High-yield currencies will begin to lose their attractiveness

As we enter 2024, the focus shifts from bond yields and inflation to the sustainability of economic growth and dependency. The USD decline may take some time to take hold until other global central banks' stances on keeping interest rates higher and longer are tested. JPY and Asian currencies have significant room to rebound in a yield-driven bearish dollar environment, but geopolitics and elections remain key risks.

The USD downtrend will be bumpy

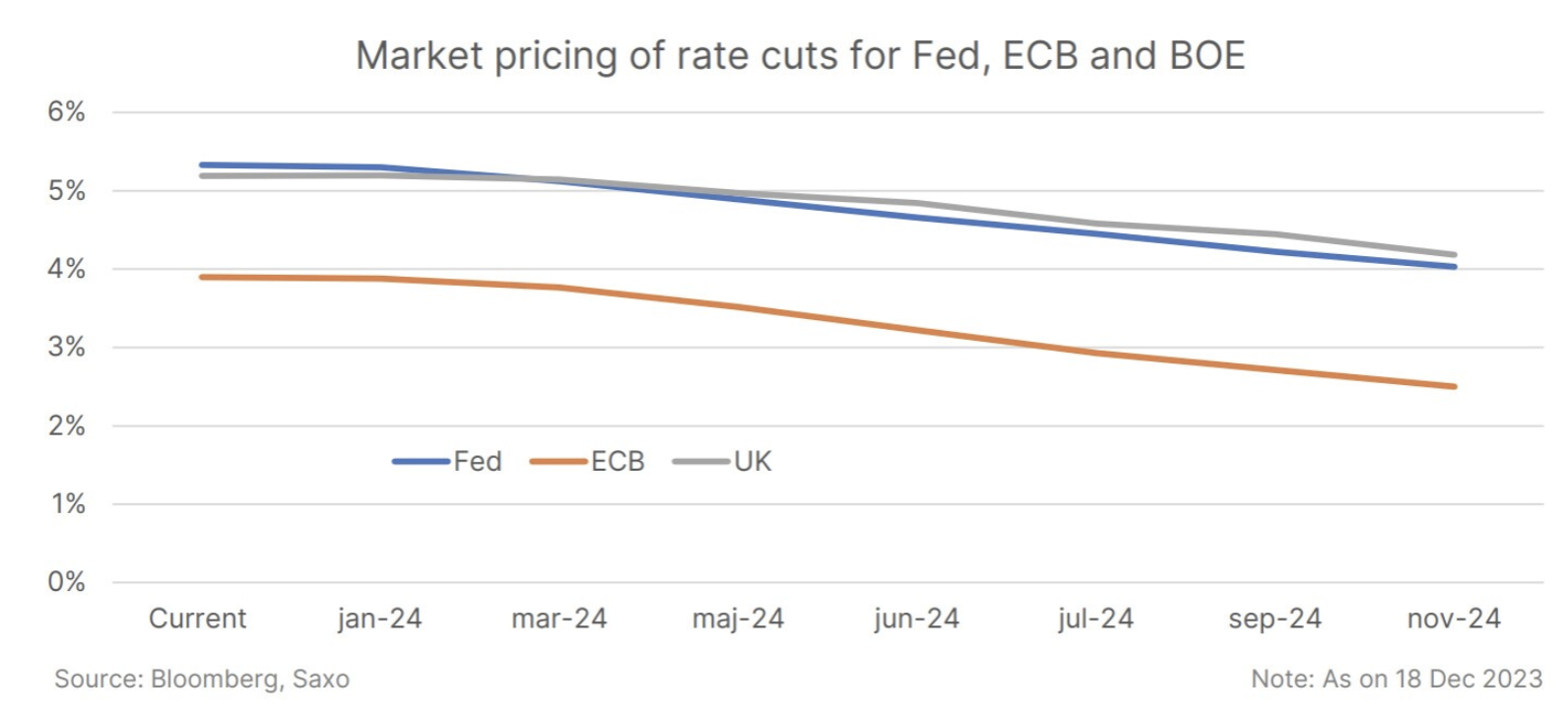

December brought a change in expectations regarding central bank policy, with the Fed adopting a more dovish stance and signaling rate cuts. This has reversed the recent strengthening of the dollar and may lead to further depreciation in 2024. However, implementation by the will be required to maintain dollar weakness Fed easy monetary policy and higher economic growth outside the United States.

While the Fed's dovish turn may support the dollar's decline, the exceptional nature of the U.S. economy will likely maintain some upward pressure on the dollar. Economic data in the euro zone and the UK may deteriorate faster, providing temporary support for the dollar in the first quarter. A permanent decline in the dollar will have to wait for a more visible deterioration in the US labor market data.

The hawkish stance of some major central banks such as EBC i Bank of England, may be challenged by weakening economic data in the first quarter. This could put pressure on EUR and GBP, especially if markets shift expectations for interest rate cuts by these central banks.

The big turnaround for the BOJ may never come

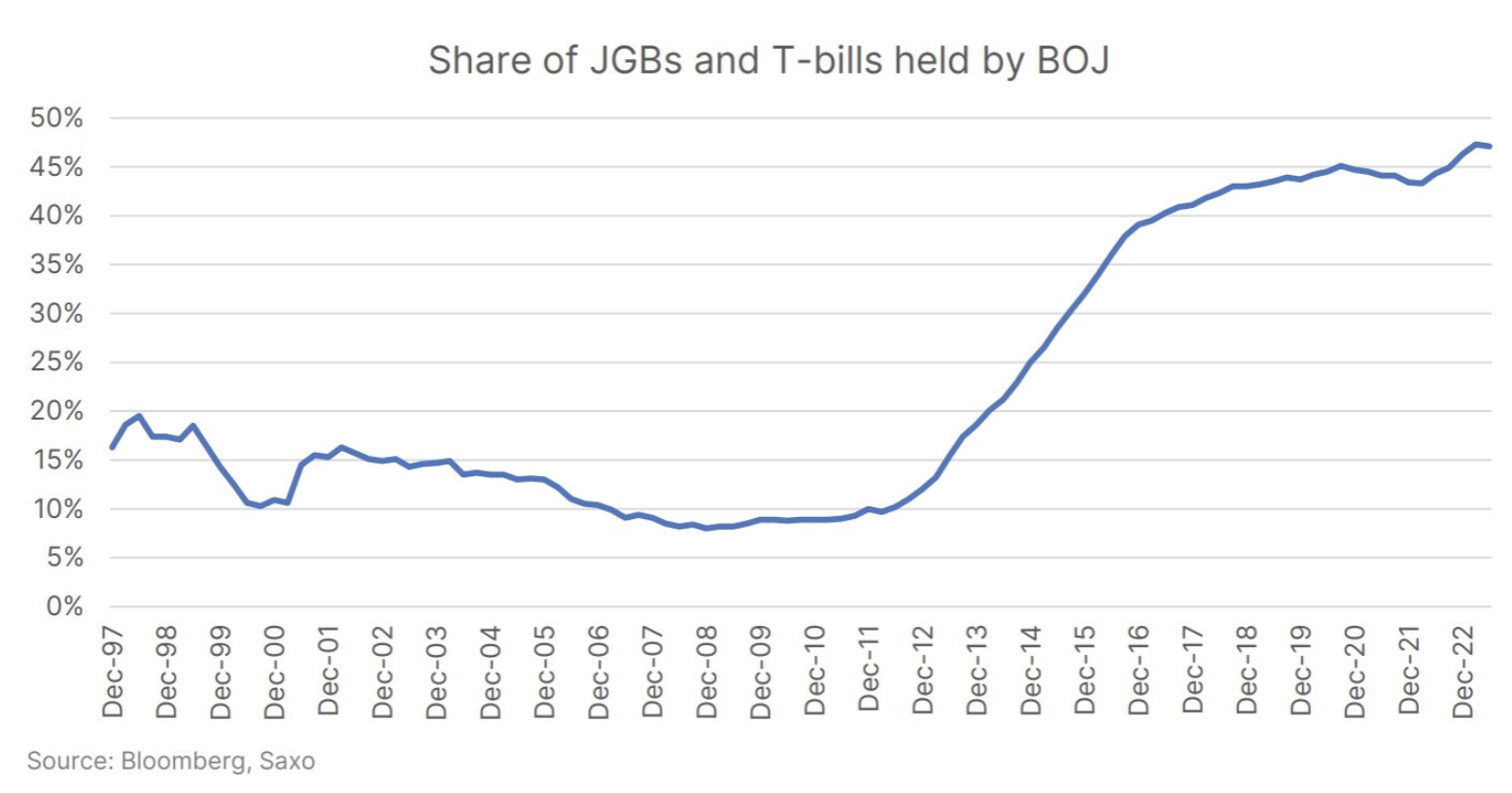

The big market bet in the first quarter will likely be whether the Bank of Japan (BOJ) will end its negative interest rate policy (NIRP) and yield curve control (YCC). There is a sense of urgency as the Bank of Japan is missing its current opportunity for a turnaround. In 2024, global central banks will likely change their stance from neutral to dovish. However, we believe that leaving the policy pursued by Bank of Japan will be gradual and modest, and markets may be disappointed if they expect YCC to be removed completely. Both liquidity and political risks remain too high for the Bank of Japan to consider a complete exit from YCC, and taking action before the results of wage negotiations are announced could undermine its credibility.

That said, the Japanese yen is a BOJ problem with a Fed solution and has the most potential to rebound in 2024. Some help may still come from expectations for a BOJ turnaround ahead of likely disappointment later in 2024. The start of a global monetary easing cycle may also serve as a warning sign for currency shifting strategies as monetary policy divergences narrow.

Room for recovery in the Asian currency market marked by geopolitical risk

The Bloomberg Asian Dollar Index fell 5% through October before the dollar's decline provided some respite in the final two months of the year. As the dollar remains depressed in 2024, Asian currencies will likely have more room to appreciate from a valuation standpoint. Any signs of economic recovery in China or measures to further support the yuan would provide additional benefits to the Asian exchange rate.

North Asian currencies, particularly KRW and TWD, could benefit if the cycle improves semiconductors it was even longer. However, fears of a global recession may come back to haunt exporters such as KRW, TWD and SGD, while domestic demand-driven currencies such as INR and IDR may perform better.

Geopolitical events, in particular the current state of wars between Russia and Ukraine or in the Middle East, as well as the elections in Taiwan, may complicate the path of recovery for Asian currencies.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)