How to avoid a conflict of interest with the broker?

Sponsored article

Over 80% of investors who trade daily loses and does not record a profit. Being their contractor / opponent must be an extremely profitable business. The investor's logic tells you that your trading partners do not want to lose or lose. So how do you establish a relationship between you and your broker to eliminate this obvious conflict of interest?

There is a lot of research into the success of active investors. The results of these studies always agree on one point that the clear majority of active investors lose. One study shows that only 34% of investors make a profit. This type of trading accounts for only 12% of the total turnover of all investors. What about the rest?

The rest are one of the most favorite clients of forex brokers, brokers who may be the counterpart of these investors' transactions. Statistically it is a mountain of gold.

The conflict of interest here is quite obvious. Below, we'll explain how to avoid it.

What happens when the broker is a contractor / counterparty in your trade?

Below we will present models and shopping tricks that are used by brokers to profit from the losses of their clients. We will explain in simple terms what position you are in if the broker is the opposite side to your trade.

- Your loss means the profit of the broker and vice versa.

- The broker sees your stop and limit orders (also orders from all other investors).

- A broker or cooperating entity creates a market that sets the price for which you can open / close a position.

In such a situation, the broker can see your cards and can decide when you have to place them.

The metaphor for the casino is well-known and very accurate. The rules of the game are set here in such a way that the casino will not lose.

The market maker sets prices and bid-ask spreads. A wider or extended spread with mark-up has the following impact on your trade:

- Worse entry / exit prices from a position - you start with a higher price than at a narrower spread and when leaving a position, you must accept the price that the market maker currently offers you.

- Starting stop orders earlier and limit orders later - your stop-loss may be affected by fluctuations in the spread width.

- Earlier collateral margin threat - calculated for the current bid / ask, the level of which is also determined by the market maker.

- Price slips - wider spread is a standard indicator of less liquidity, if the liquidity is provided only by the market of the macerator, its size is very important in this case.

In this case, the investor is not able to calculate how much of his profits he gave the market maker for his trade.

Of course, brokers on your site ensure that prices are tracked by basic financial assets. Which means that "prices should coincide" with the prices applicable in larger markets, but ultimately it is a market where the last word always belongs to the market maker. In the trading conditions of such companies, you can often read the phrase "prices are only informative and can change" and similarly.

If the cooperation between the broker and the investor is set according to the above logic, the investor is in an uncomfortable situation. The goal here is not to attribute unfair practices to one or the other broker, but to indicate an obvious conflict of interest.

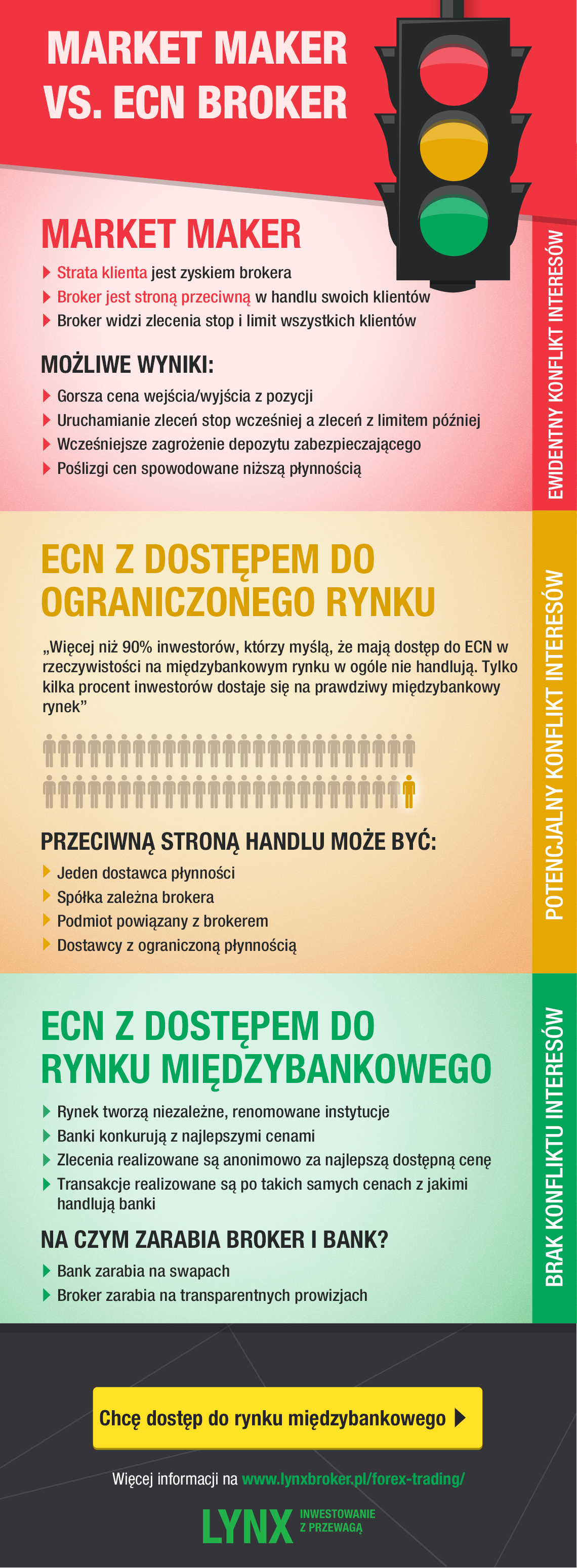

Trading models of forex brokers and their conflict of interest

More than 90% of investors who think they have access to an ECN do not actually trade at all on the interbank market. This means that only a few percent of investors receive the quality of execution that should be provided by an ECN broker.

The attitude to make sure what execution orders you can expect from your broker is to understand his trading model. The specific models are described below.

- Market Maker

The standard example described above, where the broker creates the market, sets the bid / ask level, sets technical terms of trade for customers and is, at the same time, the counterparty / trade partner for its clients. The potential conflict of interest is obvious here.

- STP

Straight-through-processing in free translation means direct processing. This means that customer orders are processed automatically without a manual system. As a STP broker, any broker with whom orders are processed automatically can be technical. There is no potential conflict of interest here.

- ECN with access to a limited market

A large part of the forex community has already realized that if you want to record long-term profit, you need transparent conditions. That's why brokers like to call themselves ECN brokers, because that's what adds a few points to transparency.

But ECN is not equal to ECN.

Why? Because the abbreviation ECN means only the technical setting that the broker your order sends to enforcement to another entity or a number of liquidity providers.

Who does the broker actually send this order to?

Theoretically, it can be only one bank or another liquidity provider. It may also be a subsidiary of the broker or another entity related to the broker.

If at first glance you are unable to answer this question, you have to ask and study deeper. Otherwise, you may find that you are basically in a similar situation as if you were a standard market maker who earns your losses.

A potential conflict of interest may occur even in the case of a broker who at first sight appears to be ECN.

- ECN with direct access to the interbank market

What liquidity providers should the ECN broker have in order to make it really make sense?

Independent reputable institutions. Examples include global banks such as: JP Morgan, Citigroup, Bank of America, Credit Suisse, HSBC, Barclays, RBS and other international banks. In the case of these institutions, it can be expected that they have no (property) affiliation to the ECN broker.

There are so-called collections (pool) in which these international banks trade with each other. We're talking about very liquid international markets. The more large banks and institutions are in this set (pool), the greater the liquidity of the market. What is more, the more varied the liquidity providers group in terms of time zones, the more active the 24 / 5 market is.

Orders in these markets are executed anonymously for the best possible price at any given time. In order for the bank to execute your order, it must offer you better conditions than all other banks and other entities.

In this international market, liquidity providers earn money by competing for your orders with the best prices and earning money on swaps. Broker, through whose orders go directly to this market, earns only on pre-defined transparent commissions. If the broker makes money on commissions, it is in his interest that you trade as long as possible. And only the investor who records the profit will trade in the long-term.

It is obvious that the interest of a real ECN broker and your interest as an investor is the same, the profit of one means the profit of the other. If you make money, the broker is happy that you are successful and you continue trading. Conflict of interest in this case falls out.

Ensure the best quality conditions for investing

From the above it follows that by choosing a broker you have three basic options:

- Market Maker

- Limited ECN

- A real ECN with access to the interbank market

If you want to secure the conditions for long-term successful investing, you should focus great attention on minimizing the possibility of a conflict of interest with your investment partner.

See the summary in the clear infographic below.

Sponsored article

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Market Maker, STP, ECN - What is the difference between Forex brokers? [VIDEO] MM STP ECN V5b](https://forexclub.pl/wp-content/uploads/2021/04/MM-STP-ECN-V5b-300x200.jpg?v=1618421777)