Latency Arbitrage - a tool for trading on "delay" quotes

There has been an advertisement on the web for some time to help us gain an advantage on Forex market. It is soft supporting us in the so-called strategy. Latency Arbitrage, i.e. trade for delays in quotes brokers. By capturing the imperfections of the "slow" broker, based on the quotations of the "fast" broker, the program is to provide us with an almost guarantee of effective trading.

Is it possible? Is this really how you can make money on the "market"? In this article I will try to explain it thoroughly and caution you before buying these inventions. But at the beginning of the introduction to the topic.

Be sure to read: TOP 5 - The most popular scams in the Forex market

What the broker sees

Assuming the possibility of a conflict of interest on the line broker - clientone can assume that in this situation knowledge on the part of the brokerage house gives him some advantage, which he can (but does not have to) use to our disadvantage. It can, for example, interfere in instrument prices, time or the manner of executing orders.

Without being on the other side it is difficult to judge what our broker sees and what not. But we can narrow this area by making a small segregation for what it sees "definitely"whatever "maybe". Due to the fact that he is the intermediary of our transactions, he certainly sees our account balance, what positions we enter and what shares we make on our account. This includes any modification that can be seen in the platform's logos, i.e. setting pending orders, modifying parameters, etc ..

However, it is difficult to say whether he sees what we have in the charts, which are the analyzes we make, which graphs we see, where we most often click, what additional indicators or tools we add to the platform. This is of course probable, especially for applications created by the brokers themselves. The chances for this state of affairs are in my opinion much smaller (almost negligible) in the case of popular mass-licensed products such as MT4 / 5.

Be sure to read: TOP 5 - Dirty plays by Forex brokers

What the broker can not see

Certainly what we have in mind. Let us also make no mistake that he knows the future, knowing which way the market will go. Even if any of his analysts were so sure, they probably would not be an analyst, and a broker would not be a broker but a hedge fund :-).

There is rather no technical possibility, except for a scenario with a possible hacking on a computer /VPS trader so that our broker can see what external software we use. He also does not see the parameters of the strategy that we have set in our EAs or indicators and their possible modifications. And that opens up some possibilities.

foundation Latency Arbitrage

For those who have not heard about it before, briefly what the title strategy is. Delay Arbitration (ang. latency arbitrage) is based on the use of imperfections of brokers whose quotes do not keep up with the market (and visible to other brokers). These phenomena are very rare and usually result from technical factors (server load, delay in data transfer from the quotation provider, etc.).

For those who have not heard about it before, briefly what the title strategy is. Delay Arbitration (ang. latency arbitrage) is based on the use of imperfections of brokers whose quotes do not keep up with the market (and visible to other brokers). These phenomena are very rare and usually result from technical factors (server load, delay in data transfer from the quotation provider, etc.).

For example, due to the publication of macro data, the currency pair rate jumps up by 50.0 pips in 2 seconds. At the broker's "Free" this movement is stretched on the 3-4 second. This gives you a potential chance (1-2 seconds delay) to get to know the situation, compare quotes and open the right position at a price "Late". Of course, in practice it is real to do only with the help of a machine that compares such dependencies in real time, and the milliseconds turn out to be crucial. However, it is likely. And here there is an opportunity to increase the advantage on the trader's side. The vision of knowing the future sounds great, right? 🙂

Advanced means better (latency arbitrage)

The software I saw an ad for "only" $ 785, and that is on promotion. From the perspective of the average retail trader, this is relatively much, but the bolder ones could choose it. After all, it's a recipe for guaranteed success, at least in theory. The website is full of examples, descriptions of activities, videos, statements with thousands of profits and capital curves climbing into the sky ...

The software I saw an ad for "only" $ 785, and that is on promotion. From the perspective of the average retail trader, this is relatively much, but the bolder ones could choose it. After all, it's a recipe for guaranteed success, at least in theory. The website is full of examples, descriptions of activities, videos, statements with thousands of profits and capital curves climbing into the sky ...

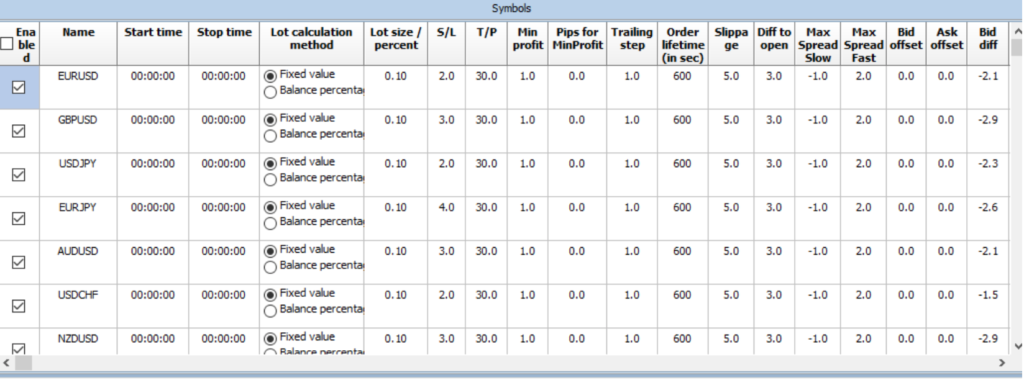

The software itself is to be much more advanced than the "first, better" EA from the network, which only compares prices and opens orders. In itself, it is supposed to be easy to use, thanks to which it can be used by both beginners and advanced. In addition to the additions in the form of automatic money management or trailing stop, there are also options that "mask" the trader's intentions. These are i.a. "invisible" stop losswhether take profit, hedging transactions, artificial / false extension of the position time and a few others. Everything is described directly on the website of the software developer.

Don't be dumber than ... a broker?

Why is not the soft right to act? There are several reasons.

- Availability. The soft itself, which is equipped with the aforementioned broker quote comparison strategy, is easily available and heavily advertised. This means that it has already reached a specific group of recipients who "invaded" brokers from around the world looking for appropriate relationships.

- Time. The movie presenting the action has over 2 years. It's a long time. Do you think that the author of the software that sells them has not used it before? If it worked, why is it selling? In order to maximize profits? Perhaps. But maybe also because the best times are over?

- Purchase. If 800 $ for a retailer is a relatively large amount, then for the broker no longer. The broker himself to be able to protect himself against "Latency Arbitrage Traders"he could buy this program himself and scrupulously work out what to do so that his clients would not be able to use it.

- Development,. Technological progress does not slow down. Access to information, including prices, is constantly improved. This means that the chances of occurrence of any delays are decreasing every day.

- Reality. In most cases, we deal with market execution of orders. This means that regardless of whether we use the services MM, STP or ECN broker, our orders are carried out at the first possible price. With dynamic changes in exchange rates, the chances of a price slippage increase significantly. If you know the price is about to jump 20.0 pips but you will hit 25.0 pip slippagehow will you come out on this? 😉

- Broker. No matter if you know more, you are still in a strange yard. The broker's yard, which is equipped with a staff of people and ... regulations that you must accept when opening an account. Ultimately, it can protect itself against any attempts to outsmart it.

PS the name of the software and www, were not given intentionally, so as not to tempt anyone ... :-)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)