The Fed puts pressure on the brake, the dollar rises, the stock markets drop

January meeting Fed This brought a strengthening of the dollar, an increase in the profitability of the American debt and declines in the stock markets. Most of all, however, it announced that the Fed would step on the brake harder.

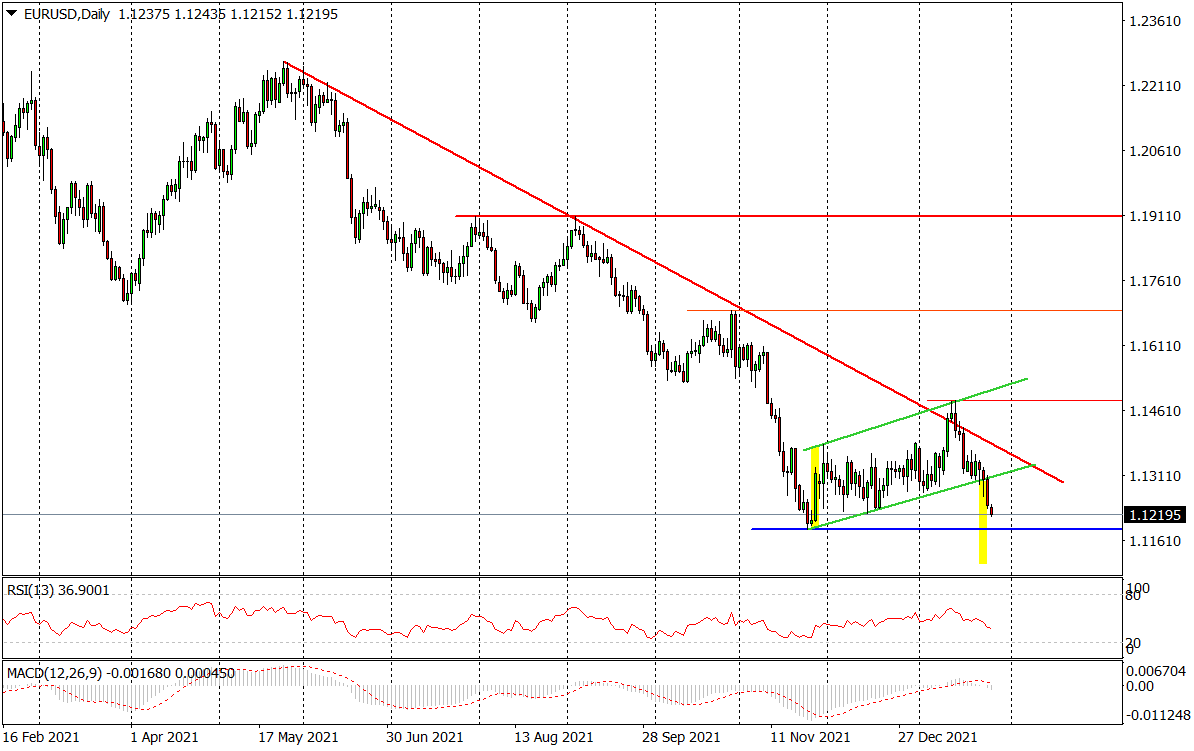

EUR / USD exchange rate is approaching 1,12, previously breaking the bottom from the 2M upward channel and failing to attack the bearish line. Yields of 10Y US bonds shot up strongly, returning to 1,9%. US indices, strongly rising before the Fed meeting, after Jerome Powell's meeting and press conference, gave up gains and closed on slight negative points. In a word, the markets reacted quite strongly to the Fed meeting. This is not surprising, as expectations for the number of US interest rate hikes in 2022 jumped from 4 to 5.

EUR / USD chart, H4 interval. Source: Tickmill

The communiqué after the meeting FOMC it matched the market expectations. The federal funds rate was kept at 0,0-0,25%, the end of the asset purchase program was announced for March and the need to raise interest rates was underlined.

Hawk Powell

What shook the markets happened at the press conference after the meeting. Fed chairman Jerome Powell sounded more hawkish than the markets had assumed. Powell not only announced hikes from March, but also did not rule out hikes at each subsequent FOMC meeting in 2022. He also stated that there is a job market in the USA "Very very strong" and will deal with the increases. Especially that wages have risen sharply. He also stressed that there was a risk that inflation would remain high for longer than previously assumed, and referring to the reduction of the balance sheet, the Fed said that talks on this subject would continue for at least two meetings (i.e. until May), and the future reduction of the balance sheet total must be significant, which will take some time.

From Powell's comments, it can be concluded that the Fed, fearing inflation, is pushing the brake pedal hard. Moreover, he is strongly convinced and strongly determined about this decision. The market sees this and is already pricing in not 4, but 5 interest rate increases in 2022. This is not only a signal for the strengthening of the dollar or further profit taking on the stock markets, but also an important benchmark for other central banks. Especially only in developing countries. They will now have to follow the blow and raise their feet more than previously assumed. Otherwise, their currencies will weaken, which will additionally boost inflation in the short term and may jeopardize the effects of fighting it with interest rate increases.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response