Flash crash on Turkish lyre - BossaFX and Solution One in conflict

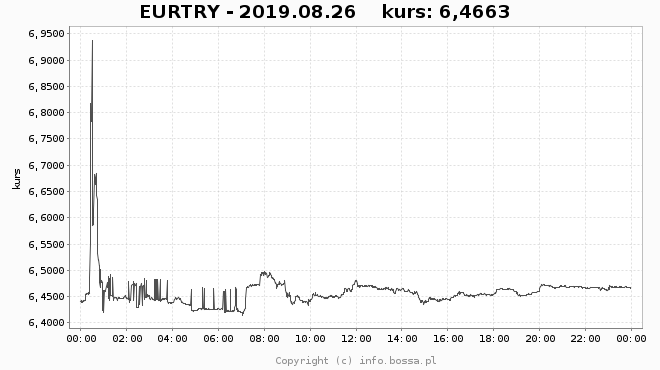

26 August. 2019 so-called currency market flash crash on the Turkish lyre. On this day, EUR / TRY quickly broke by around 10%. As a result of this event, a conflict arose between the BOŚ Bank Brokerage House and the Solution One closed-end investment fund. What is it about, what does it mean and why is it worth writing about it?

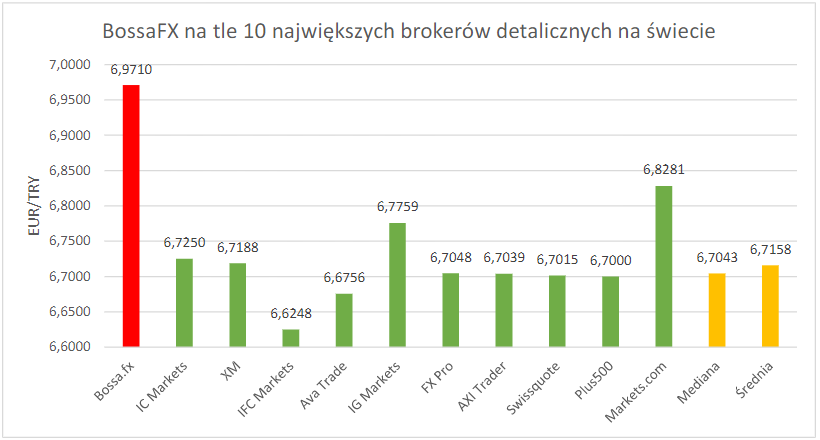

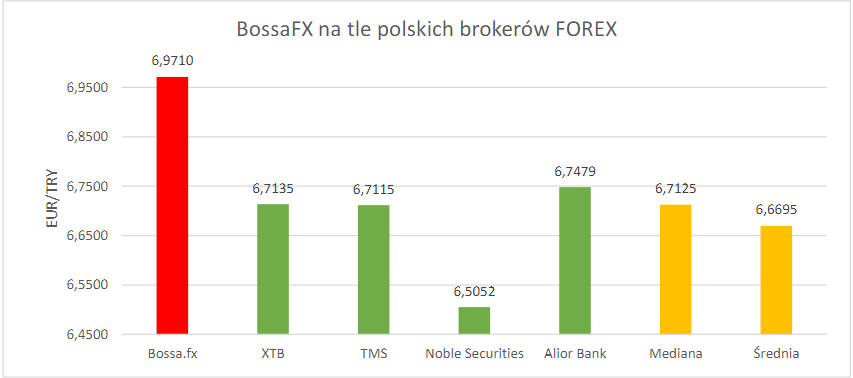

The company accused the broker "Dirty earnings" in the amount of 2 million PLN in just 8 minutes. It was supposed to be the effect of too high quotes of the EUR / TRY pair, which did not occur anywhere else and significantly deviated from the quotations that occurred in competitors. Of course FIZ Solution One represented by Tomasz Piwoński, suffered losses due to previously concluded short positions. We decided to take a closer look at the conflict, analyzing the arguments of both sides.

What is a flash crash

Before proceeding directly to the dispute, it is worth saying a word of introduction, what is flash crash. Flash crash is nothing more than an instant crash on the market, which causes the value of a given asset to change by at least a few percent (usually the effect is short-lived). It is worth noting that it is not only caused by high frequency trading. It is much more often caused by large buy / sell orders. HFT (high frequency trading) is based on algorithms using thousandths of a second.

Quite recently (about a year ago) research was conducted on this type of trade and its impact on flash-crashes. The answer to the question why such situations arise on the stock exchange is usually one large order that breaks down trading at a fast pace. Interestingly, these phenomena occur more frequently on joint-stock companies than on other markets.

Flash crash on the Turkish Lira. EUR / TRY chart, H4 interval. Source: xNUMX XTB xStation

Let's take a closer look at the EUR / TRY chart. At the four-hour interval, we see how her records have survived. It is not surprising that the vast majority of traders who had short positions were thrown out of the market. Let's take a look at how it looked at the slightly lower interval, M15.

Flash crash on the Turkish Lira. EUR / TRY chart, M15 interval. Source: xNUMX XTB xStation

Neither on the chart previously presented, nor does it look optimistic about it (except for the long open positions that were open at that time). So what is the problem of conflict between Solution One FIZ and DM BOŚ Bank? In general, the essence of the whole confusion are too high quotations, which Tomasz Piwoński explained in the reasoning published on the Internet 7-page document.

The Turkish lira has high interest rates, which, combined with low-interest currencies such as the euro, creates an extremely strong incentive to hold short positions on xxx / TRY pairs due to highly favorable swap points.

"Haircut customers"

This is exactly the term Piwoński used in his justification when presenting the subject of the conflict. His complaint regarding the positions closed by DM BOŚ Bank was not accepted. The author of the text indicates that the above-mentioned brokerage house according to its own declarations is Market Maker, in other words earns on the clients' loss positions. The situation described by Piwoński is supported by numerous examples comparing, among others, EUR / TRY exchange differences between BossaFX and other entities operating on the Polish and foreign market.

Be sure to read: Dirty plays of Forex brokers - TOP 5

Contrary to own regulations

The conflict described by the manager of Solution One FIZ between the fund and the brokerage house is also based on accusing the bank of breaking its own regulations and the principles arising from the Code of Good Practice for Brokerage Houses.

"Dom Maklerski BOŚ SA itself provides his regulations that it is required to act in the best, best interests of the client, as evidenced by the provision in the "Regulations for the provision of services by the House Brokerage Bank protection environment SA w trading in Instruments i financial and keeping bills and registers related to this turnover - the OTC market. " Section XV talks about conflicts of interest and how the Brokerage House behaves in such situations. Paragraph 54, paragraph 1, defines how a conflict of interest should be understood. "Conflict of Interest should be understood as circumstances known to DM BOŚ SA that may lead to a conflict between the interests of DM BOŚ SA or persons z nim related, a duty actions by DM BOS SA w way honest, taking into account the best interests of the client, as well as the circumstances known to DM BOŚ SA that may lead to a conflict between the interests of several clients of DM BOŚ SA. " In addition, in a document made available to Dom Maklerski BOŚ SA "Information about the policy of executing orders and acting in the best interest of the Client at Dom Maklerski Banku Ochrony Środowiska SA "there are rules for the correct execution of orders."

In the further part of the 7-page description we can read a few points of the regulations about closing a position at the best price for the customer. Therefore, the accusations that Piwoński directs are based on closing positions at unfavorable prices, which were significantly different from the prices of other retail brokers.

The charts presented in this statement by the "prosecutor" BossyFx based on the BID prices of the EUR / TRY pair from 26 August 2019. Of course, there are not all brokers and all prices available on the market at that time.

Bloomberg BGN index

In response to complaints, BossaFx referred to the Bloomberg BGN index as a tool used to determine EUR / TRY rates. This became another outbreak and an argument that the fund manager used to support his case.

"Dom Maklerski BOŚ SA itself refers to quotations of the Bloomberg agency, in which we will find prices provided by authorized liquidity providers such as Nomura, Morgan Stanley i many others. Dom Maklerski BOŚ SA used quotes presented by the Bloomberg BGN index, which are not a price, but only a virtual indicator, in addition, Bloomberg itself states that the quotation of this index is not jest based on real prices marketable and cannot be used for trading, what we can read in the description available on the website of the Bloomberg news agency: “… the rates presented from the news agency do not reflect the rates, but are only the result of the algorithm as a result of representation based on indicative rates contributed exclusively by market participants. The data is not based on any actual transactions. All data is provided for informational purposes only and is not intended for commercial purposes; Bloomberg does not guarantee the accuracy of the data. "

To enrich the described problem slightly, Piwoński compiled closing prices of other brokers at specific hours. He also presented these sets in a confrontation with Sebastian Zadora (BossyFx representative) on the vision of Comparic24.tv internet television (recording at the end of the article).

"We haven't disabled quotes"

In response to numerous accusations from the manager at Solution One FIZ, Sebastian Zadora emphasized the role of maintaining the continuity of listing on the DM BOŚ SA platform. He added that even the largest liquidity providers suspended EUR / TRY quotations for up to several minutes. Bossa used Bloomberg at that time, thanks to which they could value their own instrument (CFDs are referred to here).

Zadora comments:

"In the most critical moments when liquidity was lacking, we were able to find prices on Bloomberg, but the distribution is very large and at some moments between different suppliers is even half a lire."

BossaFX representative additionally arguing his position, presented a broker chart, which shows a break in trading on EUR / TRY.

According to Zadora, excluding quotations on the market during a "turmoil" proves the lack of liquidity of a given platform and the ability to provide it to customers. By continuing to list, users of the platform can, of course, place orders on the market and possibly modify their positions.

Sebastian Zadora also mentioned that you should not compare the prices of maximum brokers in terms of the entire flash crash, but take into account the quotes with specific "Time stamp". The task is difficult because, as it is estimated, at a critical moment (the moment of the biggest fluctuations), a significant part of the brokers presented by Tomasz Piwoński excluded quotes.

Bad side of the market

To refute Tomasz Piwoński's allegations, Sebastian Zadora added that he was on the wrong side of the market, i.e. in short positions. If he took a different position, "there would be no topic" or complaint, as commented by a representative of DM BOŚ SA As he comments:

"The derivative market has two sides, [...] in Tomek's ranking from 30 August we were losers because there were short positions at the moment."

Moreover, Zadora claims that BossaFX did very well compared to other platforms in a flash crash in the Turkish Lira versus the Euro due to the lack of trading breaks. Thanks to maintaining continuity, it was able to provide customers with the liquidity that was missing on the market - of course, as much as it was then able to.

According to the other party to the conflict, it would be good if BossaFx suspended quotes that day. Tomasz Piwoński emphasized that their suspension would not throw so many customers out of the market, thus their losses would be limited. According to him, the broker assessment criterion is the stability of the quotes and their only during market manipulations.

No resolution

There were always differences in the quotations of brokers on the OTC market. Sometimes they will play in our favor, sometimes they will not. However, in practice these are trace differences that do not affect the large disproportion in any losses or profits of traders.

Be sure to read: Chart differences between brokers - what do they result from?

Ultimately, no conflict resolution can be seen. It is likely that a complaint that has been rejected will not be reviewed and Solution One will have to accept the loss (at least temporarily) and possibly seek legal action. However, a series of questions arise.

- Can a Market Maker broker legally use any quotations that are grossly different from those of domestic and foreign competitors?

- Does the trader have to take into account every circumstance that the broker (or its liquidity provider) will "expose" to?

- And is the continuity of quotes actually a better solution than absolute suspension of quotes during flash crashes?

FIZ Solution One vs BossaFX - Flash Crash on EUR / TRY

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-300x200.jpg?v=1708677291)