When to consider that our strategy does not work?

Do you know everything about strategies and systems in the foreign exchange market? You have to know when to change it and when it doesn't work ... It is said that consistency is the foundation in trading capital management. It's just that with even the best developed money management and a model of consistency, if we make transactions chaotically, without a clearly developed methodology, the chances of success dramatically decrease. That is why the forex strategy is also important, i.e. a clear diagram of action that tells us when to enter and exit a transaction, as well as when to stop trading and how to act in certain situations.

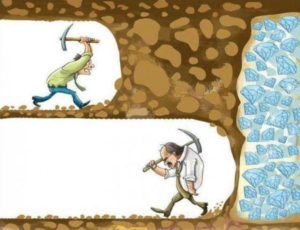

Let us not delude ourselves - there are no ideal systems. Each has its weakest moments. Sometimes these moments are longer than we might expect. Then a dilemma arises - when to recognize that our strategy is not working?

The best forex strategy is ...

After the last an educational article about the ideal indicator, there could be no continuation of the thread referring to a perfect investment strategy. Therefore, also in this topic, I will reveal the truth behind you.

The best strategy is one that ... understand! That's right :-). You're probably disappointed, hoping for a response like: "Scalping PA", "Harmonic Trading merged with S / R", "Breakout trading" or "news trading". Well, each of these strategies can make money. There is one basic condition - it must be in the right hands. Of course, there are more conditions, but more on that in a moment.

The best strategy is one that ... understand! That's right :-). You're probably disappointed, hoping for a response like: "Scalping PA", "Harmonic Trading merged with S / R", "Breakout trading" or "news trading". Well, each of these strategies can make money. There is one basic condition - it must be in the right hands. Of course, there are more conditions, but more on that in a moment.

The basis is to know the strengths and weaknesses of our methodology, to know everything about it, so that you can use it efficiently and not even in the most stressful situations for spontaneous with its parameters. Usually, it is these combinations, that is, the de facto lack of consistency in sticking to the developed assumptions, ruin our account.

READ NECESSARY: Day-trading and scalping - where are the differences and which is better?

Would you go to war without hesitation by completing combat training or weapons training? Exactly ... The more you know about your own strategy, the more confident you are "Battle".

Static advantage

When deciding to use a certain methodology, we must have been guided by something that tipped the balance. The more logical the argument, the greater the chance that our Forex strategy would be successful. It does not matter whether we used ready-made solutions found on the web or decided to create a proprietary system from scratch. There is no one and only right way to multiply your capital on the currency market.

A profitable strategy is a component of several elements that is characterized by a specific:

- effectiveness (ratio of profitable to lossy transactions),

- average profit per position relative to the average loss,

- capital management.

We may be ineffective, but if on average one position generates more than 2 times more profit than loss, we will still make a profit. There is a chance for a reverse scenario - we can take small profits from the market and cut large losses, but with high efficiency, we will still be positive. Ultimately, the quota result will be determined by capital management.

The construction of strategy is about creating a methodology that will give us in the long term statistical advantage with appropriately balanced above-mentioned parameters. Of course, assuming that we will rigidly stick to the established rules.

You need to know when to say "ENOUGH"

Is a series of losses a cause for concern? Not necessarily. I have been trading for 11 years on Forex market. During this time, I have worked through dozens, if not hundreds, of various forex strategies - mainly at the beginning of my adventure with investing. Then it is mainly the systematization of knowledge and the correction of what I use to this day. But from time to time there are new ideas. You can ask a question "Why look for something new if we have a proven system?". The answer is trivial - nothing lasts forever. The market is changing, it is constantly evolving. What works today may stop tomorrow. You, as a trader, need to learn to adapt efficiently to these changes. Otherwise you will be lost along with your capital. Sometimes symbolic changes are enough, and sometimes a general renovation or even a temporary ceasefire is needed.

Is a series of losses a cause for concern? Not necessarily. I have been trading for 11 years on Forex market. During this time, I have worked through dozens, if not hundreds, of various forex strategies - mainly at the beginning of my adventure with investing. Then it is mainly the systematization of knowledge and the correction of what I use to this day. But from time to time there are new ideas. You can ask a question "Why look for something new if we have a proven system?". The answer is trivial - nothing lasts forever. The market is changing, it is constantly evolving. What works today may stop tomorrow. You, as a trader, need to learn to adapt efficiently to these changes. Otherwise you will be lost along with your capital. Sometimes symbolic changes are enough, and sometimes a general renovation or even a temporary ceasefire is needed.

When deciding on the "X" strategy, you must have full knowledge about it. The consequence of using it is one thing, but you must have a plan B. Based on the history, you can statistically estimate how many average losing positions in a row may happen in the future and what capital slide is real but also bearable for your deposit. For this you need to properly choose volume management. If your strategy is statistically a series of 6 losing positions every now and then, and yours "pain threshold" (acceptable overlap) is exceeded after the fifth loss in a row, this means that you have failed and badly manage your capital.

But when to say "enough"? Well ... If you know your strategy like your own pocket, you do everything correctly, do not combine it, you are disciplined, and you choose the transaction volume like a "pharmacist" ... And yet your strategy brings losses in the long term ...

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)