The Eldorado of corporate bonds is a market threat

Surprised by the volatility in the equity market? Wrong!

There are a number of reasons behind the high volatility, and the current situation is not going to change soon: the coronavirus, the US elections, trade tensions and the economic recession are just some of the reasons.

However, do not wring your hands - maybe this is not the beginning of the end yet. Nevertheless, a competent investor should listen to the market in order to better plan the future.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

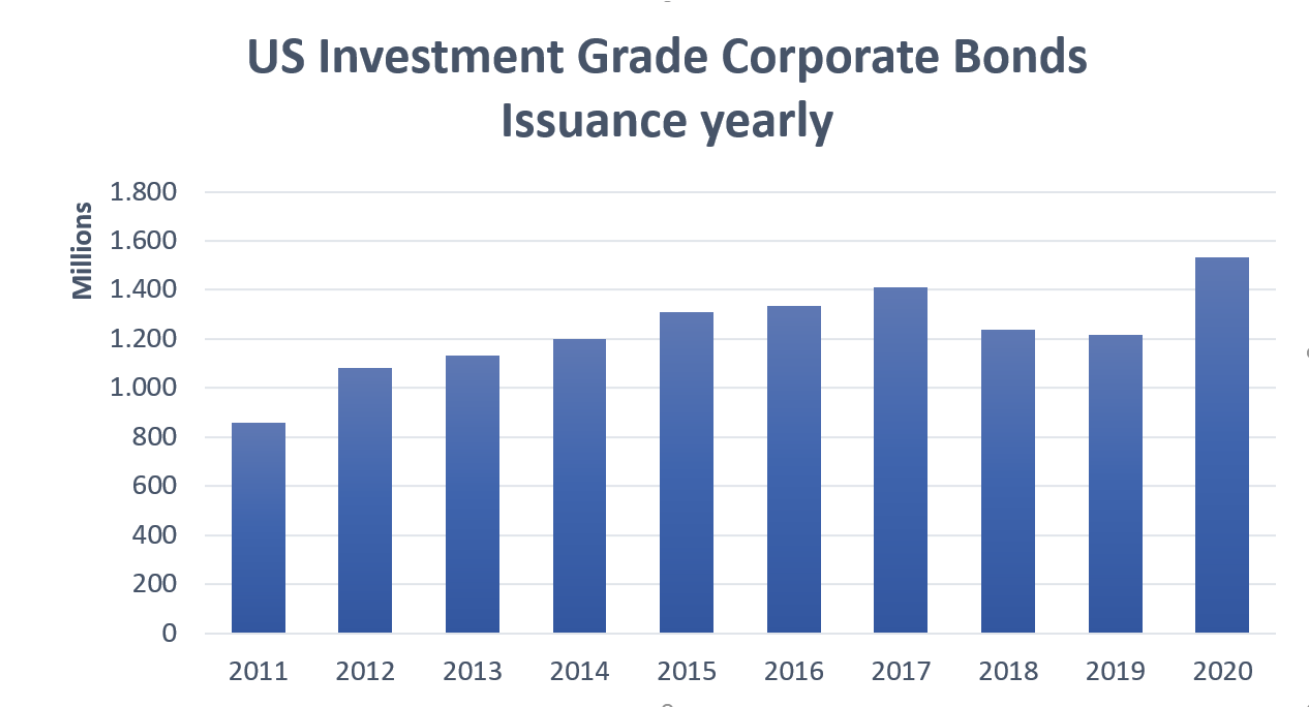

The system is over-indebted. The year is not over yet and we are already seeing record-high levels of investment grade bond issuance compared to previous years (see chart below). Companies increase their debt through the bond market to take advantage of historically low interest rates. This aggressive trend of issuing new bonds is not favorable for the investor's portfolio. The current situation is that companies are preparing their balance sheets and are worsening their overall ability to deal with the economic downturn. As if that were not enough, we are already on the verge of an economic recession.

This might be a good time to rethink your equity portfolio, cash in on selected positions, and look for safer investments.

Bonds are an excellent instrument to protect an investor from market fluctuations. When an investor buys a bond, it retains the specified return as long as it holds the bond to maturity. However, if you sell the instrument ahead of maturity, there is a risk that the bond may be worth less than when you bought it. Therefore, if you want to change your portfolio by giving up some shares and invest in bonds, you should carefully choose the period of keeping the bonds in the portfolio. If the nominal prices of bonds fall, an investor may have to hold them until maturity. For the above reasons, it makes sense for most investors to take an interest in bonds with a shorter maturity and wait until the principal is paid.

The good news is that we now have a selection of a range of investment grade US corporate bonds offering an interesting surplus over Treasury securities. Which of them should an investor choose?

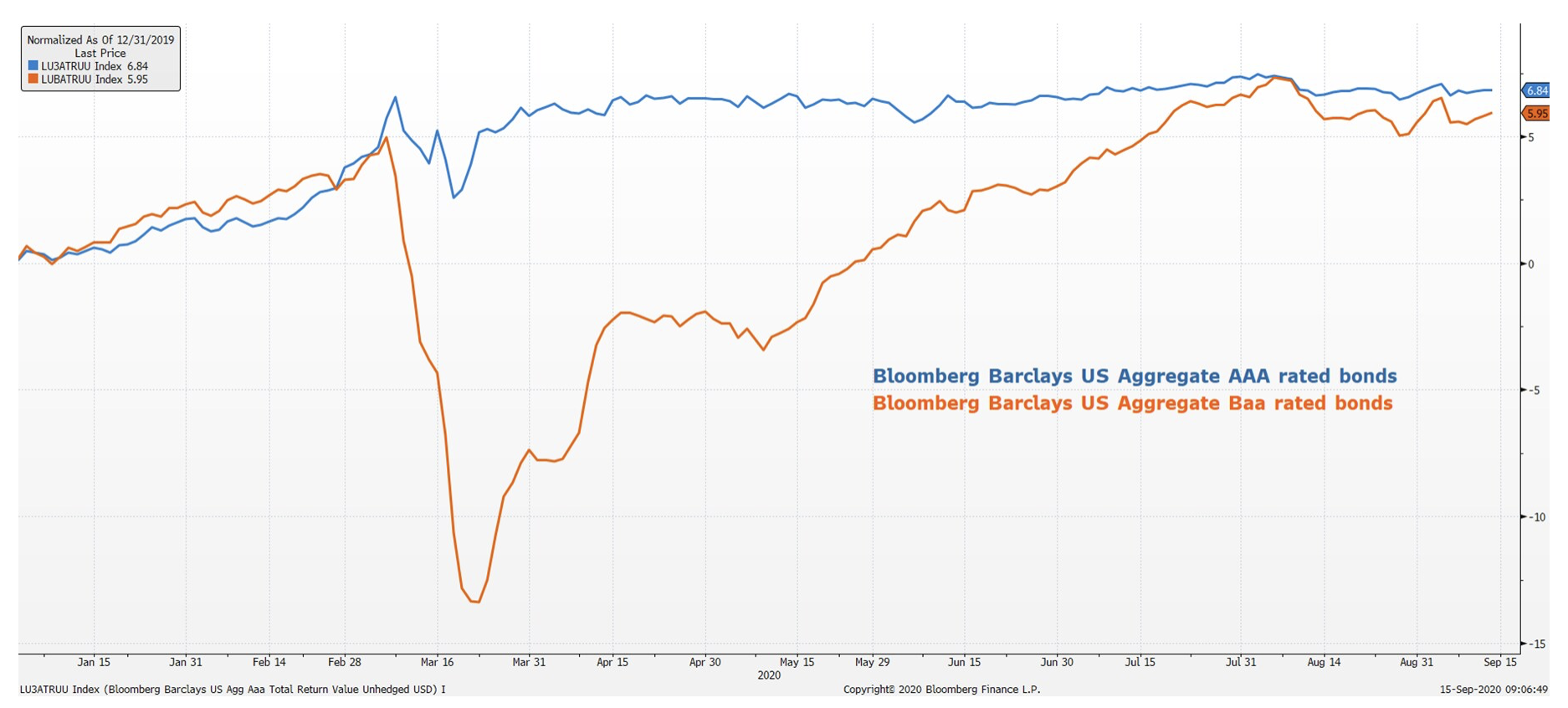

Well, it depends on what it's trying to achieve. Depending on the type of bonds you select, different results can be obtained. As you can see in the chart below, US Aaa-rated corporate bonds generate better returns even in high volatility. On the other hand, lower-rated investment grade bonds tend to be more volatile.

There is a reason for this trend: lower-rated investment-class companies are those that have incurred more debt over the past few years. Thus, they are also most vulnerable to market shocks as their rating may be downgraded to junk sooner than can be predicted.

Credit erosion in the universe of lower ratings may lead to ratings downgrades sooner rather than later. Market volatility remains high which means that long term financing options will be limited. Corporate America will experience the hard way of managing massive cost structures.

Hence, it is correct to view that higher-rated corporate bonds provide a better buffer against volatility - but there is also bad news. Such bonds are expensive! And they are likely to become even more expensive as the Federal Reserve continues to buy them.

However, it may be a consolation that the cut is often already included in the price of weaker investment grade bonds. This means that if the rating of a given security is downgraded, the price of the bond will not fluctuate so much.

In summary, obvious risks lurk in the universe of corporate investment grade bonds. The challenge is to understand which are acceptable as part of the portfolio holder's overall investment strategy. While lower-rated investment grade bonds are sensitive to the downside, they can still generate a solid surplus if held to maturity. On the other hand, investment grade bonds with a higher rating may prove useful in reducing the volatility of an investor's portfolio.

Buying a bond is very much like buying a pair of shoes. The right size is essential, but you can choose from many different colors.

My correct size is 4 to 6 years maturity and my favorite color is BBB / baa3. How is it with you?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)