FED fights inflation, WIG and Chinese indices strongly up [Weekly summary]

The past week turned out to be even more interesting on the capital markets than the previous onesnot to say crazy. This year, investors are not likely to complain about the lack of emotions, but maybe they will finally see a more calm and "boring" period.

We started the week with growing stocks and further expectations for the famous "pivot" Of the Fedwhich, as it soon turned out, did not appeal to J. Powell, who offered the market a cold shower once again this year. And at the end of the week, China entered the game, suggesting upcoming positive and significant shifts in their approach to tackling covid.

Consequently WIG closed the week with a result of + 5,6%, and the S & P500 fell -3,35%. The dollar strengthened first and then strongly depreciated on Friday. MSCI China stock index increased this week + 11,1% and MSCI Polska + 6,9% (both indices in USD).

S & P500: week with Fed and hiring report

The past week was not successful for US stocks, mainly because of the Fed. S & P500 index fell 3,35% during the week and is only 5,4% above the bearish bottom of October 12.10.2022, 100 (the index rebounded from the XNUMX-session moving average on the day of the FED meeting). Investors' hopes (another one this year) regarding the "pivot", or even pauses in rate hikes by the Fed, were once again shattered by the head of the Fed. The summary of J. Powell's message from the press conference was perhaps best summed up by Nick Timiraos (Wall Street Journal journalist, recognized by Wall Street as an informal "spokesman" for the Fed):

- FED may slow down in December (rate of hikes), even if inflation data do not improve significantly,

- If new estimates of the end funds rate were published today, they would move up (in the Fed's September economic projections this rate was 4,6%)

- Powell is not ready to talk about pause (in pay raises) today.

No wonder US stocks fell for two days after such a cold shower. A similar reaction of the market took place after Powell's speech in Jackson Hole (August 26.08) and after the press conference following the FED meeting in September (September 21.09). It's interesting that stock markets persistently return to the FED "pivot" narrative, and the head of the FED must always "ensure" that stocks fall instead of rising (rising equities reduce the effects of rate hikes by the FED by improving the so-called financial conditions). The situation was rather unthinkable in the days before high inflation.

Indeks S & P500 until 04.11.2022/XNUMX/XNUMX, own study, stooq.pl.

The second important event of the past week is, of course, the American report on the change in employment in October this year. The number of jobs increased by 261 thousand. (above expectations), and at the same time the unemployment rate rose to 3,7% (the first sign of a slowdown). Overall, the report can be considered market neutral, and it was also the last employment report ahead of the supplementary Congressional election next week.

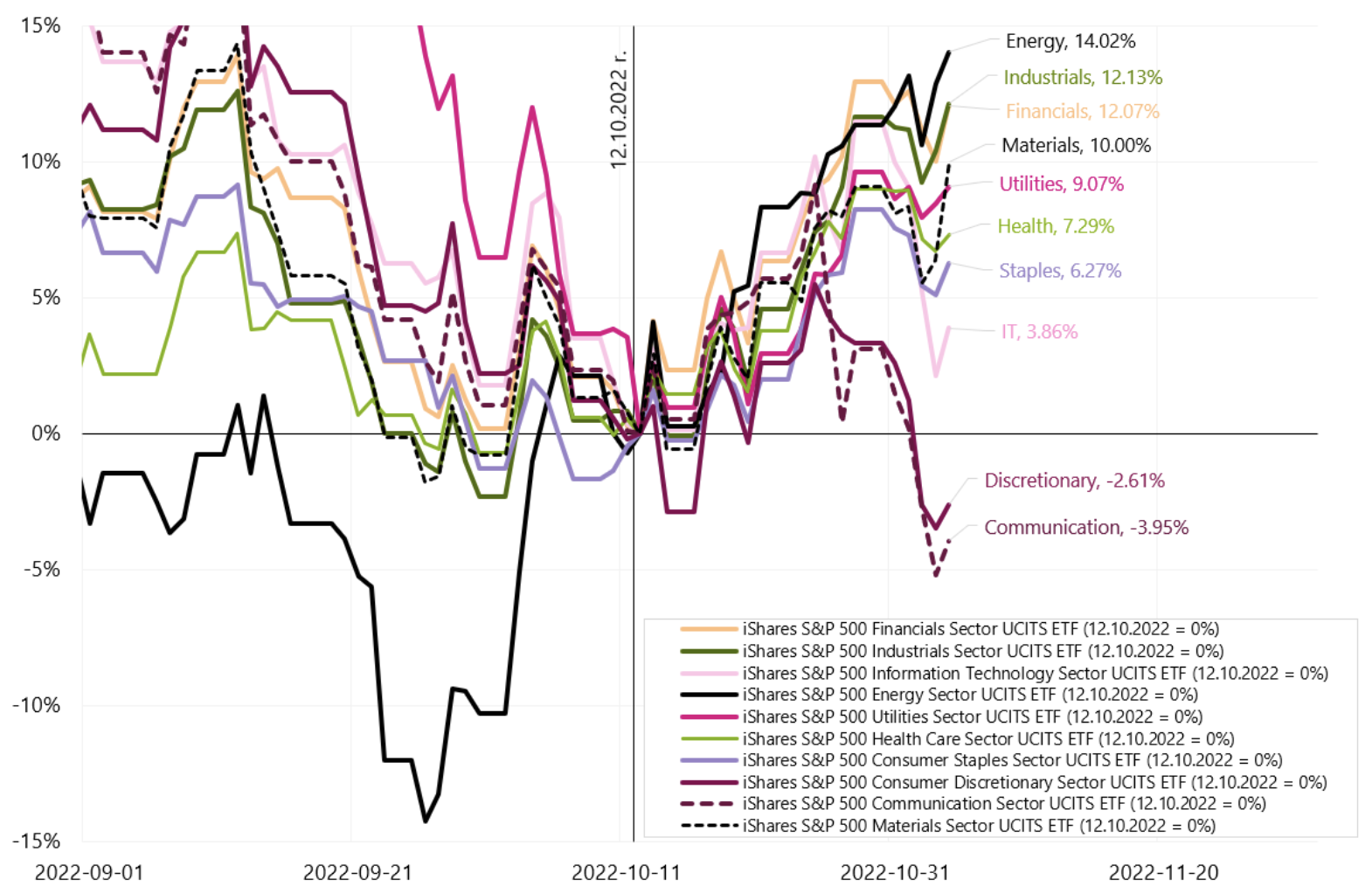

The situation is well reflected by changes in industry indices for the S & P500. Last week, the Energy index increased + 2,40%, Materials + 0,86%, while Information Technology -6,81%, Communication -6,85%, Consumer Discretionary -5,72%. However, since the last trough of October 12.10, the Energy industry has increased + 14,0%, Materials + 10,0%, Utilities + 9,1%, while Information Technology only + 3,8%, Communication -3,95%, and Consumer Discretionary -2,61%. Such behavior of individual sectors indicates rather a bearish reboundand not the beginning of a new bull market. We also have confirmation of higher interest rates and a more hawkish Fed.

Industry index S & P500 until 04.11.2022/XNUMX/XNUMX .. Source: own study, stooq.pl.

WIG strongly up, as did Chinese stocks

Polish stocks have been behaving quite strongly recently, and increases in Chinese stocks and commodities at Friday's session have helped them even more. The WIG increased by 5,6% in the past week and is already 14,6% above the low of October 12.10.2022, 100 (and at the same time we are above the 500-day average for the first time since January this year). In the short term, this is much better than the S & P5,4, which rebounded only 21,4% from the lows (but from the upside the bull market is only -30,1%, while the WIG from the uphill is -17,9%). This is still a very good result for the Polish index, let me remind you that the biggest difference in the decline from the "hill" between the two indices was as much as 1.09.2022 percentage points on 17,3/35,2/9,2. (S&P on that day was -XNUMX% from the hill, and the WIG -XNUMX%). We also “made up” as much as XNUMX points.

If the rebound on Chinese shares continues (for economic recovery, possible economic stimulus and withdrawal to some extent from the current aggressive anti-covid policy), this further rebound on the WIG may go towards the 200-session average (56 points), which at the same time would be close to the resistance line from the local summit on August 265 this year. (16 points). On Friday, we had an encouraging statement by China's chief epidemiologist at the Center for Disease Control and Prevention that Chinese authorities will soon introduce significant changes to their approach to tackling Covid-56.

Indeks WEDGE until 04.11.2022/XNUMX/XNUMX .. Source: own study, stooq.pl.

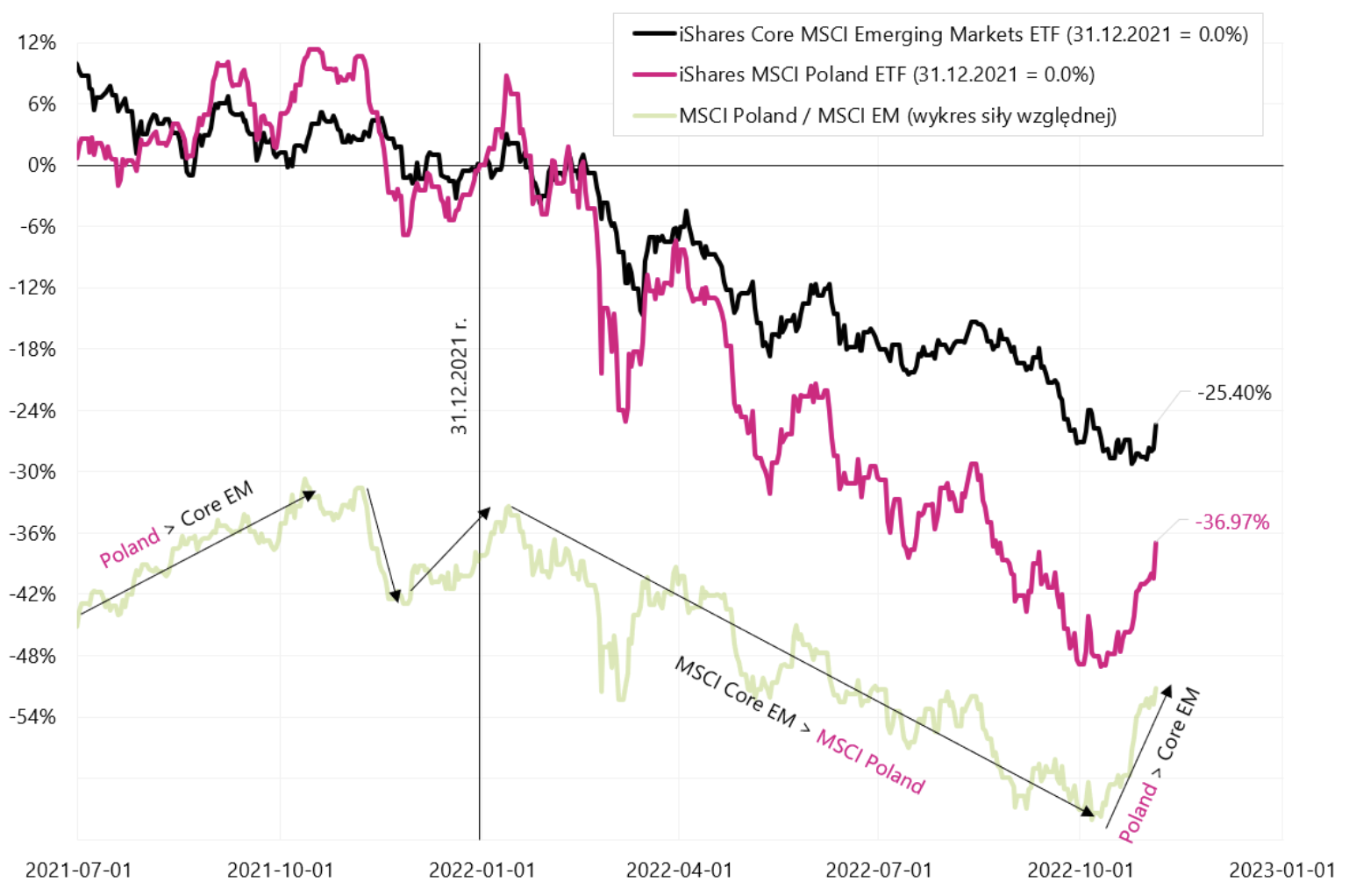

Additionally, for the first time this year, we are experiencing a stronger behavior of the Polish market in relation to the entire segment Emerging Markets. The last time such a situation occurred at the end of the boom at the end of 2021. This only underlines the nature of the current market rebound and expectations related to greater stimulation of growth in China (Polish equities are more sensitive than the entire Emerging Markets market to changes in global sentiment regarding investment risk - as can be seen in the next chart).

MSCI Poland vs MSCI Emerging Markets. Source: own study, ishares.com.

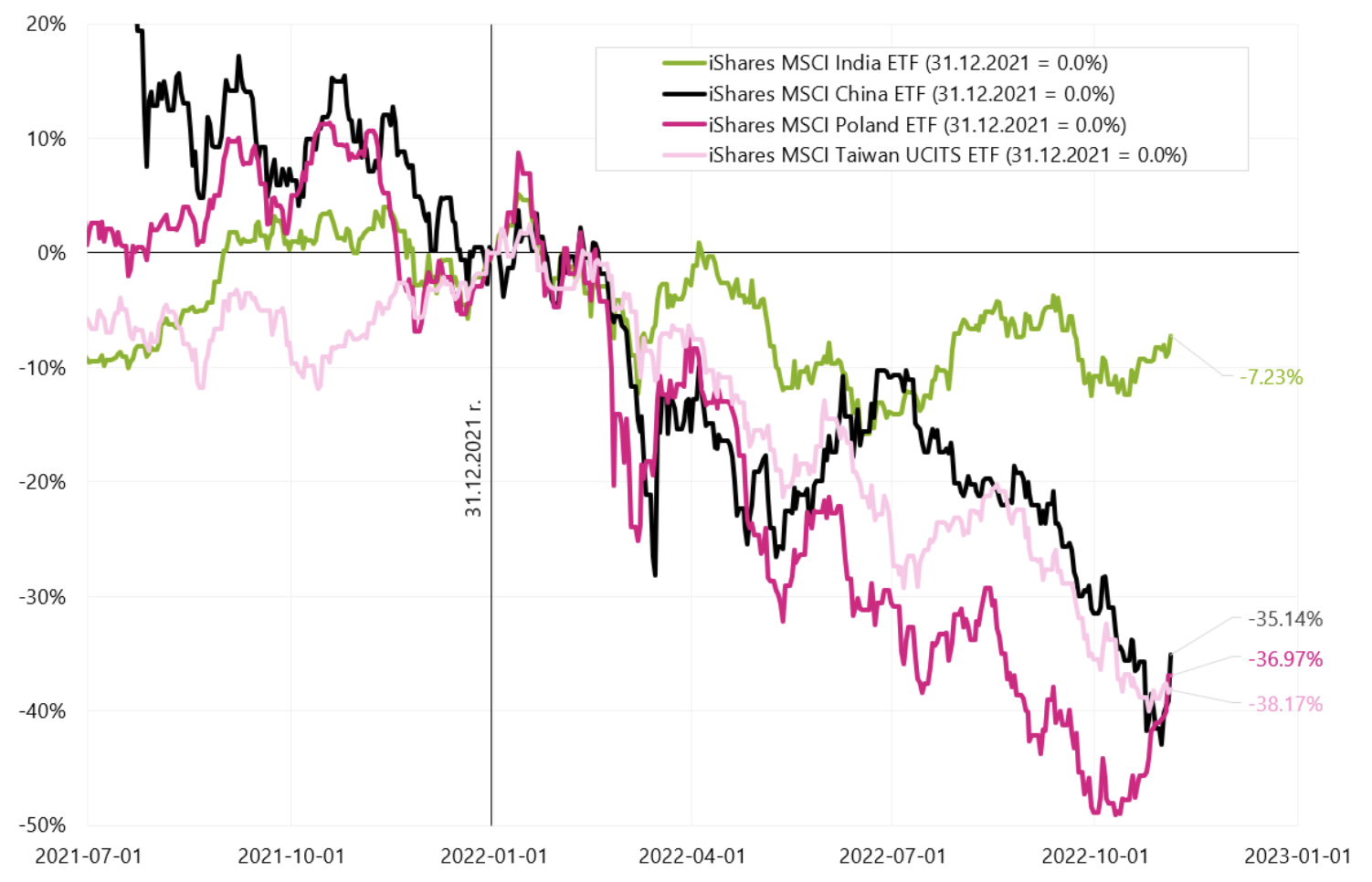

Let's also check how the main emerging markets behave. The next chart shows the changes in MSCI indices for selected countries in the current year. India is only -7,2% this year, while Poland is -36,97% and China is -35,14%. At the end of Friday's session, Polish ETF gained + 5,8%, Chinese + 6,6%, and Taiwan only + 0,36%.

ETFs for selected Emerging Markets countries, change from 31.12.2021/XNUMX/XNUMX. in USD. Source: own elaboration, ishares.com.

The FED is fully comfortable fighting inflation

Another FED meeting and another disappointment for investors. Once again, with the rebound of stock indices from the low on October 12.10.2022, XNUMX, the narrative of yet another "pivot" of the Fed this year began to accumulate, or at least about a pause in raising interest rates. The truth is that if we can talk about some "pivot" of the Fed, it is only from hawkish to more hawkish. Why? Because inflation remains the priority for the Fed, and not supporting economic growth or saving falling stocks (Before Powell's press conference, the S & P500 was at 3894 points, ie “only” 18,4% below the January 3 peak. - and that means "full comfort" for the Fed to fight inflation). With such a level of stock indices and the absence of some "crash" in the markets, the FED does not have to worry about "falling stocks" (which has happened more than once historically). Investors are still in the regime of automatically increasing risk (buying risky assets such as stocks) at every possible mention of the dovish transformation of the Fed. These are mainly the effects of the monetary policy of 2009-2021. Nevertheless, the money from the Fed's liquidity programs does not flow directly to the stock exchanges, but rather investors are willing to increase the risk in such situations (hence the increases in stock prices). But in 2001-2002 and 2008-2009, the additional FED liquidity did not affect investors who remained in the risk aversion regime (hence then we had declines in stock prices despite the dovish Fed).

The FED also has "full comfort" from the macro sidewhere the labor market remains strong (neither the unemployment rate nor first-time unemployment benefits are yet at levels that could make the FED think about a possible pivot). Similarly, the FED also has relatively great comfort from the "political side". It seems that for the Biden administration the current priority is also the level of inflation and not the level of the S & P500 index (let me just remind you what priority for the previous president was the level of the S & P500 index, when we had periods where "every second" of his tweets concerned the stock market).

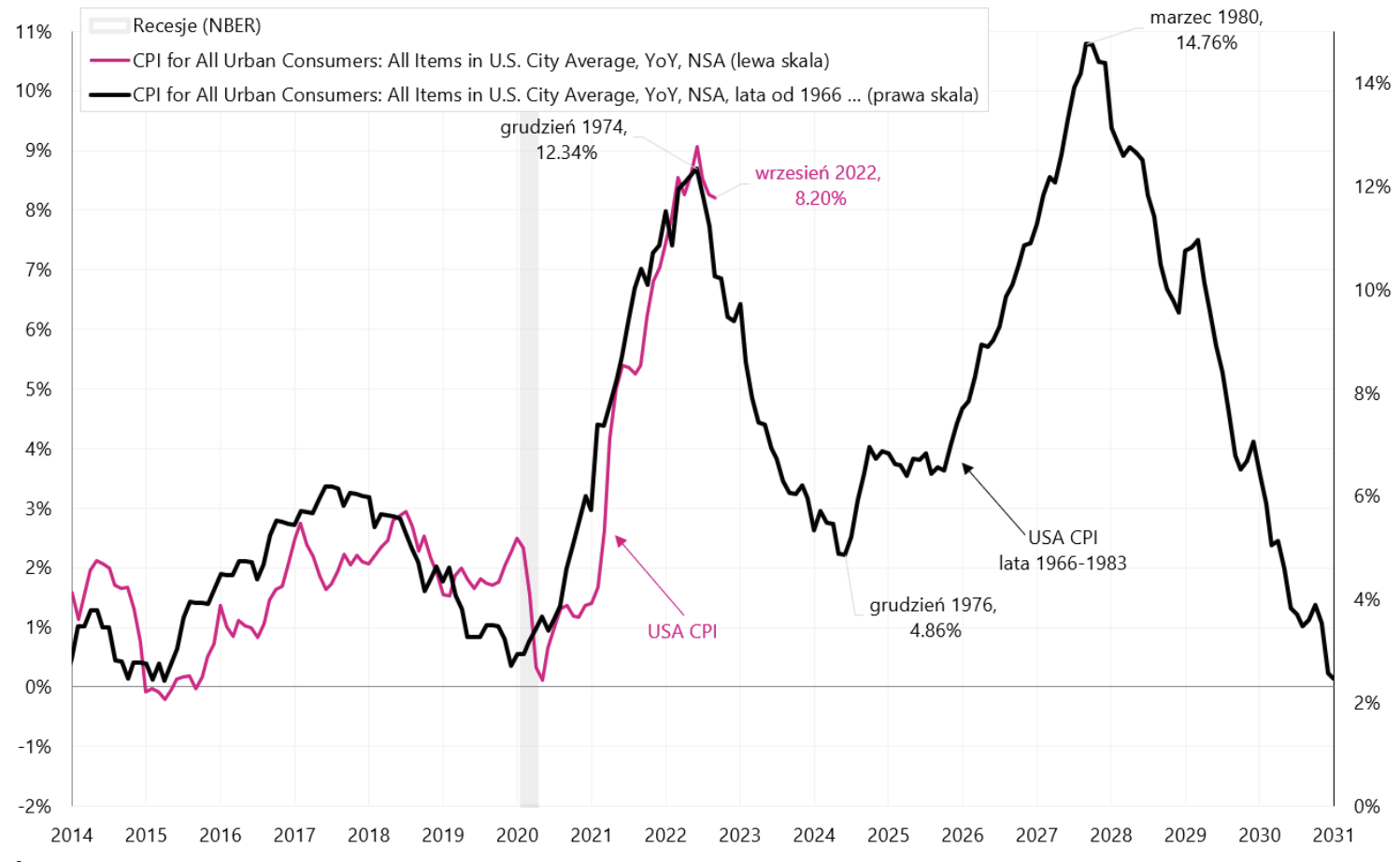

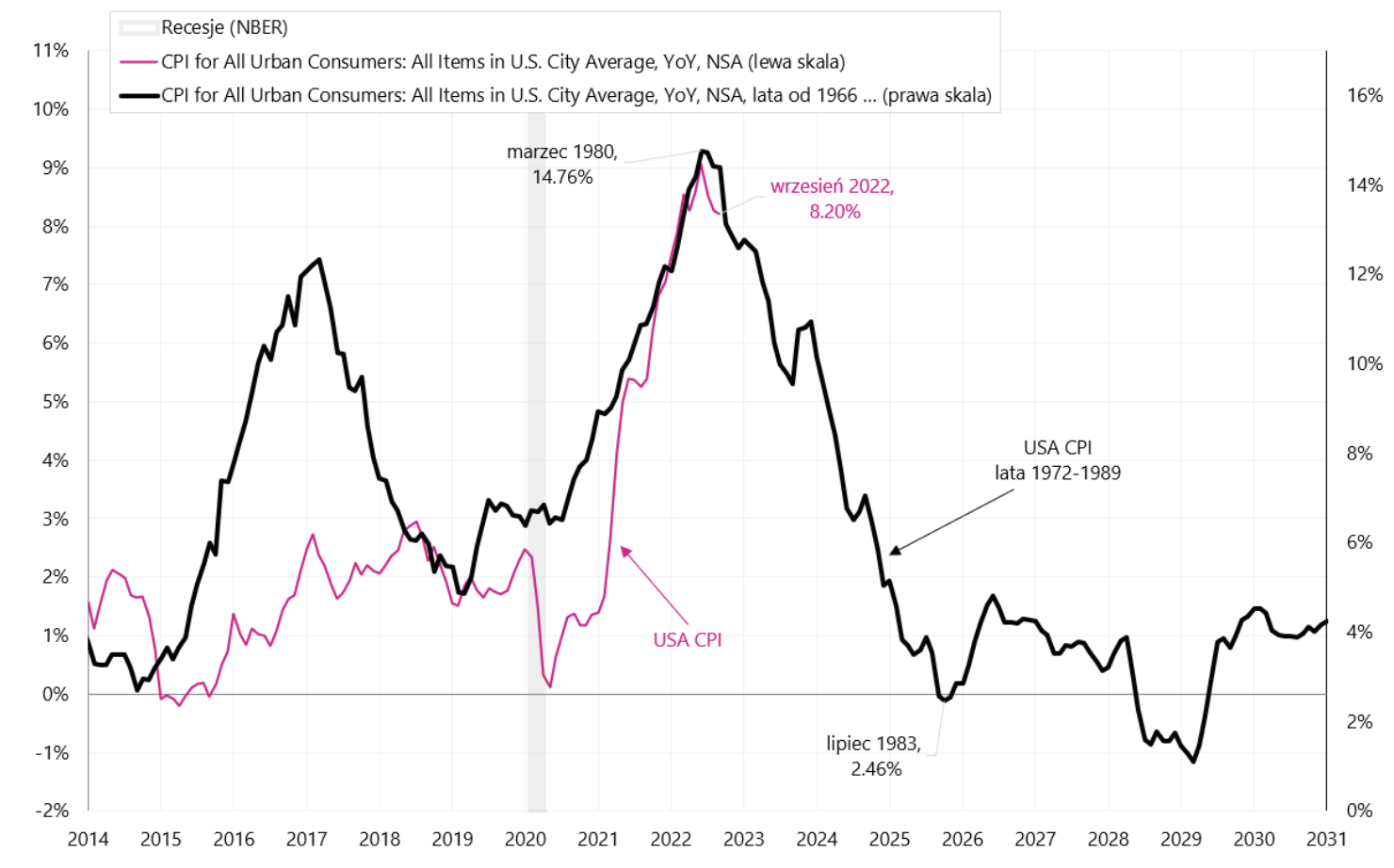

Looking at the stories from the 70s, success in tackling inflation may largely depend on the fact that the Fed can withstand (future) pressures and not cut interest rates too early. Let me remind you that when Paul Volcker was fighting inflation (by raising the interest rate to double-digit levels), he was at the same time "Public Enemy No. 1" in America for this reason. The next chart shows the US CPI inflation from the 70s superimposed on today's inflation - this is a variant of lowering interest rates too early and inflation returning to the second “hill”. Of course, it goes without saying that the scenario with a second inflation "peak" would have a large impact on the behavior of any asset class.

US CPI inflation until 2031 - SCENARIO 1 - The FED cuts rates too early. Source: own study, FRED

But in the scenario of defeating inflation, today's inflation slump (in June this year) would be analogous to the inflation slope of 1980. This scenario shows the next chart.

US CPI inflation until 2031 - SCENARIO 2 - The FED beats inflation without lowering rates too early. Source: own study, FRED

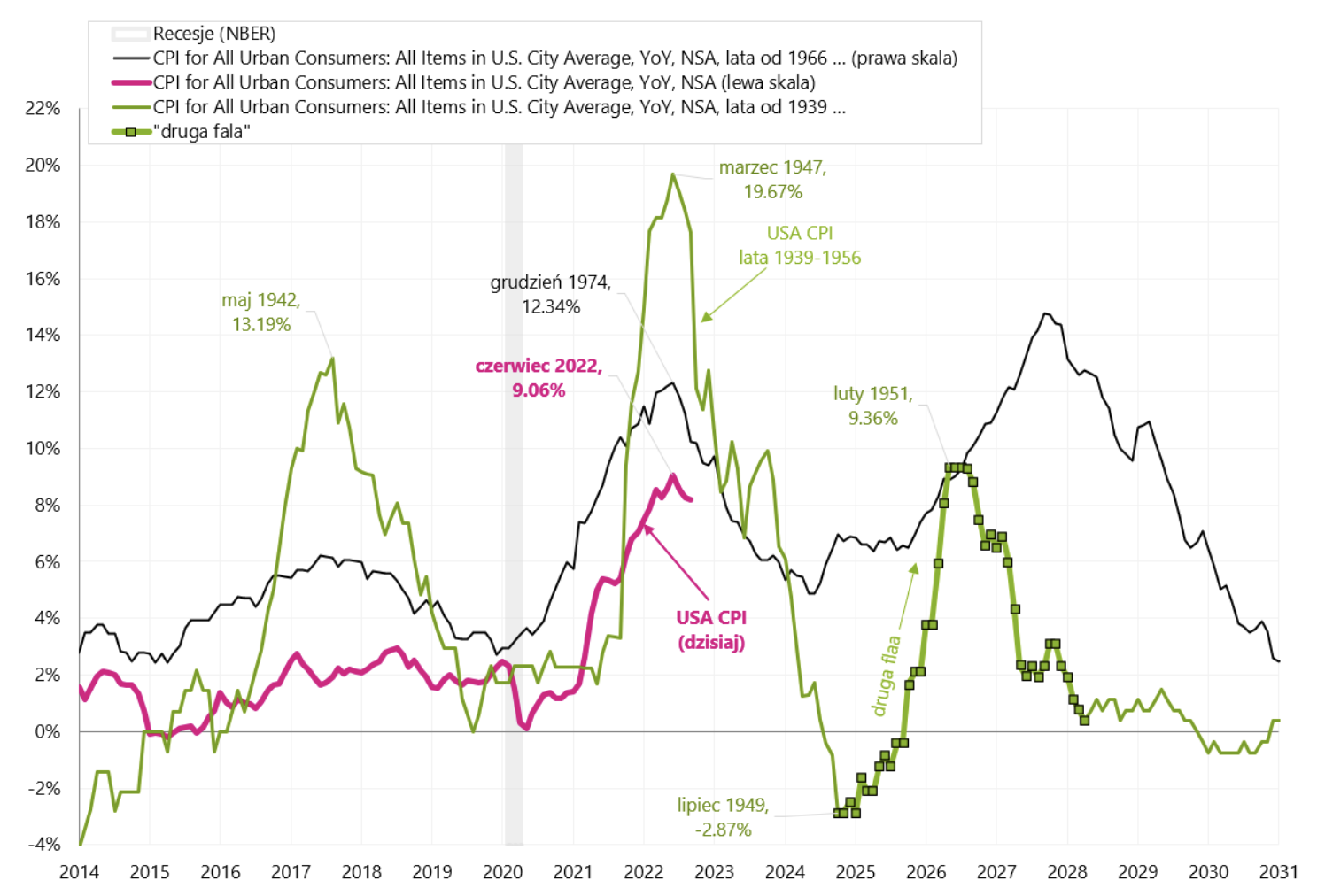

Let us also see another example of high inflation in the US, namely immediately after World War II, when in March 1947 the annual inflation dynamics in the USA amounted to 19,7%. The supply side of the economy did not manage to switch to civilian production immediately after the war and meet the enormous consumer demand for various types of durable goods, which generally led to a rapid increase in the prices of these goods. Additionally, in 1946 most of the prices were released (they were frozen by law during the war). The Fed tightened its monetary policy then, but in a completely different way than today (by limiting the creation of credit and at the same time allowing the market to determine the short-term interest rate for Treasury bills - earlier these yields were also "frozen" for the duration of the war). However that inflation actually turned out to be temporary (also thanks to the actions of the Fed), and its rapid decline in the first place even triggered deflationand then a "second wave" of rising inflation. In the next chart, we compare both inflation in 1974 and 1947 to today's situation.

US CPI inflation until 2031 - SCENARIO 3 - The Fed beats inflation, but we still have a "second lower wave", but not a second peak. Source: own study, FRED

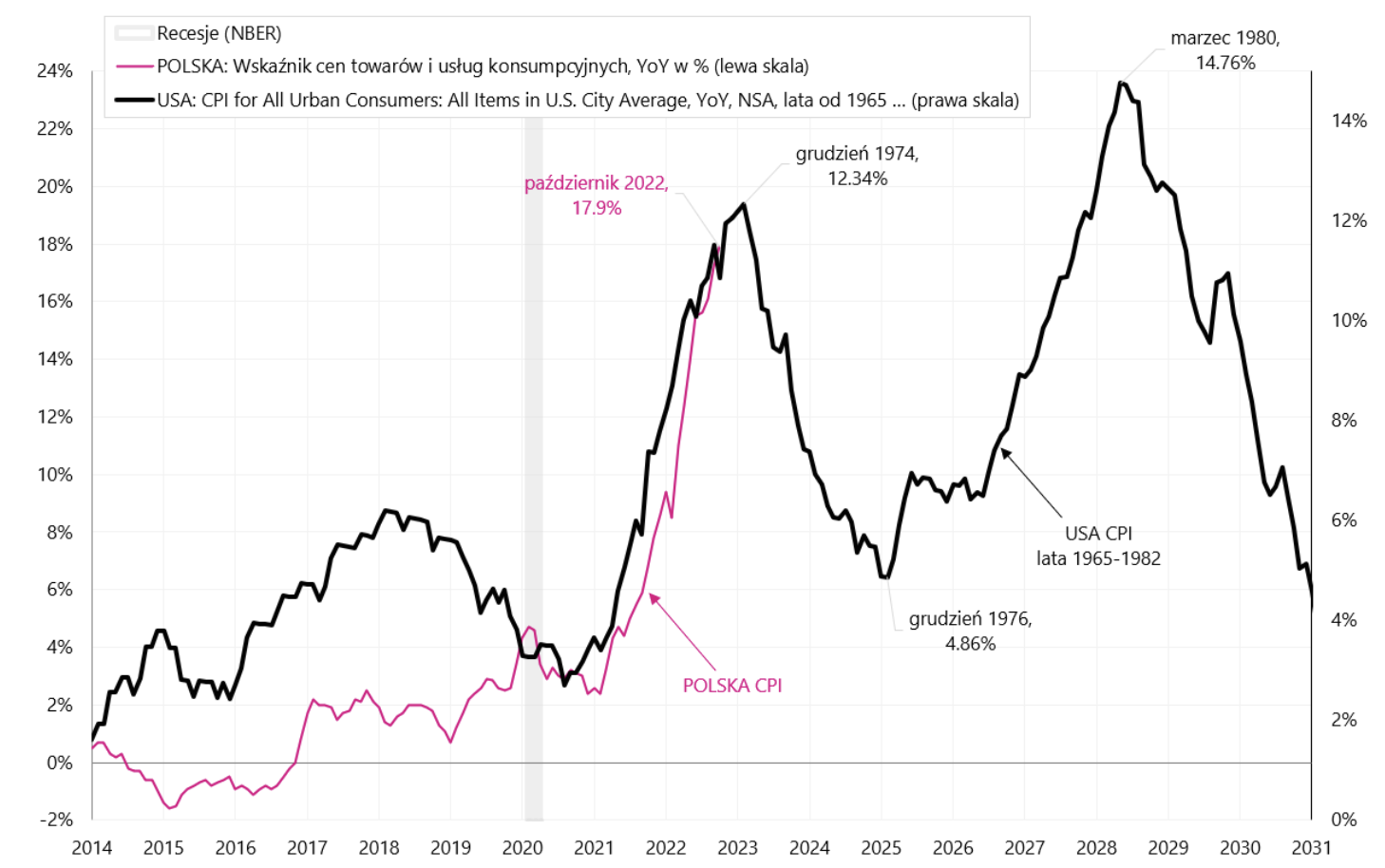

Let's take a look at what the situation in Poland would look like if we cut interest rates too early (i.e. the scenario from the 70s in the USA). The next chart presents Polish inflation against the American inflation in the years 1965-1982.

CPI inflation in Poland until 2031 - SCENARIO 4 - the "hill" of inflation in Poland is February 2023, NBP lowers rates too early. Source: own study, FRED, GUS

Summation

US equities ended the week in negative territory, and Emerging Markets markets, including Poland, were in positive territory (it is rather a rarity in the financial markets).

Once again, the market's hopes for the Fed's pivot turned out to be too early, and the FED intends to raise interest rates further (without a pause) and keep them higher for longer. At least in the short term, we can expect good news from China, which already translates into commodity prices and assets related to Emerging Markets countries. But in the medium and longer term, the US markets will decide about the end of the bear market.

About the Author

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![FED fights inflation, WIG and Chinese indices strongly up [Weekly summary] good mood in the markets](https://forexclub.pl/wp-content/uploads/2020/08/surowce-hossa.jpg?v=1598867832)

![FED fights inflation, WIG and Chinese indices strongly up [Weekly summary] Storytelling company valuation and Aswath Damodaran numbers](https://forexclub.pl/wp-content/uploads/2022/11/Wycena-firmy-Storytelling-i-liczby-Aswath-Damodaran-102x65.jpg?v=1667570808)

![FED fights inflation, WIG and Chinese indices strongly up [Weekly summary] tickmill trader of the month August 2021](https://forexclub.pl/wp-content/uploads/2021/09/trader-miesiaca-tickmill-sierpien-2021-102x65.jpg?v=1632227077)