Forex Strategy "At the End of the Day". Summary - weeks 13 and 14

The next trading period is behind us, so it's time to summarize weeks 13 and 14. They were a bit calmer than usual. Especially week 14, where the variability on the pairs I observed was not the biggest. Below we will discuss the most interesting items of the last 14 days.

Profitable transactions

W I described the 3-month summary two open transactions at that time:

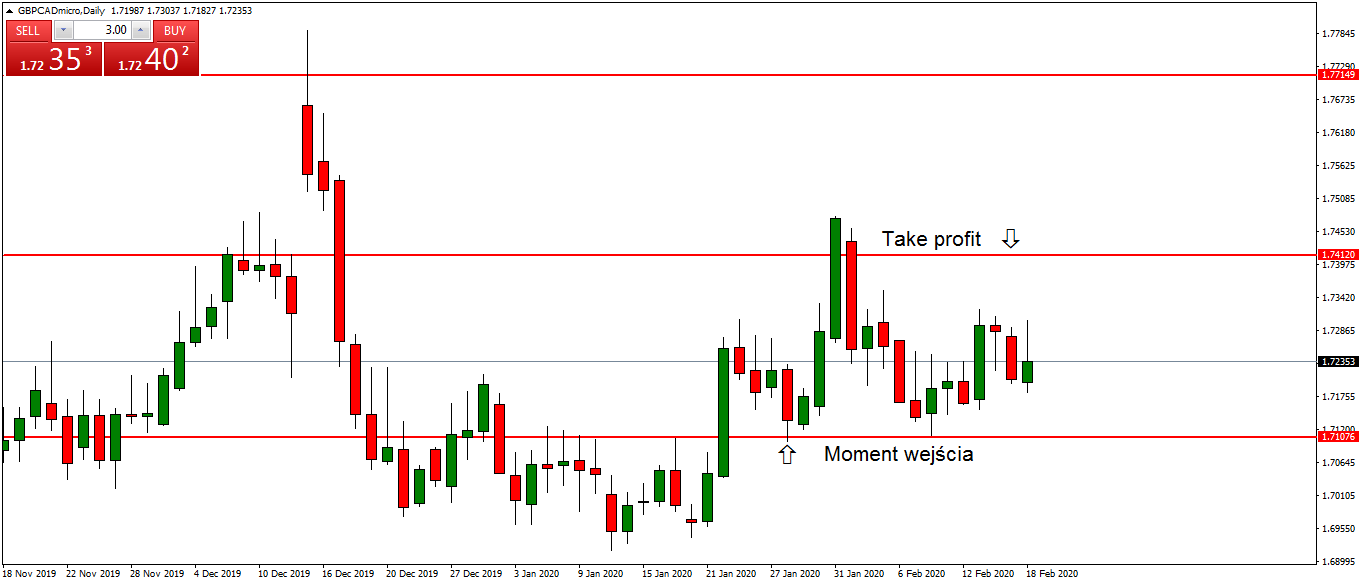

- GBPCAD - long,

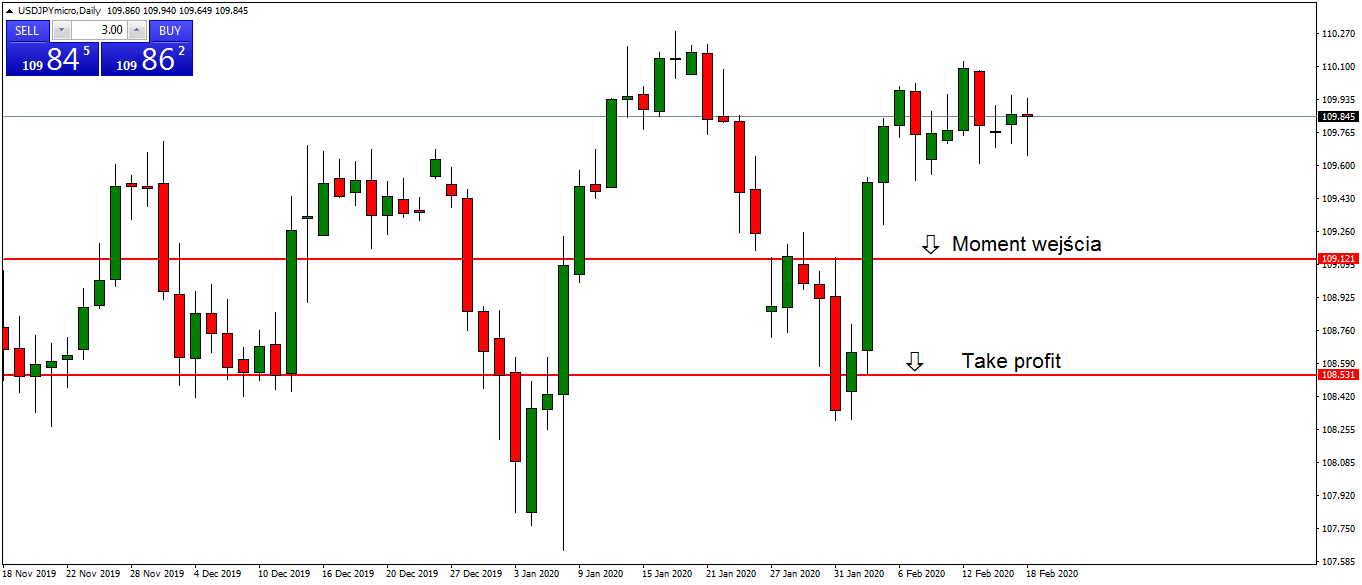

- USDJPY - short.

It was not possible to "pull" as many pips from the market as I had originally expected. However, both GBPCAD and USDJPY brought a decent profit. In both cases, there were quite rapid corrections, which resulted in the closing of both positions. On the screenshots below I have marked the entry moment and the level where take profit was activated.

Short position. USD / JPY chart, D1 interval. Source: MT4 XM

Long position. GBP / CAD chart, D1 interval. Source: MT4 XM

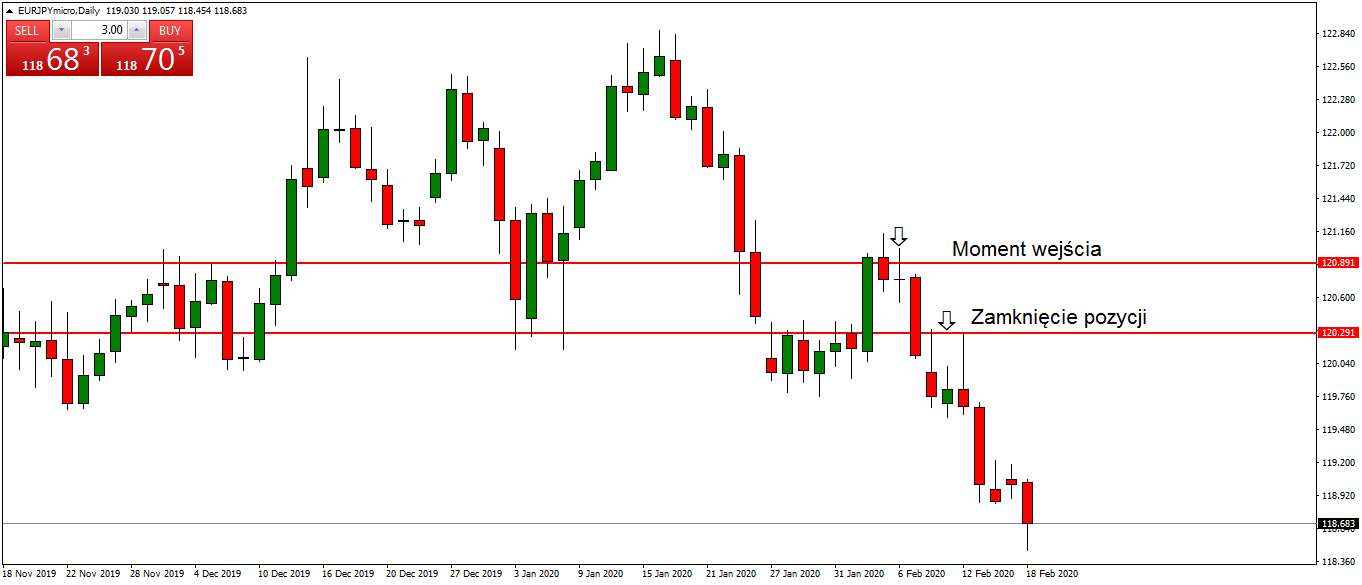

Another interesting transaction that she earned was EURJPY short. I described items in the forum. The main reason for entry was, of course, the downward trend on the daily chart and the clear rejection of the zone in 120.950 by price. The candle had a strong downward significance, which was only an additional confirmation. Unfortunately, I admit that in this case I moved the take profit a little too low, which resulted in the price closing my order and continuing the downward move without my participation.

Short position. EUR / JPY chart, D1 interval. Source: MT4 XM

Lossy transactions

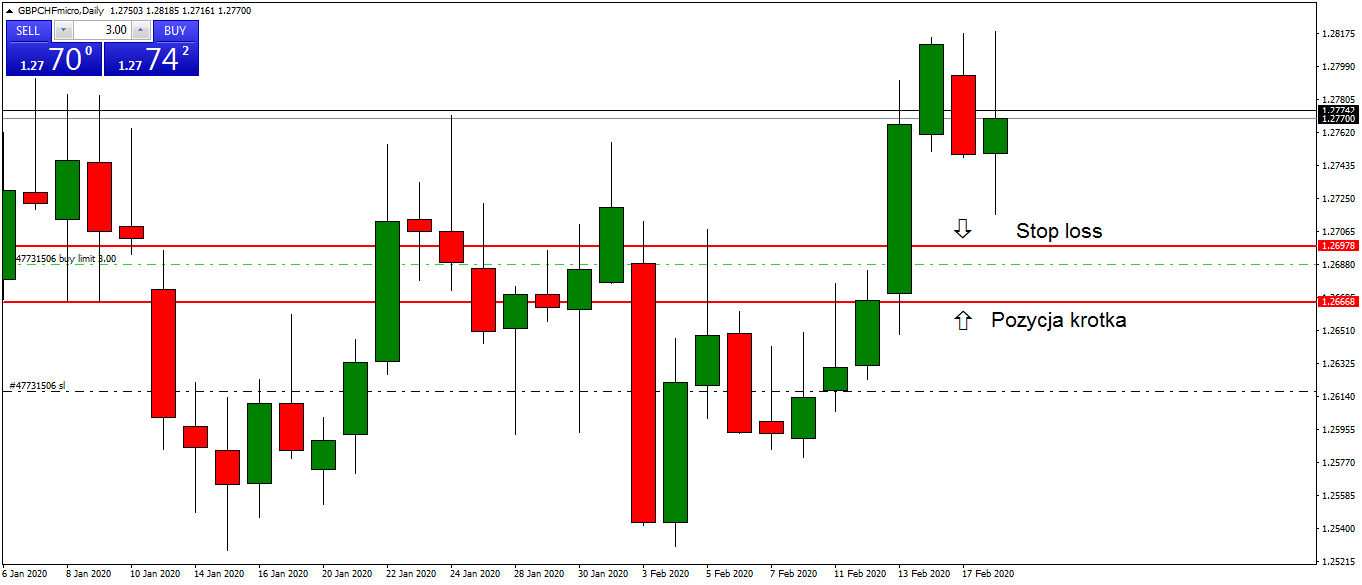

When it comes to positions that have lost, there is no doubt that GBPCHF leads the way. In the past weeks, I couldn't figure out that pair too much. The price oscillated around the key zone in the regions of 1.26750. Gentle upward approaches could be observed, but individual candle closures were still below this level. I was holding a short, but demand finally managed to break this level with a big upward swing. What took place in my opinion changes the sentiment on this pair. If there is a re-test, I will look for a long position. I have already set up a buy limit order in these regions.

Short position. GBP / CHF chart, D1 interval. Source: MT4 XM

I currently have one position open, it's long on EURAUD. It has also been described in detail on forum.

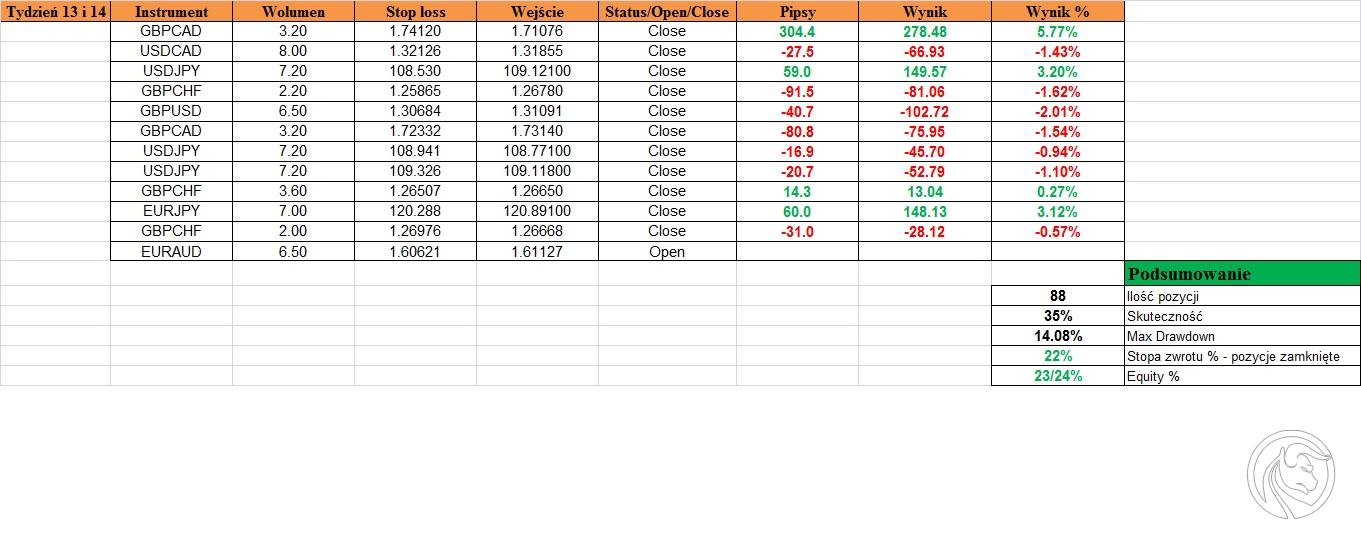

Summation

As at 18.02.2020/XNUMX/XNUMX, the rate of return when looking at Equity is approx. 23-24%, while in already closed positions the rate of return is Present in several = 22%.

Due to the fact that the number of positions has already reached almost 90 and the table has become somewhat illegible, in this list I included plays from week 13. The whole and live results are available of course on MyFxBook profile. The current situation is presented on an ongoing basis forum.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response