A return to the average for the most dynamic currencies in 2021 and a lot of volatility

Forecasts for each time horizon should always be subject to some degree of uncertainty. As of the beginning of 2022, amid rampant inflation and serious geopolitical risks, it seems that forecasting unforeseen results requires the widest margin of appreciation since the outbreak of the pandemic in early 2020. in a return to the average for some of the most far-fetched major currencies, such as the Japanese yen and the Chinese renminbi.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

The Fed will keep raising rates until something breaks

At the beginning of 2022, it seems that each speech by Fed representatives is more aggressive than the previous one. At the same time, China signals the opposite: loosening of policies and support for the Chinese economy, which has been hit hard by official measures against abuses in the giant real estate sector and against tech companies; these actions have also dealt a blow to markets and the real economy. The implementation of a "zero tolerance" policy on Covid has resulted in additional restrictions in terms of economic activity.

Historical parallels are hard to find for the current degree of divergence in policy and economic performance between the US and China, but it is similar to the comparison of America to Europe in late 2014, when the Federal Reserve tightened its policy very slowly while the ECB gearing up for a long overdue the debut of its first actual round of quantitative easing. Any movements in the USD / CNH pair in 2022 are unlikely to resemble a catastrophic collapse EUR / USD pairs from the end of 2014 to the beginning of 2015, although it can be assumed with high probability that the greater part of at least the first half of this year will be marked by a widespread weakening of the CNH.

This comes after the Chinese authorities clearly signaled a policy shift towards easing, and already in December it was in the form of a reduction in the bank's reserve requirement ratio at a time when virtually all other major central banks were tightening their policies to some extent. This also applies to the Fed led by Powell, which during the December FOMC meeting suggested accelerating the end of the quantitative easing program. The minutes of that meeting, published in early January, even hint at a lively discussion on whether a full quantitative tightening should be made in tandem with interest rate hikes in 2022. This was something that the Fed only did in 2018 (in effect, causing the market to crash at the end of this year), after it has already managed to raise rates several times.

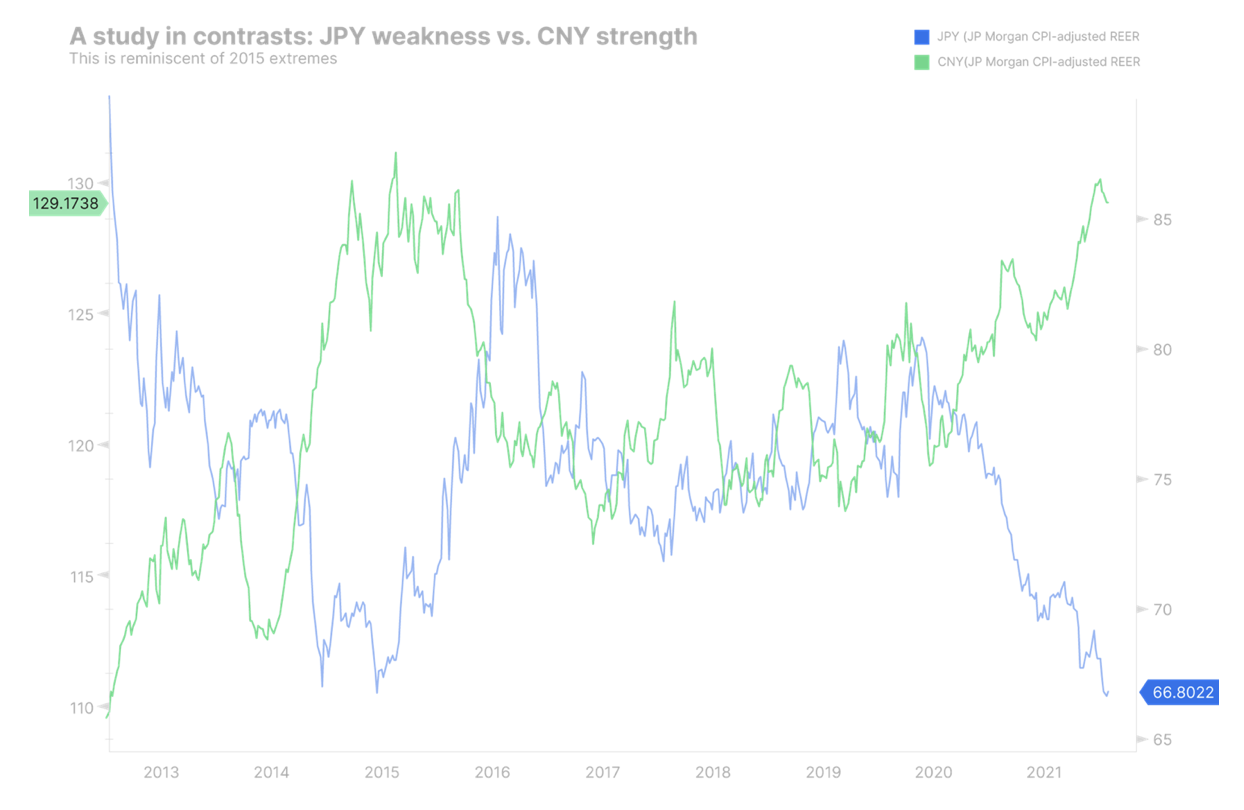

China is starting a monetary policy easing cycle - by the end of 2021 the renminbi exchange rate was to reach the highest level since the end of 2015 against the officially established basket of currencies. This policy was perhaps partly based on a desire to contain the inflationary impact of rising commodity prices in 2021; in the face of divergent policies and extreme valuations, it appears that the CNY will depreciate for much of 2021. An additional concern for China is the extent to which climate priorities will lead to sanctions against China under a new trade policy geared towards an energy mix largely based on coal. More information is presented in the chart below.

The US dollar may show resilience through the early part of 2022 compared to typical pro-cyclical currencies. However, it will most likely find it difficult to initiate a wide, decisive extension of the appreciation we saw at the end of 2021 as the longer end of the US yield curve may prove to be relatively firmly anchored. The latter is possible despite high inflation rates as the market probably correctly predicts that the Fed can only tighten quantitatively and raise rates until something bursts - first the markets and ultimately the economy itself amid the risks of an impending recession.

Even if the Fed lags behind the curve, the rebound in the US economy will also be held back by real GDP slowing down due to the enormous rise in energy prices from pandemic lows as well as the prospect of persistently high prices in the future, in particular due to the green transition. In this context, it can be seen that the fiscal cliff, or the fiscal brake, has already been included in the valuations for next year. As soon as the Fed "hits" this result, it will - right! - a new round of fiscal easing, bringing with it another round of inflation, even if the latter drops significantly from its peak in early 2022 and stays high.

Jen is way too cheap

In the fourth quarter, EUR, and the JPY in particular, performed weakly and Europe found itself in a very bad position as natural gas and electricity prices rose to a multiple of their previous highs. This was partly due to reduced supplies of Russian gas and the geopolitical situation in Ukraine, which is still very serious at the time of this forecast. Europe in QXNUMX was no less negatively impacted by the latest delta Covid wave that pushed the Old Continent back into a partial lockdown mode before the omicron fire (hopefully) unexpectedly puts an end to the pandemic by spring this year.

In March, and even in February, the ECB may find itself in dire straits, through its own fault, for insisting on maintaining a negative reference rate. The possible and probably final capitulation this year on the necessity to enter the path of rate hikes to the level of at least 0% may lead to a significant weakening of the EUR against all currencies and directing the EUR / USD exchange rate towards 1,2000 by the end of the year, if not earlier .

In Japan, the still relatively anchored US long-term Treasury yields and very weak US real yields coupled with volatility in asset markets and possibly difficult times for bond investors (is credit risk gone?) Offer solid conditions for a strengthening JPY. In addition, Japanese policy under the new leadership of Prime Minister Kishida focuses on stimulating domestic demand to reduce Abenomics inequalities - which could boost domestic demand. At the same time, in 2021, the Bank of Japan quietly de facto stopped expanding its balance sheet and stopped buying other assets under quantitative easing. As you can see in the chart below, the yen is at a historically low valuation level and may face a sharp return to the average for much of 2022.

The chart below shows the JP Morgan real effective exchange rate (CPI-adjusted and trade-weighted) for the Japanese yen (black) and the Chinese renminbi / yuan (blue). It should be noted that this is not the first time we have seen a remarkable discrepancy in relative strength, and that during a previous similar episode that started in late 2015, the return to the average was profound. (Source: Bloomberg)

The unstable approach to risk limits the growth of commodity currencies

For the smaller G10 currencies, the forecast for early 2022 may be straightforward if risk appetite and volatility are the main concerns; However, the weakening can come in different shades as energy prices can support CAD and NOK in currency pairs. The once very strong NZD may continue to decline overall as its leadership position in tightening policies in 2021 is unfavorable in relative terms, while other central banks are catching up, and RBNZ he relaxed his guidelines for the future. Given the long-term priorities of green transition (emphasis on metals and possibly uranium), we will look for value in any deep overestimation of AUD as a long-term opportunity.

Tightened fiscal and monetary policy

The ideal combination for a currency, as long as there is no abnormally high risk of government debt, is a loose fiscal policy and a tight monetary policy. In the case of the UK, it looks like we will see a tightening on both fronts and thus a different situation for GBP. The British government is located in a very different place from the United States and other countries, signaling a strong desire to rebalance domestic finances. The UK also turned out to be very limited on the supply side. Given the much smaller constraints on the British economy than in continental Europe and the fiscal stagnation associated with the euro area, any rebound from the pandemic this spring could prove to be more modest, and the strong end of 2021 and the start of this year for pound sterling could turn out to be broadly neutral . The UK economy could slow down sharply later in the year.

ECB capitulation and SBN intervention

The SBN may have the luxury of not having to intervene in the foreign exchange market if the ECB finally capitulates and signals a final tightening towards zero as inflation in Europe remains high after rebounding from a wave of omicron contamination. CHF lower than the JPY is another currency pair worth looking at for a recovery to the average, in addition to a recovery EUR / CHF exchange rate around the middle of the 2021 range.

Emerging Markets Currencies (excluding CNH)

Given the likely volatility of the markets in 2022, as the market adjusts to the more aggressive rhetoric and constraints of the Federal Reserve, the performance of emerging markets broadly may remain volatile for at least the first half of 2022 or until The Fed and US fiscal policy will be forced to reintroduce a more accommodative mood somewhere along the way due to the threat of a market catastrophe and / or the threat of a recession. As long as the US dollar remains the world's reserve currency, volatile markets and a tightening Fed policy in a world basking in USD denominated debt mean tough conditions. In addition, 2021 presented us with some dramatic, concrete, weak histories of emerging market currencies related to policy errors, ranging from missed interest rate cuts in Turkey that led to a sharp devaluation of the Turkish lira, to the Chilean peso (CLP) that It has completely lost its substitute currency for copper as the country has swung politically left and is considering the literal nationalization of mining profits above a certain threshold, thus discouraging investment. The Mexican peso was a relatively quiet currency in 2021 and may remain so for the long term, given the United States' priorities to diversify its supply chain and move it away from Asia after the pandemic caused massive disruptions, most of which are still taking place in early 2022

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response