Is it worth trading during the Christmas and New Year period?

Trading on Forex during holidays, is it additional opportunities at the end of December, or unnecessary risk and a game not worthwhile? Is it possible, and if so how, to use the end of the year to optimize your investment performance?

Rally of St. Nicholas

Children believe in st. Nicholasand investors in its stock market rally. In December, this is what media market analysts and industry portals live for. What is the title rally? It is also often called "December effect". It refers to the expected increases in company shares at the end of the year. Something like that "Certain", mini-bull market. It is true that in currencies it is hard to talk about the concept of boom, but under the slogan "Forex" more and more often, stock indices are hidden immediately, which are an inseparable element offers from FX / CFD brokers.

But, what theoretically the above-mentioned increases would result from? It is worth splitting it into two parts.

From the perspective of an individual investor, it is waiting for the so-called "January effect", which is to be characterized by rapid growth at the beginning of the year due to the implementation of new strategies and the replenishment of investment portfolios by institutional players. It is in the retailer's thinking an opportunity to hunt down the promotional price of shares before the upcoming probable increases in January. So you can assume that January effect it is to some extent effect of December (how little is missing to fall into the trap and create November effect?).

What should the discounts result from? Here we enter the second part - the activities of institutional investors. The end of the year is the time to clean up their wallets and prepare for the next purchasing plans.

Is the St. Nicholas is a sure thing? Well, the nature of a skeptic tells me to say that only death and taxes are certain. But you can go further - what is the probability of such a rally? I encourage you to study the historical charts of your favorite stock indices yourself to form your own opinion.

Tax "optimization"

Have you had a successful year of trading? Congratulations! What would you say if there is a way to "defer" your tax payment for another year? 🙂 At the beginning, I would like to emphasize that this is a completely legal solution, but it cannot be said that it is not free from flaws and risks. Personally, I am far from recommending its use, so in the context of this article treat it only as a curiosity.

To make it easier to explain the whole mechanism, let us assume a hypothetical situation.

This year we earned PLN 10 on CFD instruments. According to the Polish law, by the end of April of the following year we have time to pay the tax amounting to 000% on the income earned, i.e. PLN 19. However, there is a way not to do this. Or rather - do, but a year later. How? It's easy.

Appropriately, in the middle of December, at its beginning, or even in November, we open two opposing positions on the selected instrument of equal volume (so-called hedge - e.g. EUR / USD 1 lot sell, 1 lot buy). After some time, unless we hit the middle of the consolidation, one position will generate a substantial profit, and another equally significant loss.

The trader's task is to enter the market at the optimal time, calculate the loss necessary to optimize and close the loss ... just at the end of the year. Such a loss should as much as possible "eat up" the profit achieved in a given year, which in this example should be as close to the amount of PLN 10 as possible. The next task is to close the profitable position immediately after the market opens in January, where the profit should also oscillate around PLN 000.

What does this give us? In accordance with the domestic tax law, the settlement is made for transactions closed in a given calendar year. This means that we transfer the previously earned PLN 10 to the next year, closing one profitable transaction on January 000nd, for which we will have to settle accounts only by the end of April, but a year later.

It is not a perfect solution

There are two risks. First, there may be a price gap between the December close and the January opening. It is an option to include an additional, unplanned loss. But of course - it can also be a bonus in the form of additional profit. We can protect ourselves against this by re-opening the position in the opposite direction, although it generates an additional cost.

The second risk is the costs incurred and the proper entry into the market. This type of optimization costs us twice the spread (+ possibly commission) and the difference in swap points throughout the time of their holding. The larger the volume, the greater the chance that we will achieve a correspondingly large loss, but also higher commissions.

YOU HAVE TO SEE: Forex Taxes - Everything You Need To Know

On the other hand, the lower the hedge volume, the safer. Only in this way can we reduce the costs incurred. However, it increases the risk that the planned loss, due to a poor market entry point or low volatility, will turn out to be much smaller than needed.

What do these combinations give us? The advantage is first of all the fact that the generated profit may work for us the next year, and if it turns out to be less successful, it will automatically reduce our tax.

Breaks in trade, decrease in liquidity

Optimistic accents are behind us. It's time to get down to earth :-). In addition to potential opportunities, both to "Secure, quick earnings"And "Tax savings"also a more certain reality comes.

It is a fact that liquidity on the stock exchanges is noticeably falling between Christmas and New Years. This also applies to the currency market. Additionally, if public holidays fall in the middle of the week, the trading schedule also changes, which sometimes creates a little confusion. The decline in turnover results mainly in widened spreads, also on the main instruments. It happens that the chosen ones Market Maker brokers they are able to introduce fixed spread values for selected instruments, which they consider to be "safe" (in the context of order execution and securing transactions on the market). Not so long ago it was standard.

The chance of price gaps also increases - both immediately after Christmas and at the first session in the new year.

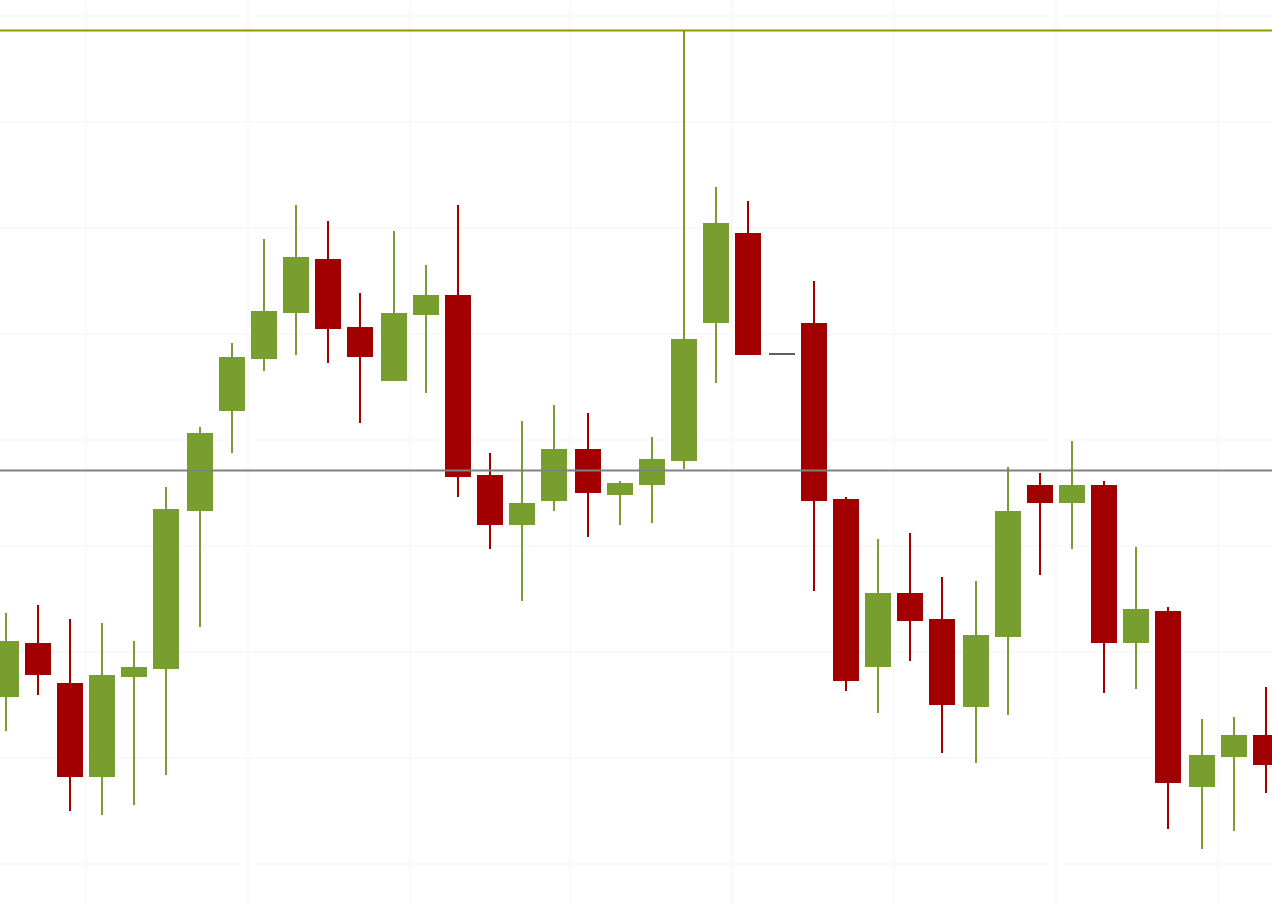

How is volatility? Practice shows that Usually it is small. So we get higher fees combined with a drop in the fluctuation range - that sounds daunting. However, the reverse also happens, where it is the lower liquidity that makes it easier to move the market rate. Over the last 15 years, various interesting situations can be observed on the historical charts (e.g. a sudden jump in the rate by xx pips in the middle of the night in both directions; low volatility just before Christmas and an increase in the amplitude of fluctuations immediately after Christmas). Just like that, without any macro data, political events or magic patterns on the chart.

EUR / USD chart. Candle D1 on December 27, 2013, breaking a new local peak. Price increase by 209.0 pips (+ 1,55%), shadow at 144,4 pips.

It is worth, is not it worth it?

The Christmas and New Year period is, above all, hope and increased risk. These are the conditions for trade that only favor those who know what to do. So if you know what to do, you don't have to wonder "is it worth it". And if you don't know ... Isn't it better to devote this time to your family? 🙂

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club Tax 8 - Settle Forex tax in 5 minutes [Video] forex club tax 8 video](https://forexclub.pl/wp-content/uploads/2022/04/forex-club-podatek-8-video-300x200.jpg?v=1649947587)