Gazprom - zloty - panic

The information about the suspension of Russian gas supplies to Poland triggered a strong sell-off of the zloty. A gas that Poland wanted to give up anyway. The FX market seems to overreact.

A wave of sell-off of the Polish currency

This news fell like a bolt from the blue, triggering a strong sell-off of the zloty and breaking the EUR / PLN rate from the consolidation lasting almost a month. It seems that the FX market has reacted, but the milk has already spilled, so it will take some time for EUR / PLN to return to around PLN 4,65.

What happened. Firstly Onet reported that Russia has suspended gas supplies to Poland. Later this information was officially confirmed by the state-owned PGNiG, who received a letter from Gazprom that from 27:08 on Wednesday, April 00, gas supplies to Poland under the Yamal contract were suspended.

Is the situation dangerous for the Polish economy? Not completely. Poland wanted to give up Russian gas by the end of the year anyway, the heating season in the country is about to end, and the gas storage facilities are largely full. Additionally, it can be expected that in such a situation the US will provide extra gas supplies to Poland as an extraordinary measure. So the situation is not very comfortable, but it is generally good and there may be no negative impact on the economy. Neither industry nor inflation.

However, financial markets have their own rules. It was strong and, above all, unexpected an impulse, there is then a reaction. The EUR / PLN exchange rate soared from PLN 4,6571 to PLN 4,7096 in the first reaction, and then for a moment even exceeded the level of PLN 4,72.

EUR / PLN 5-minute chart. Source: Tickmill

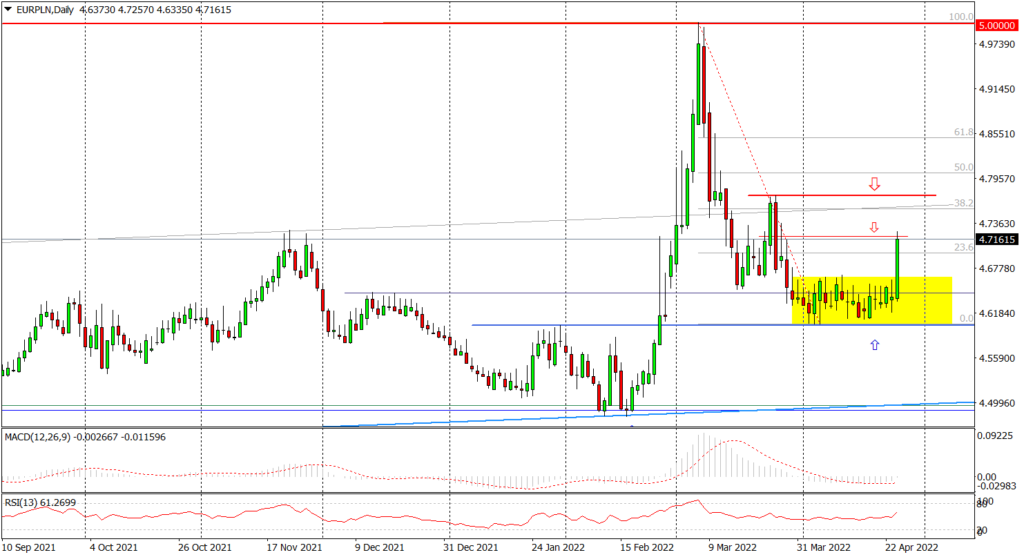

The upward move was additionally driven by the breakout of EUR / PLN from the consolidation lasting almost a month in the range of PLN 4,6037-4,6654. On the basis of technical analysis, such a breakthrough from consolidation opened the way to the resistance at PLN 4,7185. And today it has been achieved. If the situation does not change by the end of the day, then the dynamics of the upward movement on EUR / PLN makes it necessary to take into account a further increase. Until the next supply barrier at PLN 4,7733. However, going higher can be problematic.

EUR / PLN daily chart. Source: Tickmill

Emotions rule the markets but ...

Sale of the zloty in reaction to the closing of the gas tap by GazpromIn a situation where Poland is prepared for such an eventuality and intended to give up Russian gas by the end of the year, it seems to be greatly exaggerated. However, the milk has spilled and it may take time for the market to come to similar conclusions and return to pre-break levels.

There is one more important thing connected with today's discount. It can be assumed that if the zloty continues to depreciate in the coming days, it will National Bank of Poland he will consider it a factor threatening the stability of the Polish currency and will intervene in the currency market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response