The Central Statistical Office published the data. Inflation is back on the rise.

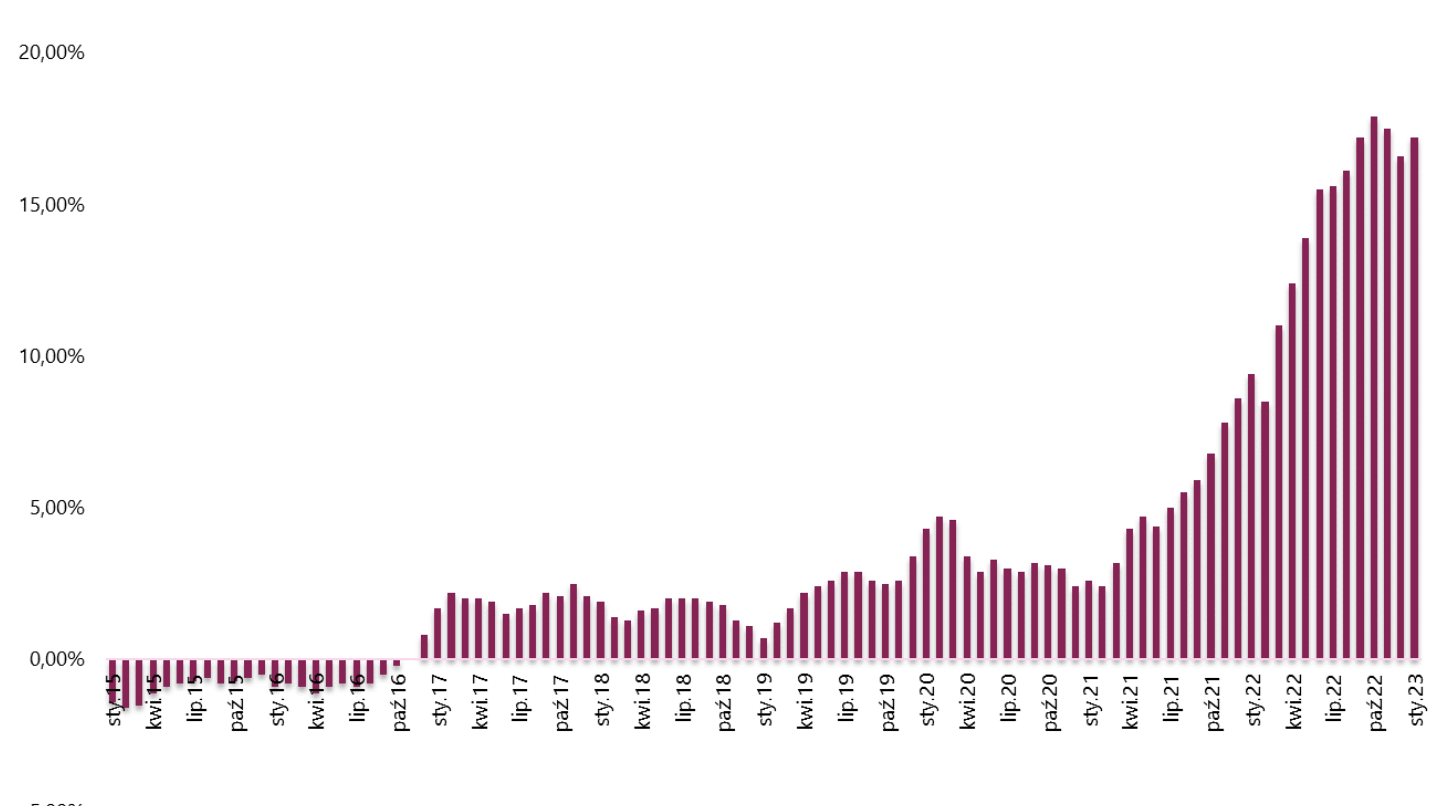

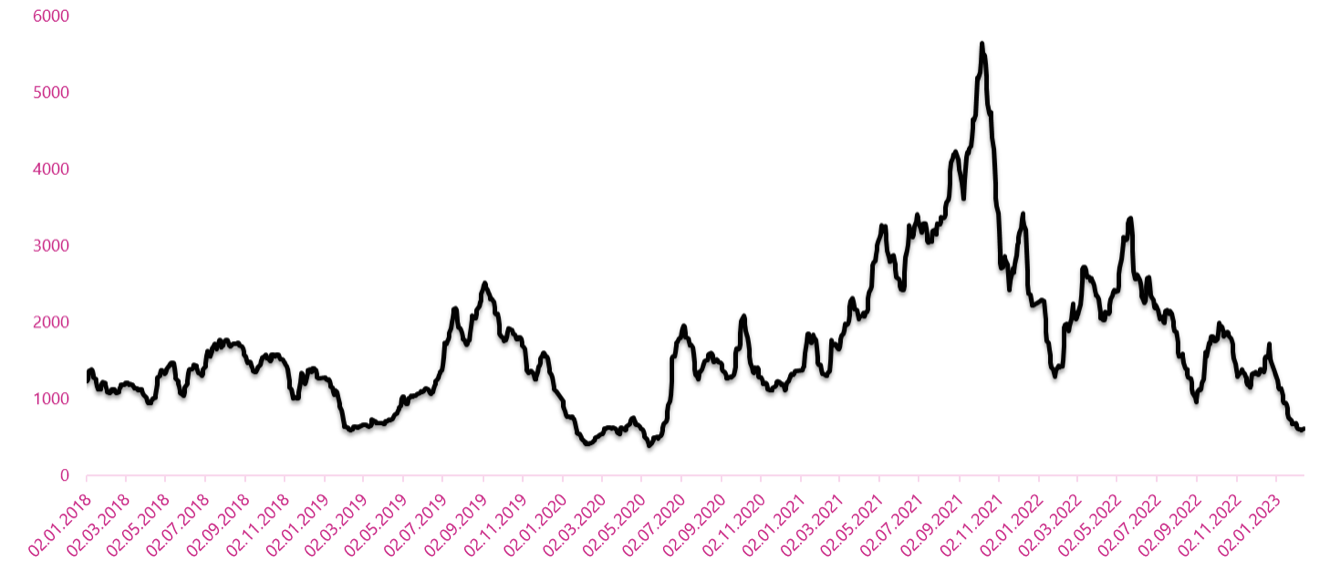

Inflation readings have been attracting the attention of a large part of society for months, arousing a lot of emotions. It was no different with the first reading for 2023. The January data broke the streak of declining inflation dynamics in Poland, which was not a surprise for careful observers of economic life. Inflation rate according to data presented by Central Statistical Office amounted to 17.20%, slightly below the maximum of the current trend.

CPI inflation in Poland since the beginning of 2015. Source: Own elaboration based on GUS data

Price increase in all categories

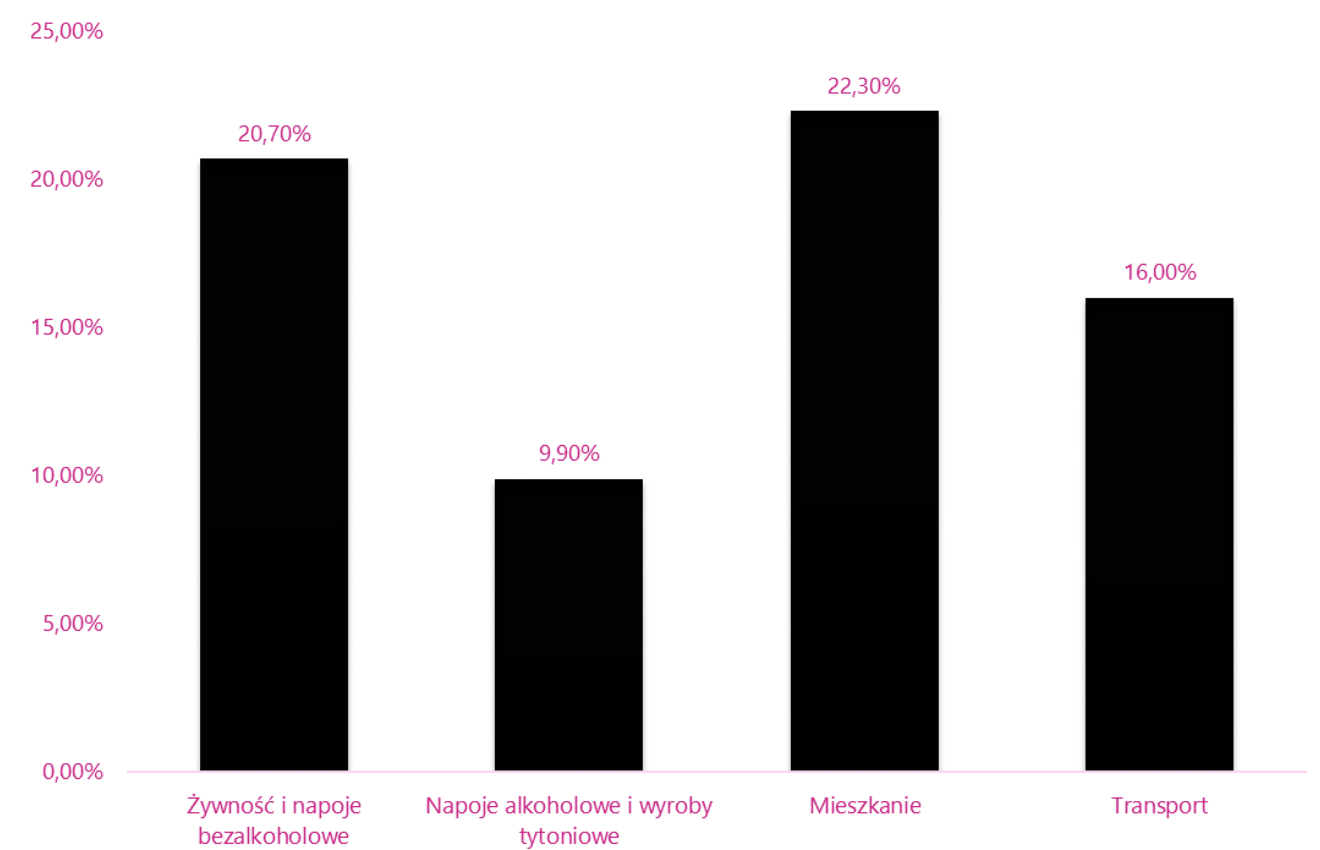

The beginning of the year is usually the moment when new price lists are introduced, and a large part of administratively regulated prices is also determined. Undoubtedly, also in 2023 we were dealing with a similar phenomenon, which translated into acceleration of inflation dynamics. Taking into account the structure of the inflation basket, for many months the greatest contribution to the high level of inflation has been made primarily by two categories - food and non-alcoholic beverages, as well as the use of a flat or house and energy carriers.

Together, these factors account for over 45% of the inflation basket, and the dynamics of changes in annual terms for both categories is the highest. Prices of food and non-alcoholic beverages increased in January at the rate of 20.70%, and the change in prices for the group of flat or house use and energy carriers amounted to 22.30%.

Inflation in individual categories in January 2023. Source: Own study based on Central Statistical Office data

Other categories also contribute to inflation. Each of the groups is characterized by values significantly exceeding the level of the inflation target, which indicates that inflation spreads over all components of the basket.

Poland is not alone in the current inflation trends. Similar trends can be observed in other countries of Central and Eastern Europe. Suffice it to say that the price index in the Czech Republic accelerated in January from 15.80% to 17.50%. At the same time, a very high dynamics was recorded on a monthly basis, amounting to 6%. The largest contribution was made by administratively regulated prices, which accounted for over 75% of the monthly increase in inflation. The rapid increase resulted mainly from electricity prices for households, which increased by as much as 139.80%.

The acceleration of inflation was also characteristic of the Hungarian economy. The index in Hungary reached a 27-year high of 25.70% in January. The record values were largely due to the adjustment of the inflation basket. The increase in the share of food and other goods (including fuels) translated into a continuation of the negative trend. In the case of food, price dynamics remains at a very high level, currently amounting to 44.00%. However, there is a high probability that inflation has reached its peak, and one of the elements limiting inflationary pressure is the significant strengthening of the Hungarian forint observed in recent weeks.

Hope for a decline in the inflation rate

Inflation in Poland oscillates around the levels recorded in October 2022 (17.90%). Taking into account the conditions of the economic environment, inflation may increase further in February, after which the index has a chance to decrease permanently. The hope of breaking the negative trend results from a combination of several factors. First of all, at the end of February and March last year, we were dealing with a price shock resulting from the start of the war in Ukraine. The resulting high base effect will be conducive to curbing inflation dynamics.

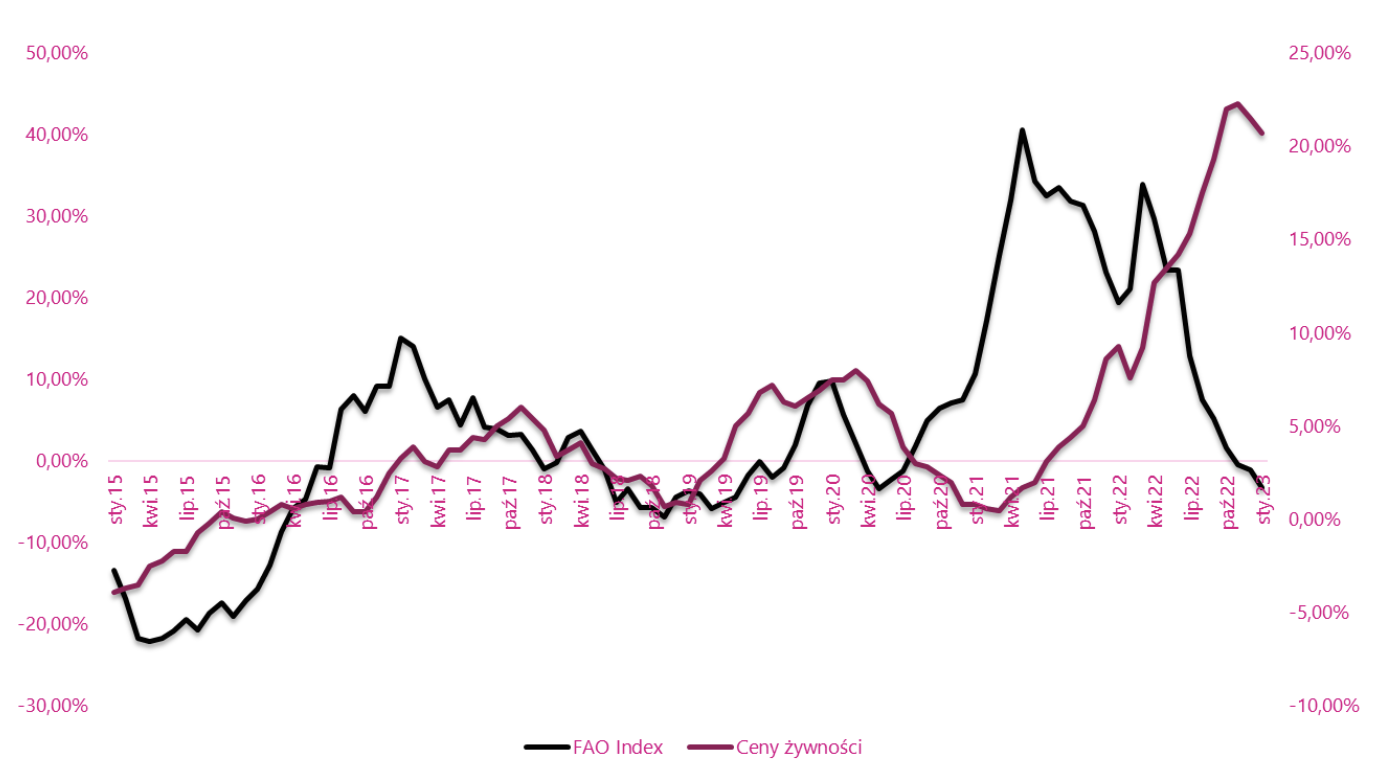

It is also worth paying attention to the factors occurring in the wholesale markets, which should reduce the price pressure over time. The global situation on the food market is reflected in the FFPI (FAO Food Price Index). In January 2023, the index recorded its tenth consecutive decline, reaching 131.20 points. This means that compared to the peak set in March last year, the scale of decreases has already reached the level of 28.60 points, i.e. 17.90%. Over the past month, a drop in the prices of vegetable oils, dairy products and sugar has been observed. On the other hand, the prices of cereals and meat remained stable in this period. Last year's price shock, which affected vegetable oils and cereals the most, was fully neutralized. Suffice it to say that the index of vegetable oils at the turn of the first and second quarter of last year exceeded the level of 250 points, and now it drops to 140.40 points. A similar trend is observed in the case of cereals, which are 4.80% above the level from the beginning of last year, but current prices are clearly lower than in the second quarter of 2022.

Food prices in Poland and % change of the FFPI index. Source: Own elaboration based on GUS and FAO data

The evolution of the FFPI index is not the only element affecting food prices in Poland. Taking into account the historical link between the FFPI index and price dynamics, it should be stated that the adjustment of food prices occurs with a delay. Taking into account the current situation on the food market, it seems a matter of time for prices to adjust to global trends, which may significantly translate into a decline in consumer inflation.

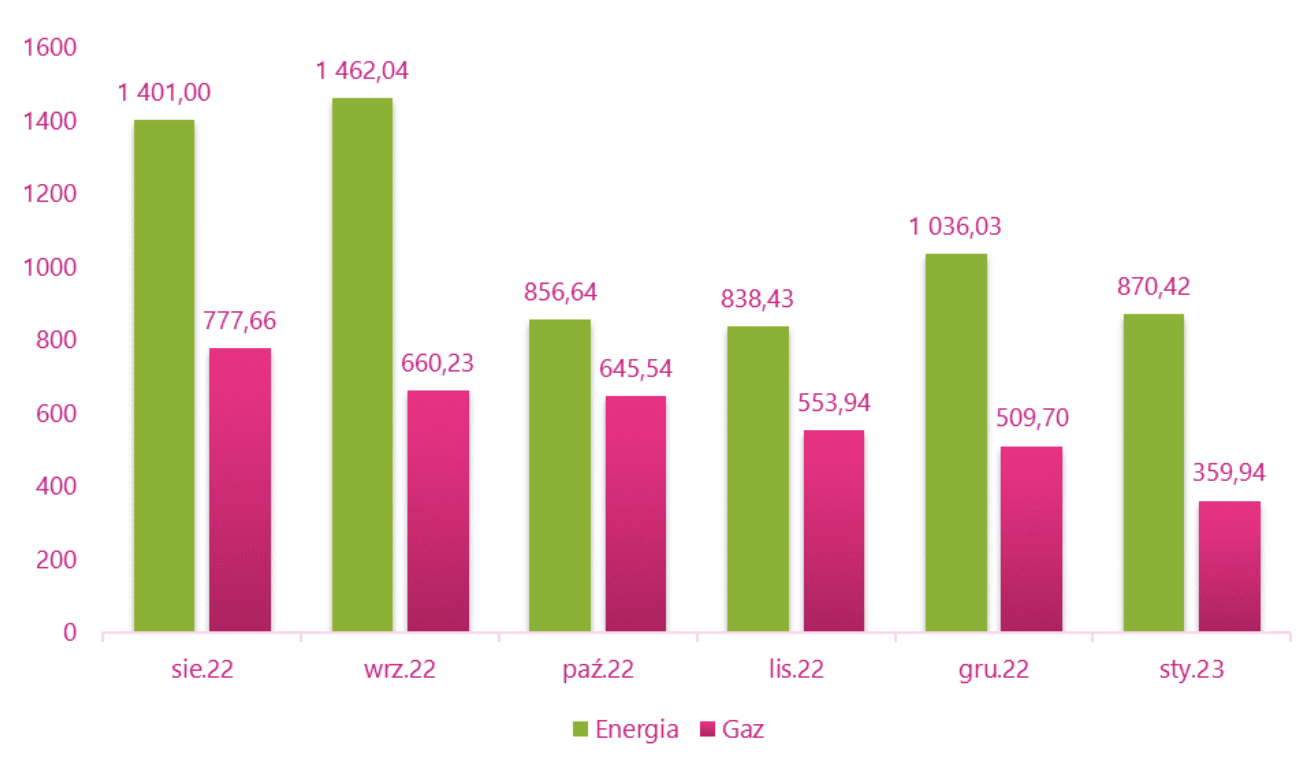

Not irrelevant to CPI inflation are the trends observed on the Polish Power Exchange. The rising costs of electricity and gas have forced many entrepreneurs to pass higher operating costs onto the consumer. The situation has been stabilizing for several months, and prices on the Polish Power Exchange have reached the lowest levels in many quarters.

Prices of electricity and gas on the Polish Power Exchange (PLN/MWh - weighted average price - contract for 2024). Source: Own elaboration based on TGE data

The effect is already visible in producer inflation, which clearly moved away from the peak recorded at the end of the first half of last year. The current developments in the energy markets in the perspective of the coming quarters should have a positive impact on limiting the inflationary pressure.

The period of the coronavirus pandemic and the war in Ukraine had a negative impact on freight costs. The extraordinary situation is reflected in the Baltic Dry Index, presenting changes in this area.

Baltic Dry Index quotes. Own development based on Investing.com data

Recent months have brought the index back to levels not seen for many quarters. The ongoing downward trend of the index is another argument for lower inflationary pressure. Undoubtedly, in addition to global factors contributing to a decrease in prices, there are also elements that, locally, may contribute to maintaining the inflation rate at an elevated level. In this place, one can mention, for example, a high increase in the minimum wage.

Summation

Inflation in Poland in January accelerated to the level of 17.20%, at the same time approaching last year's maximum in October. The upward trend is nearing its end and inflation may peak in February. In the following months, the decline in the price index will be supported by a combination of several factors: the high base effect, slowdown in the growth of food and energy prices. There is a good chance that at the end of the year inflation will fall to single-digit levels, but the road to achieving the inflation target set by the central bank remains long. The development of the economic situation in Poland and the global macroeconomic environment will determine whether the disinflation processes will proceed as intended.

Author: Piotr Langner, Investment Advisor, WealthSeed

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)