ECB: Expected slowdown in the monthly asset purchases under the PEPP

We agree with the consensus on the expected no change in monetary policy after the meeting of the Governing Council scheduled for today. The general financing conditions seem very loose. This opens the way to slowing down the pace of monthly asset purchases under the pandemic emergency purchasing program (Pandemic Emergency Purchase Program, PEPP) in the fourth quarter from EUR 80 billion a month to EUR 60 billion a month - with very small consequences for the market. ECB pigeons, such as chief economist Philip Lane, are likely to downplay this announcement. We also expect the ECB to revise its experts' projections due to the economic momentum in the euro area this summer.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Stronger growth

There was optimism from the minutes of the ECB meeting on July 21-22:

The risk to the forecast remains largely balanced [...] the possibility of faster than expected savings being used up poses some risk of an upward revision of the forecast.

From an economic point of view, the spread of the Delta variant is not a significant problem. More than 70% of the adult population in the European Union is now fully vaccinated. This is a real milestone. In our opinion, it is highly unlikely that mobility restrictions will be reintroduced in the fall (for both travel abroad and leaving home). Given the solid economic momentum, we expect the ECB to revise its macroeconomic projections upwards for this and next year.

However, there is a risk of an upward revision of the forecast inflation

Inflation in the euro area rose markedly this summer. Most Governing Board members will most likely consider the recent high inflation rates to be temporary and to a large extent the result of one-off factors. In July, the prices of industrial producers increased more than predicted, ie by 2,3% as compared to the earlier forecast of 1,4%. First estimated in August CPI index in the euro area it amounted to 3,0% as compared to the previous forecast of 2,2%, significantly exceeding the original inflation target adopted by the ECB. This increase is largely due to higher commodity prices and transportation costs, but mostly base effects. It was the key factor distorting the CPI, including in France. The August CPI reading in France was 1,9%. A year ago, summer sales took place in August. This was not the case this year, hence the marked acceleration in the growth of prices of manufactured products (+ 1,3%). The recent price evolution seems to confirm the ECB's risk analysis. However, if energy and intermediate prices continue to rise for longer, there is a real risk that the higher producer prices will be passed on to consumers. This would cause a drop in consumer spending.

Technical adjustment of asset purchases under PEPP

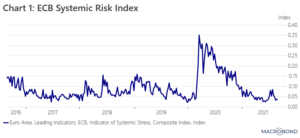

The general financing conditions seem very loose. The ECB's systemic stress index returned to its pre-pandemic level of 0,03 (see Chart 1). Originally developed in 2012 during the sovereign debt crisis in the euro area, this indicator is based on fifteen financial stress measures. This is an authoritative way of assessing the overall financing conditions in the euro area. In the context of the economic momentum in the euro area this summer, this signals the need to slow down the pace of asset purchases in Q80. We expect the pace of purchases to slow down from EUR 60 billion a month to EUR 2020 billion a month. This would be a level similar to the volume in January and February XNUMX. "Pigeons" z EBC, such as chief economist Philip Lane, are likely to downplay this announcement to prevent the market from interpreting it as a signal of a final cut in asset purchases. In our opinion, the effects of the technical adjustment for PEPP asset purchases will be marginal.

Exit strategy discussions are premature

Looking ahead, we expect the ECB hawks to exert even more pressure to develop an exit strategy for contingent monetary policy measures. We originally assumed that the debate on the future of PEPP would take place in December / early next year. However, it may start earlier. Unless the pandemic resumes in the coming months, it is unlikely that the PEPP will be extended beyond March 2022. Two options are considered: a transitional accommodative asset purchase program (mentioned by ECB President Christine Lagarde at the beginning of summer ) or increasing the monthly volumes of the asset purchase program (Asset Purchase Program,APP).

Forecasting an interest rate hike by the ECB at this point does not make sense due to its very distant potential date. From the investor's perspective, the rate hike is basically irrelevant.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)