

- increasing transparency,

- increasing internal and external control,

- improving the protection and security of retail investors,

- maintaining the appropriate market structure.

It should be noted that the Forex industry is only a small element from the whole, but it is he who is the most interested in us.

Goals and effects

Transparency

New obligations have been imposed on financial institutions to improve the transparency of their operations. Firms are required to provide much more information to regulators and customers alike. An example is the obligation for brokers to publish spreads and Bid, Ask prices and information on the depth of the market by specifying the size of historical orders. In addition, they are required to provide data before and after the transaction is completed after paying the appropriate fee. One of the curiosities is the change that forces brokers who have so far offered investment analyzes to their clients free of charge, so that they now have to charge for it.

Market structure

The MiFID II directive introduces a new concept to the market structure - OTF, i.e. an organized trading system. It is to function in parallel with other structures, such as a regulated market (RM), a multilateral trading platform (MTF - the exchange model known from the LMAX platform) and systematic internalisation (SI). However, OTF only covers non-investment instruments (spot trading, CFDs, other derivatives).

External control

The new version of the Directive has increased the range of asset classes to be reported. It also included a greater number of financial institutions that must report their transactions to ESMA, even though they did not have such an obligation earlier. Institutions dealing in HFT (high frequency transactions) must register as investment companies and present their algorithms. Revealing them is to prevent the so-called flash crashom and other unforeseen situations that threaten other market participants.

Internal control

MiFID forces all Forex brokers and investment firms to register all transactions concluded for at least 5 years. This period may be additionally extended (but not shortened) as a result of the decision of the local regulator. For example, in Germany, it was decided that it will be 10 for years. The same applies to records of correspondence with clients and recordings of telephone conversations.

Each of the investment companies will have to hire a dedicated employee for the so-called Compliance issues, which will monitor whether all new legal standards are being met.

Non-EU companies

Another interesting thing is that the MiFID II Directive will also apply to entities registered outside the EU but operating within its territory.

Leverage on the Forex market

Most of us are eagerly awaiting information on what will happen next with the leverage on the FX retail market. MiFID II Directive does not regulate this. However, it gives more power to ESMA (European Securities and Markets Authority) and ultimately this institution will decide on the amount of leverage and other key factors for the retail Forex industry. Consultations with national regulators are underway until the end of January. It is assumed that the details of all decisions and the shape of changes will be known at the turn of February-March this year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)