ETFs - physical or synthetic replication. What is better?

ETFs are passively managed funds, the assumption of which is to faithfully reproduce a given index, industry or group of assets. Funds achieve this in two ways - through physical replication or synthetic replication of selected assets.

We recently published an article explaining the basics of investing in ETFs. if you need an introduction to the ETFs topic here. Today we will go a step further and look at what are the characteristics of synthetic and physical ETFs.

ETFs - Physical Replication

It consists in buying physical assets that are part of a given ETF. For example ETF for gold Sprott Physical Gold Trust [PHYS] he buys the physical bars of this yellow metal and stores them in the Canadian mint.

Another method of physical replication is the purchase of S&P 500 stocks by a fund that aims to mimic the movement of this US index. This is how the funds Vanguard S&P 500, SDPR S&P 500 or iShares S&P 500 operate. In this case, the number of shares purchased by the funds corresponds exactly to the structure of shares in the S&P 500 index.

In the case of very liquid shares from the US stock market, the use of physical replication is not a problem. Regardless of the fund's needs, the markets provide the liquidity needed and the fund can replicate the 1: 1 index performance.

Limitations of physical replication

The problem arises when the fund's demand exceeds the liquidity of the assets it replicates. Such a situation may occur in the case of funds giving exposure to shares of companies in emerging markets where the stock exchange does not provide sufficient liquidity or even the shares are too low to cover the fund's needs.

Another situation where the fund may have a problem with the use of physical replication is when the fund is about to acquire 20% of all available shares in the company. After exceeding 20% of its shares, the fund would bear the obligations and costs of a large shareholder, which would negatively affect the annual fees of operating the fund. For this reason, ETFs avoid buying such large blocks of shares in one company.

Sampling

In such a situation, the fund can save itself, still using physical replication, replace assets that it is not able to buy directly, with other, very similar ones. For example, a fund investing in companies from the raw materials sector, unable to purchase the right amount of shares, may start buying, for example, shares of companies building mine infrastructure.

This situation somewhat contradicts the idea of ETFs, whose task is to faithfully map the behavior of specific assets, rather than relying on the accuracy of the fund analysts' assessment of the predicted similarity of behavior of companies from related sectors.

ETFs - Synthetic (Swap) Replication

Sometimes even sampling is not enough. Then the funds use synthetic replication. Simply put, this involves a contract to exchange the rate of return on your assets.

In this way, the fund can offer a rate of return on assets that it does not physically possess. However, he has access to the rate of return generated by these assets under his swap contract, e.g. with an investment bank.

Synthetic replication is generally considered less secure. An additional risk factor is the involvement of a third party in this equation. In physical replication, if the fund goes bankrupt, the physically owned assets should cover the fund's liabilities to investors. In the case of synthetic replication, when a bank or institution providing rates of return on assets included in the synthetic fund goes bankrupt, investors can have a big problem to get their profits paid out.

In turn, supporters of synthetic funds pay attention to the much lower operating costs of "synthetics". Sympathizers of synthetic funds also point out that in the case of physically replicated funds, the lack of a third party is deceptive. In the case of physically stored assets, there is a third party who stores and secures these assets and is theoretically an additional risk factor.

How to check which replication a given ETF uses?

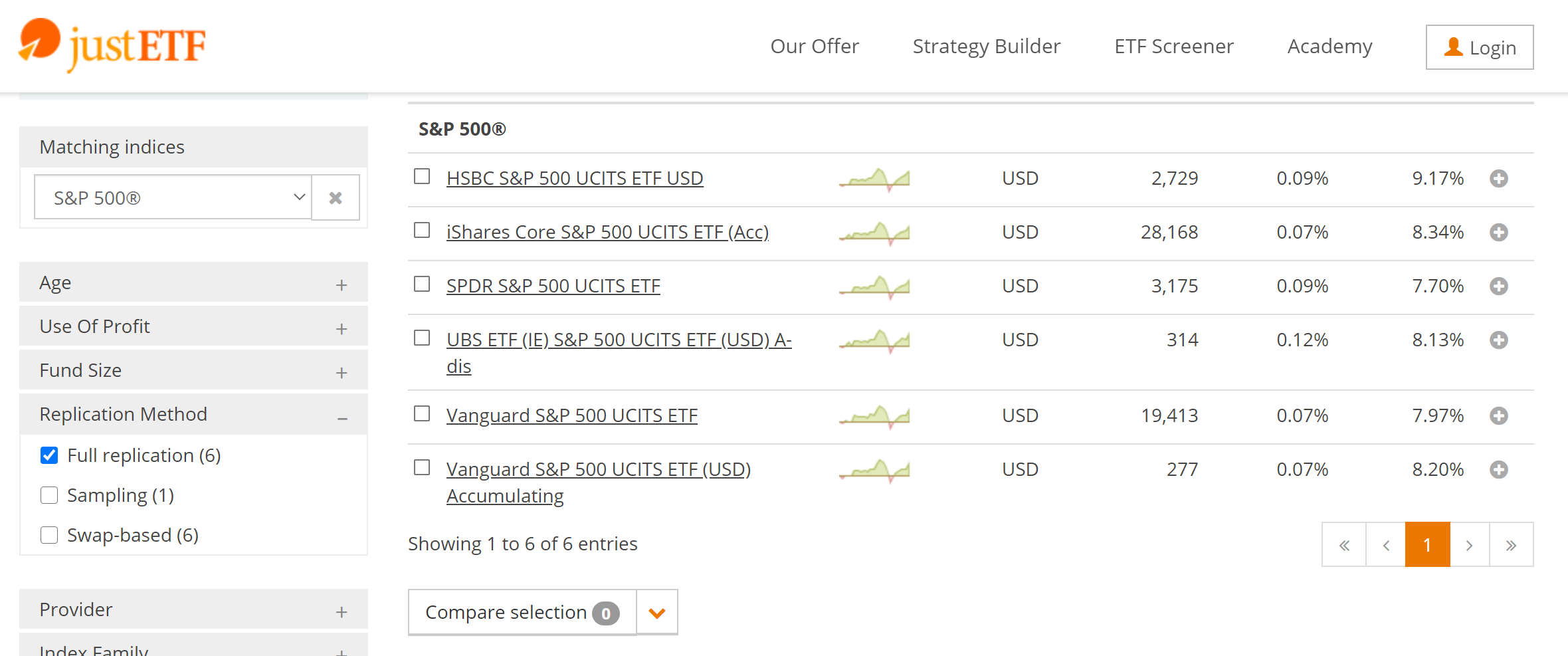

How to check how the fund of interest is replicated? For example on the page justetf.com we can search for ETFs using the replication method filter. If we are only interested in funds with physical replication and not using sampling, we check box "Full replication". If we are looking for synthetic funds for ourselves, check the box "Swap-based".

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)