ESMA a Forex: Effects of product intervention on the European market

Izba Domów Maklerskich is closely monitoring the situation on the OTC market. This time, the focus was on the analysis of the level of turnover - before and after the entry into force of ESMA's product intervention. The conclusions are clear. Investors who have used the services of European brokerage houses so far have fled outside the EU.

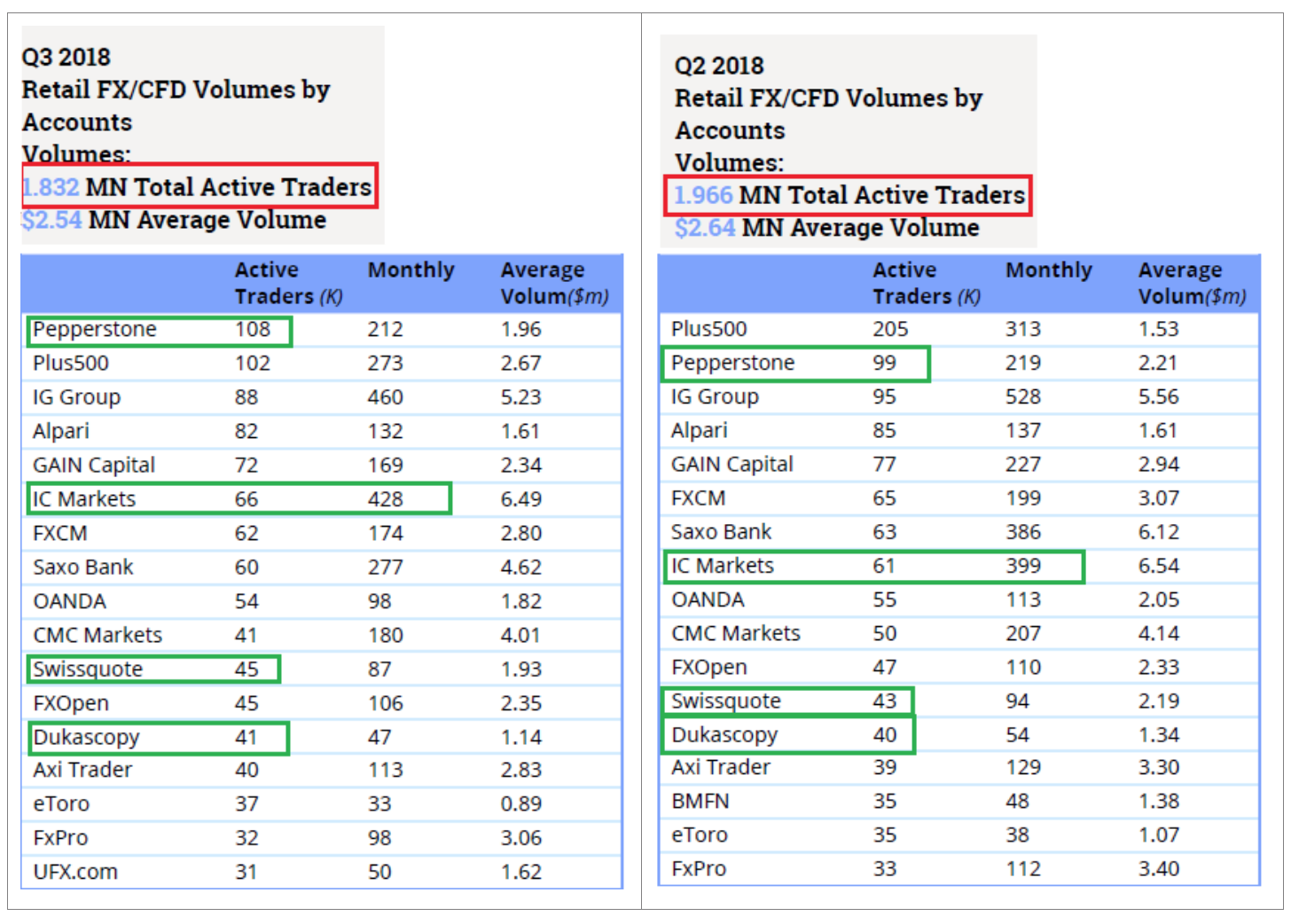

In the comment below, Marek Wołos, an IDM expert on OTC markets, presents data that confirm the above-mentioned fact - a large part of retailers to foreign brokers in search of higher leverage.

ESMA and Forex trading - Effects

Marek Wołos, Chamber of Brokerage Houses:

In recent years, brokerage houses have incurred significant costs of implementing new national and EU regulations, which often have reduced the competitiveness of the Polish brokerage industry towards entities from outside the European Union.

W following the recent regulatory changes, in some market segments there is a risk of regulatory arbitrage to the detriment of the domestic brokerage industry and its customers. In August, 2018, the European regulator ESMA introduced a product intervention that significantly limited the level of leverage for individual clients trading on the forex market. As a consequence, retail customers for whom leverage is one of the key parameters of the OTC market attractiveness, they transfer accounts to brokers who do not comply with EU law and offer competitive trading conditions, including higher leverage. After only a few months of ESMA's product intervention, by the end of 2018 QXNUMX, the number of active investors in European brokerage houses decreased significantly. On the other hand, the increase in turnover and the number of active investors is recorded by companies from countries not covered by ESMA's product intervention. After the intervention is introduced, a conscious investor will be more likely to use the services of a foreign entity, e.g. a company from Switzerland, because it offers better transaction conditions than a domestic brokerage house operating under the supervision of the Polish Financial Supervision Authority.

Australian and Swiss Eldorado

According to the Finance Magnates report "Intelligence Report Q3 2018"describing the CFD market in the world, foreign brokerage houses operating on the forex market recorded an increase in turnover and the number of active investors, with a general downward trend in the market. In the third quarter of 2018 turnover IC Markets, one of the largest forex traders registered in Australia, grew to USD 428 billion per month. Previously, i.e. before the introduction of ESMA's product intervention, the broker had never recorded such a level of turnover. Another Australian broker, Pepperstone, in the third quarter of 2018 was among the top five largest entities in the industry, although the average monthly volumes of the broker did not increase significantly compared to the second quarter of 2018. decline in turnover with European competitors who previously overtook it in the rankings. During the period under review, Swiss brokers such as Swissquote and Ducascopy recorded an increase in the number of active clients. These companies have acquired at least several thousand active individual investors, while in the EU brokerage houses a decline in the number of active players is visible. Additionally, Swissquote recorded record revenues and profits in 2018. The total revenue of the broker in 2018 increased by 15%. y / y to CHF 214 million.

IDM has repeatedly pointed out that foreign brokerage entities appear in Poland, offering competitive transaction conditions on the forex market to domestic retail clients. IDM, informed the Ministry of Finance and the Polish Financial Supervision Authority about such cases. These entities do not comply with EU regulations, including ESMA's product intervention and their activities are probably incompatible with national law. Such companies, through intensified online advertising campaigns, offer European retail customers competitive trading conditions on the OTC market, encouraging them to take advantage of their offer of services and transfer their bill there.

The above-mentioned data confirm the fears raised by domestic and European investment firms about investors fleeing to foreign investment firms not complying with ESMA's product intervention regulations and offering higher leverage on CFD products, which is one of the key parameters encouraging clients to change brokers. The Chamber has repeatedly called for taking into account the conditions of the industry's competitiveness in legislative activities, warning against the risk of regulatory arbitrage.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-300x200.jpg?v=1708677291)